CryptoSlate analysts examined the detailed proof-of-reserves of main crypto exchanges outdoors of Coinbase and Binance. It revealed that Bitfinex holds essentially the most vital Bitcoin (BTC) reserves, with $3.5 billion price of BTC.

The information was obtained on Dec. 16 from OKX, KuCoin, Crypto.com, ByBit, Binance, BitMEX, and Bitfinex. OKX follows Bitfinex with the second largest BTC pool with greater than $1.5 billion in BTC, whereas Binance comes because the third with simply above $5 billion in BTC. BitMEX locations fourth, with simply over $1 billion in BTC. Crypto.com, ByBit, and KuCoin got here because the fifth, sixth and seventh with $700 million, $370 million, and $300 million, respectively.

Reserves in billions

Bitfinex, OKX, Binance, and BitMEX calculate their reserves in billions. Amongst all exchanges included on this evaluation, Bitfinex emerged because the trade that held considerably extra BTC than the opposite six that launched their proof-of-reserves.

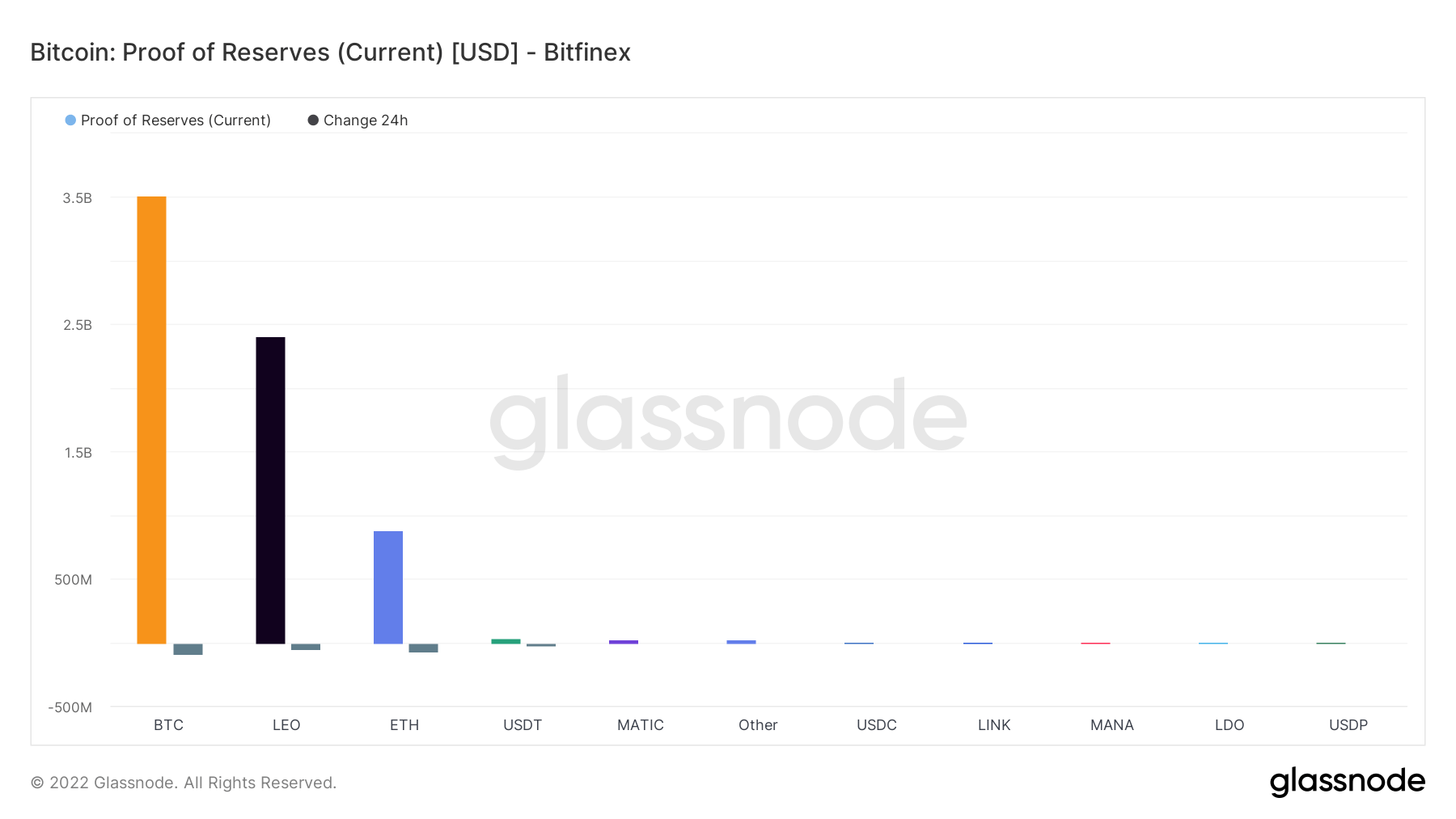

Bitfinex

In line with the numbers, Bitfinex entered the weekend with $3.5 billion in BTC and round $2.37 billion in UNUS SED LEO (LEO). The trade additionally holds just under $1 billion price of Ethereum (ETH).

Moreover BTC, LEO and ETH, the chart reveals that Bitfinex holds eight extra property in tens of millions every.

Knowledge from Nov. 21 confirmed that 91% of Bitfinex’s reserves have been manufactured from BTC and ETH, which meant that Bitfinex held essentially the most BTC. Regardless that its ETH reserves have shrunk, the trade nonetheless holds the most important quantity of BTC.

One other examine on the finish of November 2022 confirmed that Bitfinex held over $11 billion price of Tether (USDT), equating to 60% of the entire USDT provide. Nevertheless, the present knowledge point out that this quantity retreated to tens of millions inside two weeks.

