Retail

merchants are more and more on the lookout for a secure approach to retailer their capital in a

world of high-interest charges and really sluggish curbing of record-high inflation.

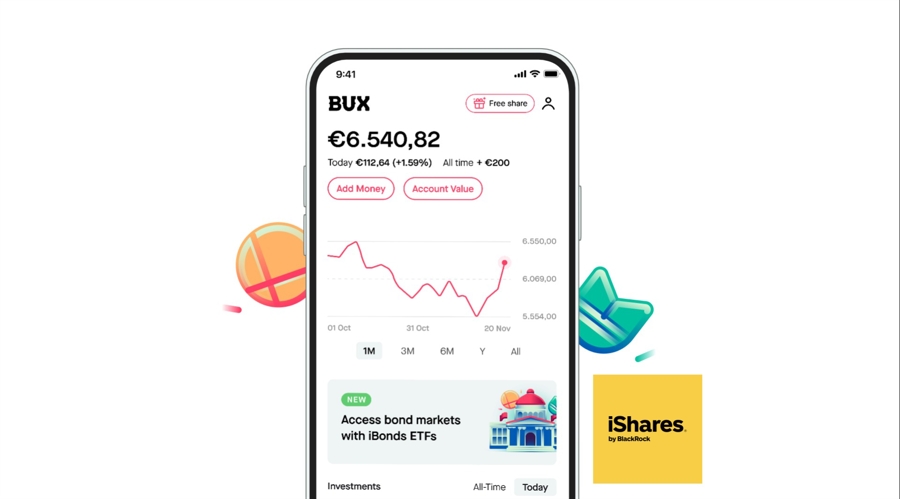

The zero-commission funding platform, BUX has determined to satisfy this demand and

provide devices that had been beforehand reserved for institutional merchants solely.

BUX has

added iBonds exchange-traded funds (ETFs) to its portfolio as a part of its

collaboration with the funding market large, BlackRock. These mix the important thing

traits of conventional bonds and ETFs, offering retail buyers

throughout Europe with cost-effective entry to the company bond market.

4

iShares iBonds from BlackRock have been added to the provide, maturing in

December 2026 and December 2028, every accessible in each greenback and euro

variations. The specs of the 4 new devices are offered within the

desk beneath:

Supply: BUX

As BUX

claims, company bonds had been beforehand reserved just for institutional

buyers. Now, iBonds enable retail buyers to entry company bonds inside

an ETF framework, which mirrors the habits of typical bonds. It ensures the

transparency and liquidity of ETFs and the cost-efficiency of bonds.

“We

are delighted to convey iBond ETFs to our prospects throughout Europe,”

commented Yorick Naeff, the CEO of BUX. “With iBond ETFs, buyers can

profit from the diversification and liquidity related to ETFs, whereas additionally

having fun with the predictability of a set expiry, and advantages of revenue, very similar to

a bond.”

Comfortable to announce that as of immediately, everybody will get entry to a brand new groundbreaking product: iBonds. It’s a brand new product from @BlackRock. It’s an ETF, however with a set maturity date. #investing #new

Investing entails danger. You possibly can lose your fundinghttps://t.co/gUrmwRVgZR

— BUX (@bux) August 16, 2023

In Could, the

BUX platform introduced a reputation change from BUX Zero. In line with Naeff,

dropping ‘Zero’ from the title exhibits the corporate’s dedication to constructing its

flagship app and increasing its present providers with new devices.

Merchants Transfer to Passive

Investments

New

devices for savers appeared a number of months after BUX introduced that it will

provide an ETF financial savings plan in Europe, which is in collaboration with BlackRock.

In line with a survey performed by BUX, Europeans are afraid to take a position independently

as a result of an absence of correct data, and the financial savings plan is designed to vary

that. The most recent bond provide is a pure extension of this.

The corporate

permits its customers to create portfolios utilizing iShares ETF funds, which offer

broad publicity to bonds and shares in world markets. The BUX financial savings plan can

be custom-made, selecting from varied iShares ETF funds, together with equities ,

bonds, themes, sectors, components, and balanced ETF funds.

“When

investing is made cost-efficient and accessible, thousands and thousands of buyers flip to

iShares ETFs as instruments to construct funding portfolios and obtain monetary

well-being. We’re delighted to be working with BUX; this partnership creates

an environment friendly method for buyers throughout Europe to entry the advantages of ETFs and

spend money on world markets in an easy, accessible, and cost-efficient

format,” Christian Bimueller, the Head of Digital Distribution Continental

Europe at BlackRock, commented.

