Fast Take

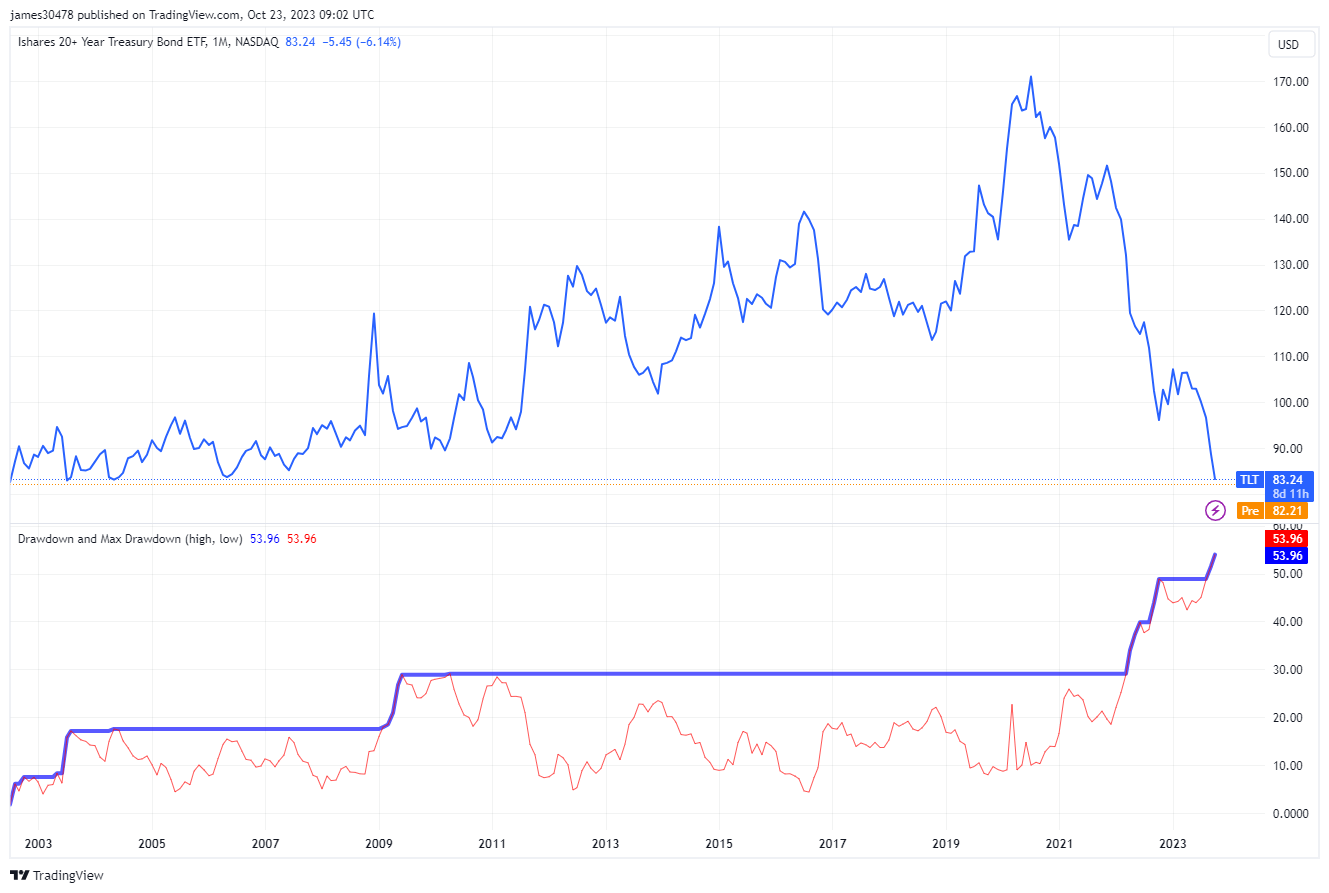

Final week, Oct. 18, analyst Dylan Leclair noticed a similarity within the drawdowns of Bitcoin and TLT.