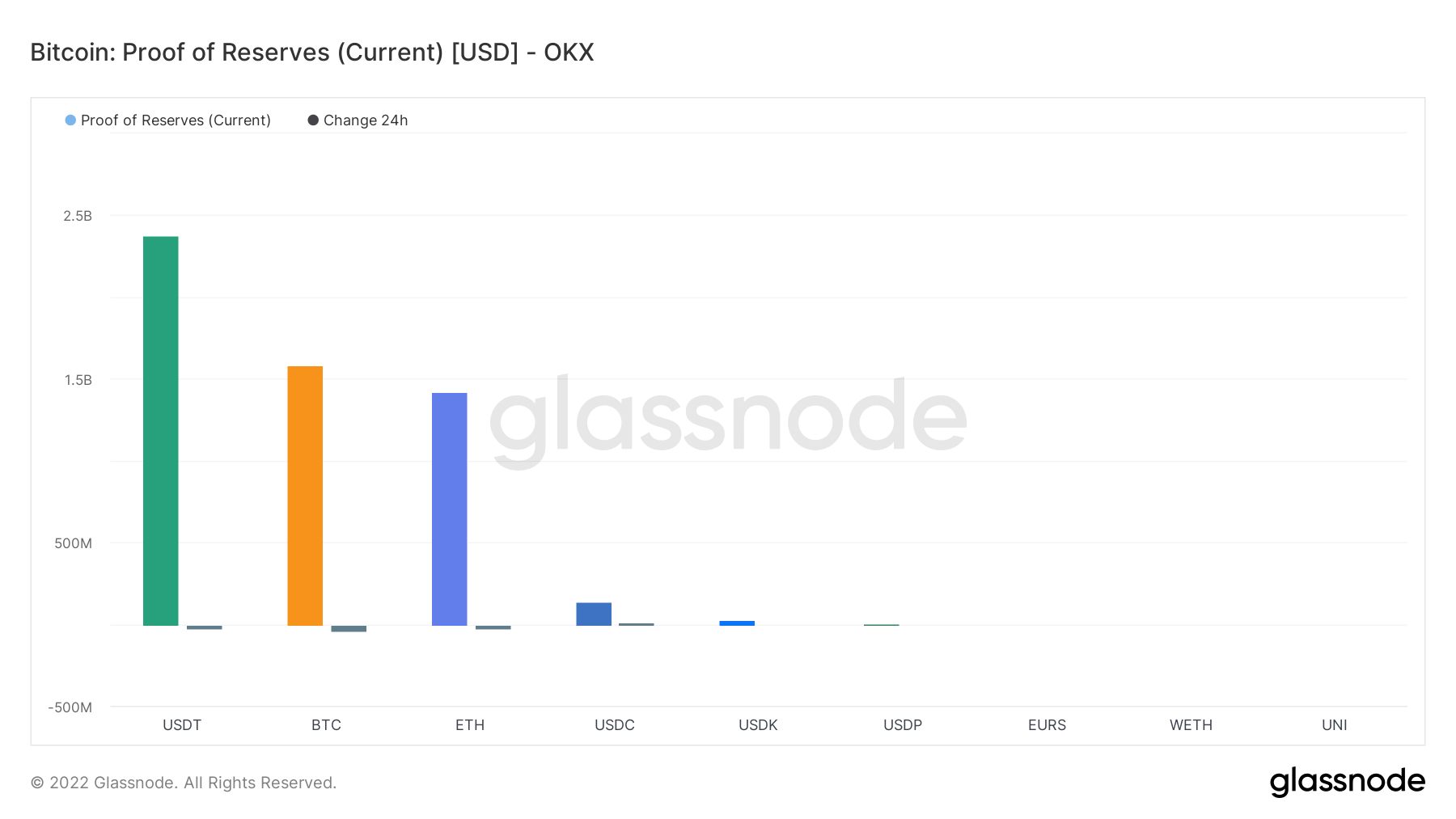

OKX

OKX is the one trade included on this evaluation that measures its BTC reserves in billions. The trade’s BTC reserves quantity to only above $1.5 billion.

Along with the appreciable quantity of BTC, OKX additionally holds round $2.43 billion in USDT. Moreover, the trade has just under $1.5 billion price of ETH.

In line with OKX’s announcement, it’s also backing all its customers’ property at 1:1 with actual funds.

