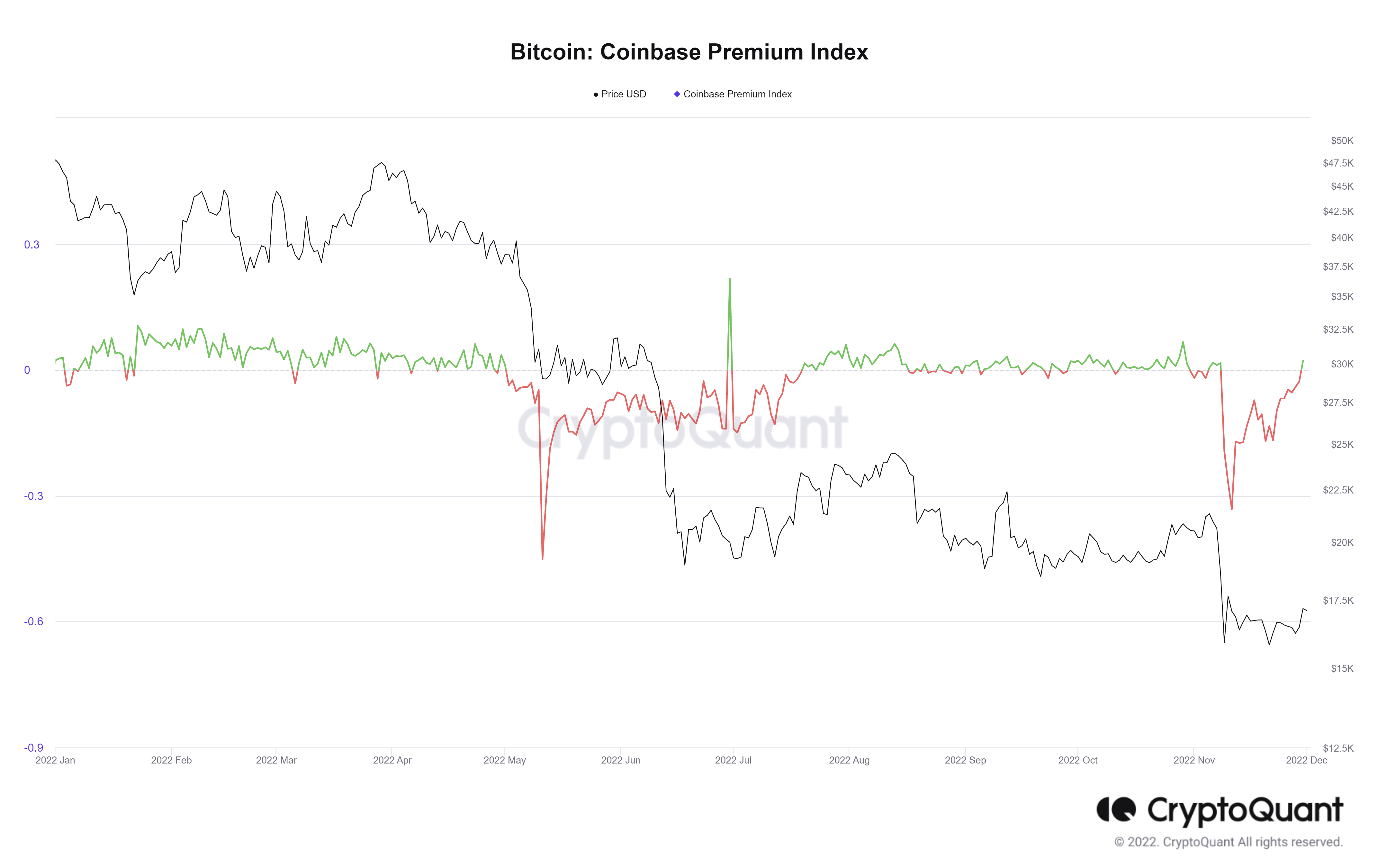

In keeping with the on-chain information and analytics supplier, CryptoQuant, the Coinbase Premium Index has turned inexperienced for the primary time for the reason that fallout of the FTX collapse.

As an indicator that exhibits an indication of “whale accumulation,” Coinbase Premium is the value distinction between Coinbase’s BTC/USD pair and Binance’s BTC/USDT pair.

“For instance. when the Bitcoin worth repeatedly broke 20k, 30k, and 40k whereas the Coinbase premium was sustaining greater than $50 premium. It signifies that in these dips, establishments or different whales had been accumulating.”

Coinbase Professional is taken into account “the gateway” for institutional investor purchases of cryptocurrencies, and as such, Coinbase Premium is used to trace institutional whale’s motion.

