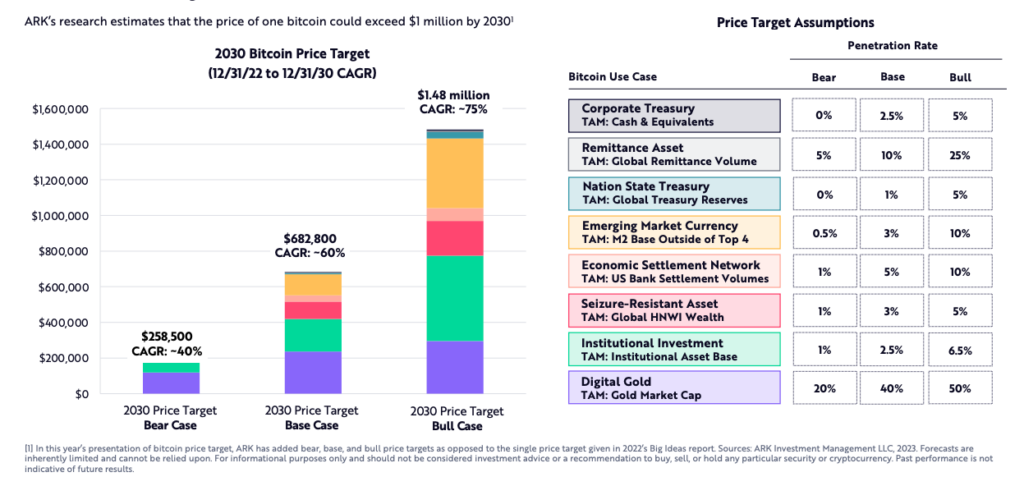

Cathie Wooden’s ARK Make investments expects Bitcoin’s worth to rise to $1M per coin by 2030, together with a increase in annual charges of good contract networks, based on a brand new report printed by the funding administration agency.

The highlights of the Jan. 31 report embrace:

- Bitcoin will hit $1 million per coin by 2030

- Good contract networks may facilitate $450 billion in annual charges by 2030

- Utility in good contract networks are increasing and diversifying

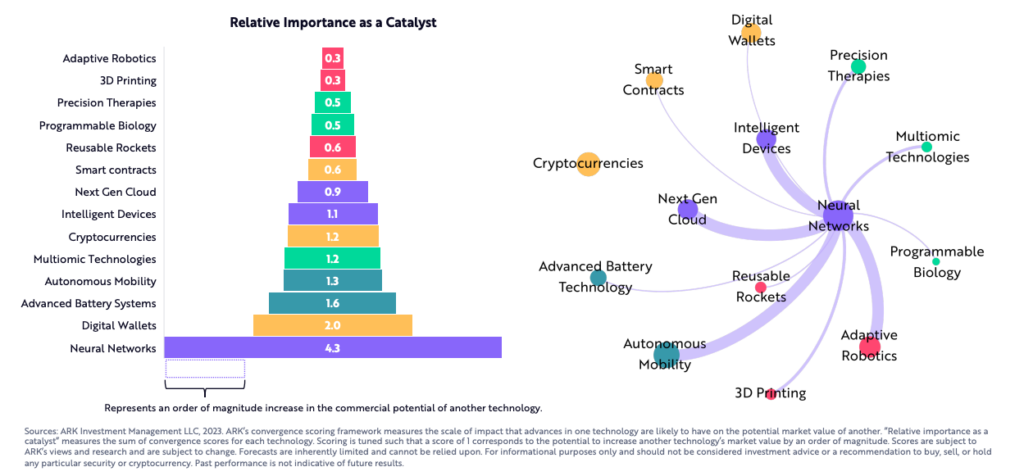

- Neural networks and AI will converge with different applied sciences like crypto to usher in a brand new world

ARK’s total funding thesis is based on 5 converging technological improvements that may reshape the following a number of years, that are public blockchains, synthetic intelligence, power storage, robotics, and multiomic sequencing

Every of those is damaged down into a number of sectors, industries and actions that ARK hopes will harness its funding car’s financial potential.

