CleanSpark’s hash charge hit 6 EH/s on Dec. 21, in comparison with 2 EH/s on Dec. 31, 2021 — marking a 3x enhance on an annual foundation.

The corporate hit its year-end objective for the hash charge and stated it expects to hit 16 EH/s by the top of 2023.

2022 monetary highlights

CleanSpark mined a complete of three,750 Bitcoin (BTC) in the course of the 2022 fiscal 12 months ending Sept. 30 — up 320% on an annual foundation, in accordance with its annual monetary report.

In the meantime, income for the 12 months was up 235% to $131.5 million from $39.3 million in 2021.

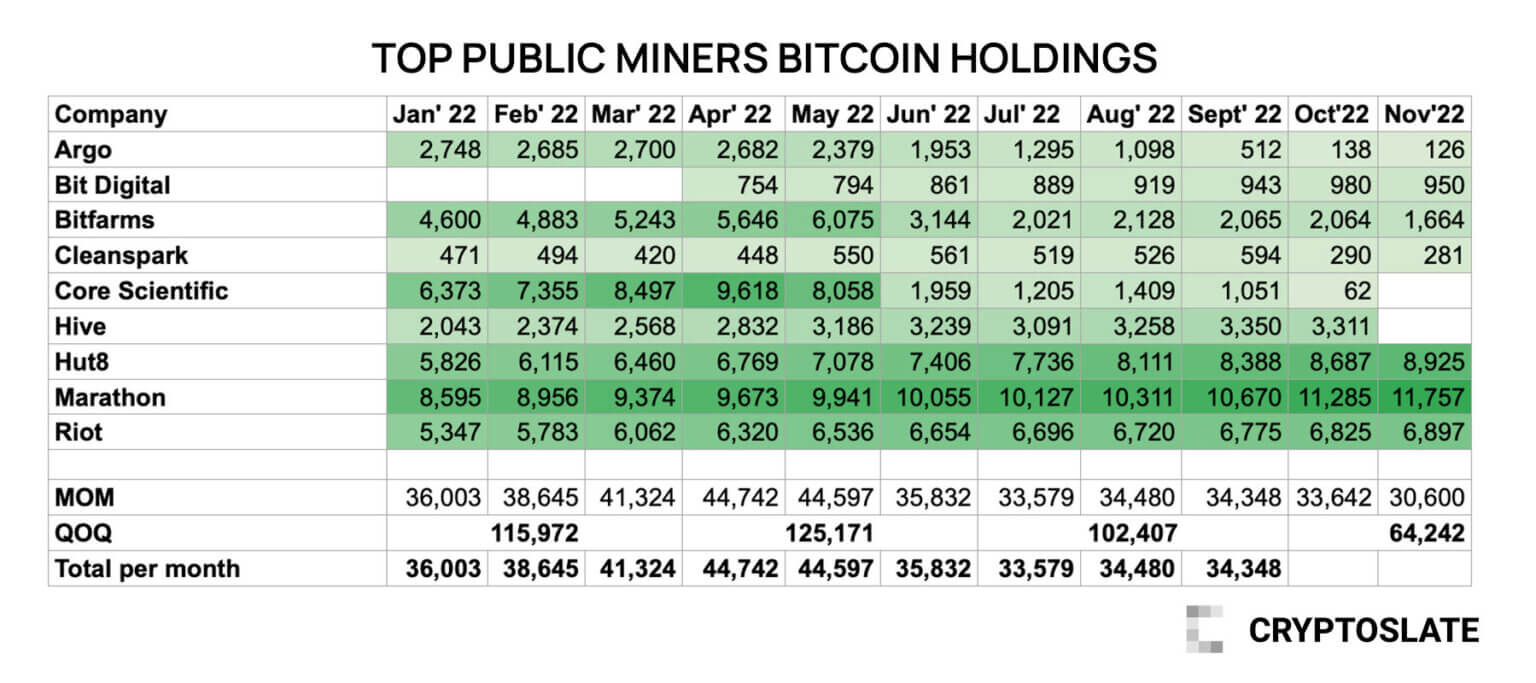

Nonetheless, regardless of the 2x and 3x enhance in income and mined BTC, the corporate’s BTC reserves are down 40.3% to 281 BTC as of Nov. 30, in comparison with 471 on Jan. 31, in accordance with CryptoSlate knowledge.

Based on the report, CleanSpark holds $20.5 million in money and $11.1 million in BTC as of the top of September 2022. Along with its mining belongings, CleanSpark’s whole belongings equate to $452.6 million for the fiscal 12 months of 2022.

BTC reserves down 40.3%

CryptoSlate knowledge reveals that CleanSpark bought off 304 BTC in October and an additional 9 BTC in November, following the top of its fiscal 12 months.

As of Nov. 30, the corporate held 281 BTC in reserve, in comparison with 594 on the finish of September and 471 on the finish of January.

Based on the numbers, CleanSpark began the 12 months with 471 BTC and managed to extend this quantity to 594 BTC in September, which is the top of CleanSpark’s fiscal 12 months.

On Sept. 30, BTC was being traded for round $19,422. At this value, 594 BTC equates to round $11.1 million, which can also be acknowledged within the 2022 fiscal 12 months report amongst CleanSpark’s belongings.

Nonetheless, the information additionally reveals a pointy 51% lower from 594 BTC in September to 290 BTC in October. This quantity fell to 281 BTC in November, equating to a 40.3% lower from January’s 471 BTC.