Bitcoin miners play a pivotal function within the cryptocurrency ecosystem. They validate transactions, safe the community, and flow into new Bitcoins. Their conduct, particularly in holding or promoting mined cash, can present perception into market sentiment and future worth actions.

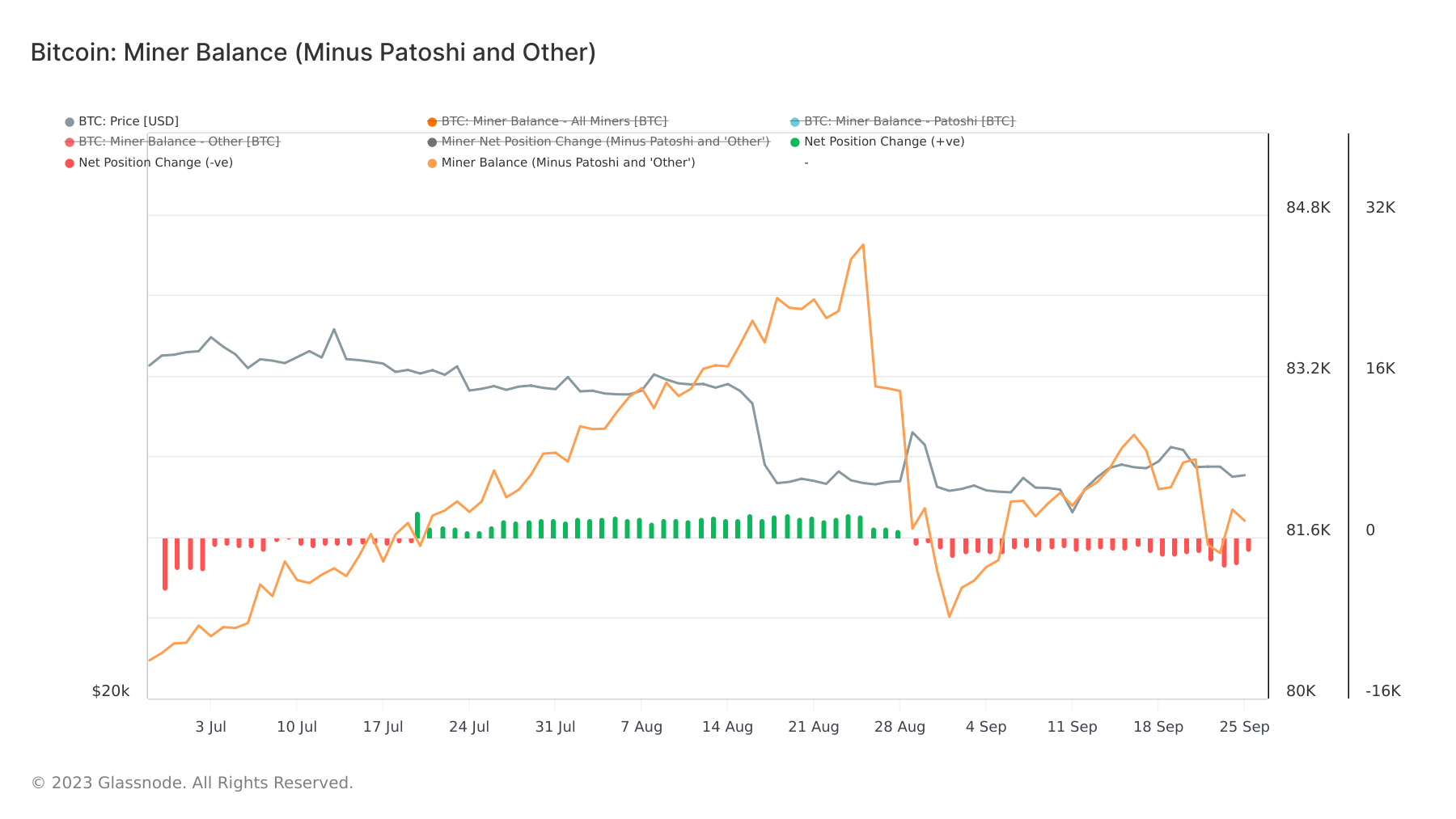

Information from Glassnode has proven that there was a unfavourable internet place change in miner balances in September. This implies miners have been promoting extra Bitcoin than they’ve been mining. This might end result from many various elements — miners may be promoting BTC for USD or different fiat currencies to cowl operational prices or take income. Some may also be offloading their BTC in anticipation of a worth stoop.

