Bitcoin (BTC) begins a brand new week on a promising footing with BTC value motion close to one-month highs — can it final?

In a brand new 12 months’s enhance to bulls, BTC/USD is at present browsing ranges not seen since mid-December, with the weekly shut offering trigger for optimism.

The transfer precedes a conspicuous macroeconomic week for crypto markets, with the December 2022 Shopper Value Index (CPI) print due from the USA.

Jerome Powell, Chair of the Federal Reserve, will even ship a speech on the financial system, with inflation on everybody’s radar.

Contained in the crypto sphere, FTX contagion continues, with Digital Forex Group (DCG) at odds with institutional shoppers over its dealing with of solvency issues at subsidiary Genesis Buying and selling.

On the identical time, underneath the hood, Bitcoin nonetheless reveals indicators of restoration from the FTX turmoil, with miners amongst these catching a break.

Cointelegraph takes a take a look at these components and extra because the second buying and selling week of January will get underway.

Bitcoin value passes $17,000

Bitcoin managed to spike greater on the Jan. 9 weekly shut, hitting ranges absent from the chart since Dec. 16.

Information from Cointelegraph Markets Professional and TradingView reveals native highs coming in at $17,250 on Bitstamp.

Regardless of solely including a number of hundred {dollars}, the transfer on BTC/USD didn’t go unnoticed given the extraordinarily compressed buying and selling vary in place for a lot of earlier weeks.

Nonetheless, eyeing potential continuation, merchants have been lower than keen to vary their longer-term conservative perspective.

“Onwards and upwards to my $17,300 – $17,500 goal,” Crypto Tony informed Twitter followers in an replace on the day.

“I’ve taken some revenue right here on my scalp lengthy, and stay in my brief so long as we’re under 17,500 on 4 hour closure.”

Michaël van de Poppe, founder and CEO of buying and selling agency Eight, likewise left the door open for some modest upside continuation, however warned that the beginning of the week would current hurdles.

“Nonetheless watching a case like this on Bitcoin,” he confirmed alongside an explanatory chart.

“I believe we’ll proceed rallying coming week, however in all probability have a drop resulting from Gemini or correction on Monday first.”

In the meantime, Venturefounder, a contributing analyst at on-chain analytics platform CryptoQuant, reminded traders to zoom out.

“Bitcoin has been caught between $16k and $18.5k for two months now,” he acknowledged.

“Watch this vary very very fastidiously, a break from both course can carry 20% volatility, might occur quickly. A definitive break of $16k might see $13k, make $18.5k assist we are able to see $22.5k.”

CPI countdown returns as threat asset merchants eye volatility

All eyes, together with these of the Federal Reserve, are on inflation knowledge this week with the December print of the Shopper Value Index (CPI) due for launch.

CPI, which is able to greet markets on Jan. 12, is a key part of Fed coverage, and merchants and analysts alike are keenly conscious that the indicators it gives can result in shifts in its stance.

Just lately, CPI has been declining, hinting that the Fed’s present rate of interest hikes have had a optimistic impression on inflation.

Ought to this proceed and even decline greater than anticipated, hopes that the Fed will lower charge hikes quicker — and even cancel them altogether — will enhance.

This in flip gives a window for threat property, together with crypto, to realize, as Fed coverage easing ignites urge for food for threat.

“Anticipating huge volatility. Large money place and lightweight place measurement for me,” Ted Zhang, dealer and analysis analyst at Revere Asset Administration, informed Twitter followers, describing the CPI occasion as a “big week.”

Others famous the bizarre timing of the CPI schedule, with the information coming two days after a speech on the financial system by Fed Chair, Jerome Powell.

“Sadly or fortuitously the speech is on Tuesday whereas cpi on Thursday so any hawkishness will probably be undone publish cpi numbers on Thursday!” one response learn, including that market reactions to Powell’s speech could properly quantity to “noise.”

In accordance with CME Group’s FedWatch Device, the probabilities of a 25-basis-point charge hike this month at present stand at 75% versus a 25% likelihood of a big 50-basis-point transfer.

Long term, skeptics, together with “Massive Quick” investor Michael Burry, preserve that inflation will return, with the Fed obliged to lift charges once more because of this.

