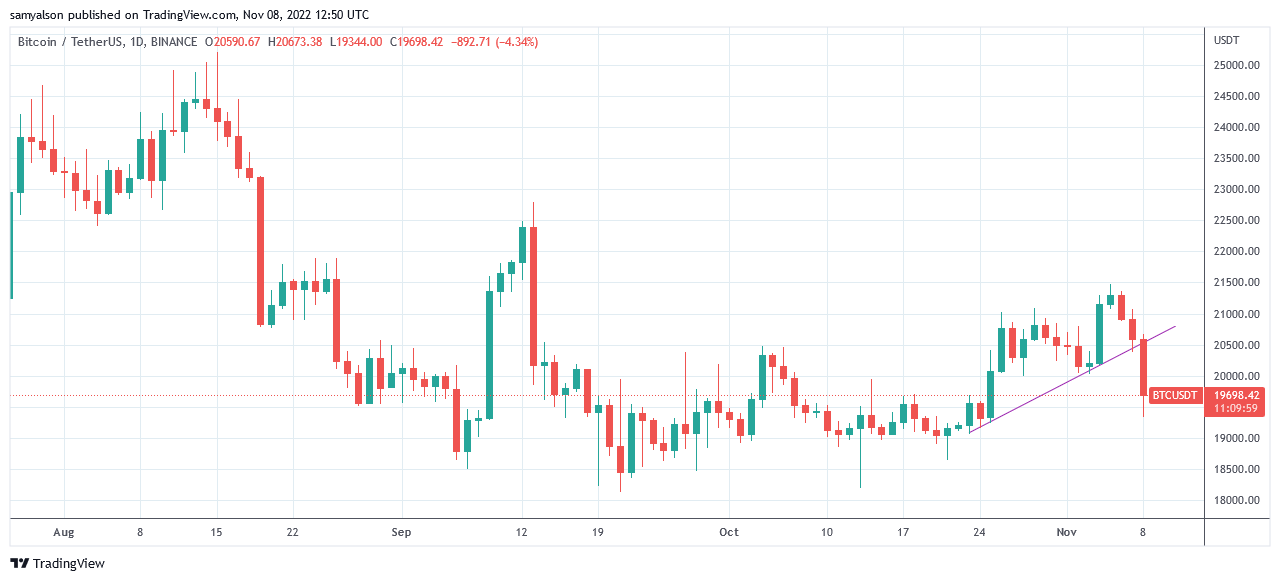

Promote stress results in Bitcoin breaking its native uptrend, constructing since Oct. 23.

Assist was discovered at $19,300, however draw back fears are stoked because the feud between Changpeng Zhao (CZ) and Sam Bankman-Fried (SBF) continues.

On Nov. 6, CZ tweeted about latest revelations coming to mild, resulting in the choice to promote FTT tokens held by Binance.

The incident sparked rumors of FTX insolvency and a Terra-Luna-styled collapse on the playing cards. During the last 24 hours, FTX’s native FTT token has sunk by 23.5% to $17.30 on the time of press.

Market jitters following the feud have seen $89 billion of capital outflow from the full crypto market cap since Sunday.

The vast majority of capital outflow got here late Monday night (ET), because it turned clear that CZ had opened a can of worms, together with revelations in regards to the relationship between FTX and its buying and selling arm Alameda.