“Neural Networks are crucial catalyst”

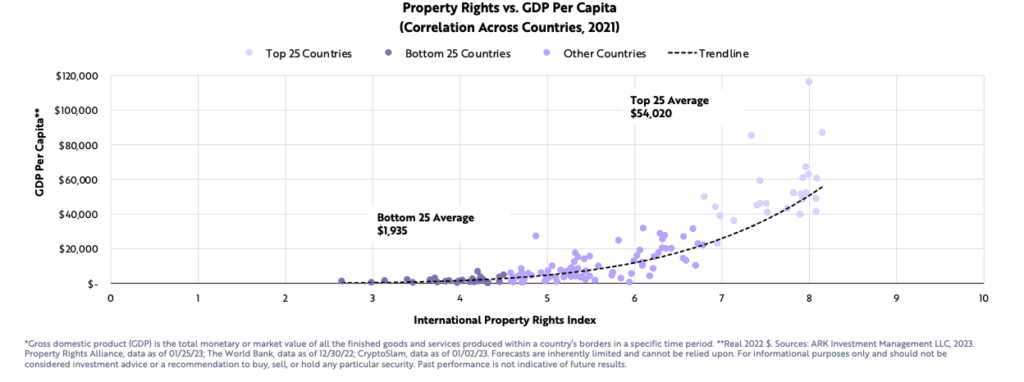

The institution of property rights is predicted to bolster the worth of digital belongings within the coming years as nicely, per the ARK Make investments report. Traditionally, property rights, each bodily and mental, have proven a constructive relationship with GDP per capita, which is usually used as a measure of way of life. Digital belongings, with decentralized proof of possession, are more likely to drive a rise in on-line spending per capita. ARK predicts that international NFT transaction quantity will skyrocket from immediately’s $22 billion to $120 billion by 2027, a greater than five-fold improve.

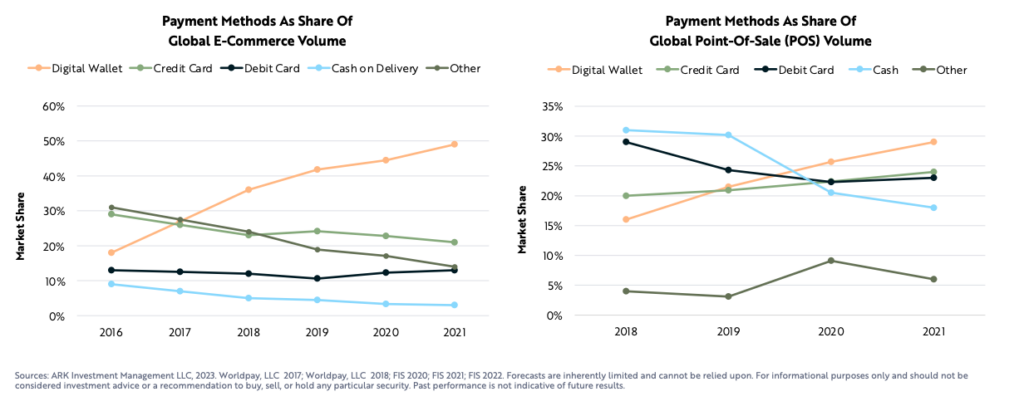

By onboarding billions of shoppers and thousands and thousands of retailers, digital wallets are poised to disrupt conventional banking by saving cost transactions practically $50 billion in prices, ARK predicts. With 3.2 billion customers, digital wallets have reached 40% of the world’s inhabitants. In line with ARK analysis, the variety of digital pockets customers is predicted to develop at an annual fee of 8%, penetrating 65% of the worldwide inhabitants by 2030.

