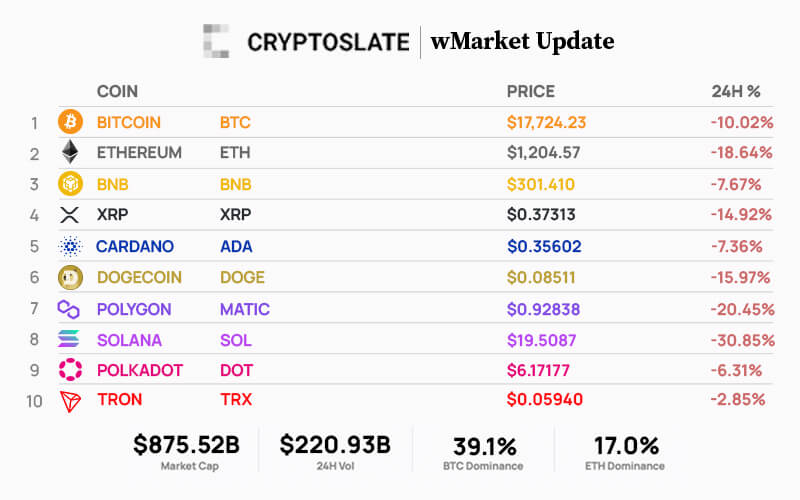

Within the final 24 hours, the cryptocurrency market cap noticed outflows in extra of $100 billion because the trade plunged to $875.52 billion from $971.29 billion as of press time — down 11.02%.

Bitcoin and Ethereum market cap fell by 9.06% and 17.56% to $341.85 billion and $149.58 billion, respectively.

The highest 10 cryptocurrencies recorded huge losses over the reporting interval as FTX’s implosion closely impacted the market. Solana posted the very best loss, dropping 30.85% over the reporting interval.

Most high 10 digital belongings recorded losses of over 6% — BTC and ETH fell by over 10%, respectively. Tron posted the smallest loss — down 2.85%.

The market caps of Tether (USDT) and BinanceUSD (BUSD) barely elevated to $69.8 billion and $23.06 billion, respectively. USD Coin (USDC) market cap decreased to $42.7 billion.

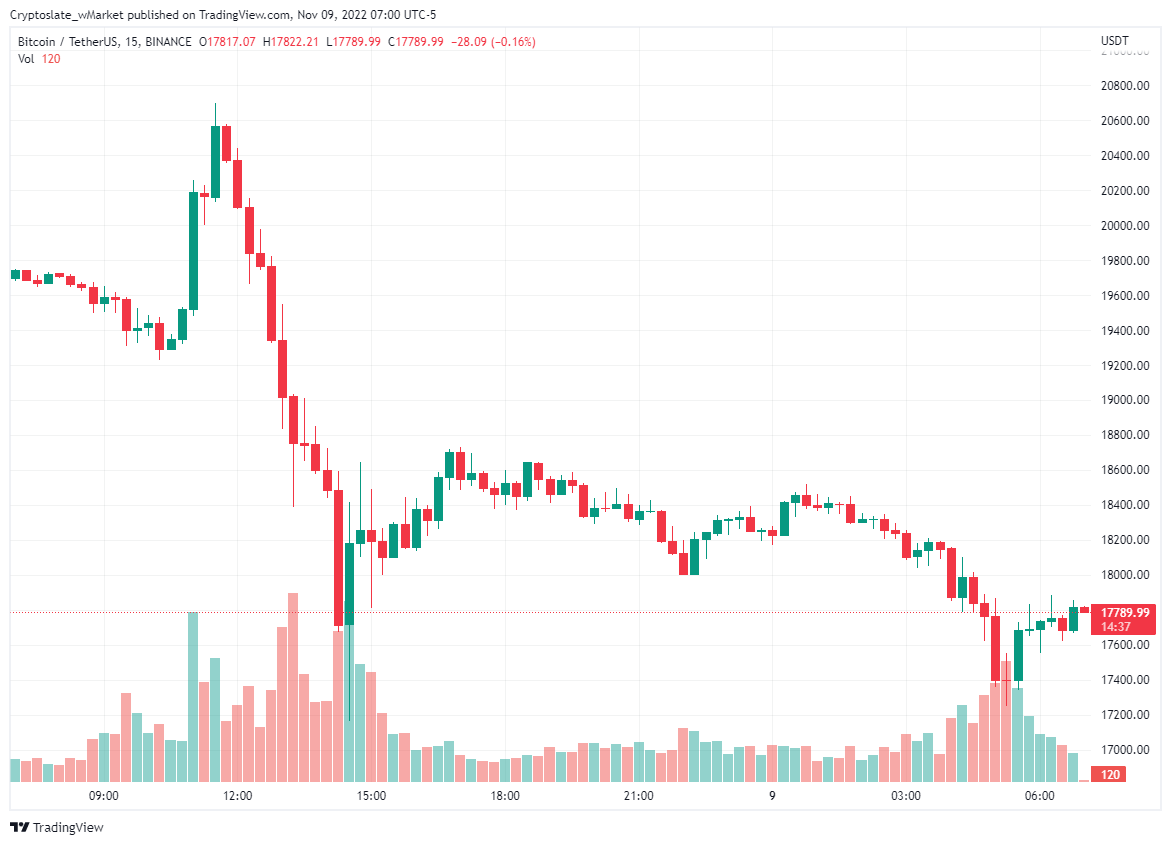

Bitcoin

During the last 24 hours, Bitcoin posted losses of 10.02% to commerce at $17,724 as of 07:00 ET. Its market dominance elevated to 39.1% from 38.66%.

