Crypto-based funding merchandise market recorded $53.7 million in outflows throughout the week of Might 1-7, with Bitcoin (BTC) primarily based merchandise accounting for nearly all, in keeping with CoinShares’ weekly report.

BTC and short-BTC-based merchandise recorded a complete of $54.9 million in outflows, because the CoinShares report famous.

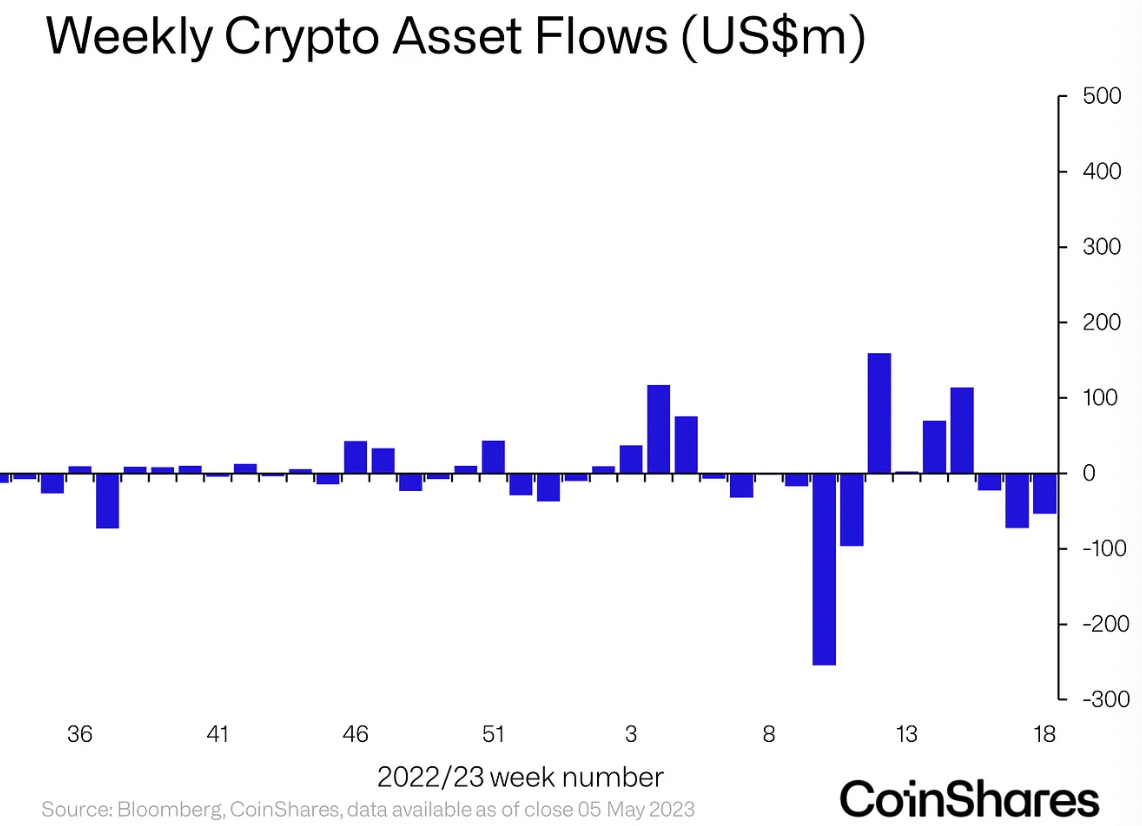

The week of Might 1-7 additionally marked the third consecutive week of outflows for the crypto funding merchandise market.

The market’s final outflows streak began in February and lasted six weeks straight. The combination worth misplaced throughout this era reached $408 million, with the largest recorded throughout the week of Mar. 6 – 12 with $225 million.

