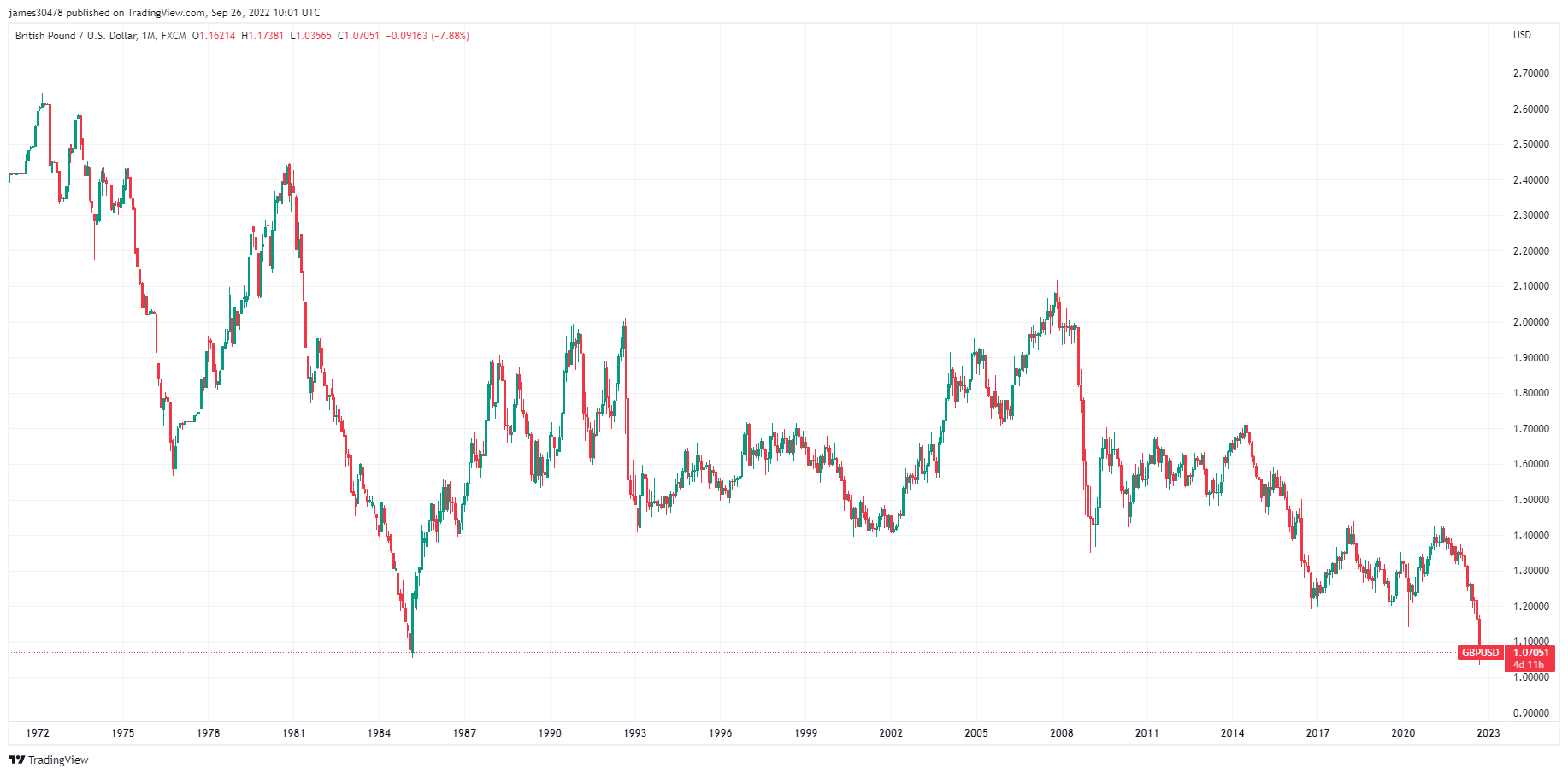

On Sept. 16, 1992, the British pound dropped to its all-time low. The day has since turn into often known as “Black Wednesday,” or the day George Soros broke the Financial institution of England.

