XRP, the fifth-largest cryptocurrency out there, has entered a part of macro consolidation following a major decline that started on July 20. This consolidation has maintained the token’s worth inside a variety of $0.4858 and $0.5505, earlier than Ripple Labs’ authorized victory in opposition to the US Securities and Change Fee on July 13.

XRP Consolidation Continues Regardless of Robust Buying and selling Exercise

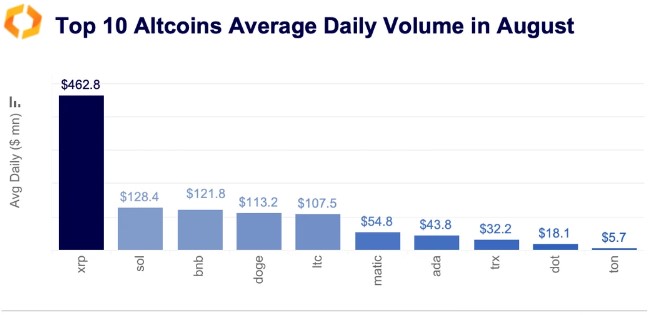

In accordance to insights from crypto market knowledge supplier Kaiko, XRP demonstrated excessive commerce quantity throughout the summer season. XRP’s common commerce quantity within the earlier month reached $462 million, 4 instances larger than the next most outstanding altcoins by commerce quantity.

The query arises as to why XRP did not maintain its worth beneficial properties regardless of its spectacular commerce quantity.

Analyzing the typical share of promote quantity for XRP gives some insights. Notably, the most important Korean trade, Upbit, and OKX skilled vital promoting stress, whereas shopping for exercise was extra outstanding on US-based Coinbase all through the earlier month.

One other fascinating statement is the rise in common commerce dimension for XRP on Coinbase, surpassing all different high ten altcoins.

This means that purchasing demand could have been pushed by massive merchants in the US, as traders regained entry to the token following the July court docket ruling.

Nevertheless, it’s important to notice that although XRP tops the record on offshore markets, its share of buying and selling quantity in the US stays decrease, rating it because the sixth most traded altcoin by cumulative commerce quantity.

Presently, XRP is buying and selling at $0.5063, displaying a steady worth inside 24 hours. Furthermore, the token has maintained a constant consolidation part, experiencing a slight lower of two.7% and 1.4% over the previous seven and fourteen days, respectively.

This raises whether or not XRP’s uptrend will prevail or if additional draw back actions are looming.

Is A Bullish Resurgence Or Downtrend Imminent?

Crypto analyst Egrag Crypto not too long ago took to the social media platform X (previously generally known as Twitter) to current two contrasting situations for XRP’s worth motion.

The primary state of affairs steered a possible dip to $0.43 and even $0.35, which might be seen as a shakeout earlier than a rebound. The second state of affairs proposed a extra optimistic outlook, with XRP doubtlessly aiming for heights of $0.60 and $0.67 earlier than skyrocketing to new ranges.

To achieve additional insights into the probability of those situations, it’s essential to look at XRP’s resistance and help strains on the each day chart above.

The chart reveals that whereas surpassing the subsequent resistance stage of $0.5401 and regaining bullish momentum, XRP may doubtlessly expertise a considerable 27% uptrend towards $0.6700, as predicted by Egrag Crypto. Nevertheless, the token at the moment faces two vital hurdles in attaining this.

XRP’s 200-day and 50-day Transferring Averages (MAs) can act as stable resistance ranges if the token’s buying and selling quantity just isn’t accompanied by enough shopping for stress. Presently, XRP is buying and selling under these two strains, which provides to the problem of surpassing the resistance.

If XRP fails to beat these resistances and maintain its consolidation part, one other correction could quickly be on the horizon for the token.

Alternatively, bullish traders might want to defend the closest help flooring for XRP at $0.4524. If this stage is breached, the token may decline additional to the $0.3495 zone and even the $0.2854 line, representing XRP’s one-year help.

Contemplating the assorted situations and the resistance and help strains depicted within the chart, the absence of catalysts that would propel XRP to larger worth territories, coupled with a failed try to keep up its macro consolidation zone, could lead XRP in the direction of persevering with its downtrend and doubtlessly reaching a brand new yearly low.

Featured picture from iStock, chart from TradingView.com