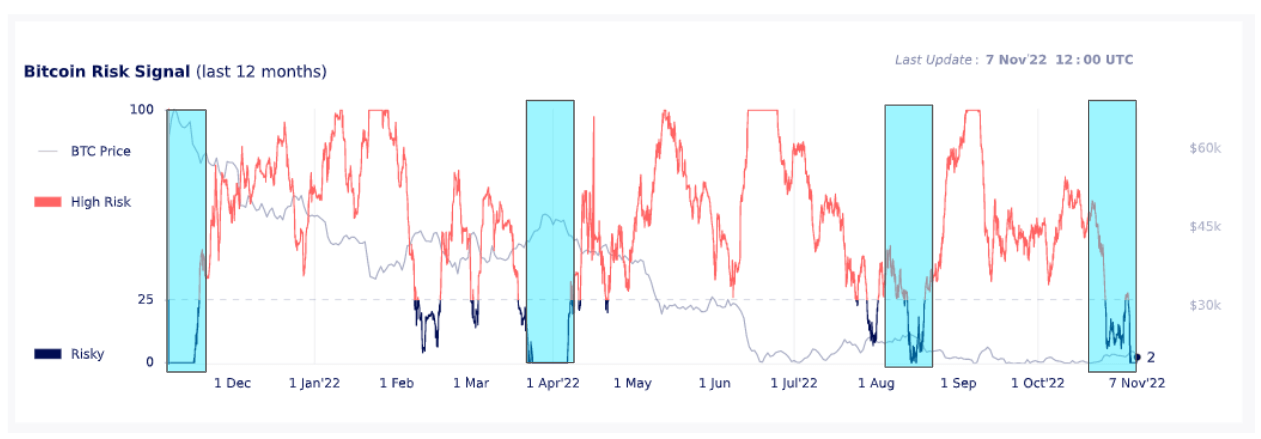

Bitcoin Danger Sign flashes pink

During the last 24 hours, token costs throughout the board have sunk. The highest 100 exceptions are Chainlink and Toncoin.

Amid the sell-off, market chief Bitcoin is down 5.2% to $19,700. It was reported 20,000 BTC left FTX, which at one level led to a damaging 198 BTC stability on the trade.

The market upheaval has triggered warning indicators, with the Bitcoin Danger Sign indicator sinking to a low of two. For the reason that November 2021 prime, the Danger Sign has solely hit two on three different events – every time a significant drawdown in value adopted.

OKG founder Star Xu mentioned the continuing scenario is harming all the crypto trade and known as on CZ to strike “a brand new deal” with SBF.

If sadly FTX turns into one other LUNA,no one within the trade can profit from the accident together with Binance. Each clients and regulators will lose some confidence about the entire trade .I hope CZ can take into consideration cease to promote FTT and make a brand new take care of SBF.

— Star (@starokg) November 8, 2022

FTX and Alameda

In 2019, on allegations of buying and selling in opposition to customers, and the battle of curiosity arising from market making, investing, and buying and selling, SBF mentioned Alameda operates as a liquidity supplier on FTX solely and is handled a lot the identical as different LPs.

Alameda is a liquidity supplier on FTX however their account is rather like everybody else’s. Alameda’s incentive is only for FTX to do in addition to doable; by far the dominant issue helps to make the buying and selling expertise nearly as good as doable.

— SBF (@SBF_FTX) July 31, 2019

In October 2021, SBF stepped down as Alameda’s CEO and was changed by co-CEOs Caroline Ellison and Sam Trabucco. Trabucco resigned from his place in August, citing a call to “prioritize different issues,” leaving Ellison as sole CEO.

For all intents and functions, Alameda and FTX are separate corporations. However because the drama was unfolding, it emerged that round 40% of Alameda’s property are composed of FTT, or FTT collateral, tokens.

Dylan LeClair famous that the FTX “financial institution run” is being supported by Alameda sending stablecoins, suggesting a better relationship “than was led on.”

Of the entire issues that give me trigger for concern, #1 is that as FTX is getting drained of reserves from withdrawals, Alameda is sending stables from its buying and selling wallets to the FTX scorching pockets.

Coincidence, or are the strains blurred between the 2 entities greater than was led on? pic.twitter.com/LtWj8hJ0U2

— Dylan LeClair 🟠 (@DylanLeClair_) November 7, 2022

Ought to additional drawdowns ensue, Alameda faces additional liquidity stress, which as an investor in quite a few crypto tasks presents a contagion threat.