Fast Take

The affect of short-term holders on Bitcoin’s market dynamics was palpable yesterday on Oct. 17, as Bitcoin costs surged to $30,000, fueled by the misinformation of a spot exchange-traded fund (ETF) being reported by CoinTelegraph.

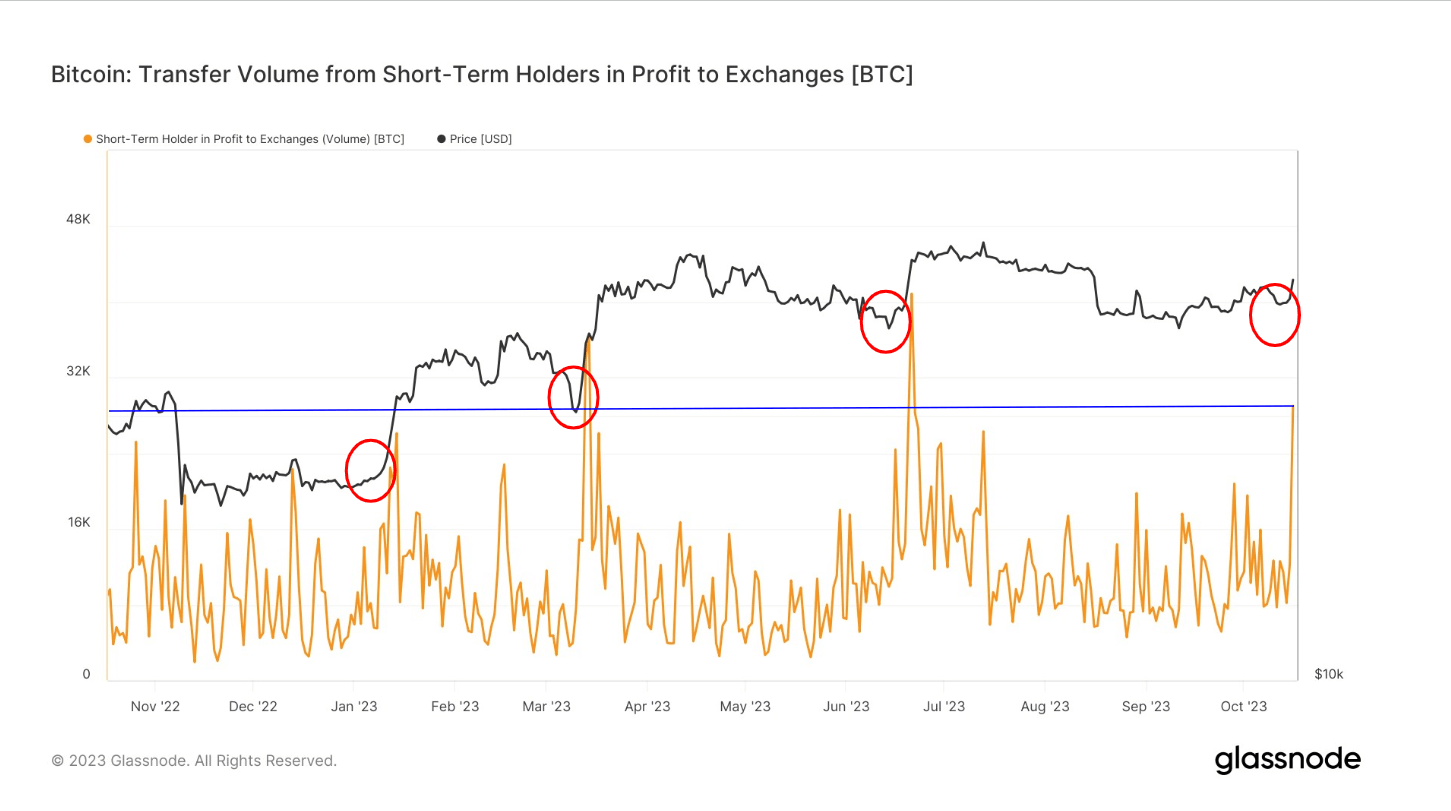

Brief-term holders, outlined as traders who bought Bitcoin inside the final 155 days, capitalized on this surge, promoting roughly 30,000 Bitcoins at a revenue. This marked the third-highest such occasion this yr.

Traditionally, an analogous development has been noticed throughout native bottoms within the value, as seen in January, March (following the SVB collapse), and June. In such cases, Bitcoin costs tended to understand, prompting this cohort to promote for earnings. This conduct, nevertheless, exerts further promoting stress on Bitcoin, creating potential short-term headwinds for the cryptocurrency’s value.

Conversely, final week, this group additionally accounted for the second-highest quantity of Bitcoins bought at a loss this yr. This occurred amidst widespread concern as Bitcoin costs plummeted to $26,000. Whereas a few of this may be attributed to merchants locking in earnings and losses on account of Bitcoin’s minimal volatility this yr, it underscores the numerous function short-term holders play within the cryptocurrency’s value actions.

The provide of Bitcoin held by short-term holders has reached an all-time low of two,357,000.

The submit Bitcoin’s wild trip to $30k and again reveals short-term holders’ market video games appeared first on CryptoSlate.