Bitcoin noticed a major dip over the weekend, with BTC dropping from $70,090 on April 11 to $64,400 on April 13. Regardless of the preliminary fears of a broader battle within the Center East growing and a possible market downturn starting, Bitcoin’s value managed to stabilize at round $66,000 as of April 15.

To grasp the character of those fluctuations — whether or not they point out a mere short-term correction or sign a extra important shift — it’s essential to look at the behaviors of various market individuals, notably short-term and long-term holders.

Quick-term holders (STHs) and long-term holders (LTHs) react in a different way to market volatility. STHs are sometimes extra reactive to cost adjustments and exterior occasions, tending to dump their holdings throughout market dips. In distinction, LTHs typically preserve their positions by means of volatility, reflecting a dedication to Bitcoin’s long-term worth.

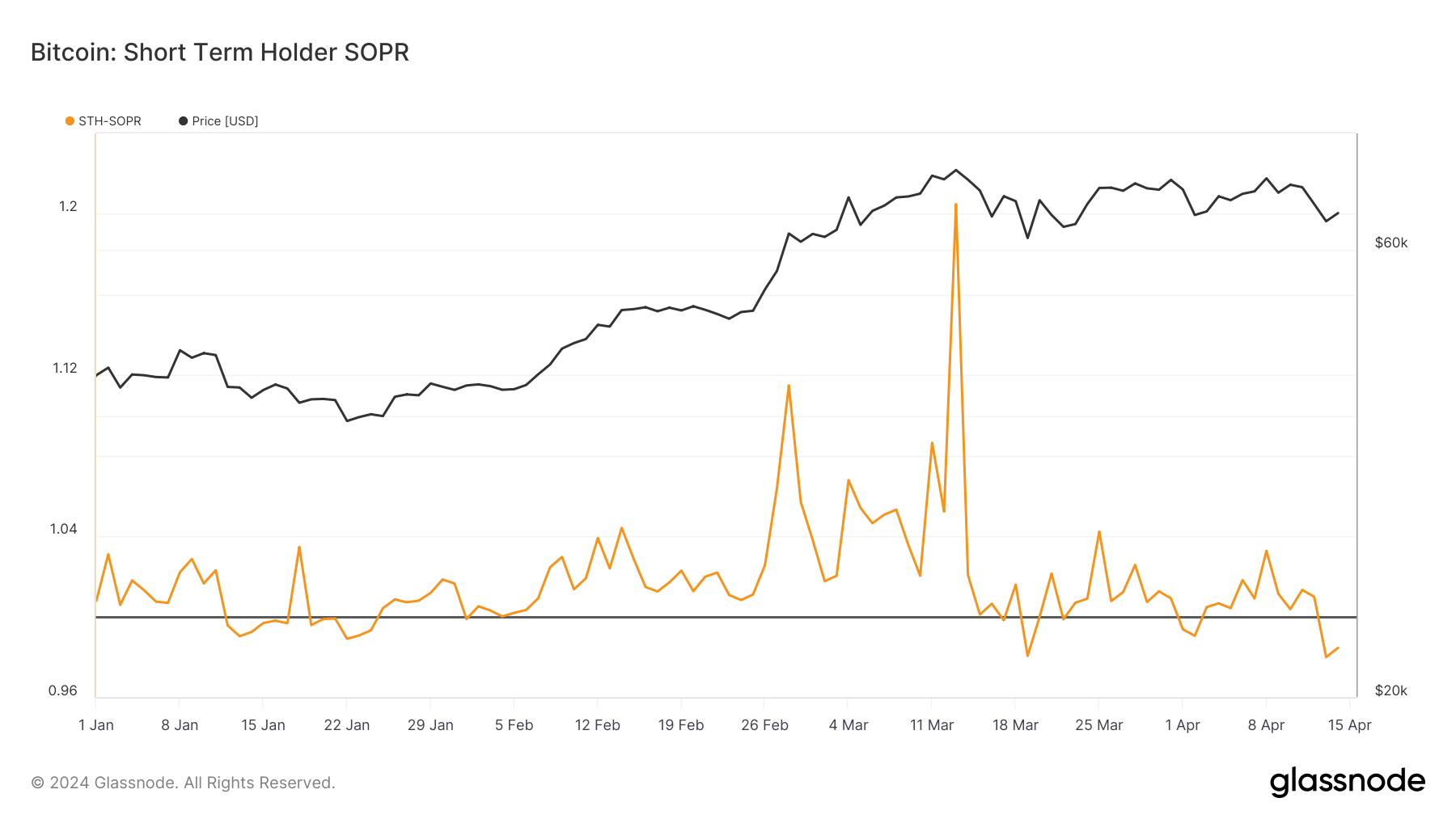

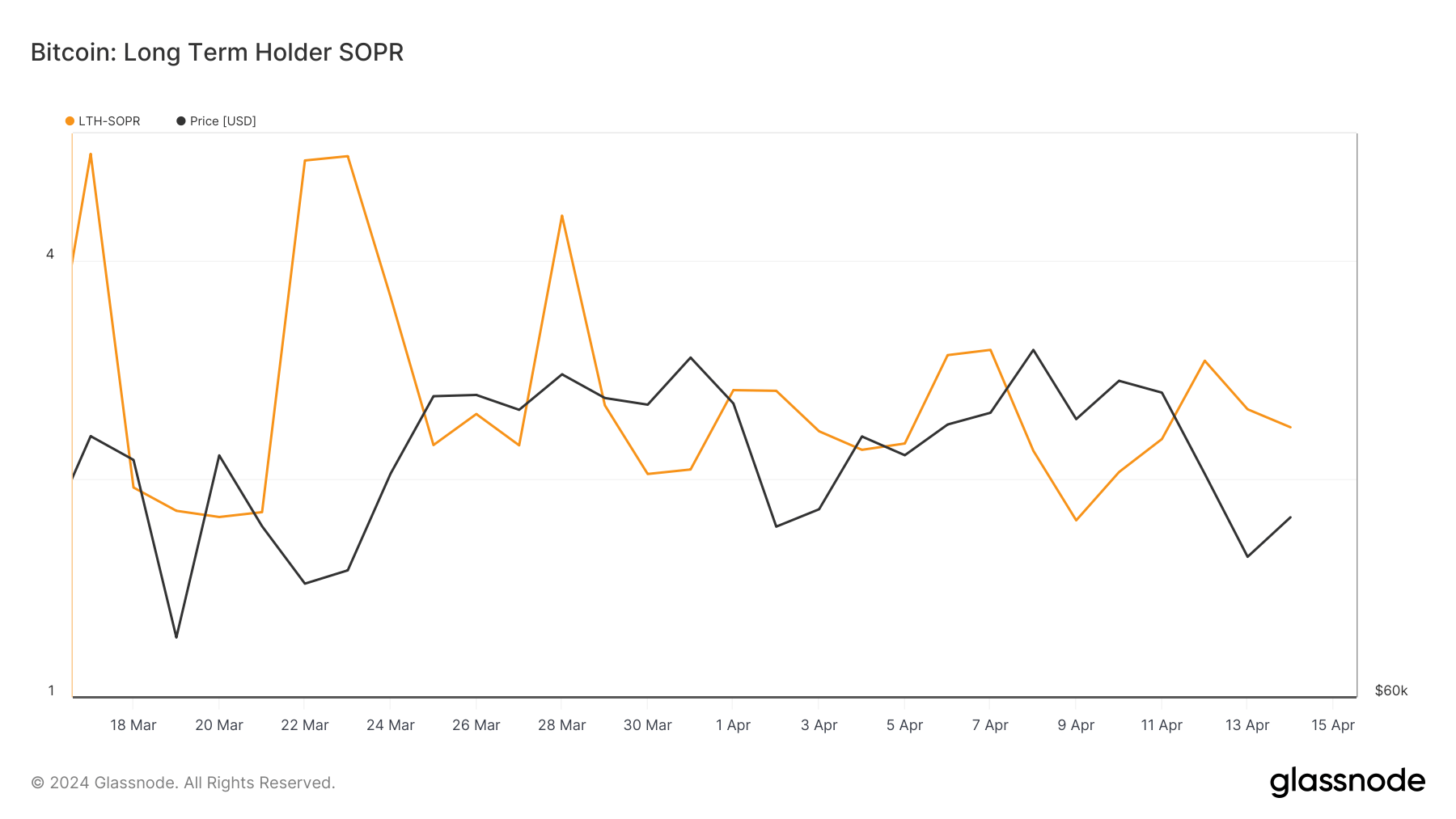

Among the finest metrics that assesses the speedy market reactions is the spent output revenue ratio (SOPR), which measures the revenue ratio realized by cash moved on-chain. SOPR values above 1 point out that cash are, on common, being bought at a revenue, whereas values beneath 1 recommend promoting at a loss. A nuanced understanding requires dissecting this metric into STH SOPR and LTH SOPR to seize the distinct behaviors of those two teams.

Through the dip, the STH SOPR fell sharply from 1.009 on April 12 to a yearly low of 0.979 on April 13, signaling that short-term holders had been promoting their Bitcoin at a loss. This metric barely recovered to 0.984 by April 14, nonetheless beneath the breakeven threshold of 1.

