Bitcoin (BTC) holders had it powerful in 2022, however it was a good harder 12 months for BTC mining — mining shares fell over 80%, and mining firm bankruptcies solidified the bear market — however the worst of miner capitulation could possibly be over, in keeping with CryptoSlate evaluation.

With BTC worth down 75% from its all-time excessive (ATH), the hash fee too reached an all-time excessive as miners elevated efforts to make sure profitability within the vitality disaster.

BTC Miner capitulation lowering

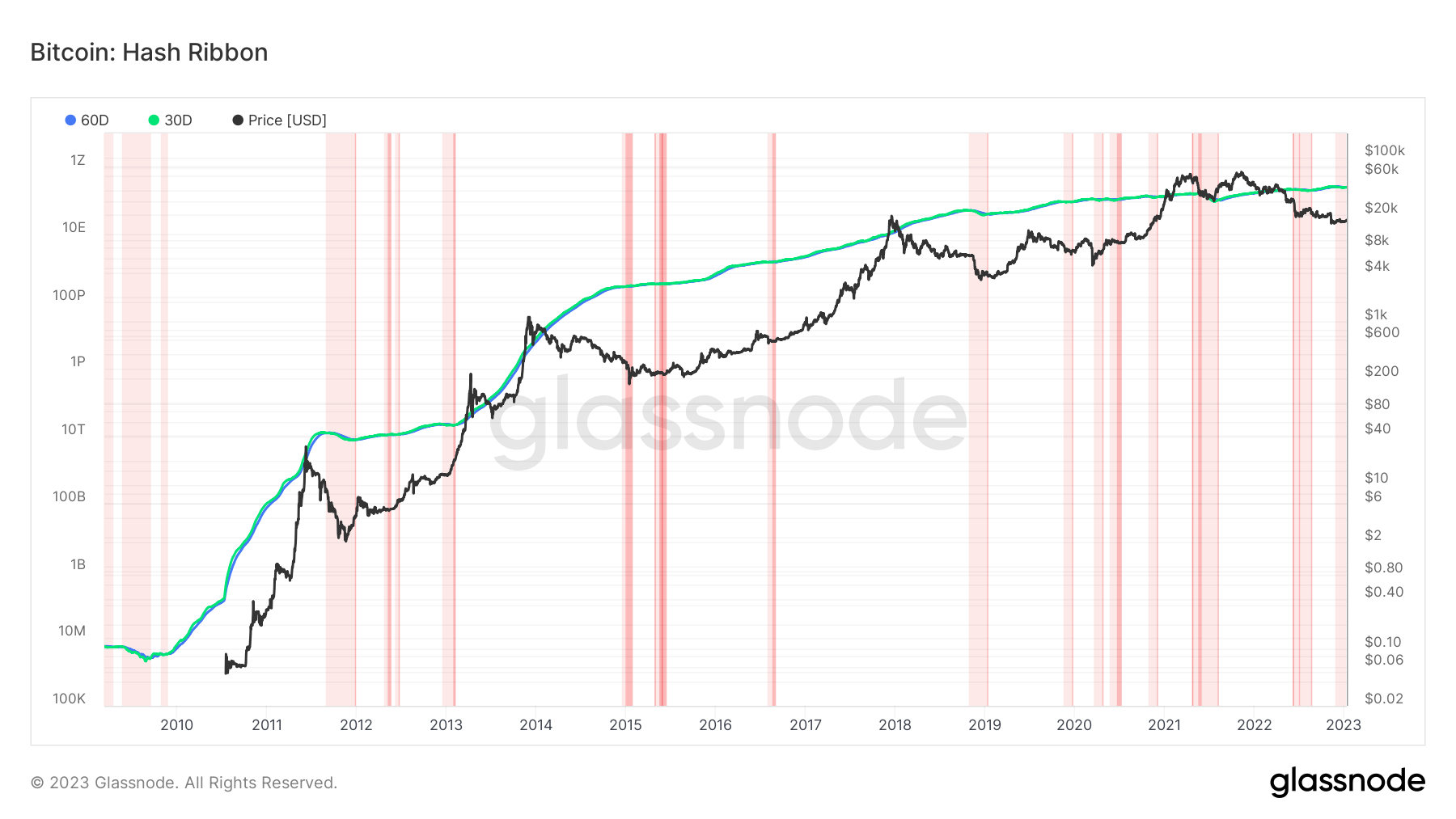

The Hash Ribbon indicator chart above signifies that the worst of miner capitulation is over when the 30-day transferring common (MA) crosses the 60-day MA — switching from light-red to dark-red areas.

