For nearly the whole lot of 2022, U.S. inflation information has prompted ache within the markets, nonetheless, a slowdown in October gave new hope for much less aggressive Fed hikes. Buyers grabbed the prospect with each fingers as U.S. equities and fixed-income had their greatest day because the spring of 2020 whereas the greenback index sank with its worst every day decline since 2009.

U.S. headline inflation eased to 7.7% from 8.2% in September which noticed the slowest tempo of inflation since January.

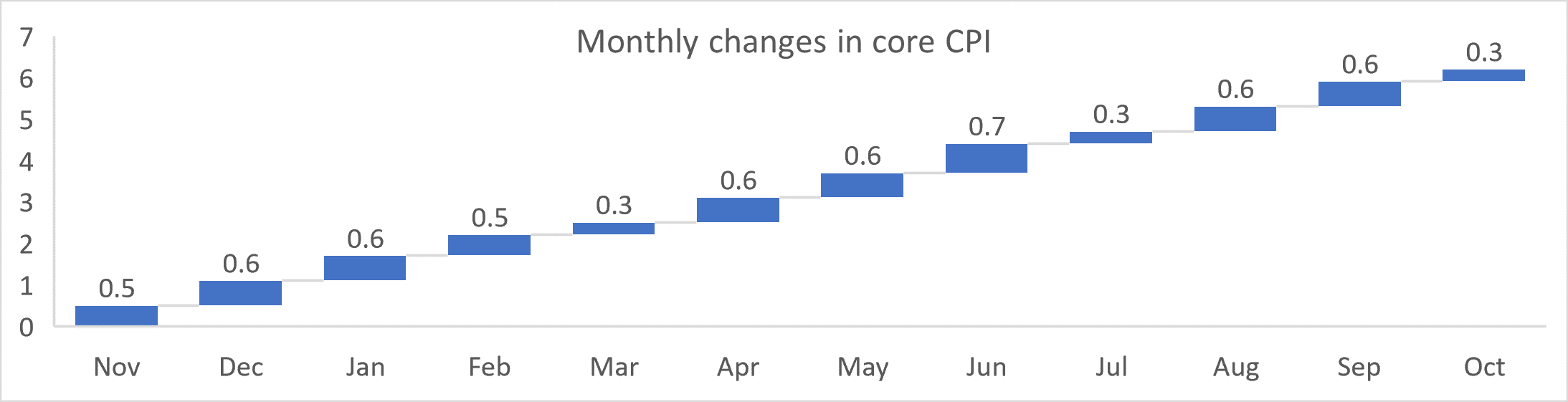

Core inflation rose 0.3% in October and introduced core figures to six.3% from its forty-year excessive of 6.6%.

Renewed hopes of a slowdown in price hikes and an earlier finish to the fed cycle on account of a slowing core and headline inflation. Philadelphia Fed President Patrick Harker commented,

“I count on we’ll sluggish the tempo of our price hikes as we method a sufficiently restrictive stance.”

Expectations are actually firmly in place for a 50bps hike in December, and a 19bps minimize from the fed funds price peak that’s anticipated in June.