Nonetheless, regardless of the persistent unfavourable internet place change, the whole miner stability hasn’t decreased this month. Miner balances have grown from 80,810 BTC on Sep. 1 to 81,760 BTC on Sep. 25. This uptick means that miners are offloading a few of their holdings however aren’t parting methods with their newly minted cash. As a substitute, they’re nonetheless in accumulation mode, albeit at a doubtlessly slower charge.

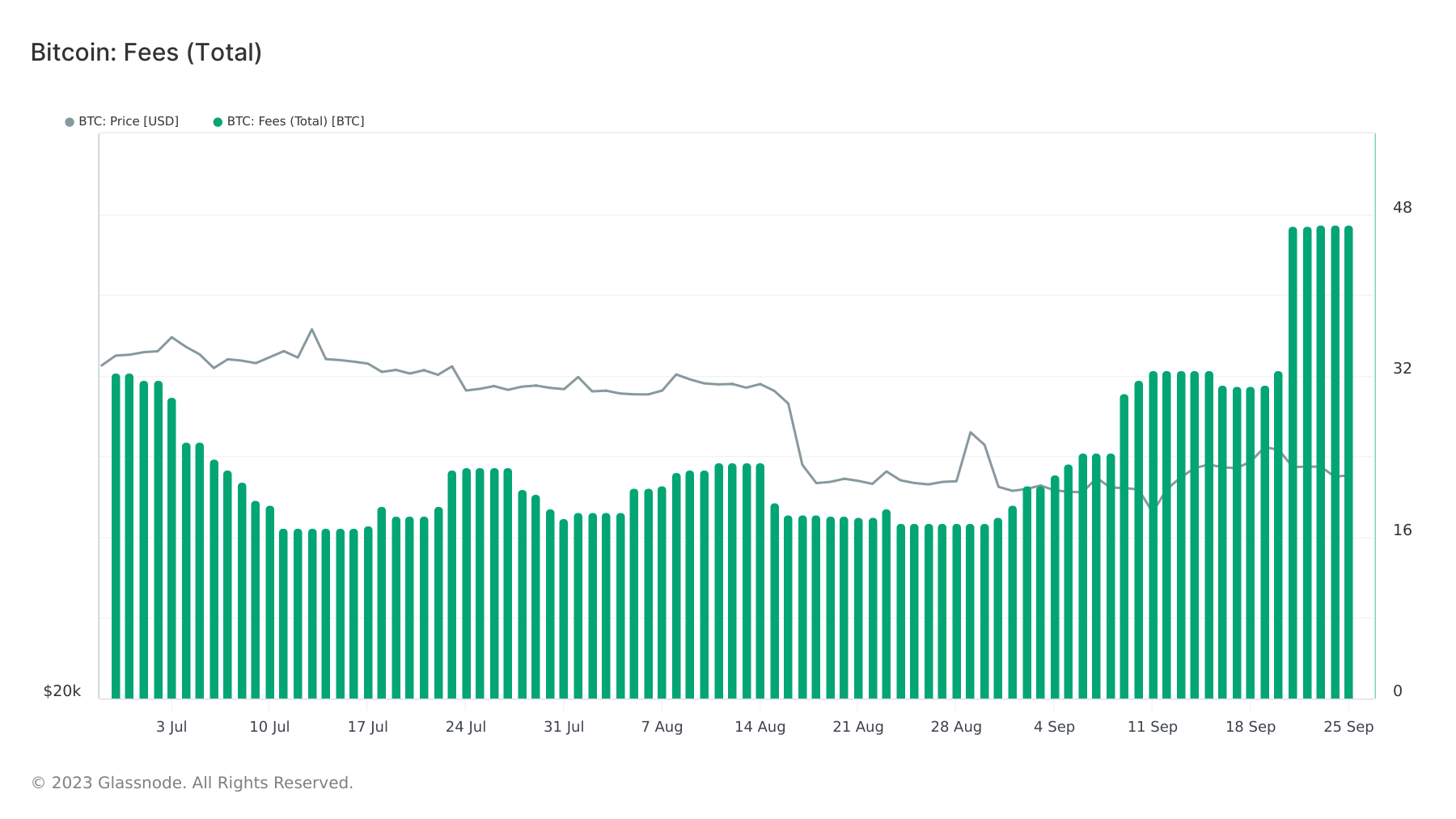

There has additionally been a notable enhance in Bitcoin transaction charges this month, which jumped from 19 BTC on Sep. 1 to 46.9 BTC by Sep. 25. This uptrend factors to heightened demand for transactions, probably on account of a bustling Inscriptions market or an inflow of customers. Nonetheless, the spike in charges is also attributed to community congestion, one thing the Inscriptions market has lengthy been criticized for. A full Bitcoin mempool means many transactions are piling up, ready to be included in a block, main customers to fork out greater charges to expedite their transaction confirmations.