“CPI inflation is unlikely to fall as little as 2%, not to mention go destructive,” gold bug Peter Schiff wrote in a response to Burry final week.

“However I agree with you that the Fed will return to QE and the official inflation charge will hit a brand new excessive. The unofficial precise charge will hit a brand new all-time document excessive.”

DCG publicly faces the music

Because the fallout from the FTX saga rolls on, it’s institutional funding big Digital Forex Group (DCG) coming in for a grilling this month.

Publicity to FTX heightened strain on sure DCG subsidiaries in an more and more advanced story which has even raised questions on the way forward for the most important institutional Bitcoin funding automobile,

The Grayscale Bitcoin Belief (GBTC) at present has BTC property underneath administration in extra of $10 billion. Its share value, in keeping with knowledge from Coinglass, trades at an implied 44% low cost to the Bitcoin spot value.

As Cointelegraph reported, trade Gemini has had a few of its property frozen in DCG agency Genesis Buying and selling after it halted withdrawals in mild of FTX. Its co-founder, Cameron Winklevoss, has publicly appealed to DCG CEO, Barry Silbert, for solutions.

Jan. 8, he wrote in an open letter to Silbert, marked a deadline for the state of affairs to be resolved, however with time up, Silbert himself disputes this.

“DCG delivered to Genesis and your advisors a proposal on December twenty ninth and has not obtained any response,” he claimed in a part of a Twitter response to Winklevoss on Jan. 2.

Ought to occasions take an unpredictable flip, the implications for Bitcoin markets could turn into extra severe, with DCG’s prominence as an funding entity making the debacle notably conspicuous.

Describing latest occasions, Checkmate, lead on-chain analyst at Glassnode, mentioned that DCG was persevering with to “blow up in sluggish movement.”

“And Bitcoin value is principally a stablecoin,” he added.

“2023 all depends upon DCG at this level,” Justin Herberger, writer of the Make investments and Prosper e-newsletter, in the meantime forecast.

“In the event that they someway collapse, it’s gonna get ugly. That might be our final leg right down to 85% draw down from Bitcoin ATH’s.”

Miners break extreme promoting streak

Bitcoin miners have been on the radar for many of 2022, however the BTC value dip which adopted the FTX implosion worsened an already tenuous state of affairs.

Miners started to divest themselves of their saved bitcoins with a purpose to stay financially viable, and on-chain metrics swiftly warned of a miner “capitulation” already in progress.

As Cointelegraph reported, nevertheless, neither the extent of the sell-off nor its length appeared crucial, and not too long ago, the state of affairs has stabilized.

“The heavy promote strain from Bitcoin miners that has barraged the marketplace for the final 4 months has lastly subsided for now,” William Clemente, founding father of crypto analysis agency Reflexivity, summarized alongside knowledge from on-chain analytics agency Glassnode this weekend.

That knowledge confirmed the 30-day web place change for Bitcoin miners, this in actual fact starting to extend versus the month prior.

Separate Glassnode knowledge supported the remark, with miners’ BTC reserves hitting their highest in a month on Jan. 8.

Eyeing Bitcoin’s hash charge — the estimated processing energy devoted to mining — Jan Wuestenfeld, analyst at crypto analysis and advisory agency Quantum Economics, was equally upbeat on the established order.

“It’s loopy how the hashrate, albeit miners coming underneath heavy strain, has solely corrected a bit during the last two months of 2022 and now’s even growing contemplating the 30-day transferring common,” he famous.

Final week, Bitcoin’s community issue adjusted downward by round 3.6%, bearing in mind a drop in competitors amongst energetic miners. In accordance with the most recent forecast from BTC.com, nevertheless, the subsequent adjustment will wipe out these losses so as to add 9% to the problem degree, in so doing marking a contemporary all-time excessive.

“Excessive worry” meets 18-month crypto quantity lows

Crypto market sentiment is as not sure as ever relating to the near-term outlook, in keeping with the Crypto Worry & Greed Index.

Associated: Macroeconomic knowledge factors towards intensifying ache for crypto traders in 2023

Over the weekend, the Index, which compiles a sentiment rating from a basket of weighted triggers, dipped again into the highest of its most bearish bracket, “excessive worry.”

