Buyers count on the Fed’s aggressive program of price hikes to degree off as soon as inflation reveals indicators of being reigned in. Nevertheless, forecasts counsel the U.S. economic system is way from cooling.

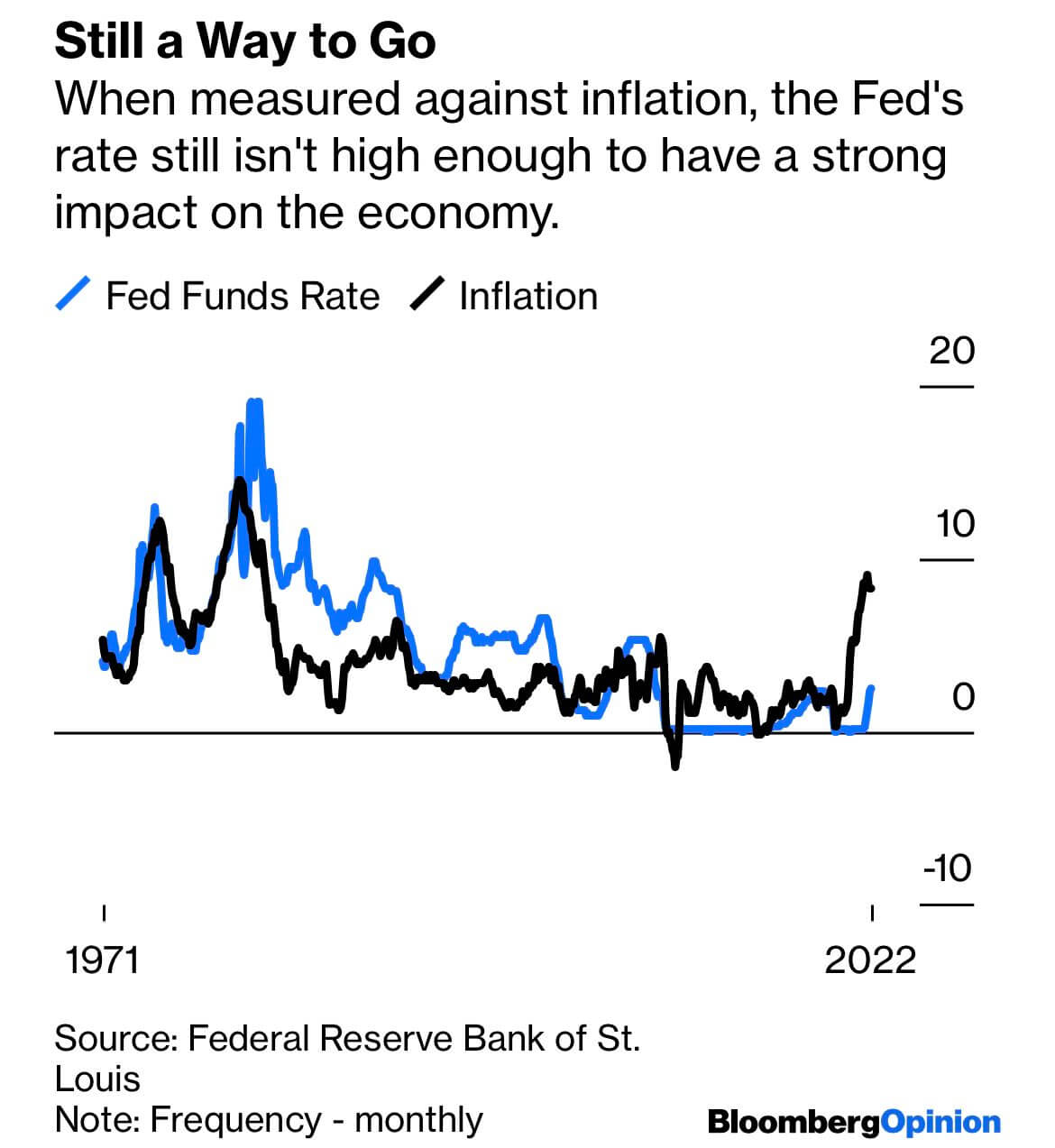

Final month, famed hedge fund supervisor Stanley Druckenmiller identified the uncomfortable reality that traditionally, as soon as inflation hits 5%, it has by no means reverted course with out Fed funds rising above CPI.

With September’s CPI inflation working at 8.2% year-over-year, price will increase could have an extended and painful method to go earlier than the Fed eases off – piling on promote stress in risk-on markets, together with crypto.

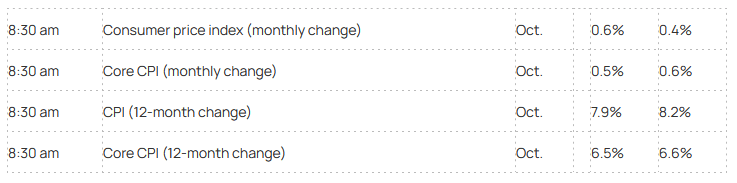

CPI forecast

In response to MarketWatch, total CPI is predicted to extend by 0.6% for October, to a year-over-year change of seven.9%.

Presently, markets are at a pivotal level. Both inflation cools, and central banks ease off price hikes, or fixed-income yields proceed making new highs, recession threat rises, and belongings come below additional stress.

This week’s U.S. October CPI report carries appreciable weight after the earlier month noticed little headway in reigning in core inflation, regardless of the previous eight months of price climbing.