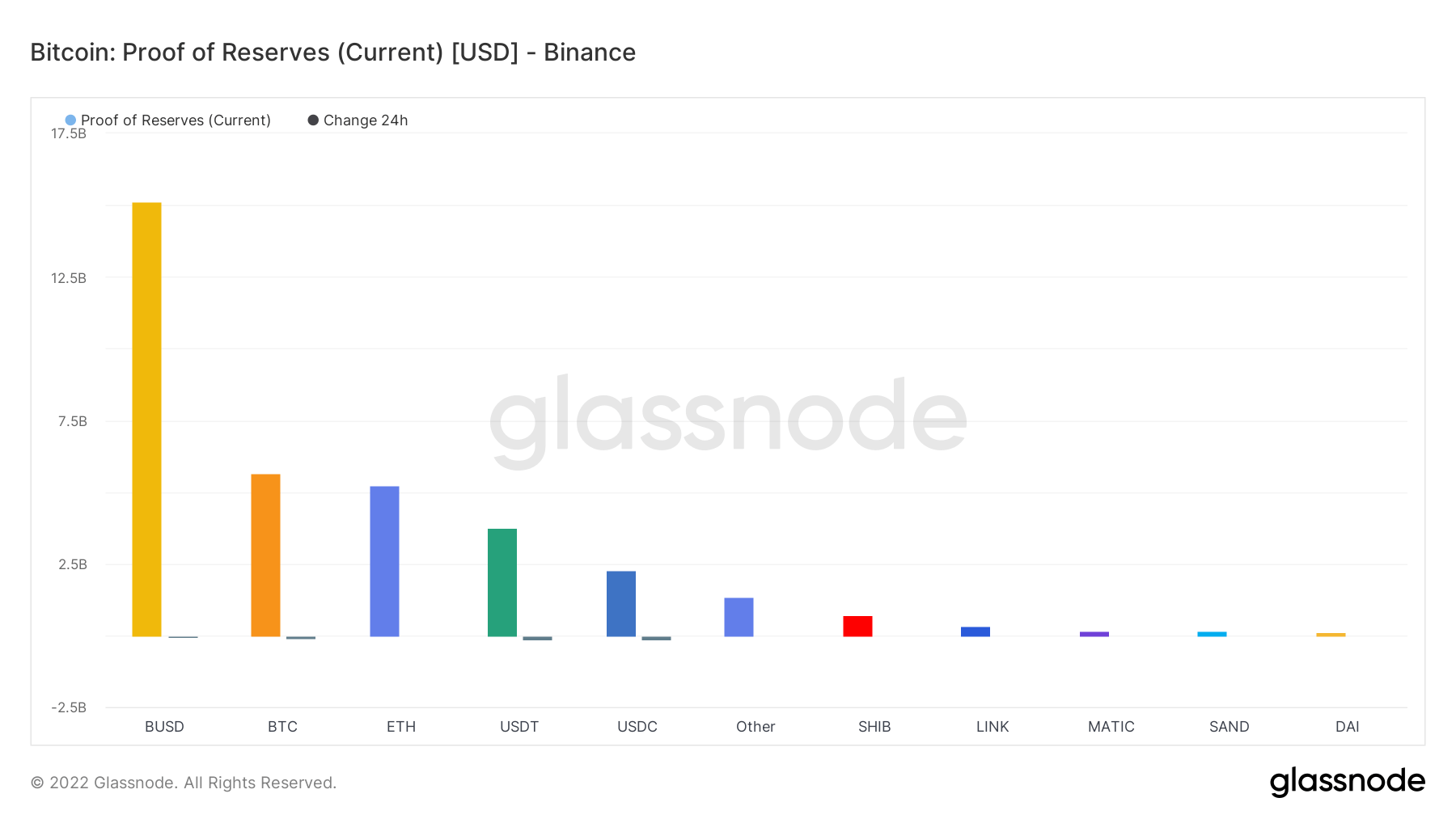

Binance

Binance locations third in rating with practically $5.6 billion in BTC. The trade additionally holds $5 billion in ETH.

Regardless of the dimensions of its BTC pool, Binance holds $15 billion in Binance USD (BUSD), $6.25 million in USDT, and virtually $2.5 billion in USDC.

On Dec. 15, Binance skilled a withdrawal disaster the place its reserves shrank by $3.5 billion in 24 hours. Regardless of that, the trade holds the most important total reserves amongst all different exchanges included on this evaluation.