A primary for 2023, “excessive worry” is nonetheless acquainted to longtime market individuals, who watched as sentiment endured its longest-ever stint within the Index’s lowest zone final 12 months.

On the identical time, interplay with crypto seems noticeably missing at present value ranges.

Information from analysis agency Santiment has captured the bottom transaction quantity throughout crypto since mid-2020.

“Altcoin quantity is especially low,” a notice to an accompanying chart acknowledged.

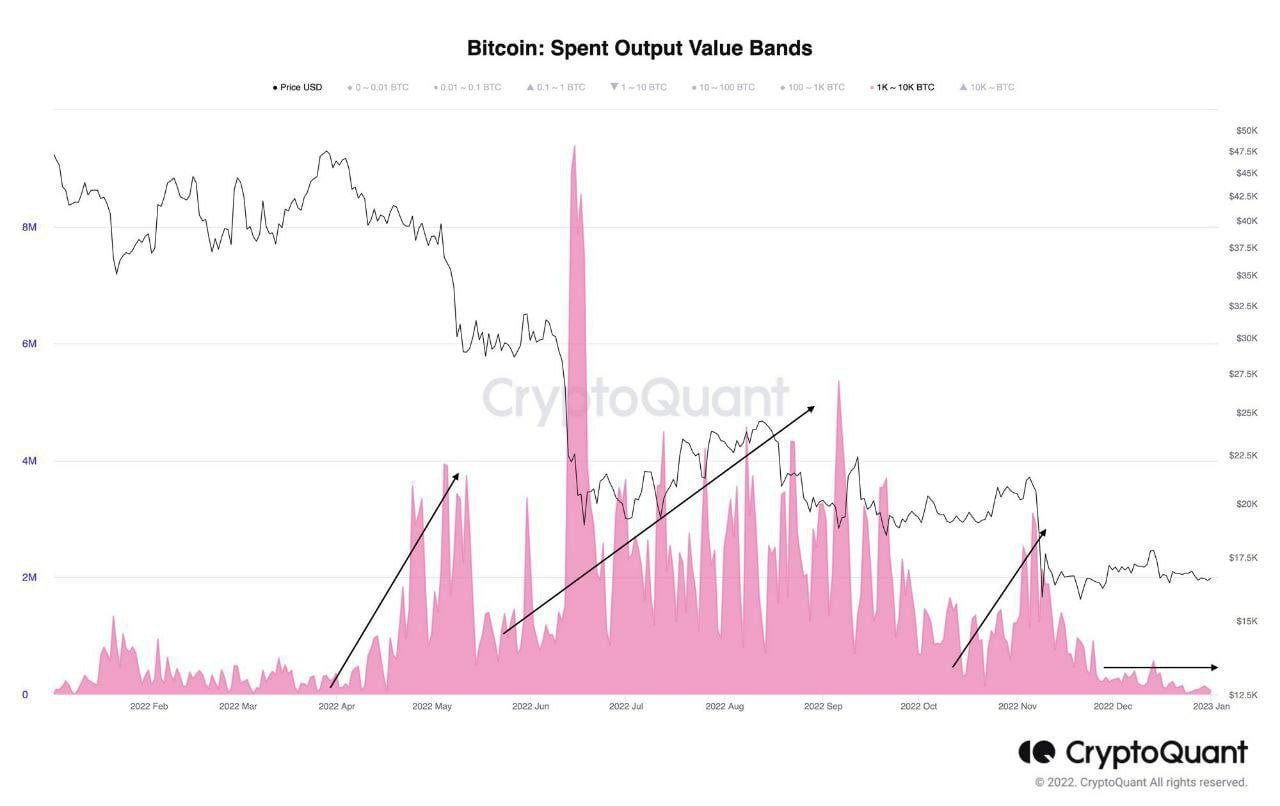

Separate numbers from CryptoQuant flagged by common social media commentator CryptoBitcoinChris nonetheless famous that whale promoting had additionally decreased since December, this doubtlessly setting a development and “optimistic impact on market sentiment.”

The views, ideas and opinions expressed listed here are the authors’ alone and don’t essentially mirror or characterize the views and opinions of Cointelegraph.