Earlier within the yr, when Bitcoin reached highs of over $73,000, the STH SOPR peaked at 1.204, displaying worthwhile gross sales by short-term holders. Furthermore, the spent value of Bitcoin by STHs on April 13 was $65,130, exceeding the spot buying and selling value of $64,900, indicating {that a} important variety of STHs had been promoting at a loss.

Alternatively, long-term holders confirmed way more resilience. As Bitcoin’s value fell beneath $70,090, the LTH SOPR rose from 2.271 on April 11 to 2.913 on April 12, suggesting that long-term holders had been nonetheless promoting at a major revenue regardless of the downturn. This determine adjusted barely to 2.358 by April 14 however remained effectively above the breakeven level.

Taking a look at SOPR alone, we are able to see that the weekend dip did not sway the boldness of long-term holders. Whereas long-term holder balances have been growing up to now week or so, people who bought throughout the dip had been small in numbers and had been realizing income.

In the meantime, the habits of short-term holders confirmed panic, with many opting to chop losses and promote their BTC. This implies a reactionary strategy to market information and value actions, additional confirming the long-term pattern related to STHs.

The distinction in responses from these two cohorts reveals the significance of segment-specific evaluation and reveals that whereas short-term sentiment might waver, the long-term outlook stays strong.

The publish Bitcoin’s weekend dip shakes out short-term holders appeared first on CryptoSlate.