The traditionally secure forex misplaced 4.8% of its worth in opposition to the U.S. greenback, successfully preserving the U.Ok. out of the E.U.’s newly fashioned European Alternate Fee Mechanism (ERM). The nation joined the ERM in an effort to assist the unification of European economies however successfully failed to stick to the phrases of the ERM.

Britain’s lack of ability to maintain the pound secure opened the door for speculators to quick the forex. George Soros, an investor and fund supervisor, amassed one of many largest quick positions on the pound which enabled him to pocket $1 billion.

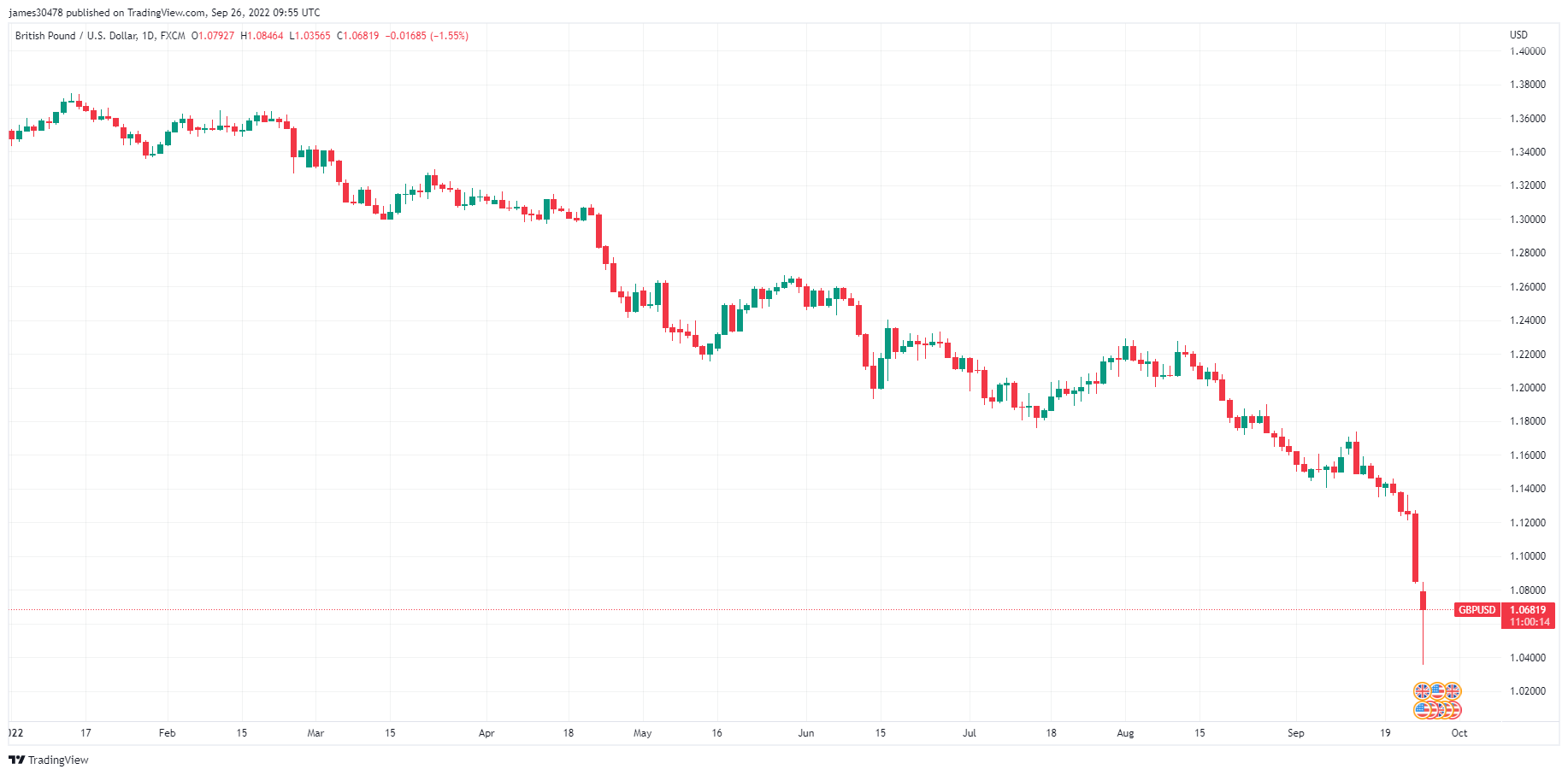

On Sept. 26, 2022, the British pound skilled a flash crash virtually as massive because the one on Black Wednesday, shedding 4.3% of its worth in opposition to the U.S. greenback.

