ARK Funding, a enterprise capital firm based by Cathie Wooden, is bracing for the coldest winter it had in a very long time.

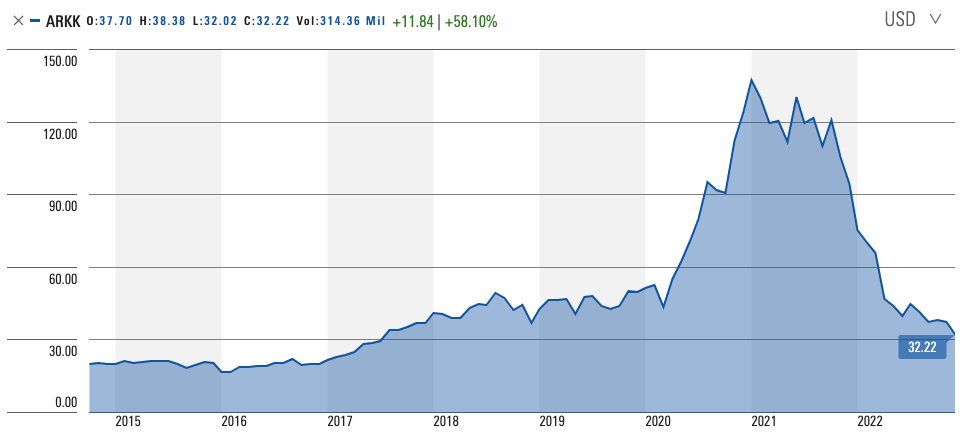

The ARK fund, a pandemic-era success story that introduced Wooden to worldwide fame, has seen each inventory it owns drop to all-time lows. Shares of the fund itself are down almost 63% this 12 months and are again to their late 2017 ranges.

In accordance with Morningstar Direct, the loss seen with ARKK shares, the fund’s Innovation ETF, was the biggest drop amongst greater than 230 actively traded diversified ETFs. In distinction, the S&P 500 is down simply over 14% this 12 months — together with dividends.

ARK’s fall from grace

There are a number of elements that contributed to ARK’s downfall, and its crypto publicity, particularly by means of GBTC and COIN, is the most important one.

The $7.1 billion fund holds round 30 inventory positions, with Zoom, Tesla, and Coinbase making up the most important proportion of its portfolio. ARK noticed exponential progress originally of the pandemic in 2020, when Wooden jumped head-first into growth-oriented tech corporations and ramped up the fund’s publicity to crypto.

Wooden’s technique has the fund investing closely in applied sciences she believes have the potential to “change the world.” This technique paid off inside months of investing in unprofitable early-stage startups, as Zoom grew to become a family title in the course of the pandemic and Tesla recorded its finest 12 months ever.