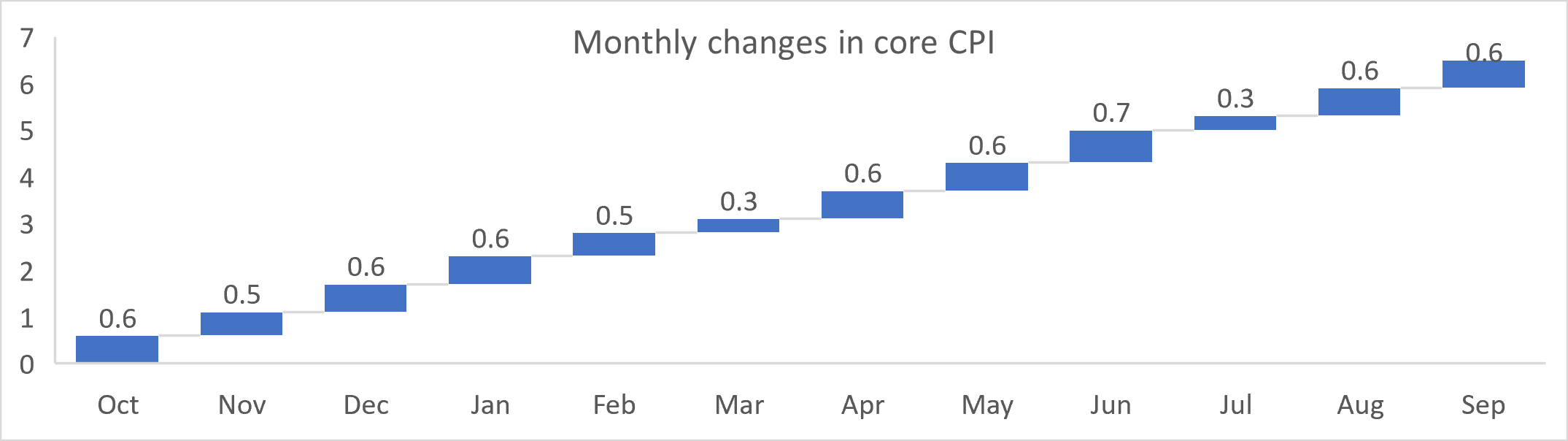

Slowing value beneficial properties for core items costs had been greater than offset by sooner value will increase for providers. The development for 0.6% month-to-month will increase in core CPI over the previous yr was bucked by simply two smaller will increase of 0.3% in March and July.

Equities are weak; what about crypto?

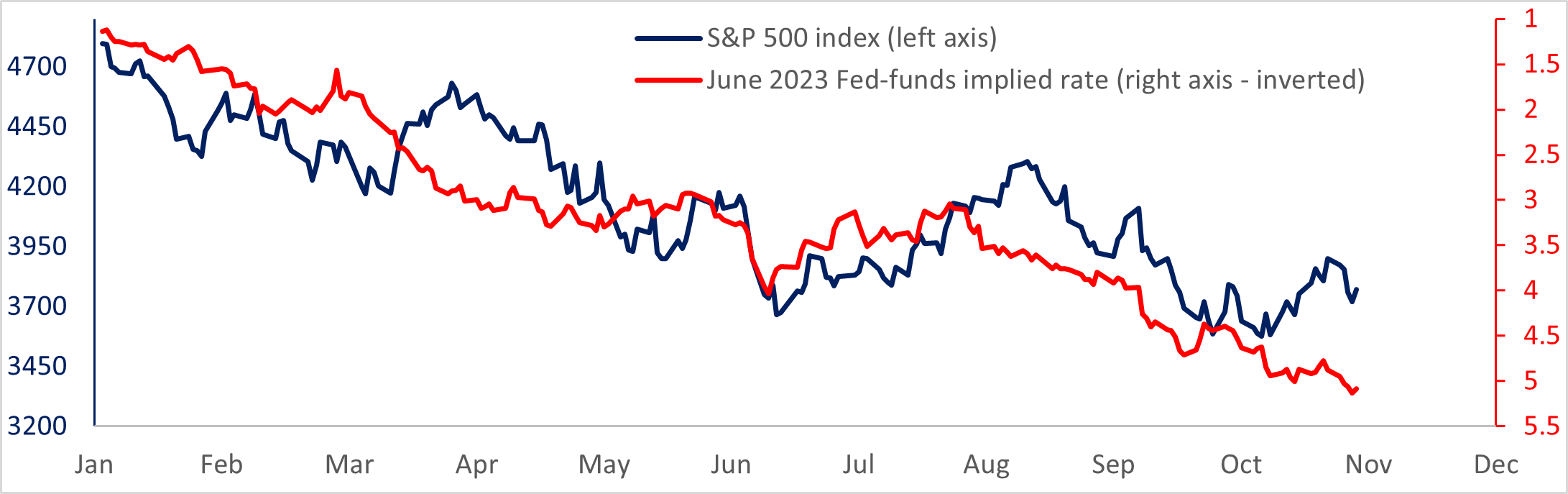

Following the FOMC assembly on November 2, by which the U.S. central financial institution carried out a fourth successive 75 foundation level hike, Fed Chair Jerome Powell mentioned peak charges might be increased than beforehand anticipated. Market expectations are for a peak price of round 5% by subsequent summer time.

The chart beneath reveals the S&P 500 and inverted implied Fed funds price. Issues are that equities are weak to an extra slide if the optimistic correlation reasserts itself.

In current weeks, Bitcoin has proven a decoupling from shares, resulting in a return of the protected haven narrative. Nevertheless, it stays to be seen whether or not this development will proceed to play out amid these unprecedented instances.