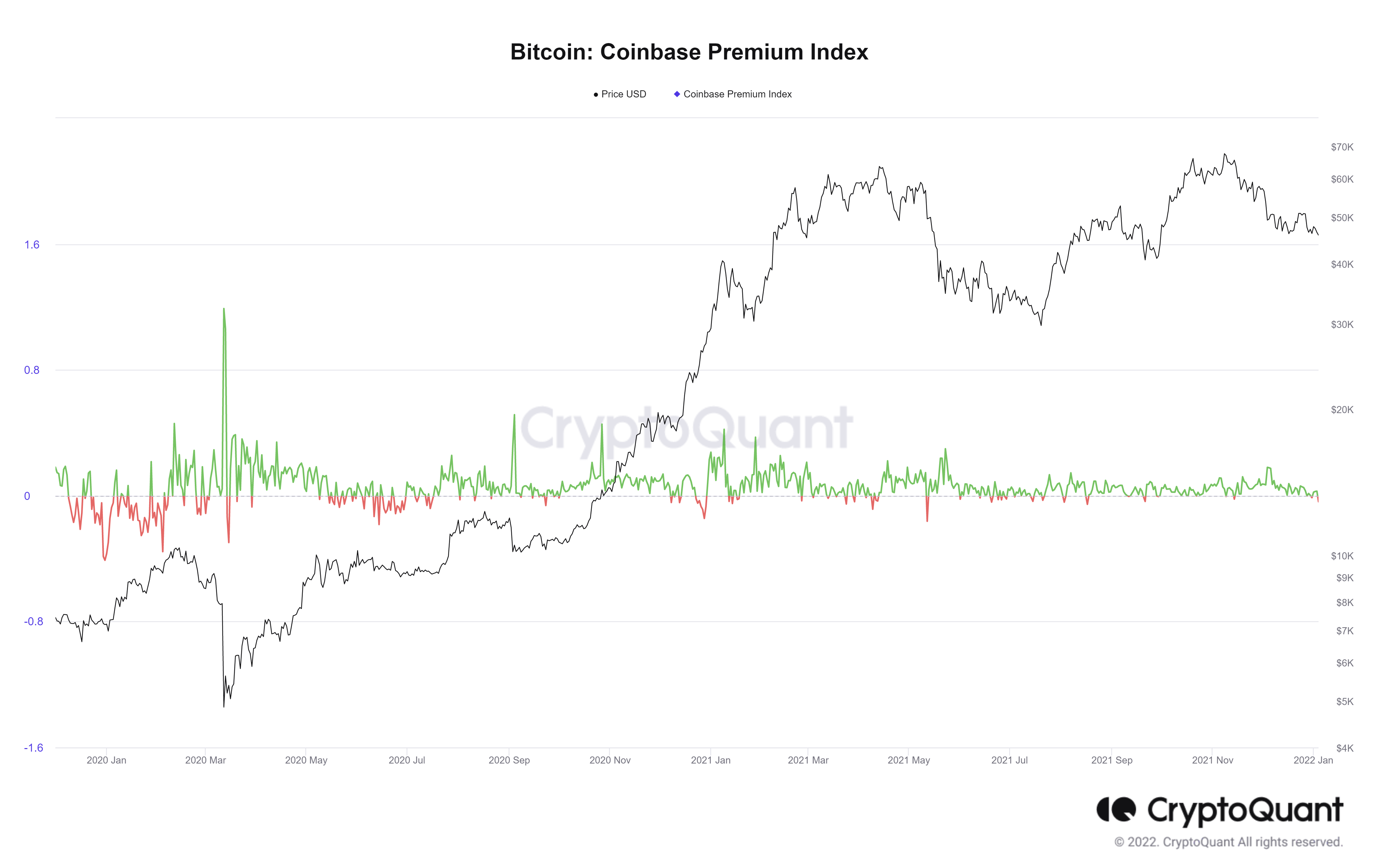

CryptoQuant states that the “2020 bull run was pushed by institutional traders and excessive net-worth people within the U.S., which makes traders test Coinbase Premium greater than ever.”

Traditionally, the highs and lows of the Coinbase Premium Index have signaled potential robust buys and powerful sells from Coinbase.

For instance, when the Coinbase Premium reaches excessive values, it indicators Coinbase whales could also be accumulating Bitcoin whatever the excessive worth. Nevertheless, the reverse additionally applies when the Index falls to low values, indicating Coinbase whales are both not shopping for as repeatedly or probably promoting their cash.

Reviewing the 12 months to date, the Coinbase Premium Index has flipped between crimson and inexperienced marginally – solely straying from this sample in the course of the two main capitulation occasions witnessed this 12 months (Luna and FTX). This exhibits a degree of uncertainty and an absence of conviction from establishments this 12 months in comparison with earlier years.