BitGo, the Palo Alto-based crypto custody agency, has raised $100 million in funding, setting its valuation at a powerful $1.75 billion, a stark distinction to its price ticket in 2021 when a $1.2 billion acquisition deal by Galaxy Digital Holdings was ultimately referred to as off, in accordance to Bloomberg.

BitGo focuses on securing crypto property, with personal keys usually protected in bodily vaults. The corporate acts because the custodian for main gamers within the crypto area, together with the collectors of the bankrupt digital asset trade FTX alongside Pantera Capital, Swan Bitcoin, and lots of others.

BitGo’s give attention to regulatory security and licensed operations could have given it a aggressive edge on this unsure market panorama, marked by rising tensions over classifying cryptocurrencies as securities. Chatting with Bloomberg, CEO Mike Belshe acknowledged the market’s issue however emphasised the significance of being licensed and controlled, stating that “regulatory security is simply on all people’s minds proper now.”

Apparently, Bloomberg experiences that BitGo’s funding got here completely from new buyers, primarily based within the US and Asia, with some venturing from exterior the crypto trade, in response to Belshe.

The corporate has not disclosed the names of the contributors on this funding spherical however made it clear that the raised capital can be utilized in half for strategic acquisitions, with two offers already within the pipeline.

Navigating the crypto custody aggressive panorama.

Whereas BitGo thrives, it’s value noting the hostile circumstances surrounding one other notable participant within the crypto custody market, Prime Belief.

As reported by CryptoSlate, Prime Belief, as soon as a good power in digital asset custody, has filed for Chapter 11 chapter following a stop and desist order from the Nevada Monetary Establishments Division because of the firm’s lack of ability to meet buyer withdrawal requests. This case led BitGo to terminate its deliberate acquisition of Prime Belief in June.

The contrasting fortunes of BitGo and Prime Belief make clear the volatility of the crypto market and the criticality of regulatory compliance, underlining the significance of the ‘belief’ component in digital property.

Prime Belief is registered as a Certified Custodian, in response to its web site. Nonetheless, its lack of ability to meet buyer withdrawals casts doubt on the efficacy of its segregation of funds. CryptoSlate requested Prime Belief whether or not buyer funds are appropriately siloed from different firm property and was knowledgeable that “No additional assertion is on the market right now.”

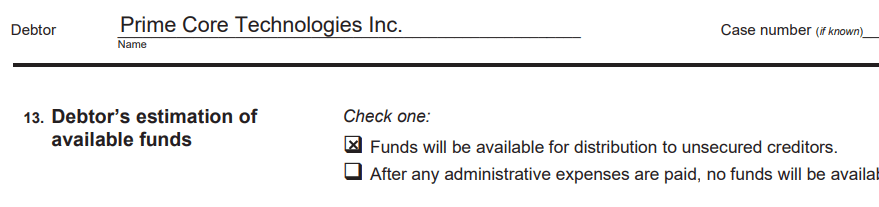

But, the Chapter 11 filings for Prime Belief did point out that funds can be found to repay unsecured collectors.

Different lively gamers within the crypto custody area embody Anchorage Digital, Coinbase Prime, Fireblocks, Gemini, and Constancy, amongst others.