ARK publicity to crypto

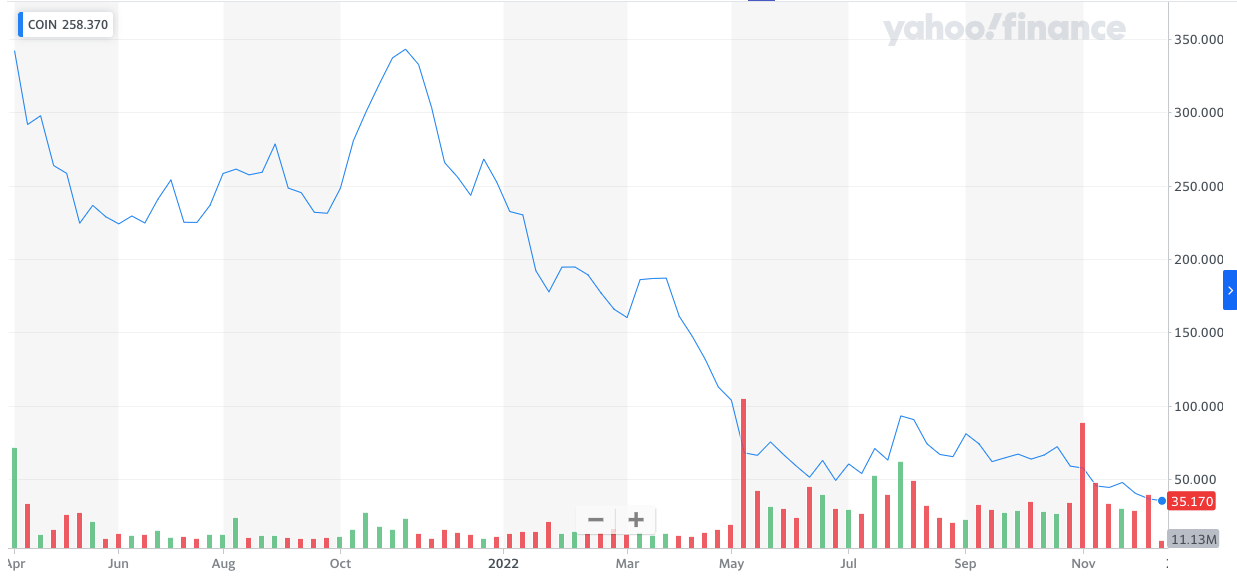

Coinbase additionally noticed its shares attain their all-time excessive on the top of the pandemic, making ARK one of the worthwhile funds within the house.

ARK additionally has an enormous place within the Grayscale Bitcoin Belief (GBTC), holding over 6.15 million shares. And whereas the place represents lower than 0.50% of ARK’s portfolio, the losses GBTC suffered hit the fund arduous.

Bitcoin’s drop from its all-time excessive of $69,000 shook GBTC, inflicting its shares to drop greater than 76% for the 12 months. GBTC is at the moment buying and selling at over 50% low cost to its NAV which means it has carried out even worse than Bitcoin. Coinbase noticed its share lose over 80% of its worth this 12 months, placing extra strain on the already struggling fund.

Whereas analysts may disagree about what precise a part of Wooden’s portfolio hit it the toughest, all of them agree that ARK is in bother. Jon Burckett-St. Laurent, a senior portfolio supervisor at Exencial Wealth Advisors, mentioned that ARK lacks a risk-management recreation plan. The fund was constructed on the stimulus-era free cash and its existence largely depends upon it now, he advised The Wall Road Journal.

Trade perspective

Todd Rosenbluth, the top of analysis at VettaFi, advised Traders.com that Wooden’s narrowly-focused, thematic ETF appears to be too concentrated for a lot of shareholders. Its crypto publicity doesn’t assist both.

Nevertheless, Cathie Wooden has continued to shrug off issues in regards to the fund’s well-being. Not solely is Wooden standing by her investments, however she’s additionally doubling down on the riskiest positions in her portfolio.

In November, ARK added $43 million of Coinbase shares. One other one among Wooden’s funds, ARK Subsequent Era Web ETF, bought $6 million price of GBTC in October, considerably growing its publicity to Bitcoin.

The buyers that also stand by Wooden all appear to share her conviction.

For the reason that starting of the 12 months, the variety of accounts holding the fund decreased by round 8%. In mid-November, the overall variety of accounts holding ARKK reached its yearly low.

Nevertheless, information from Webull Monetary LLC confirmed that clients have really added money on a web foundation to ARKK in 2022. Over $1.4 billion has been poured into ARK Innovation ETF this 12 months.

Optimism for the longer term

This reveals that buyers stay assured that the disruptive tech Wooden is concentrated on is but to see its heyday. The sharp losses all the shares in ARK’s portfolio skilled haven’t shaken investor confidence and most appear to be prepared to bear short-term losses.

These short-term losses might worsen within the coming weeks. Anthony Denier, the CEO at Webull, mentioned that buyers could possibly be concentrating on their holdings for tax-loss harvesting — the apply of promoting shedding positions earlier than the top of the 12 months to appreciate losses and write them off as a tax loss. If a few of these holding ARKK resolve to liquidate, the fund might see its shares plummet even additional, Denier advised The Wall Road Journal.