Fast Take

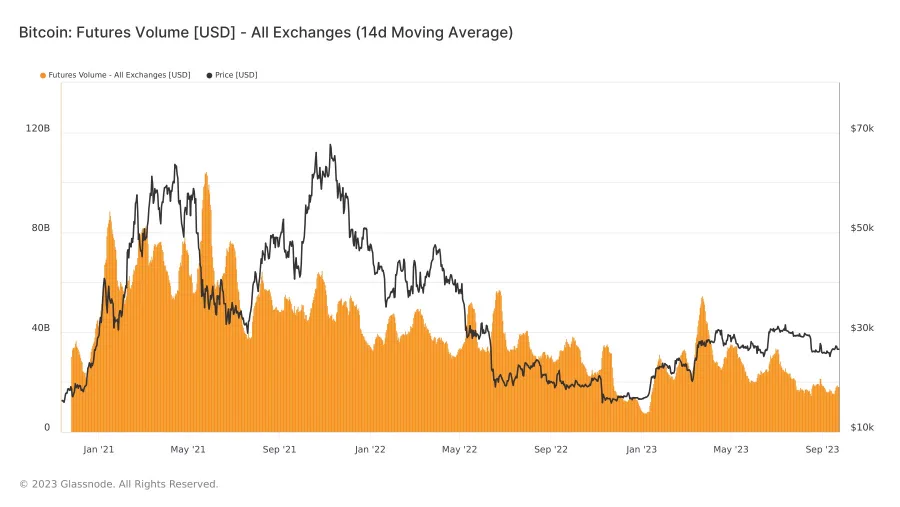

Bitcoin futures buying and selling has seen a big contraction from Jan. 2021 to Sept. 2023, with the entire 24-hour USD worth of traded futures contracts falling from $90 billion to $18 billion.

This contraction might be attributed to a number of elements. The primary is a lower in speculative exercise. As market individuals develop extra risk-averse, they might cut back their futures buying and selling in favor of direct holding. A decline in value volatility throughout this era additional signifies a possible shift away from speculative buying and selling in the direction of a extra cautious method.

Moreover, the noticed decline could replicate a broader bearish sentiment throughout the market, probably driving merchants to liquidate their positions and transfer towards the spot market. The spot market is usually considered as much less dangerous, which could attraction to merchants in a bearish market atmosphere.

This development aligns with a broader shift within the method and preferences of merchants, transferring from risk-oriented futures in the direction of extra steady and direct types of holding.

The publish Danger aversion in markets as Bitcoin futures buying and selling sees a big decline appeared first on CryptoSlate.