Fast Take

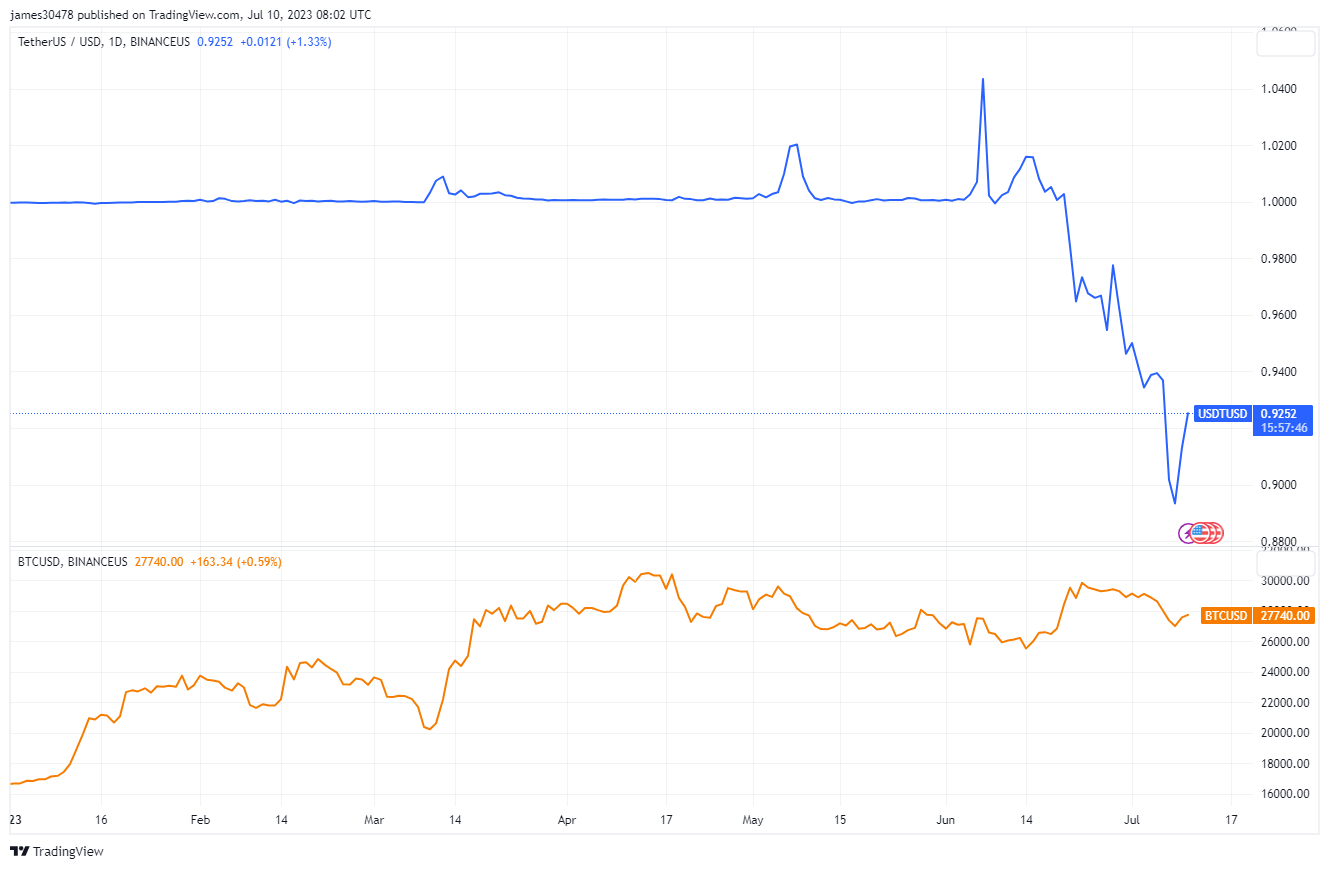

Over the previous few weeks, there have been noticeable discrepancies within the asset costs on Binance U.S. This difficulty has come to the forefront because of the irregular buying and selling charges of Bitcoin (BTC) and Tether (USDT), two of the most important cryptocurrencies on the platform.

The present buying and selling worth of Bitcoin on Binance U.S. is $27,700. This worth level is uncommon and represents a big low cost when in comparison with different platforms. In distinction, Bitcoin is buying and selling at its anticipated spot worth on Coinbase, indicating a selected pricing difficulty with Binance U.S.

Concurrently, the stablecoin Tether (USDT) is buying and selling at an unusually low worth on Binance U.S. Presently, USDT is valued at $0.92, which deviates from the norm. As a stablecoin, USDT is usually pegged to the U.S. greenback at a 1:1 ratio, that means that one USDT ought to be equal to $1. This present charge signifies a substantial low cost.

Comparatively, the pricing mechanism on Coinbase stays according to the anticipated spot costs for each Bitcoin and USDT. This reaffirms the anomaly of Binance U.S.’s present pricing construction.

The continuing discrepancy within the pricing mechanism on Binance U.S. is inflicting concern throughout the cryptocurrency group and highlights the necessity for additional investigation into the matter.

The submit Continued arbitrage in Binance U.S. asset pricing: Bitcoin and USDT appeared first on CryptoSlate.