Filip

Kaczmarzyk, a Member of the XTB Administration Board, confirmed merchants’

willingness to hunt passive investments a number of months in the past. In an interview with Finance

Magnates, he admitted that the agency’s purchasers had been extra more likely to go for

shares and ETFs as a substitute of conventional CFDs.

“In

2022, as many as 44% of XTB purchasers in Poland invested in shares and ETFs. In

Romania, this end result was even greater, reaching a staggering 55%. Due to this fact, we

can anticipate that this development will proceed within the coming months, and even

years,” Kaczmarzyk defined.

Retail

merchants are more and more on the lookout for a secure approach to retailer their capital in a

world of high-interest charges and really sluggish curbing of record-high inflation.

The zero-commission funding platform, BUX has determined to satisfy this demand and

provide devices that had been beforehand reserved for institutional merchants solely.

BUX has

added iBonds exchange-traded funds (ETFs) to its portfolio as a part of its

collaboration with the funding market large, BlackRock. These mix the important thing

traits of conventional bonds and ETFs, offering retail buyers

throughout Europe with cost-effective entry to the company bond market.

4

iShares iBonds from BlackRock have been added to the provide, maturing in

December 2026 and December 2028, every accessible in each greenback and euro

variations. The specs of the 4 new devices are offered within the

desk beneath:

Supply: BUX

As BUX

claims, company bonds had been beforehand reserved just for institutional

buyers. Now, iBonds enable retail buyers to entry company bonds inside

an ETF framework, which mirrors the habits of typical bonds. It ensures the

transparency and liquidity of ETFs and the cost-efficiency of bonds.

“We

are delighted to convey iBond ETFs to our prospects throughout Europe,”

commented Yorick Naeff, the CEO of BUX. “With iBond ETFs, buyers can

profit from the diversification and liquidity related to ETFs, whereas additionally

having fun with the predictability of a set expiry, and advantages of revenue, very similar to

a bond.”

Comfortable to announce that as of immediately, everybody will get entry to a brand new groundbreaking product: iBonds. It’s a brand new product from @BlackRock. It’s an ETF, however with a set maturity date. #investing #new

Investing entails danger. You possibly can lose your fundinghttps://t.co/gUrmwRVgZR

— BUX (@bux) August 16, 2023

In Could, the

BUX platform introduced a reputation change from BUX Zero. In line with Naeff,

dropping ‘Zero’ from the title exhibits the corporate’s dedication to constructing its

flagship app and increasing its present providers with new devices.

Merchants Transfer to Passive

Investments

New

devices for savers appeared a number of months after BUX introduced that it will

provide an ETF financial savings plan in Europe, which is in collaboration with BlackRock.

In line with a survey performed by BUX, Europeans are afraid to take a position independently

as a result of an absence of correct data, and the financial savings plan is designed to vary

that. The most recent bond provide is a pure extension of this.

The corporate

permits its customers to create portfolios utilizing iShares ETF funds, which offer

broad publicity to bonds and shares in world markets. The BUX financial savings plan can

be custom-made, selecting from varied iShares ETF funds, together with equities ,

bonds, themes, sectors, components, and balanced ETF funds.

“When

investing is made cost-efficient and accessible, thousands and thousands of buyers flip to

iShares ETFs as instruments to construct funding portfolios and obtain monetary

well-being. We’re delighted to be working with BUX; this partnership creates

an environment friendly method for buyers throughout Europe to entry the advantages of ETFs and

spend money on world markets in an easy, accessible, and cost-efficient

format,” Christian Bimueller, the Head of Digital Distribution Continental

Europe at BlackRock, commented.

Filip

Kaczmarzyk, a Member of the XTB Administration Board, confirmed merchants’

willingness to hunt passive investments a number of months in the past. In an interview with Finance

Magnates, he admitted that the agency’s purchasers had been extra more likely to go for

shares and ETFs as a substitute of conventional CFDs.

“In

2022, as many as 44% of XTB purchasers in Poland invested in shares and ETFs. In

Romania, this end result was even greater, reaching a staggering 55%. Due to this fact, we

can anticipate that this development will proceed within the coming months, and even

years,” Kaczmarzyk defined.