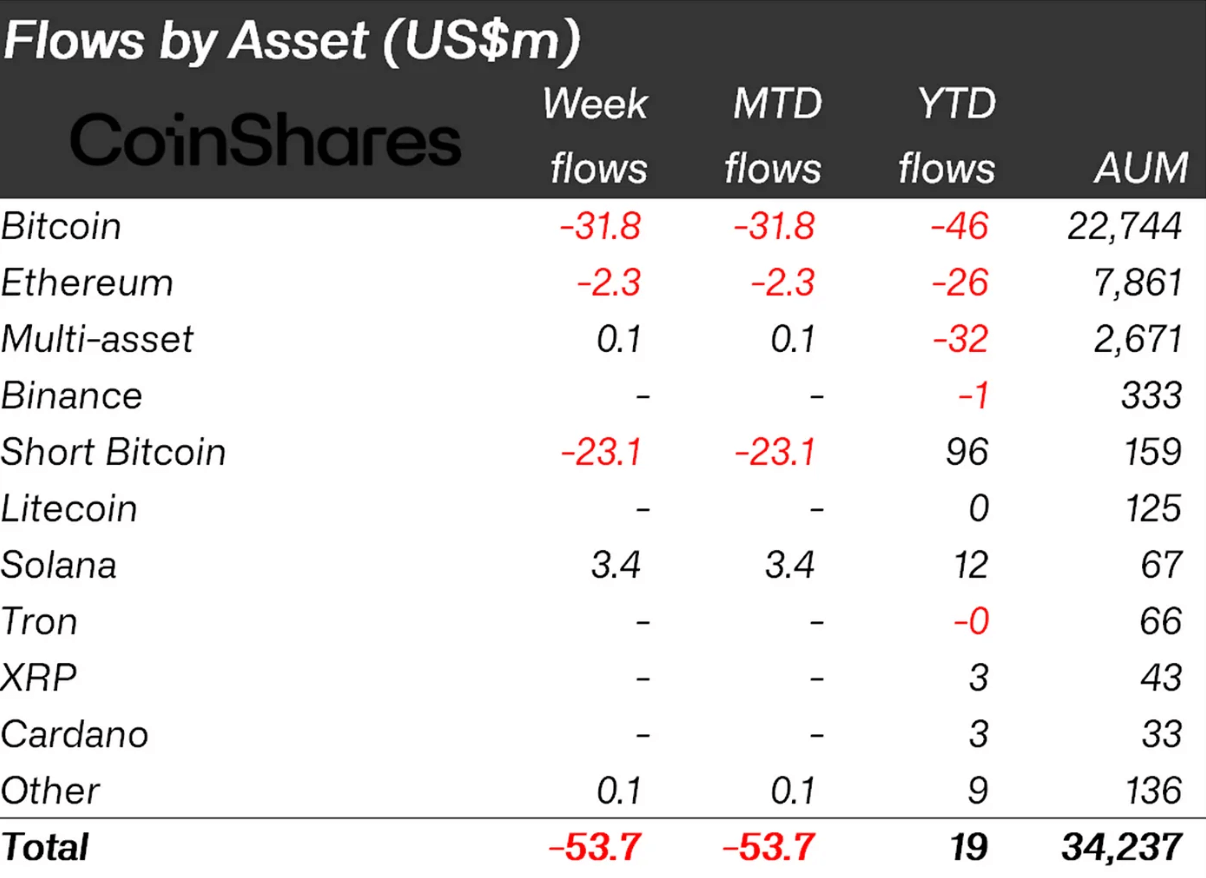

Flows by asset

BTC and Quick-BTC-based merchandise have been nearly solely accountable for the weekly outflows. Inside seven days, BTC misplaced $31.8 million, whereas short-BTC merchandise noticed $23.1 million in withdrawals.

That is notably uncommon for short-BTC merchandise. Even when the market was on its six-week-outflows streak, short-BTC merchandise recorded inflows nearly each week. Acknowledging this irregularity, the CoinShares report said that this was the “largest weekly outflows from short-bitcoin on file of US$23m.”

Apart from BTC, Ethereum (ETH) additionally closed the week on the adverse by recording $2.3 million in withdrawals. In return, multi-asset and Solana (SOL)-based merchandise noticed inflows value $100,000 and $3.4 million, respectively, bringing the general market rating to -$53.7 million.

