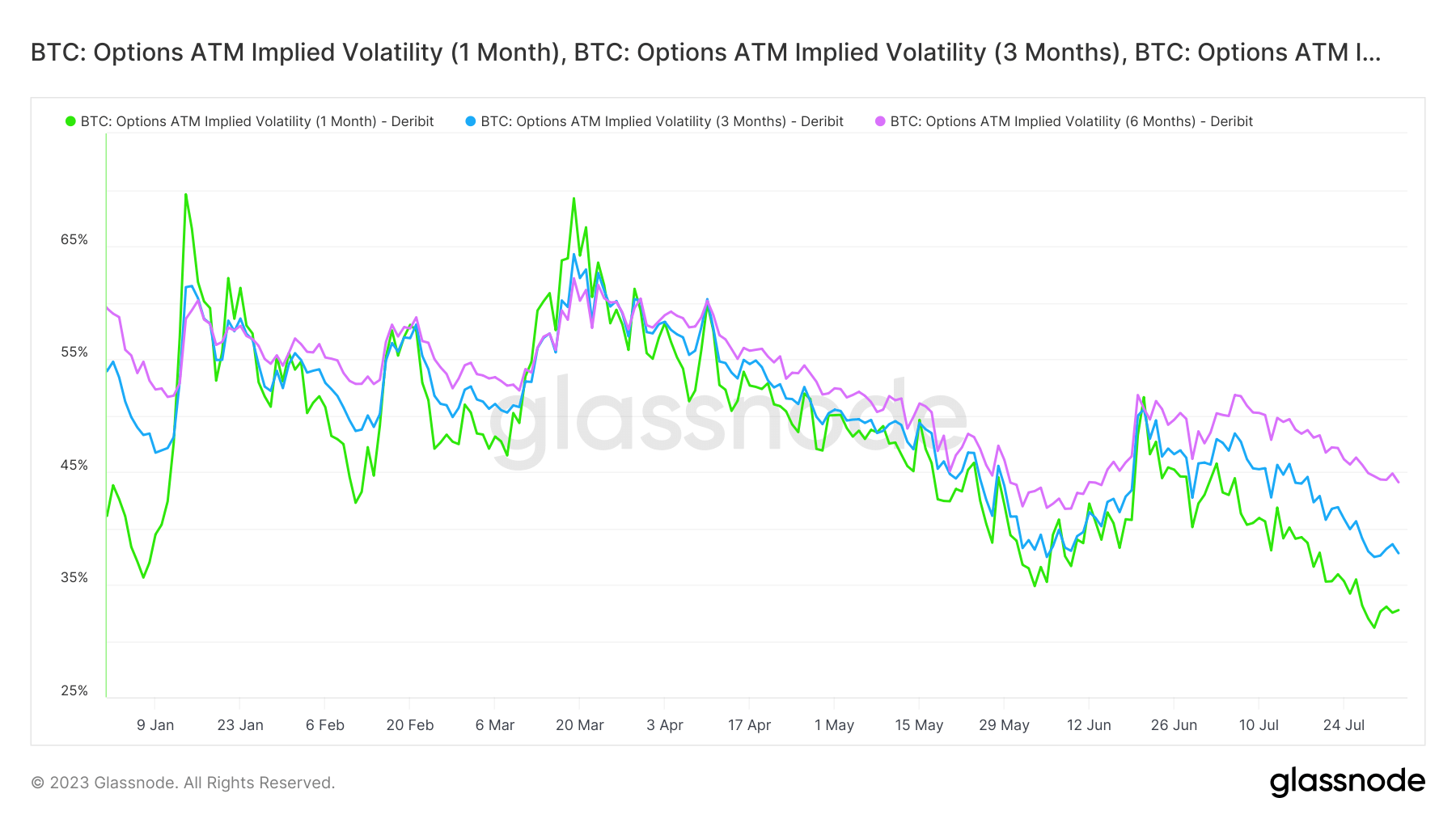

The implied volatility (IV) for Bitcoin choices decreased considerably in July.

The IV for Bitcoin choices on Aug. 3 is as follows:

| Expiry Interval | Share |

|---|---|

| 1-Month Expiry | 32.73% |

| 3-Month Expiry | 37.78% |

| 6-Month Expiry | 44.07% |

Implied volatility is a metric that represents the anticipated share change within the value of Bitcoin over a 12 months, with a 68% likelihood. Basically, it represents the market’s expectation of Bitcoin’s volatility over the period of the choice.

The growing IV for longer-dated Bitcoin choices means that the market is anticipating higher value uncertainty or volatility in the long term. This sample is called “volatility skew.”

Nonetheless, the lower in IV in July signifies that the market’s expectation of Bitcoin’s value volatility has decreased for the close to time period.

The publish Choices implied volatility drops however market nonetheless expects turbulence appeared first on CryptoSlate.