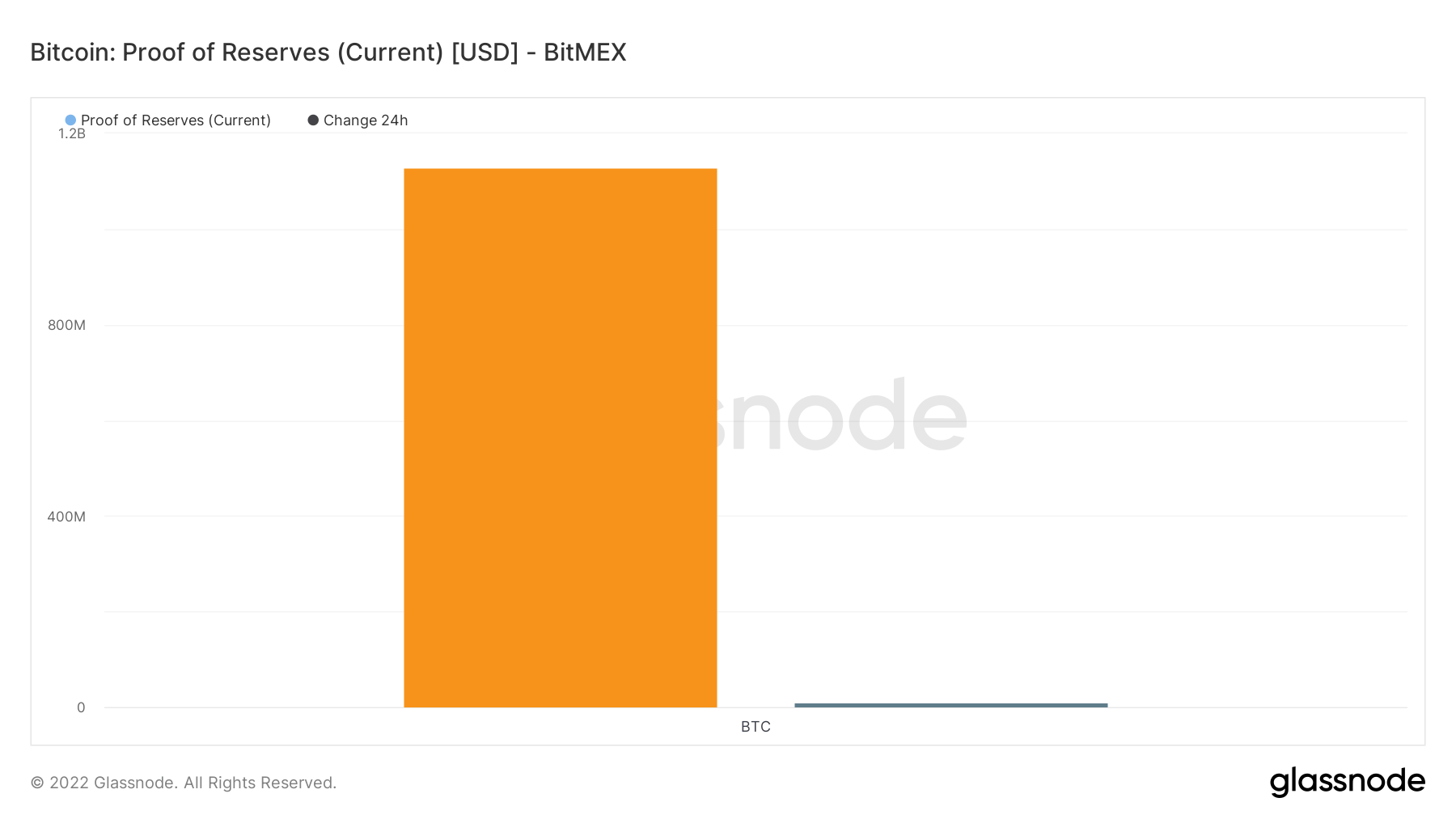

BitMEX

BitMEX holds the fourth largest BTC reserves, with round $1.1 billion. The information doesn’t disclose another asset sort below BitMEX’s reserves.

The trade additionally introduced that it plans to put off round 30% of its workers in early November.

Reserves in tens of millions

Different exchanges included on this evaluation measure their reserves when it comes to tens of millions. Amongst the remaining 4, Crypto.com holds essentially the most BTC.

