Fast Take

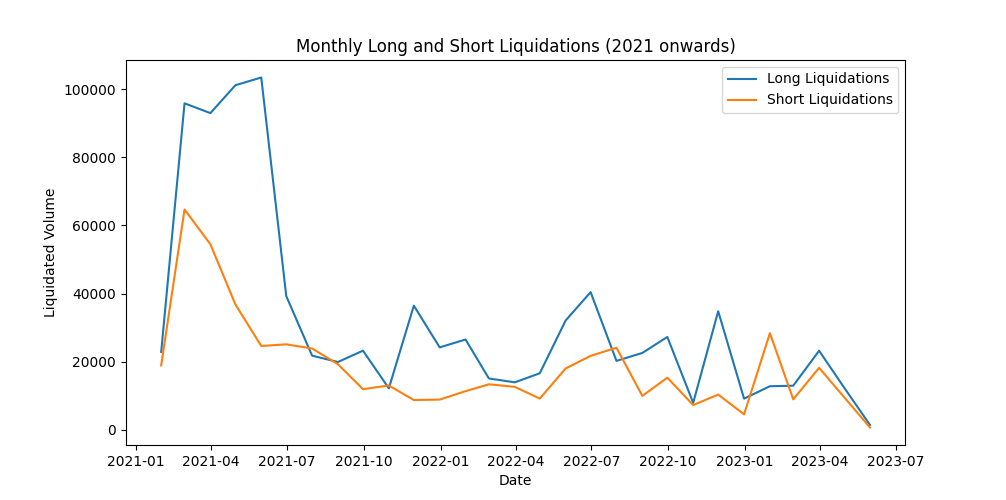

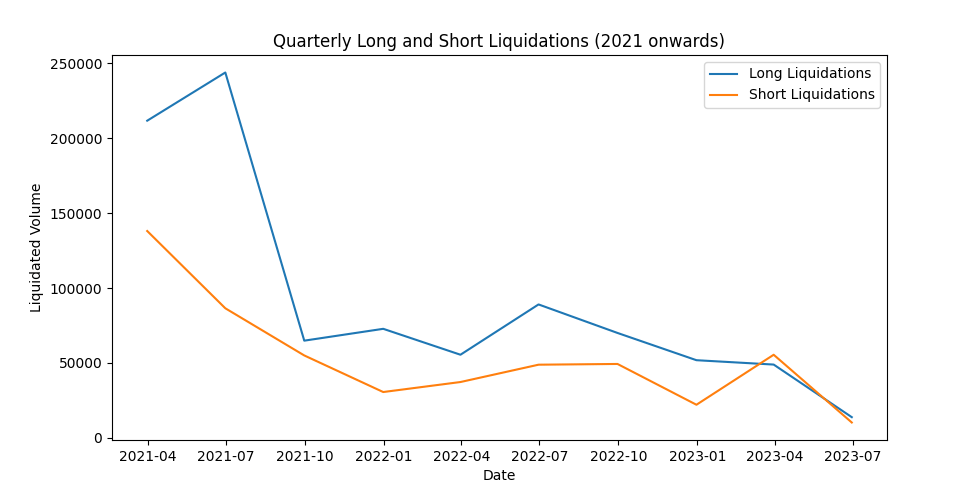

- Liquidations had been one of many primary speaking factors in the course of the 2021 and 2022 cycles — lengthy being liquidated for the higher two years.

- Many causes liquidations had been loads in 2021 in comparison with 2022 had been resulting from leverage, whale exercise, and market sentiment.

- As 2021 was a bull market, market sentiment was robust to the upside, and costs continued to extend. Therefore, lengthy liquidations on small pullbacks had been obliterated.

- Into 2022, a bear market, and costs continued to go down 75% from their all-time excessive, buyers needed to go lengthy at any second; nevertheless, they continued to get burnt.

- Into 2023, it has been a mixture of brief and lengthy liquidations; shorts did take pole place in 2023 and had been on the fallacious aspect. However now you possibly can see liquidations are very comparable in dimension, suggesting a impartial market.

The publish Caught within the crossfire: how lengthy and brief liquidations form the crypto market’s future appeared first on CryptoSlate.