When this paradigm shift happens, a change from unfavourable to constructive worth momentum is predicted, which traditionally reveals good shopping for alternatives (switching from dark-red again to white).

It’s suggestive that the worst of miner capitulation is sort of over as BTC turns bullish and breaks out in direction of $19,000, in keeping with Glassnode knowledge within the chart above analyzed by CryptoSlate.

BTC miner provide promote stress abating

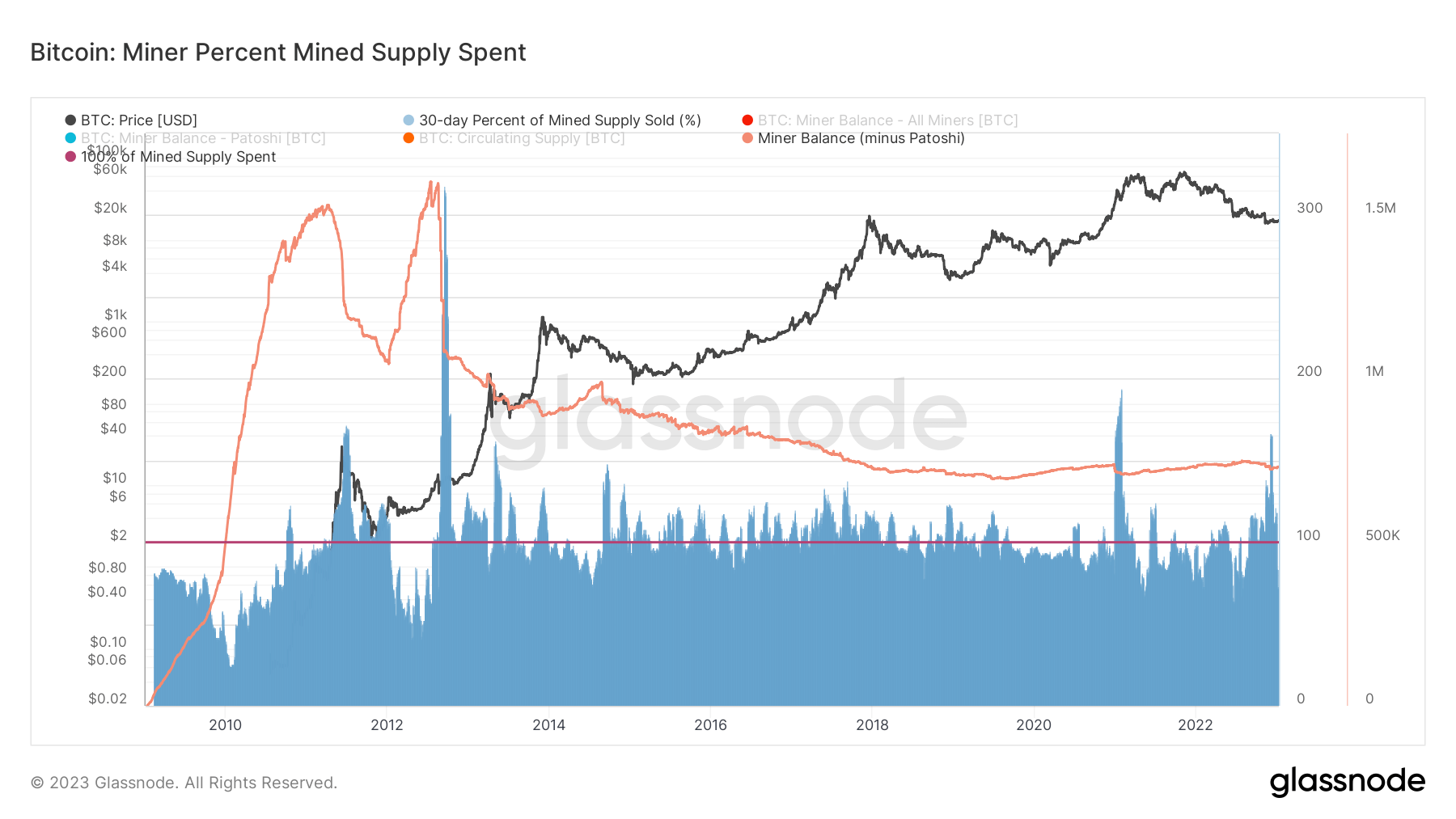

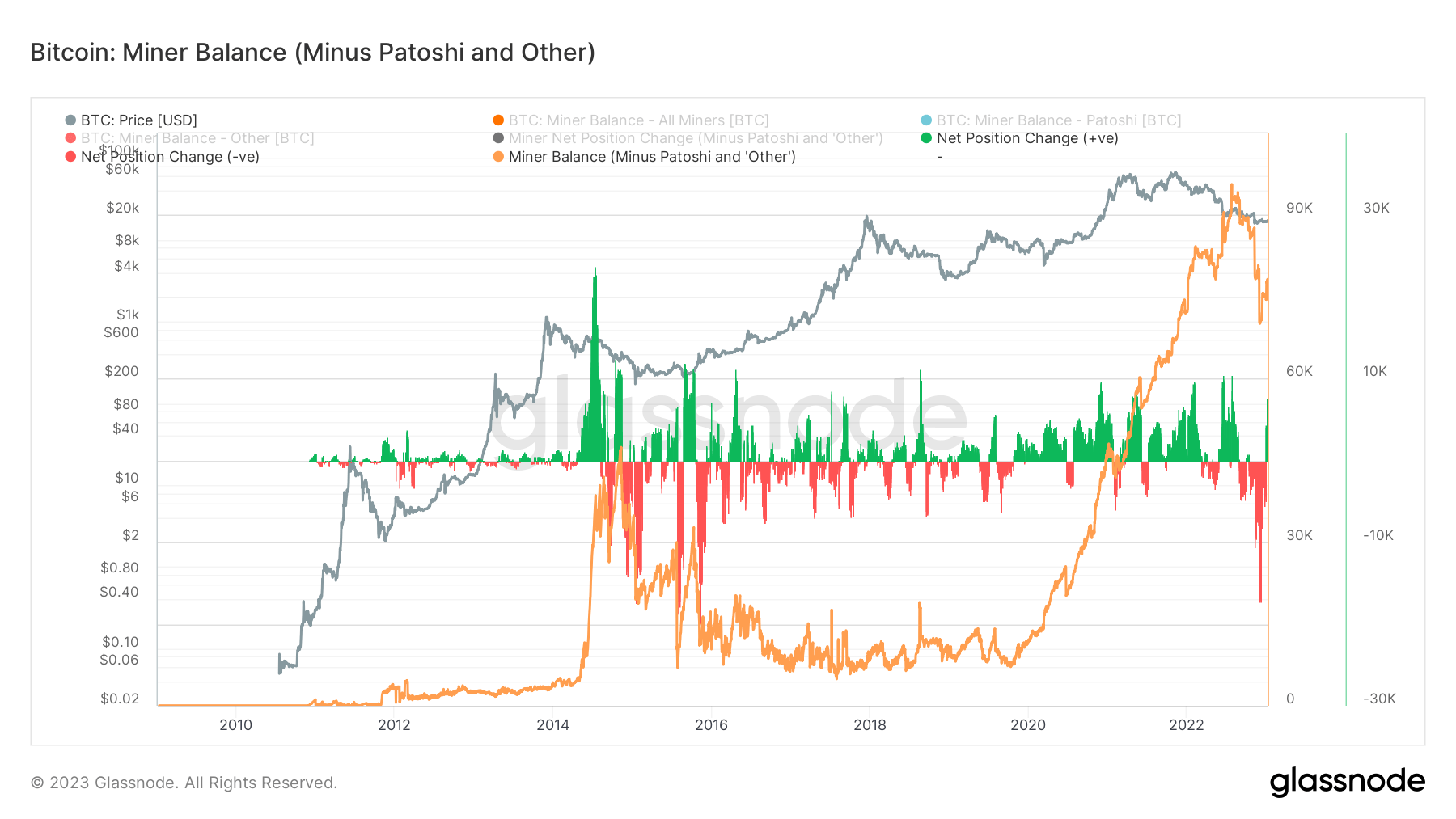

The whole provide of BTC presently held in miner wallets has hit roughly 1.8 million BTC after a drawdown of roughly 30,000 BTC. This doesn’t straight point out that the BTC was bought however might, in reality, have been moved to a different pockets for long-term storage.

