Core Scientific, one of many largest publicly traded Bitcoin miners, may not make it till the top of the yr.

In its quarterly report filed with the SEC, the corporate stated “substantial doubt” exists about its skill to proceed going if it fails to boost liquidity.

“Nevertheless, the power to boost funds by means of financing and capital market transactions is topic to many dangers and uncertainties and present market situations have decreased the provision of those capital and liquidity sources.

The Firm anticipates that current money assets can be depleted by the top of 2022 or sooner. Given the uncertainty concerning the Firm’s monetary situation, substantial doubt exists concerning the Firm’s skill to proceed as a going concern by means of November 2023.”

Doubts concerning the firm’s solvency have been first raised on the finish of October when a earlier submitting revealed its working efficiency and liquidity have been severely impacted by rising electrical energy prices and falling Bitcoin costs.

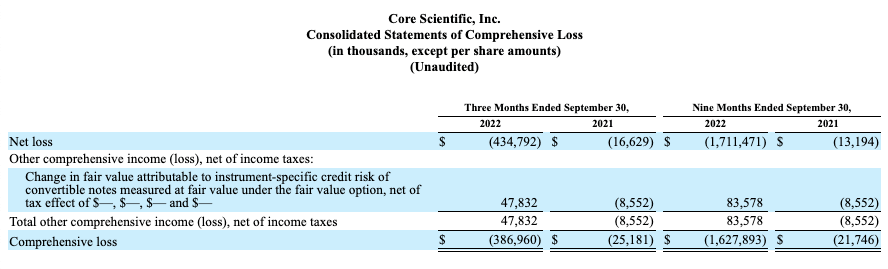

Core Scientific’s 10-Q submitting now reveals little doubt concerning the firm’s struggles, as the corporate reported a $434.8 million web loss within the third quarter alone. The $862 million in web losses accrued within the second quarter deliver the corporate’s complete web losses for the 9 months ended Sept. 30 to $1.71 billion.

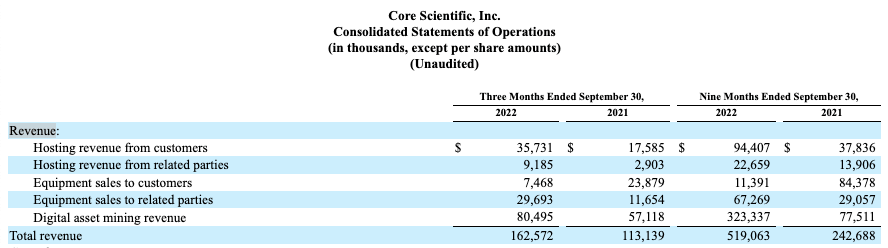

All year long, the corporate generated solely $519 million in income. It reported $162.5 million in income for the third quarter.

Core Scientific claims that the losses it accrued have been a results of rising electrical energy prices and a quickly declining value of Bitcoin. Nearly all of the corporate’s income from internet hosting got here from two clients — one accounted for 46% of its income in 2022, whereas the opposite accounted for 19%.

In a separate a part of the submitting, the corporate stated Celsius was “one among its largest clients.” Since submitting for voluntary reduction underneath chapter 11 in September, Celsius has reportedly been trying to withhold fee of sure prices billed as a part of its contract with Core Scientific. The corporate is actively searching for a decision from the chapter court docket.

Nevertheless, the submitting reveals that losses Core Scientific accrued from different bills might dwarf the quantities it’s searching for from Celsius.

The corporate revealed that it supplies internet hosting companies to entities which are managed and owned by its executives. It additionally offered mining tools to its personal executives, with the income from these gross sales greater than doubling when in comparison with final yr.

Tools gross sales income from its personal executives greater than doubled from $29.1 million in 2021 to $67.3 million in 2022.

Because the starting of the yr, Core Scientific spent $1.8 million on personal jets and enterprise journeys for its executives. It additionally misplaced $13.1 million on exchanges and entered into an settlement to lease workplace area for its new headquarters for a base lease of $14 million to be paid over a interval of 130 months.