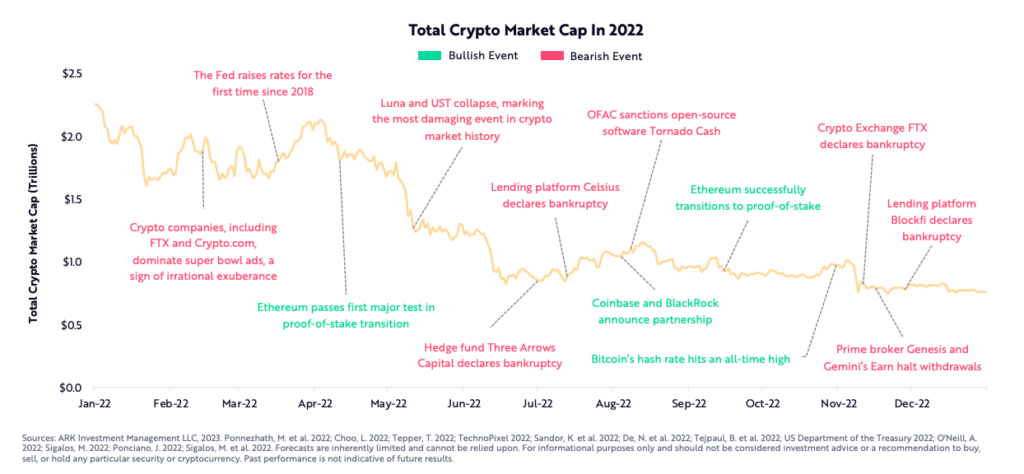

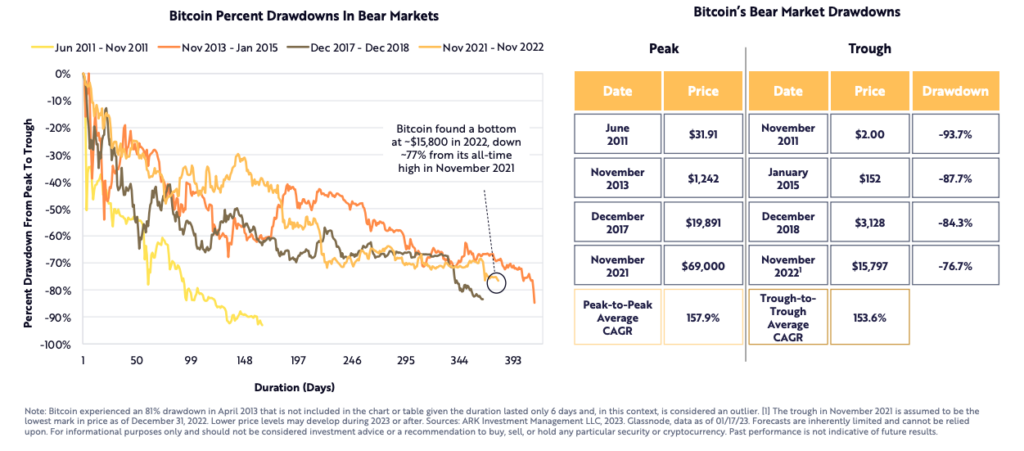

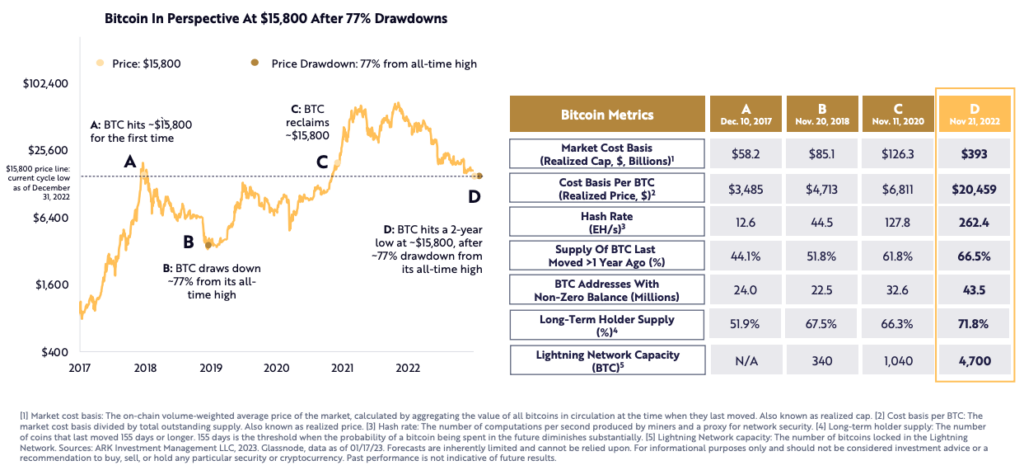

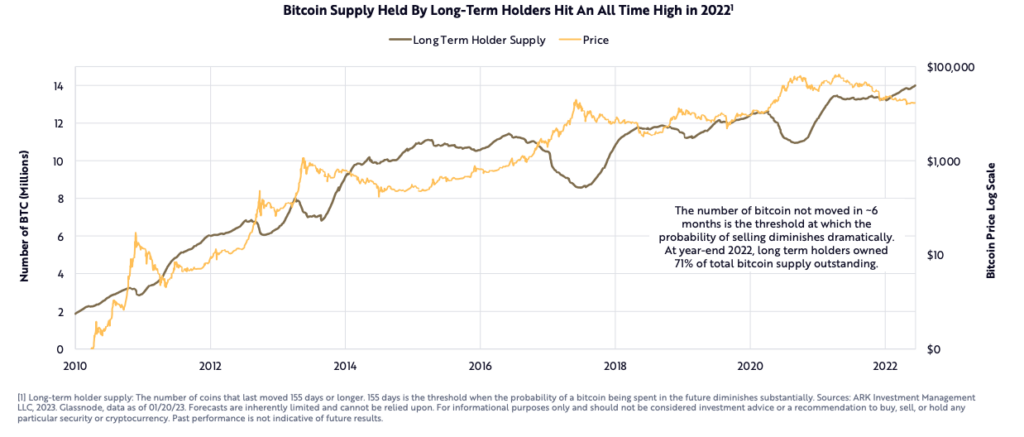

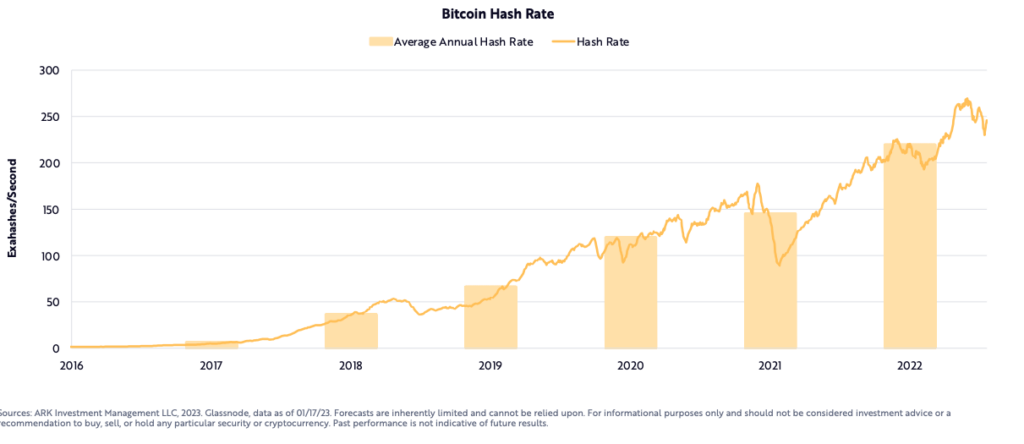

“We consider Bitcoin’s long-term alternative is strengthening […]its community fundamentals have strengthened and its holder base has change into extra long-term targeted. Contagion brought on by centralized counterparties has elevated Bitcoin’s worth propositions: decentralization, auditability, and transparency. The value of 1 bitcoin may exceed $1 million within the subsequent decade.”