One of many most important culprits behind this crash might be massive merchants. Important choices limitations at 1.07 kilos to the greenback triggered a cascade that noticed the pound drop via 1.06, 1.05, and 1.04 in a matter of hours. The pound at the moment stands at simply 7 cents above parity with the U.S. greenback.

For the reason that starting of the yr, the pound crashed over 21% in opposition to the U.S. greenback and eight% in opposition to the euro.

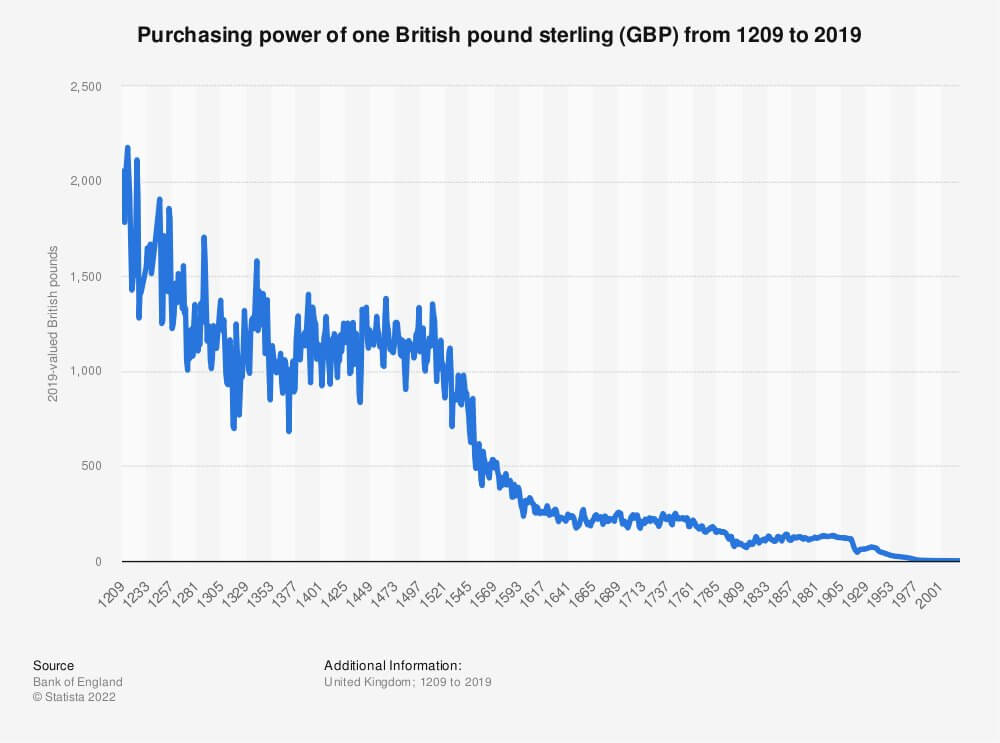

Whereas the pound’s woes would possibly look current, the forex has been experiencing a gradual drop for the higher a part of the final 8 centuries.