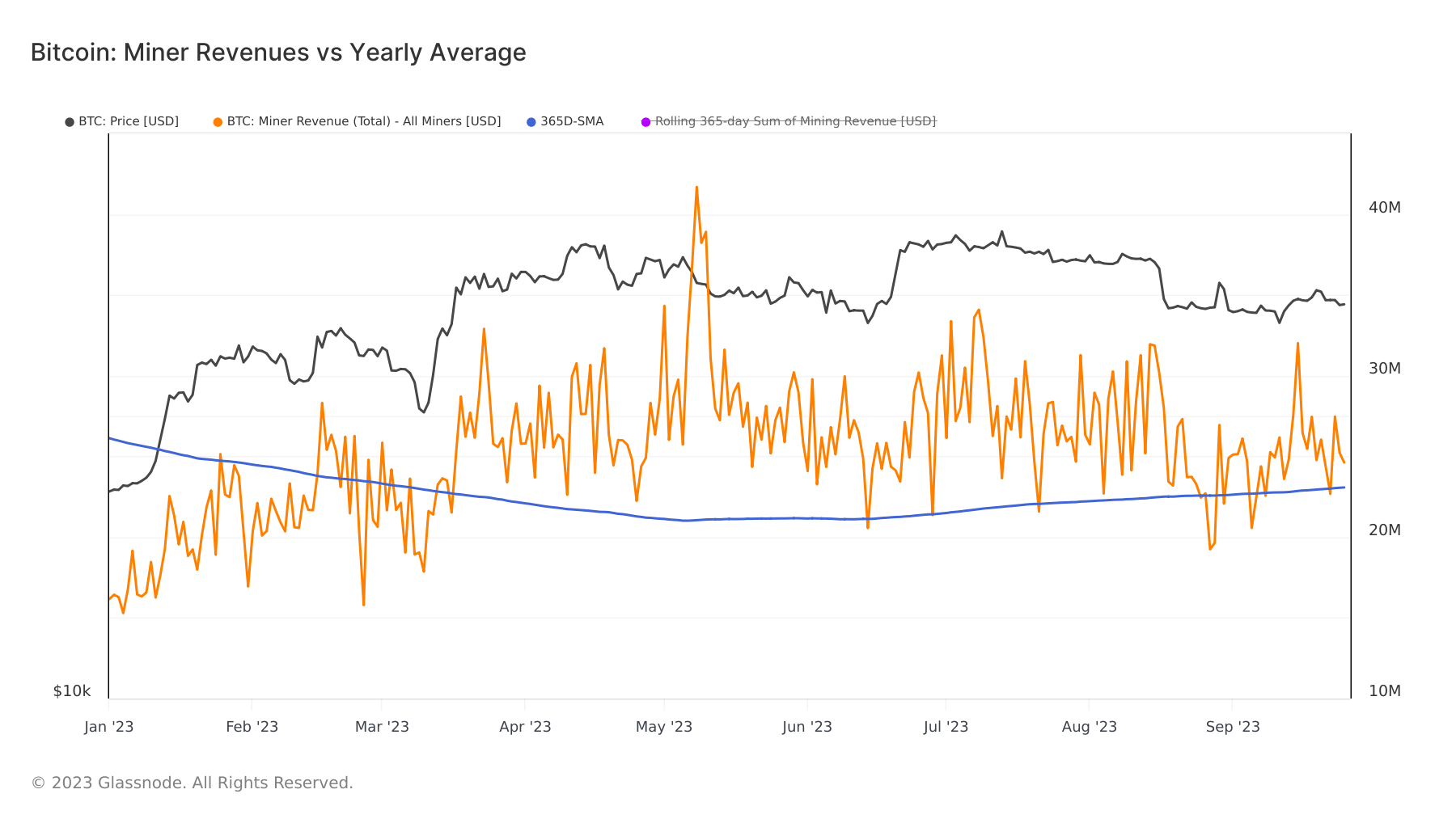

Evaluating the present mining income with the yearly common signifies a positive surroundings for miners. In line with information from Glassnode, miner income has been above the yearly common for many of September. This can be a continuation of a development that started in March when the yearly common dropped beneath the present income after a number of months of divergence. This may very well be on account of a mixture of rising Bitcoin costs, the above-mentioned elevated transaction charges, or each. This development started in March and has since steered sustained demand and exercise within the Bitcoin community.