In line with ARK, Bitcoin traders at the moment are extra targeted on long-term investments than ever earlier than. Regardless of market concern fueled by the failure of a number of main crypto organizations, on-chain information means that Bitcoin holders stay steadfast of their dedication to long-term prospects.

Institutional funding remained bullish all through 2022, regardless of contagion from main scandals and collapses throughout the trade. Highlighted by:

- Blackrock: In June 2022, Aladdin by BlackRock partnered with Coinbase Prime to supply institutional purchasers direct entry to cryptocurrencies, beginning with Bitcoin. This collaboration has the potential to deliver trillions of {dollars} into the crypto asset class within the upcoming years.

- BNY Mellon: In October 2022, BNY Mellon launched a crypto asset custody platform to safe belongings for institutional traders. As the corporate manages over 20% of the world’s investable belongings, it has the potential to broaden monetary companies effectively utilizing Bitcoin.

- Eaglebrook Advisors: In October 2022, Eaglebrook Advisors and ARK Funding Administration joined forces to offer monetary advisors with entry to actively managed crypto methods, together with direct possession of crypto belongings, low funding minimums, and seamless portfolio reporting integration.

- Constancy: In November 2022, Constancy formally launched retail buying and selling accounts for Bitcoin and Ether, permitting traders to commerce and securely maintain these belongings on its platform.

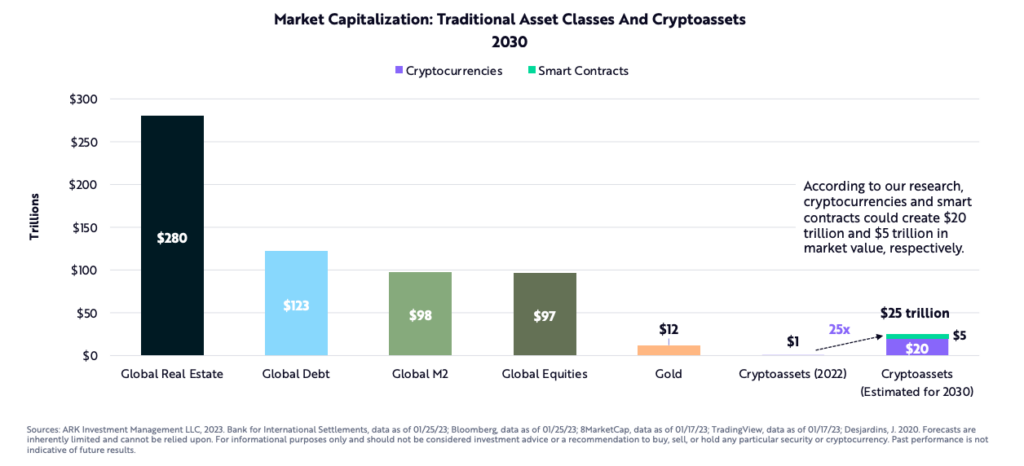

“Bitcoin is more likely to scale right into a multi-trillion greenback market.”