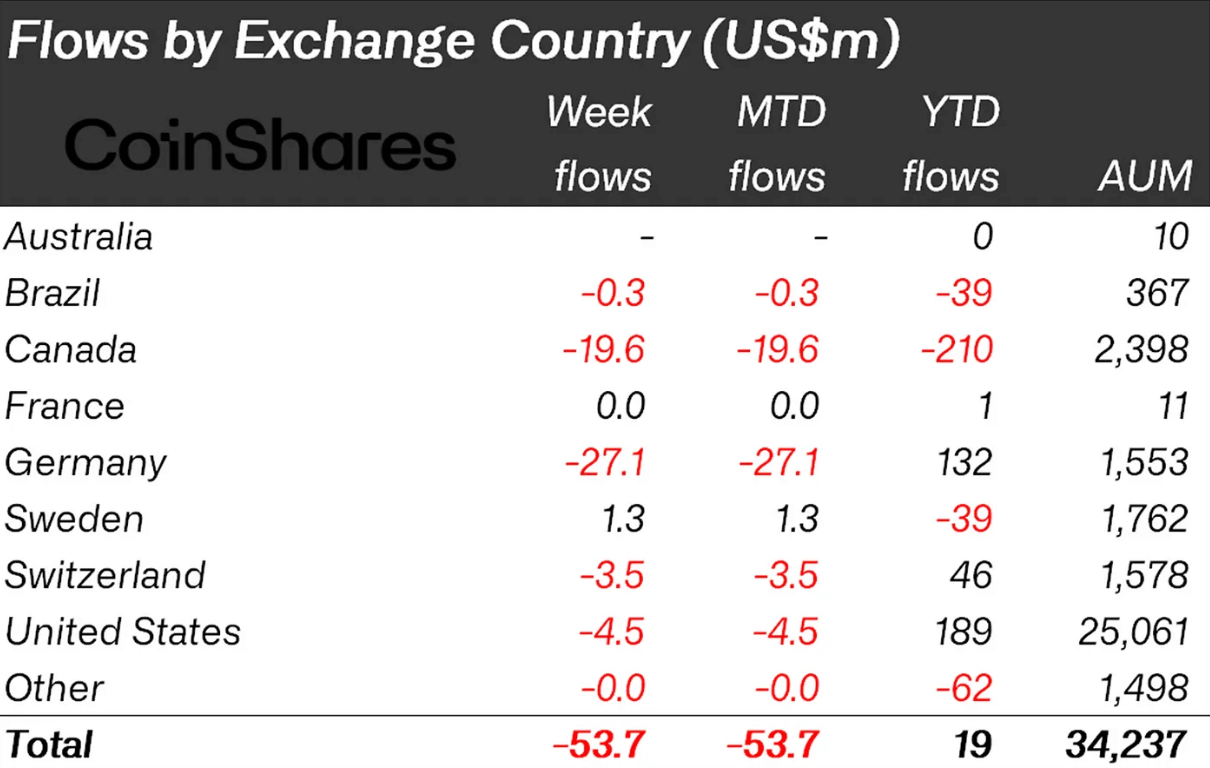

Flows by nation

asset actions on a geographical foundation Germany and Canada comes ahead by recording probably the most important outflows of the week. Germany noticed $27.1 million in withdrawals, whereas Canada recorded $19.6 million in outflows. The 2 nations accounted for 86% of the whole outflow quantity of the week.

The US, Switzerland, and Brazil additionally contributed to the withdrawals by recording $4.5 million, $3.5 million, and $300,000 in outflows, respectively. However, solely $1.3 million value of inflows have been dropped at the market by Sweden.

When the actions are filtered primarily based on the suppliers, solely Objective Investments comes ahead with $1 million in inflows. 3iQ, CoinShares, and ProShares recorded $19.4 million, $13.4 million, and $5.4 million in outflows, respectively.