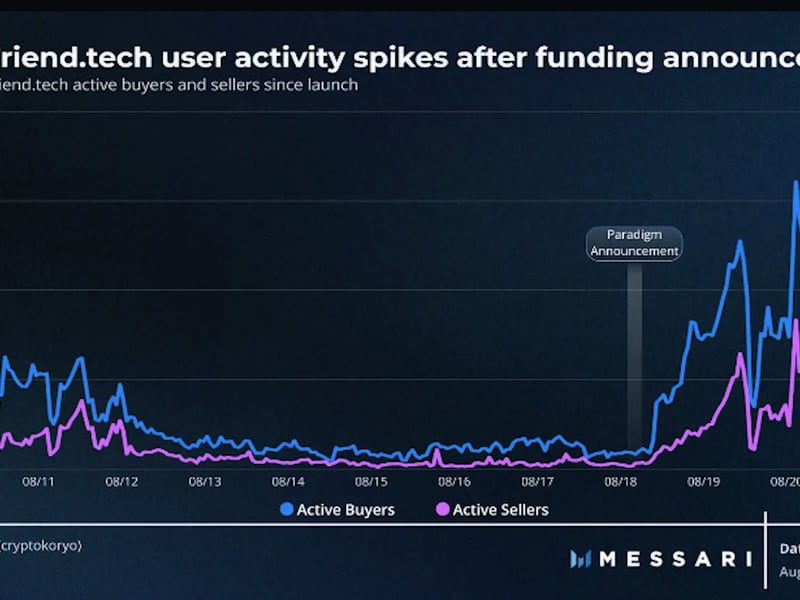

PRICE OF POPULARITY: Coinbase, the large U.S. crypto trade, is getting a quick schooling, as one of many first large publicly traded corporations to run its personal blockchain. Its new Base mission, a layer-2 community atop Ethereum, simply launched this month, and already one in all its new purposes, Good friend.tech, has gone viral, shortly attracting greater than 100,000 customers and producing greater than $25 million in charges. Good friend.tech, which permits customers to buy shares of X (Twitter) influencers, noticed a speedy spike in exercise (see chart above) after asserting on Aug. 18 that it had scored seed funding earlier this 12 months from the crypto-focused venture-capital agency Paradigm. Good friend.tech’s early success has helped drive up key metrics on the Base community, driving its whole worth locked (TVL) previous $200 million and at one level pushing transactions per second above these of Ethereum in addition to rival layer-2 initiatives Arbitrum and Optimism. In response to FundStrat, Base has accrued almost $4 million in charges, $2.5 million of which is retained by Coinbase; it really works out to $30 million additional income on an annual foundation. One query is whether or not Base can retain the expansion as soon as this scorching ball of cash bounces to the following crypto craze. “Good friend.Tech’s speculative nature,” writes Galaxy Analysis, “highlights ongoing questions over Coinbase’s function in moderating a series that immediately is ‘decentralized’ in identify solely.”