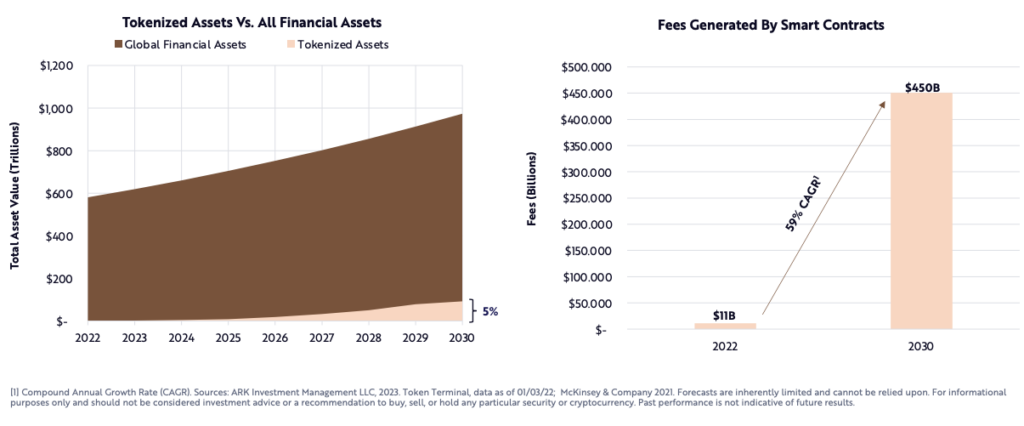

ARK’s analysis predicts that as the worth of tokenized monetary belongings grows on blockchain, decentralized purposes and the good contract networks supporting them have the potential to earn $450 billion in annual income and attain a market worth of $5.3 trillion by 2030.

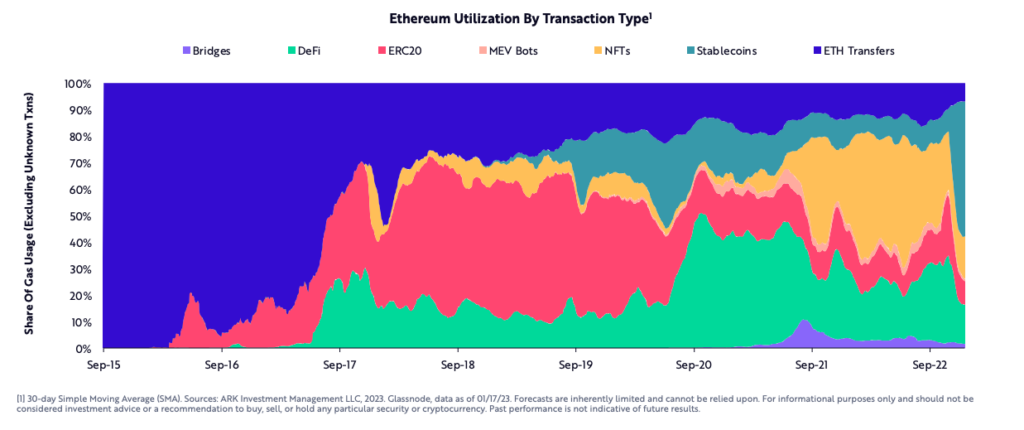

“The utility of good contract networks is increasing and diversifying.”

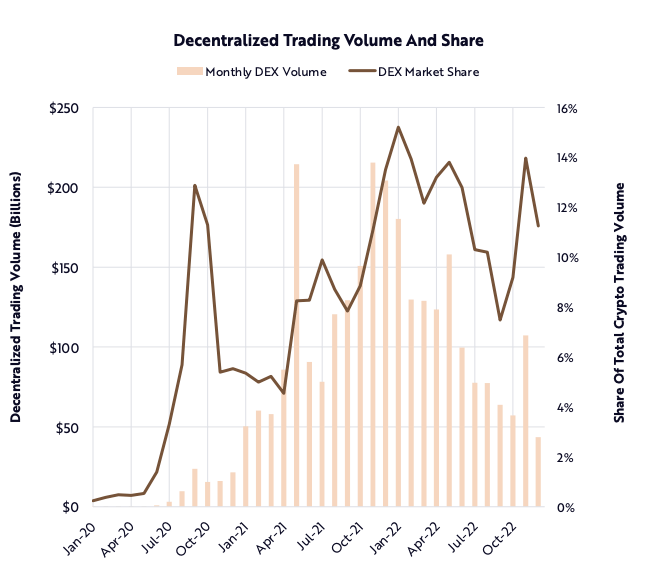

In line with the report, merchants are choosing self-custody options and shifting away from centralized intermediaries, as they more and more desire the transparency provided by decentralized exchanges. Since 2020, the buying and selling quantity of decentralized exchanges (DEXs) has been rising as a proportion of complete crypto buying and selling quantity, although CEX nonetheless management a lot of the market, the report predicts DEXs will solely get stronger.