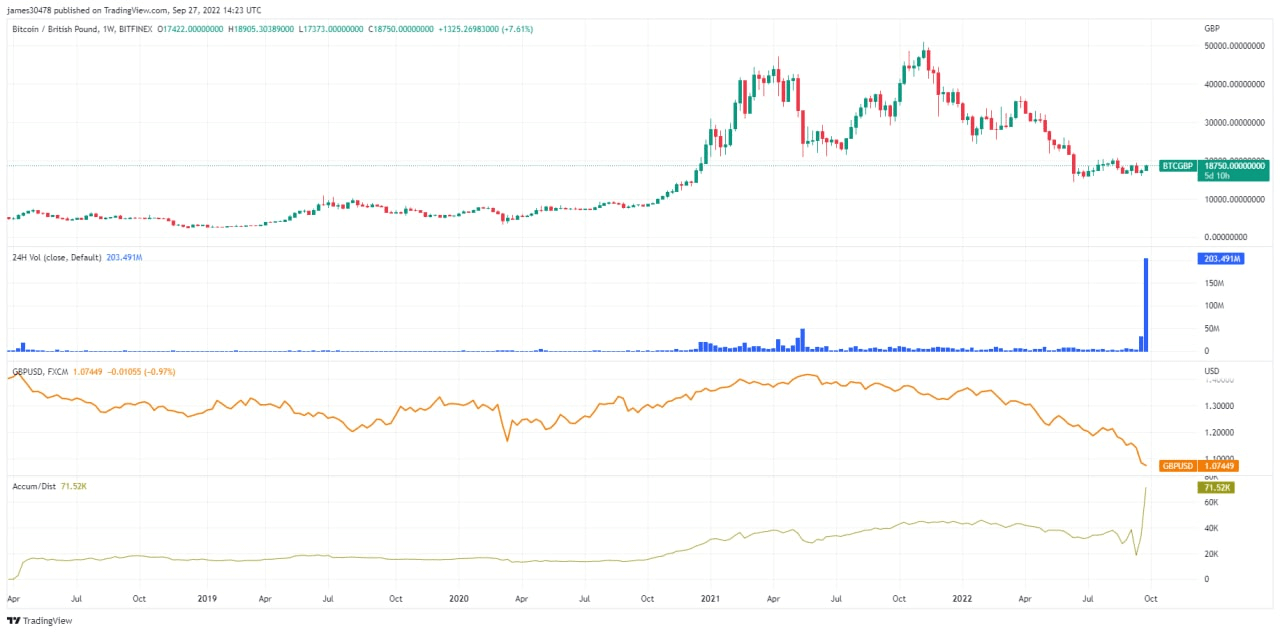

With the pound plummeting to its 30-year low, folks flocked to exhausting property to keep away from main losses. On Sept. 26, the BTC/GBP buying and selling quantity soared over 1,200% as British pound holders started aggressively buying Bitcoin. This stands in sharp distinction to the BTC/USD pair, which has seen a comparatively flat buying and selling quantity on centralized exchanges all through the summer season.

The quickly weakening pound posed a large risk to authorities debt markets within the U.Ok. The potential for systemic threat to the nation’s monetary stability pressured the Financial institution of England to take emergency motion and intervene within the bond market. On Sept. 28, the Financial institution of England introduced that it might droop its program to promote gilts and begin shopping for long-dated bonds.

British chancellor Kwasi Kwarteng’s newly imposed tax cuts and borrowing plans additional debased the pound and led to a pointy lower in U.Ok. authorities bonds. To guard their holdings from dangers related to inflation and rising rates of interest, most pension funds make investments closely in long-term authorities bonds. The Financial institution of England’s emergency measures are an try to offer assist to hundreds of cash-strapped pension funds which can be in hazard of failing to fulfill margin calls.

This can be a stark reminder that the world of conventional finance may be as unpredictable because the crypto market. Flash crashes and hypothesis might turn into a brand new actuality for fiat currencies and commodities many regarded as proof against manipulation.