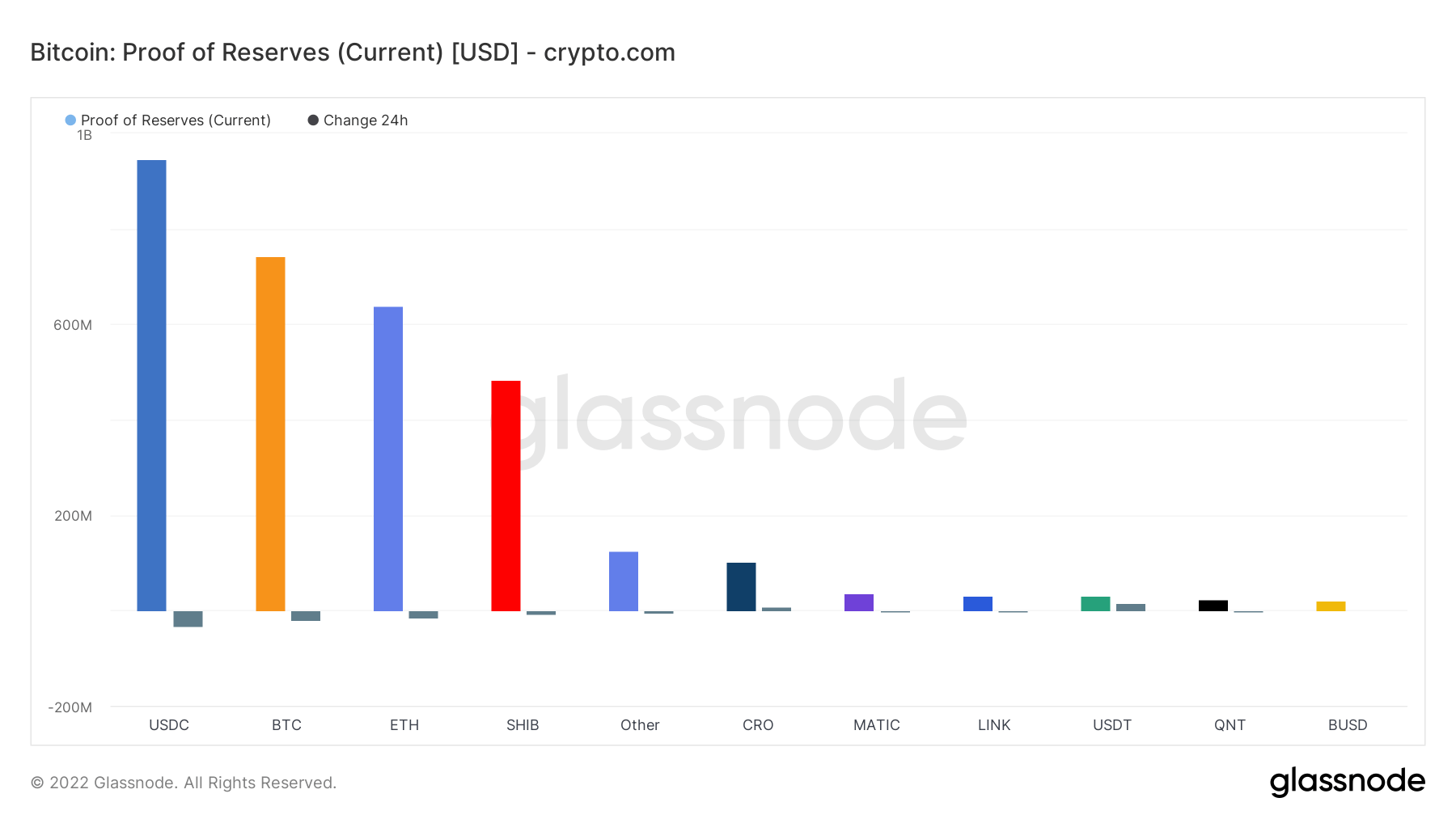

Crypto.com

Crypto.com entered the weekend with practically $700 million price of BTC and simply above $600 million in ETH.

From Nov.21, 52% of Crypto.com’s reserves have been manufactured from BTC and ETH, which equated to 53,024 BTC and 391,564 ETH. Present knowledge means that the trade shrunk its BTC reserves whereas rising its ETH holdings.

Crypto.com additionally holds over $900 million price of USD Coin (USDC) and round $500 million in SHIBA INU (SHIB).

The trade launched its proof of reserves on Dec. 6 and confirmed that each one property have been totally backed by 1:1 on the trade, with additional reserves to spare. Nevertheless, the audit agency Mazars Group audited the proof of reserves, which revealed that it was making ready to drop its shoppers on Dec. 16.