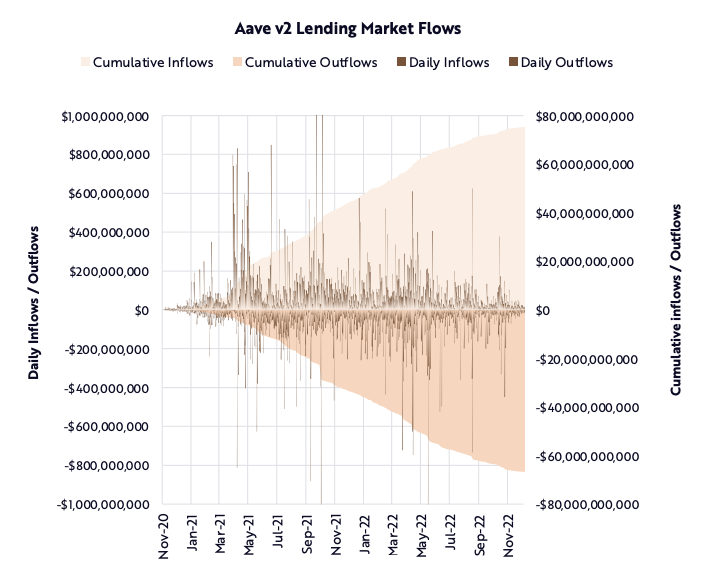

Whereas a number of crypto lending corporations, akin to Celsius and Voyager, skilled insolvencies, decentralized lending markets like Aave remained operational. These markets continued to course of deposits, withdrawals, originations, and liquidations with none service disruptions. From November 2020 to current, Aave has processed over $75 billion in inflows and $66 billion in outflows, all by means of automated good contracts.

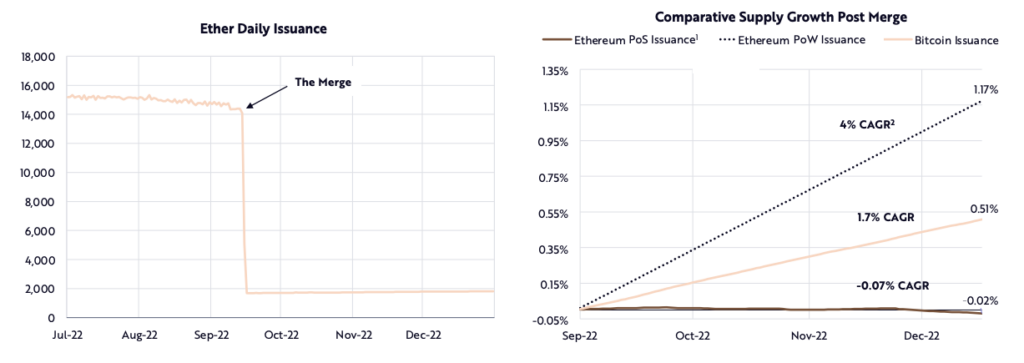

Adjustments within the Ethereum community entered a brand new part with its merge in September 2022, which marked its transition from Proof-of-Work (PoW) to Proof-of-Stake (PoS). With this transformation, Ethereum eradicated the necessity for energy-intensive mining to safe its community, thereby enhancing its financial coverage and decreasing the issuance of latest tokens. This new token mannequin has resulted in a flattening of Ethereum’s internet annual token issuance, which is now decrease than Bitcoin’s 1.7% and decrease than the 4% in Ethereum’s earlier PoW mannequin. Because of the steady community, the availability of Ether is predicted to lower into the approaching years, illustrated by ARK by way of projected provide progress post-merge.