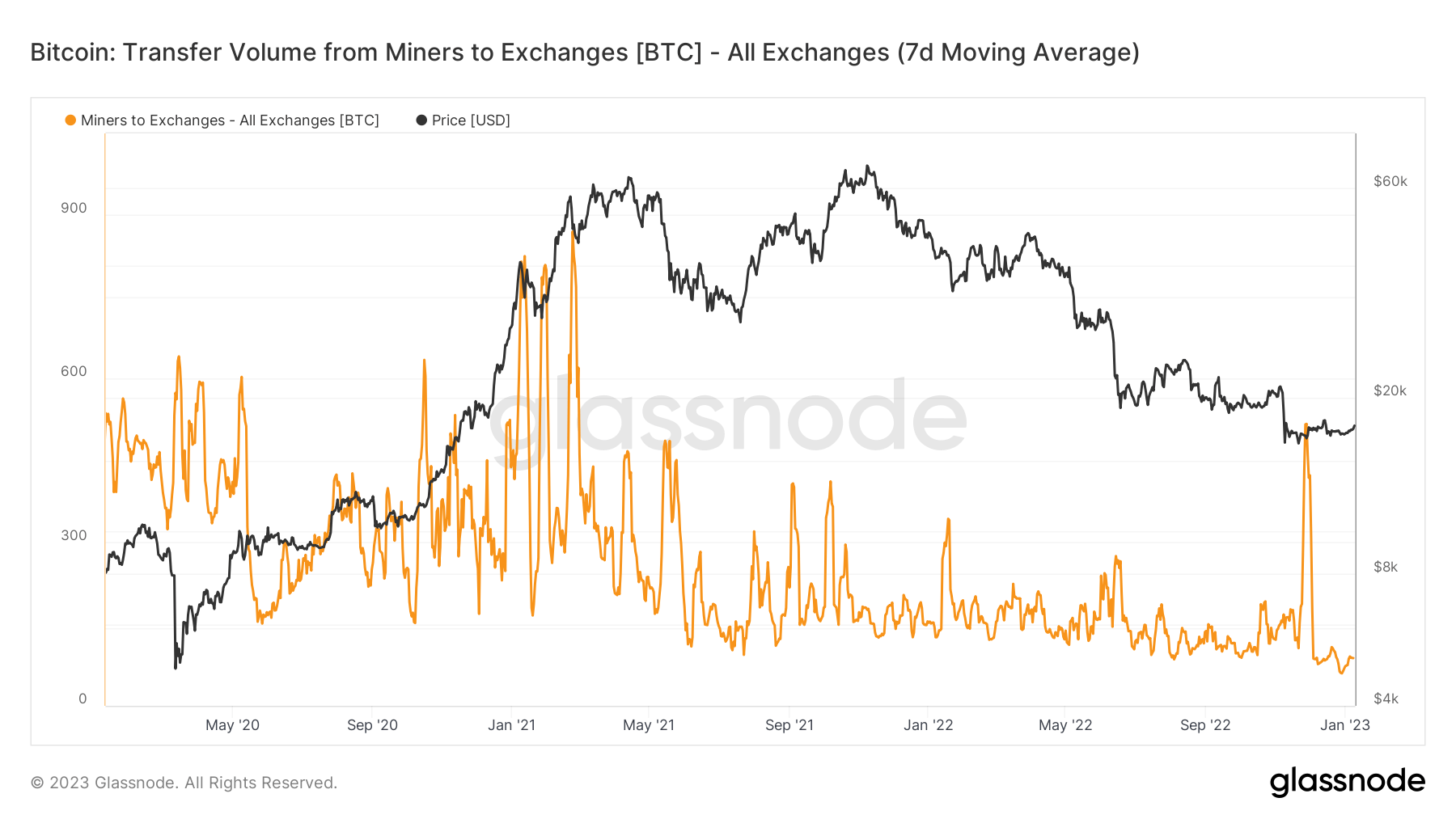

In the meantime, miner spending has drastically decreased as switch quantity from miners to exchanges falls enormously, as proven within the chart beneath.

Miner promote stress has reached its lowest within the final three years as lower than 100 BTC is being bought on a seven-day MA. When in comparison with the vicious drawdown in 2022 — the place miners had been spending extra BTC than was being mined — all charts point out promoting stress is about to modify to purchase stress.