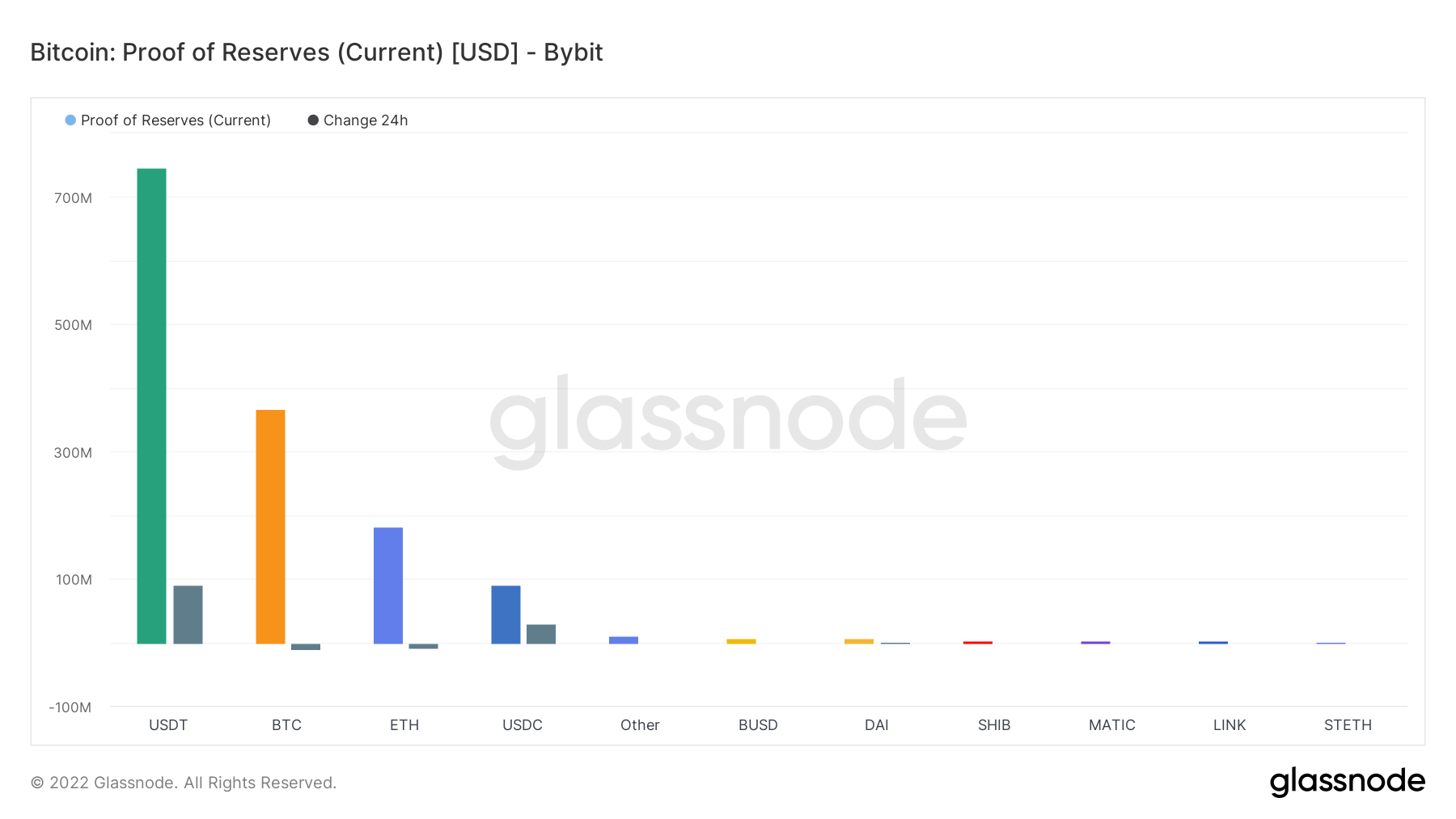

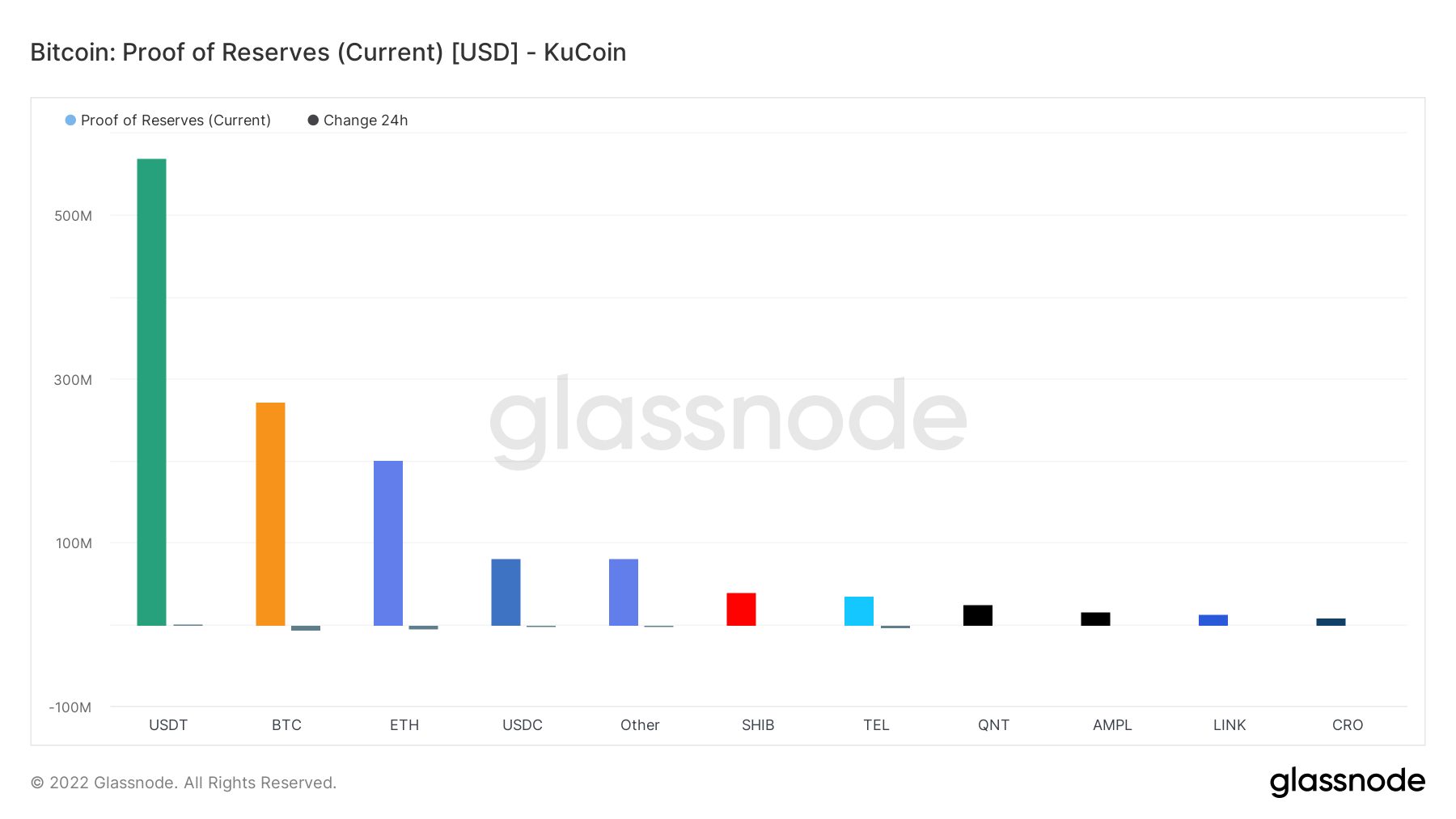

ByBit and KuCoin

Primarily based on the BTC reserves’ rating, ByBit and KuCoin come fourth and fifth, respectively, with solely slight variations of their reserves.

The numbers present that ByBit holds practically $370 million in BTC and virtually $200 million in ETH. As well as, the trade additionally has over $700 million USDT and practically $100 million USDC stablecoins.

ByBit lately introduced that it might be updating its withdrawal limits primarily based on verification ranges and planning to put off round 30% of its workers attributable to difficult market circumstances.

KuCoin, then again, holds rather less than $300 million in BTC and $200 million in ETH. The trade has over $600 million in USDT and USDC stablecoins mixed.

Following the FTX fallout, KuCoin was one of many first exchanges that disclosed its holdings. On Nov. 11, KuCoin’s CEO, Johnny Lyu, introduced the trade’s holdings by way of his Twitter account. As well as, the trade launched its proof-of-reserves on Dec. 5, which the Mazars Group audited.