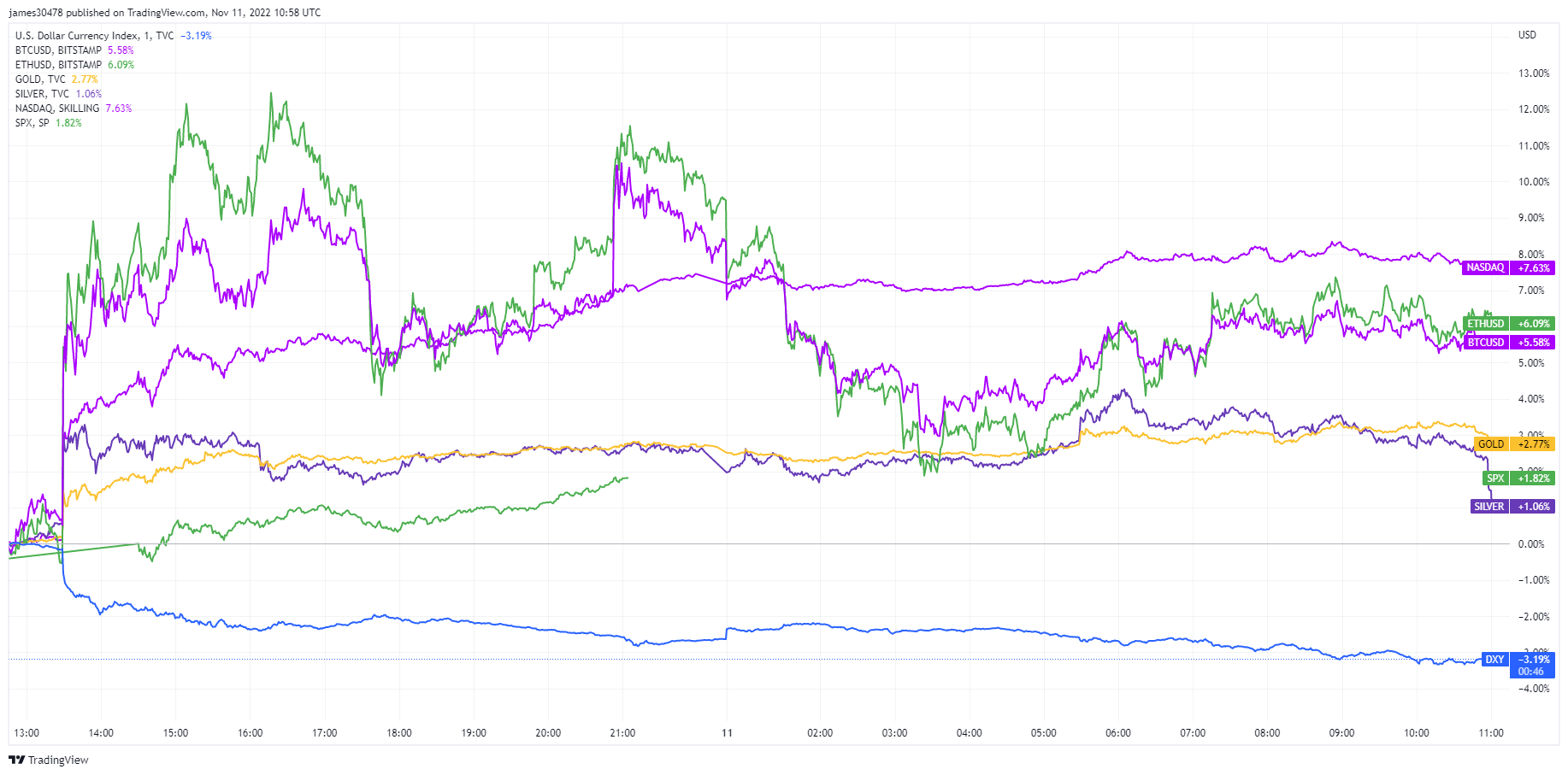

Steep declines in U.S. treasury yields and the Greenback noticed an urge for food for risk-on property as buyers noticed headline inflation probably roll over. U.S. equities surged with S&P closing 5.5% increased, Nasdaq 7.4% increased, in addition to Gold and silver surging. Each Bitcoin and Ethereum rallied on the constructive information, 6% and eight% respectively.

This rally was short-lived because the FTX sage unfolded. Buyers skilled a short interval of optimism that drove costs up quickly earlier than bearish sentiment took maintain as soon as once more and capitulation resumed, probably now pushing costs even decrease than earlier than.

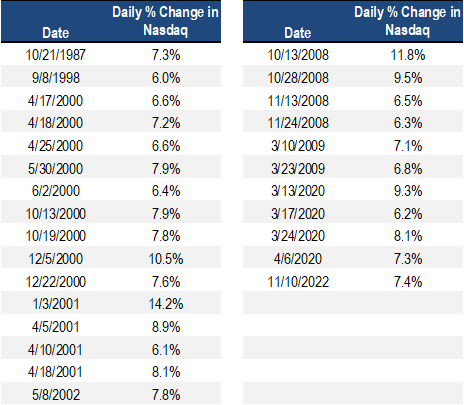

Nov. 10, noticed the Nasdaq rally 7.5% the most important acquire since March 2020, and in line with Stockcharts days like this don’t occur in bull markets. In 2000-2002, the Nasdaq had 14 up days of 6% or extra and buyers would have been incorrect in calling the underside on all 14 events.

Moreover, in 2008-2009, the Nasdaq was up 6% or extra for six days, and merchants would have been incorrect 4 instances pondering the underside had occurred.

As markets are forward-looking the narrative might have modified from inflation has peaked, to a potential recession that may see the Fed pause, pivot, and even finally resume quantitative easing sooner or later within the first half of 2023.