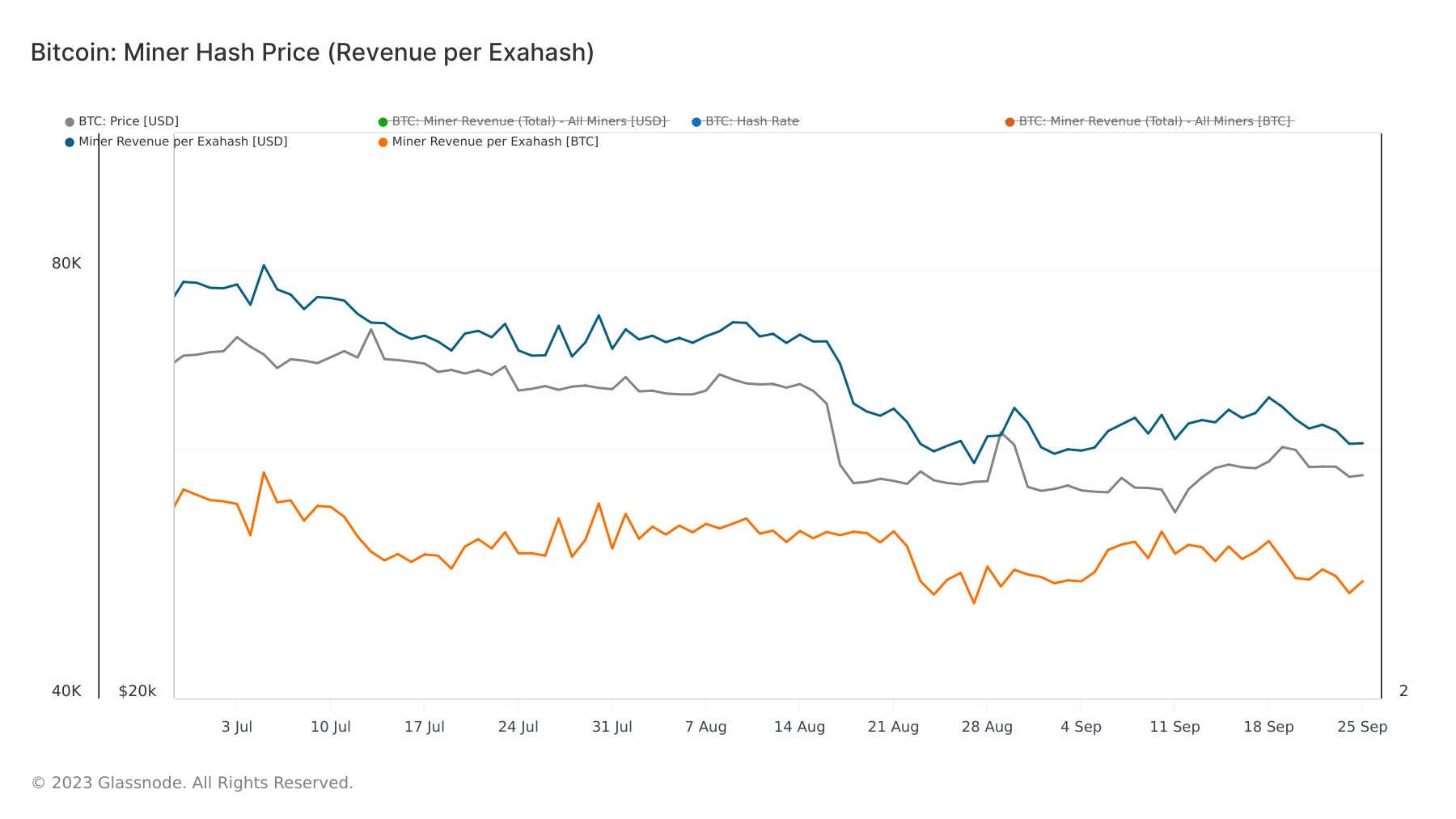

A more in-depth examination of miner income per exahash reveals a slight dip in Bitcoin-denominated income, shifting from 2.32 BTC to 2.30 BTC because the month’s inception. This means that miners are pocketing a tad much less Bitcoin for each unit of computational effort. Potential culprits may very well be escalating competitors amongst miners or minor community inefficiencies. Nonetheless, when seen by the lens of USD, the income per exahash has climbed from $60,120 on Sep. 1 to $60,505 on Sep. 25, signaling an appreciation in Bitcoin’s greenback worth.

The sentiment within the Bitcoin market seems to be a mix of optimism and warning. Miners, whereas promoting, proceed to build up. The uptick in charges underscores a bustling community, and the sustained above-average miner income since March hints at a conducive surroundings for mining, doubtlessly luring extra miners to the fray. The dip in Bitcoin-denominated income per exahash raises eyebrows, however the uptick in its USD counterpart reveals a constructive enhance in Bitcoin’s valuation.

The publish Cautious optimism in Bitcoin miner exercise as accumulation tentatively continues appeared first on CryptoSlate.