The World Cup simply kicked off and the native token of the sports-themed cryptocurrency ecosystem, Chiliz, has dropped 15% in worth over the previous 24 hours.

This isn’t the sort of information merchants and buyers need to examine. The long-awaited World Cup clearly had no compensating impact on the prevailing financial circumstances.

Right here’s A Fast Rundown Of How CHZ Is Doing:

– Available knowledge signifies a robust bear market hindered CHZ’s rally

– Close to 1:1 ratio of lengthy vs brief positions exhibits cautious help for the token

– Worth continues to fall; bulls ought to defend at $0.1664 and $0.1554

The token’s worth has dropped considerably as of this writing. CoinGecko and CoinMarketCap report that CHZ has dropped one other 9% since yesterday.

The token is buying and selling at a crimson candle worth of $0.1780, which can also be mirrored within the charts. CHZ’s rehabilitation could also be more difficult now that the World Cup has turn into controversial over a number of points.

Chiliz Could Come Up With A Shock

Whereas CHZ is predicted to rise, the token’s worth has declined after reaching a excessive on November 19. This was the day earlier than the World Cup started. Nonetheless, CHZ might show extra resilient than market contributors anticipate.

At the start, CryptoQuant knowledge signifies that the token’s change reserves are low. Which means that fewer CHZ tokens can be found on exchanges and are being ready on the market available on the market.

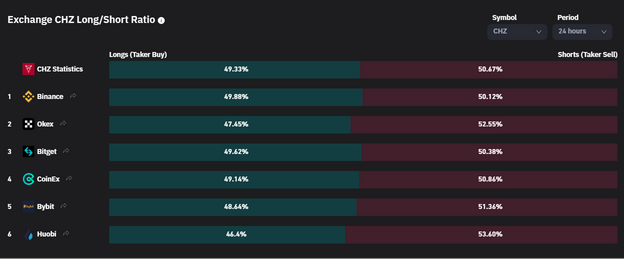

In line with CoinGlass statistics, that is accompanied by an virtually 1:1 ratio of lengthy positions to brief ones. These are extremely bullish claims, and the technicals mirror the token’s resiliency.

As the worth continued to say no, the cash circulation index elevated, indicating {that a} worth pullback might happen throughout the subsequent few days.

Nonetheless, due to unfavorable market circumstances, the MFI might misinterpret, leading to additional struggling. As of writing, the bears are aiming for a breakout on the 61.80 Fib stage ($0.1664)

Longer Tough Street Forward?

The enlargement of the Bollinger band, indicating a greater-than-usual diploma of market volatility, together with the CMF index’s latest crossing into the unfavourable half of its vary, might be grounds for decrease pricing.

CHZ bulls ought to defend the $0.1664 stage as a result of the shifting averages are displaying robust promote alerts. If the bears break via, $0.1554 will present extra help.

The precise aid rally for CHZ is not going to happen within the close to future. Nevertheless, as indicated by the proportion of lengthy to brief positions, buyers and merchants are keen to sacrifice short-term revenue for a higher long-term profit.

With CHZ’s restricted overseas change reserves, we anticipate the aforementioned helps to delay or halt the downward market.

CHZ whole market cap at $1.08 billion on the every day chart | Featured picture from Coinx3, Chart: TradingView.com