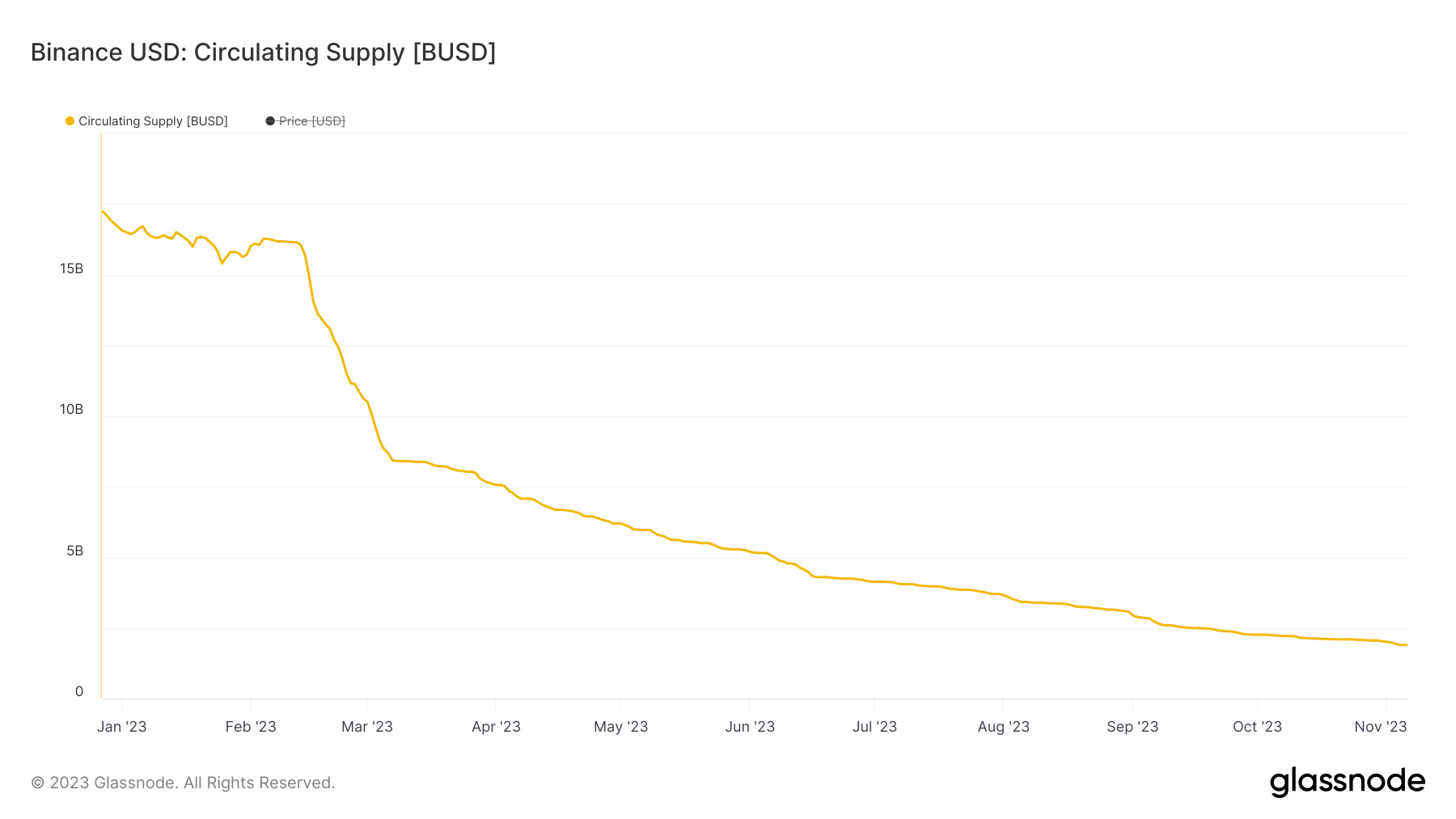

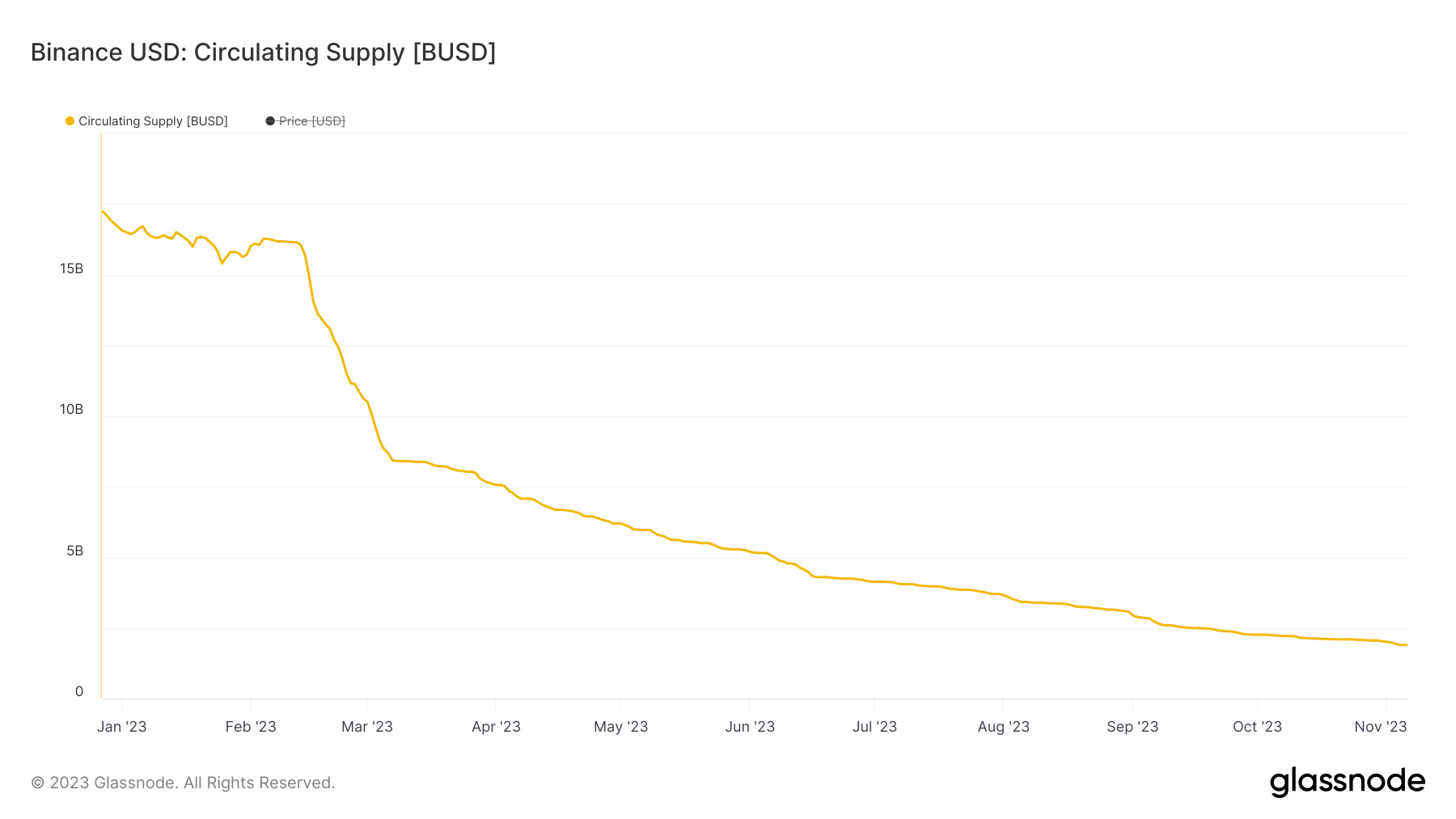

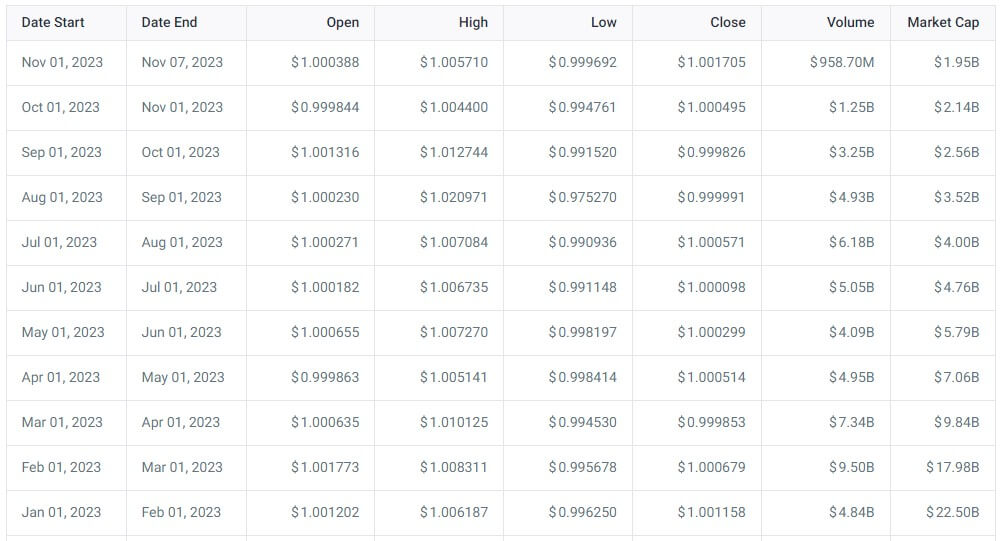

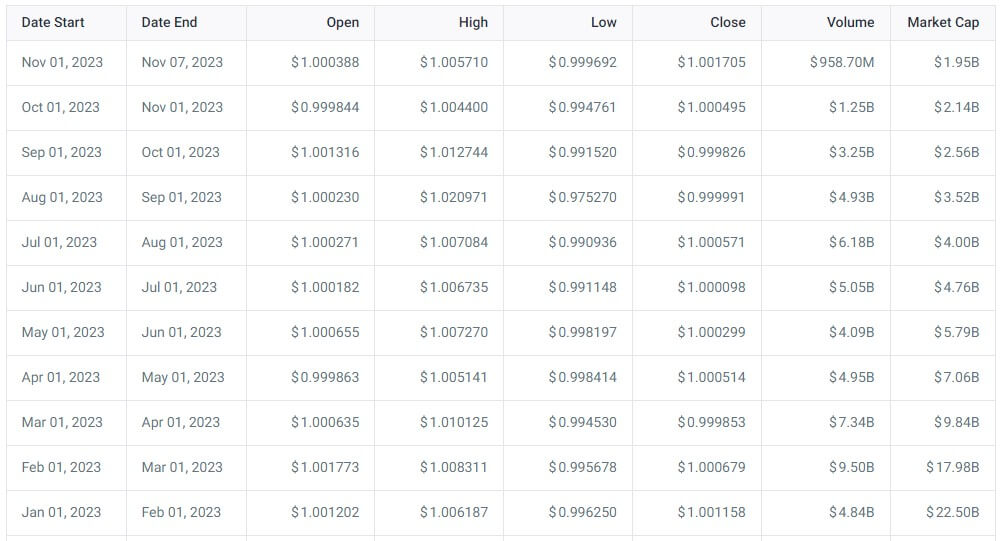

The availability of Binance’s USD (BUSD) stablecoin has declined by greater than 90% to below 2 billion after peaking at an all-time of almost 23 billion in November 2022, in keeping with CryptoSlate’s information. BUSD provide sits at round 1.88 billion as of press time.

Curve’s BUSD V2 pool additionally reveals that crypto merchants are displaying a desire for different stablecoins because the pool’s dashboard is closely imbalanced.

The BUSD V2 dashboard exhibits that the embattled stablecoin accounted for roughly 67% of the pool’s $970,000 reserve, whereas USDT made up 7.5%. The opposite stablecoins within the pool — USD Coin (USDC) and DAI — make up the steadiness.

