Fast Take

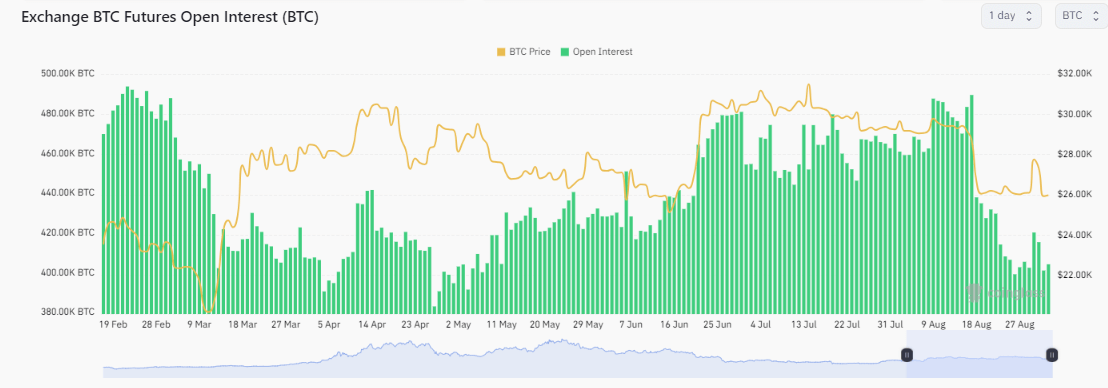

The current knowledge evaluation signifies a important shift in Bitcoin futures contracts, notably within the wake of the Grayscale lawsuit. Bitcoin open curiosity, the full variety of excellent futures contracts, has suffered a major discount, with a tough estimate of 400,000 Bitcoin in futures contracts representing one of many lowest readings year-to-date.

The diminishing liquidity indicators a possible change in investor sentiment or strategic funding choices.

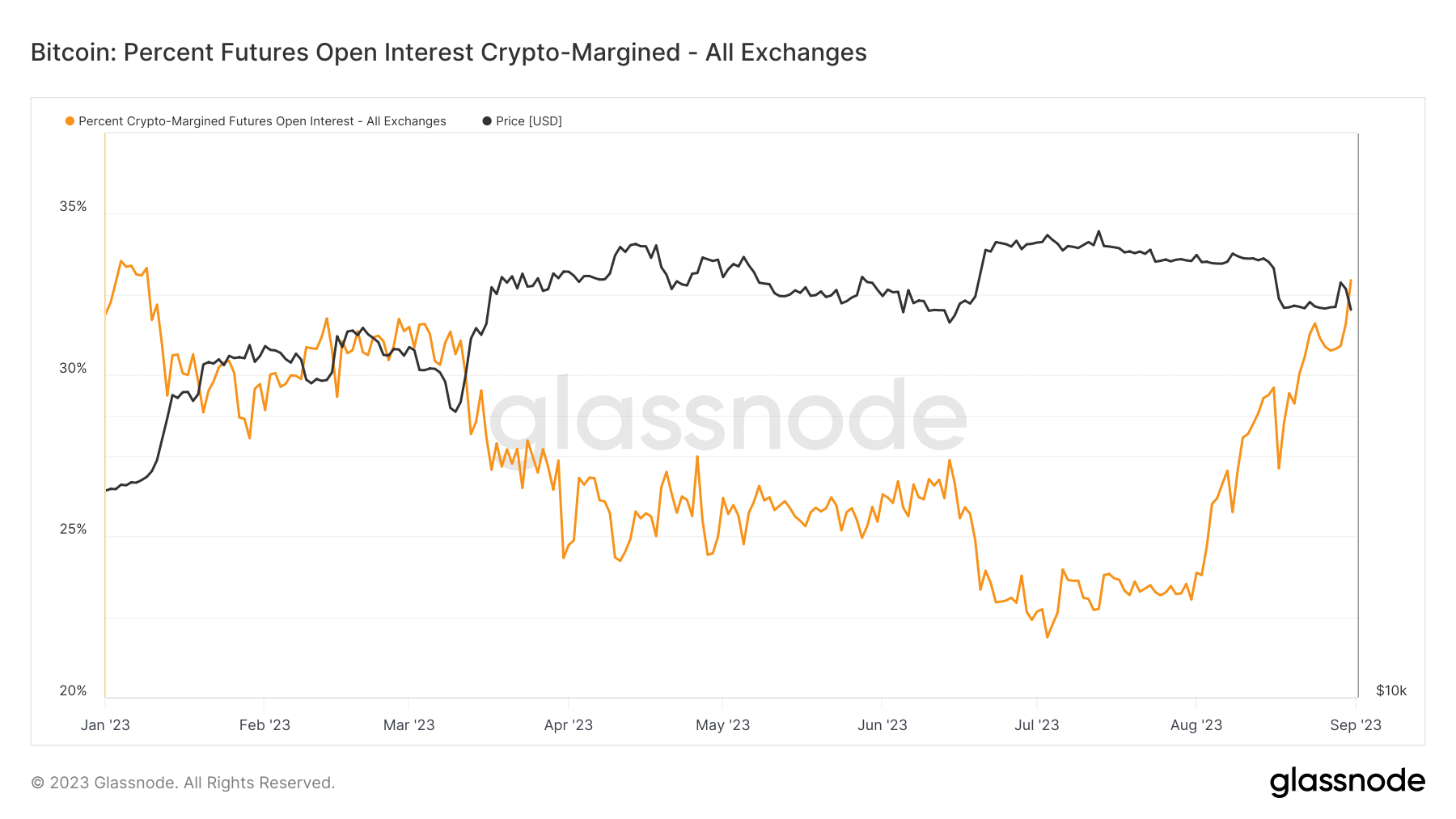

Curiously, whereas total Bitcoin futures contracts have declined, crypto-margin futures contracts assert a opposite pattern. Crypto-margin refers to futures contracts with open curiosity margined within the native cryptocurrency (Bitcoin, on this case) moderately than a standard foreign money like USD or a stablecoin.

The crypto-margin is ready to succeed in new year-to-date highs, with roughly 135,000 Bitcoin, or round 33% of all open curiosity contracts, being positioned within the crypto margin.

The submit Contrasting currents in crypto market as Bitcoin futures plunge, crypto-margin soars appeared first on CryptoSlate.