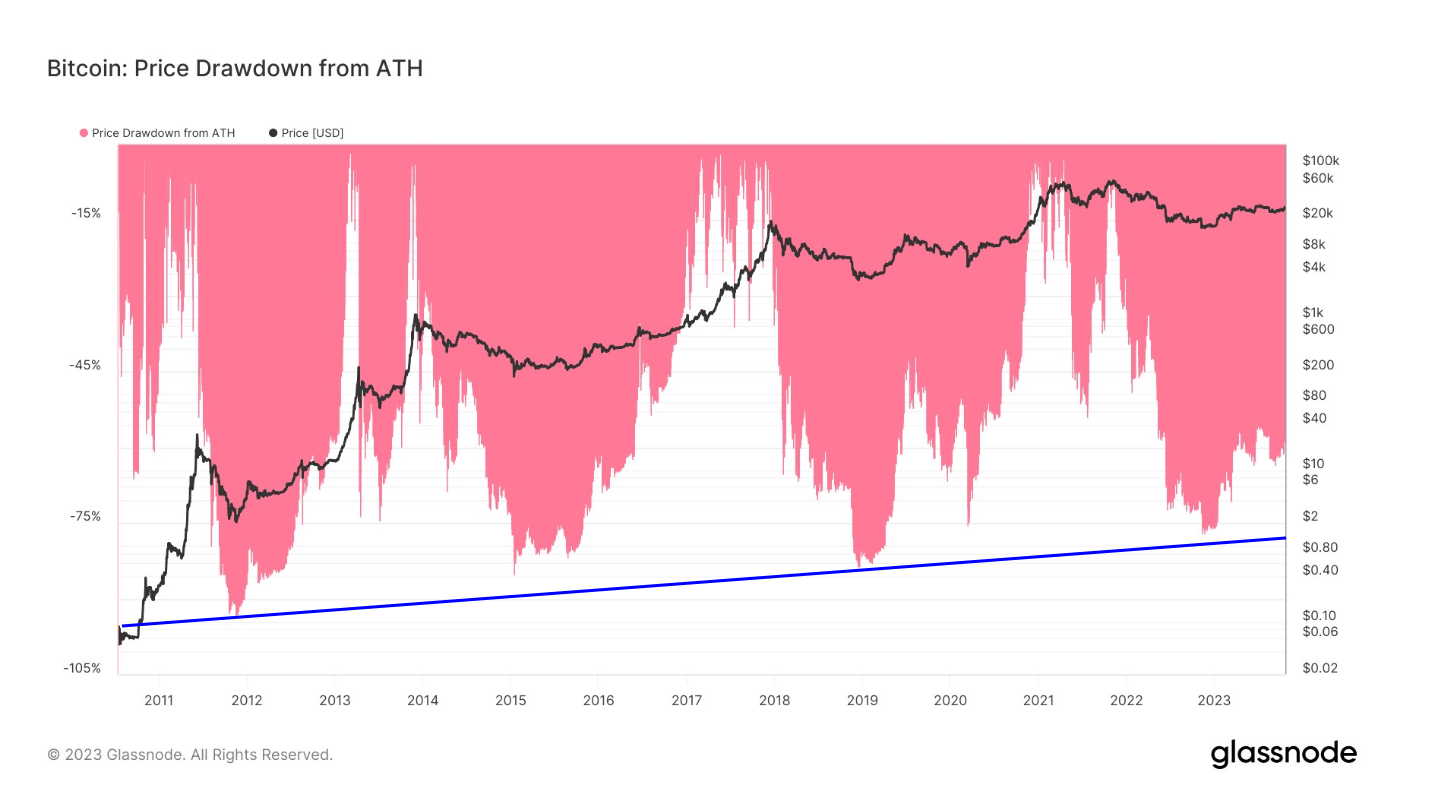

A comparability of the drawdowns of Bitcoin and TLT, the U.S. lengthy bond, an ETF with a complete asset holding of $95 billion, in line with VettaFi, reveals an interesting development. Bitcoin, typically underneath the scanner for its volatility, demonstrates resilience in its restoration trajectory. Following a plunge to $15,500 in the course of the FTX collapse in Nov. 2022, Bitcoin has made a big rebound, buying and selling at roughly $30,000. This efficiency represents a drawdown of 56% from its all-time excessive, aligning with earlier bear market habits.

Curiously, every successive cycle data a much less extreme drawdown. The utmost drawdown of this cycle for Bitcoin to this point stands at 77%.

In distinction, TLT is at the moment witnessing its most extreme drawdown ever, at 54%. This juxtaposition underscores the cruel influence felt within the bond market whereas concurrently highlighting Bitcoin’s restoration. A mere few share factors now separate the 2 drawdowns, including a brand new dimension to the dialogue on monetary asset stability.

The put up Convergence in drawdowns of Bitcoin and U.S. lengthy bonds, as TLT plunges appeared first on CryptoSlate.