After briefly spiking above the $20,000 mark, BTC printed an enormous crimson candle that noticed it commerce at a brand new bear market low of $17,500 round 15:00 UTC. The flagship digital asset continued to commerce sideways for the remainder of the day.

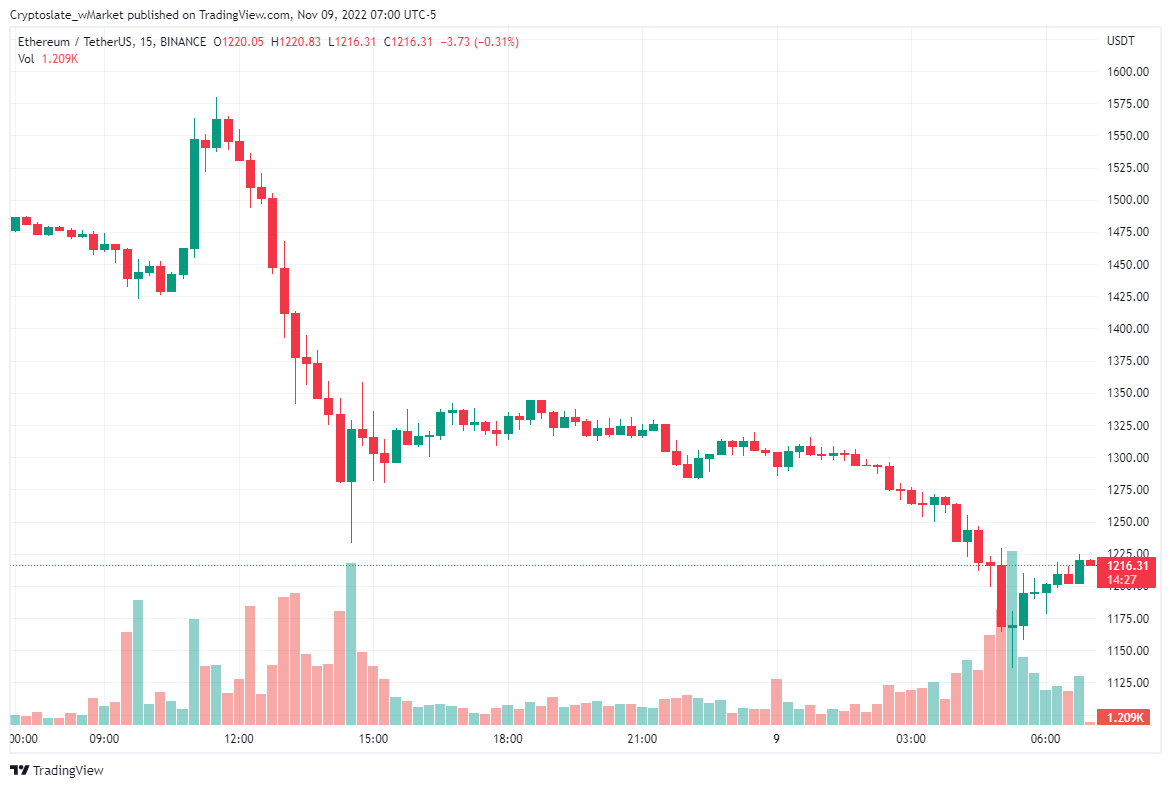

Ethereum

ETH decreased 18.64% to $1,204 as of 07:00 ET. Its market dominance additionally dropped to 17% from 18.58%.

Like BTC, ETH briefly spiked above the $1,500 help earlier than step by step declining to across the $1,200 area. The second-largest digital asset bottomed at $1,157 over the reporting interval.

High 5 Gainers

Counos X

CCXX is the day’s greatest gainer, rising by 100.59% to commerce at $35.98 as of press time. It was unclear why the token was rising. Its market cap stood at $644.75 million.

Stasis Euro

EURS is up 10.2% over the reporting interval and is buying and selling for $0.99. The Euros-based stablecoin has loved a flurry of recent actions, with Circle saying that it will be accessible on Solana by 2023. Its market cap stood at $123.65 million.

Hex

HEX can also be among the many day’s high gainers, rising 9.48% to $0.03 as of press time. Its market cap stood at $5.91 billion.

Tether Gold

XAUT has risen by 2.16% within the final 24 hours to $1,703.38 as of press time. The dear metal-backed digital asset has loved gentle progress over the past seven days, rising 3%. Its market caps stood at $419.92 million.

Pax Gold

One other gold-backed digital asset among the many high gainers is PAXG, growing by 2.3% over the reporting interval to commerce at $1,701 as of press time. Its market cap stood at $553.33 million.

High 5 Losers

FTX Token

FTT is the day’s greatest loser, dropping 75% of its worth over the past 24 hours to commerce at $4.42 as of press time. The huge sell-off wiped off over $1.5 billion from the market cap of the struggling crypto agency native token. Its market cap stood at $596.63 million.

Serum

One other FTX-linked token that capitulated inside the final 24 hours was SRM. The Solana-based DEX token fell by 42.06% to $0.40 as of press time. Its market cap stood at $106.56 million.

Hashflow

HFT is on the day’s greatest loser checklist for the second consecutive after dropping 38.27% over the reporting interval to commerce at $0.56 as of press time. Its market stood at $102.6 million.

Solana

The FTT-led carnage additionally adversely affected the native token of the layer1 blockchain community SOL. The digital asset plummeted by 35.93% to $18.20 as of press time. Speculations are rife that Binance’s buy of FTX may negatively influence the community. Its market cap stood at $6.59 billion.

Synapse

SYN recorded a 31.28% loss over the past 24 hours to commerce at $0.64 as of press time. The cross-chain protocol has skilled a sell-off over the past seven days, tanking by over 30%. Its market cap stood at $89.02 million.