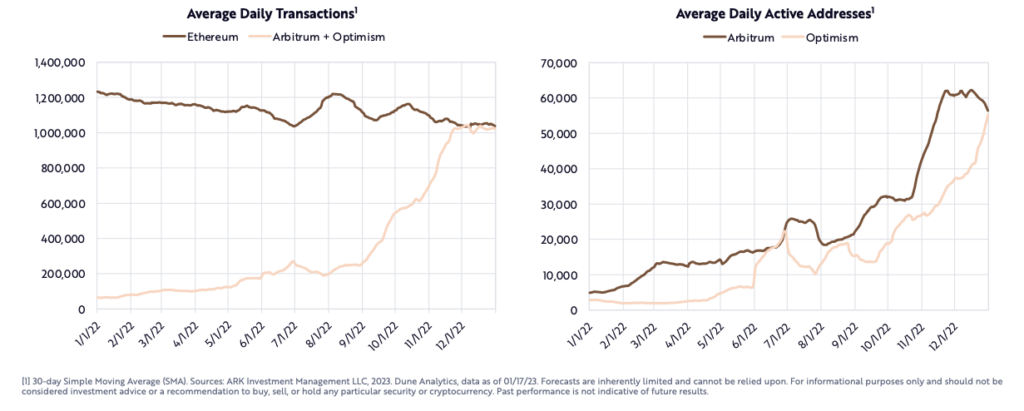

Ethereum’s layer 2 scaling answer appears to be enhancing community exercise. In 2022, the variety of transactions on Arbitrum and Optimism, two extensively used layer 2 networks, reached the identical degree as these on Ethereum’s base layer. Moreover, the variety of energetic addresses on every community grew considerably, with a rise of 11 occasions for Arbitrum and 19 occasions for Optimism.

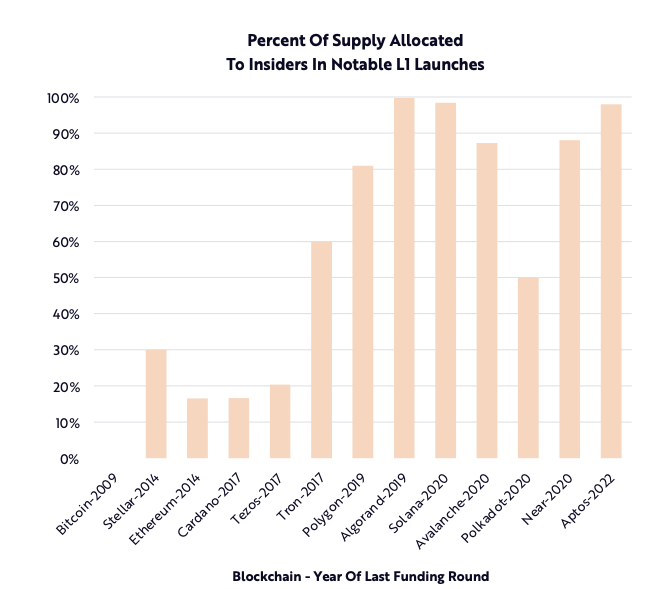

Some trigger for concern stays the proportion of token provide taken by some layer 1 networks. On layer 1 blockchains, there was an increase within the proportion of token provide managed by insiders akin to founding groups, non-public traders, and personal foundations and funds. This development is because of the accumulation of bigger reserves by founders to compete with established gamers, in addition to elevated funding from enterprise capital in base layer protocols. Moreover, regulatory issues have led to a lower in the usage of Preliminary Coin Choices as a way of open distribution, ARK factors out.

“Good contract networks may facilitate $450 billion in annual charges by 2030.”

Following the collapse of centralized crypto intermediaries prior to now yr, decentralized public blockchains with self-executing contracts present a extra clear and non-custodial answer for monetary companies. Decentralization is turning into an important consider upholding the unique objective of public blockchain infrastructure. ARK analysis signifies that as the worth of tokenized monetary belongings will increase on the blockchain, decentralized purposes and the good contract networks driving them may generate $450 billion in annual income and attain a market worth of $5.3 trillion by 2030.