Knowledge from CoinCodex additional exhibits that BUSD’s buying and selling quantity has quickly tanked throughout the previous 12 months with its common month-to-month quantity falling to $1.25 billion in October from a peak of $9.5 billion recorded in February.

Why BUSD provide fell

BUSD’s provide fall can largely be attributed to regulatory actions that prompted a swift exodus of the troubled stablecoin throughout the crypto neighborhood, inflicting its circulating provide to cut back drastically.

In February, the New York Division of Monetary Companies ordered Paxos to cease minting the stablecoin.

Its destiny was sealed in June when it was labeled as a safety by the U.S. Securities and Change Fee (SEC) in its lawsuit towards Binance.

Each Binance and Paxos vehemently rejected this SEC classification.

Binance advises on alternate options

As BUSD faces an impending discontinuation, Binance has suggested its customers to transition their holdings into First Digital USD (FDUSD), a stablecoin launched by Hong Kong-based First Digital Group in late July.

This advice has prompted a exceptional upswing in FDUSD’s market provide, now at an all-time excessive of $682 million. Nonetheless, the adoption of this stablecoin continues to be considerably restricted, primarily as a result of it’s solely accessible on the Binance platform, missing broader publicity on main crypto exchanges.

Earlier than selling FDUSD, Binance additionally advocated for the Justin Solar-associated True USD (TUSD). TUSD has emerged as one of many fastest-growing stablecoins this 12 months, with a market capitalization exceeding $3.4 billion, largely attributed to early help from Binance.