One of many foundational ideas of Bitcoin is the Unspent Transaction Output, or UTXO. Each Bitcoin transaction ends in the creation of those UTXOs, which signify a chunk of Bitcoin that may be spent in future transactions. While you ship or obtain Bitcoin, you’re basically working with UTXOs: combining them, splitting them, and creating new ones.

Your complete historical past of Bitcoin transactions is out there on the blockchain, and UTXOs present a transparent snapshot of which items of Bitcoin are but to be spent, providing a clear view of Bitcoin’s liquidity. Analyzing the quantity and measurement of UTXOs can supply insights into community exercise, congestion, and customers’ transactional habits.

UTXO consolidation refers back to the course of of mixing a number of smaller UTXOs right into a single, bigger UTXO. It’s akin to exchanging a number of smaller denominations of cash for a bigger be aware. Consolidation can profit customers as it could possibly result in less complicated and sometimes cheaper future transactions. Nevertheless, it will also be a response to particular community or market circumstances, reminiscent of charge optimization, pockets administration, or preparations for important fund actions.

Given the significance of UTXOs within the Bitcoin ecosystem, analyzing associated developments can present helpful insights into consumer behaviors, community well being, and potential future market actions.

In current weeks, the Bitcoin community displayed intriguing patterns that will signify UTXO consolidations by its customers. CryptoSlate’s evaluation of knowledge in 2023 discovered notable shifts in transactional habits.

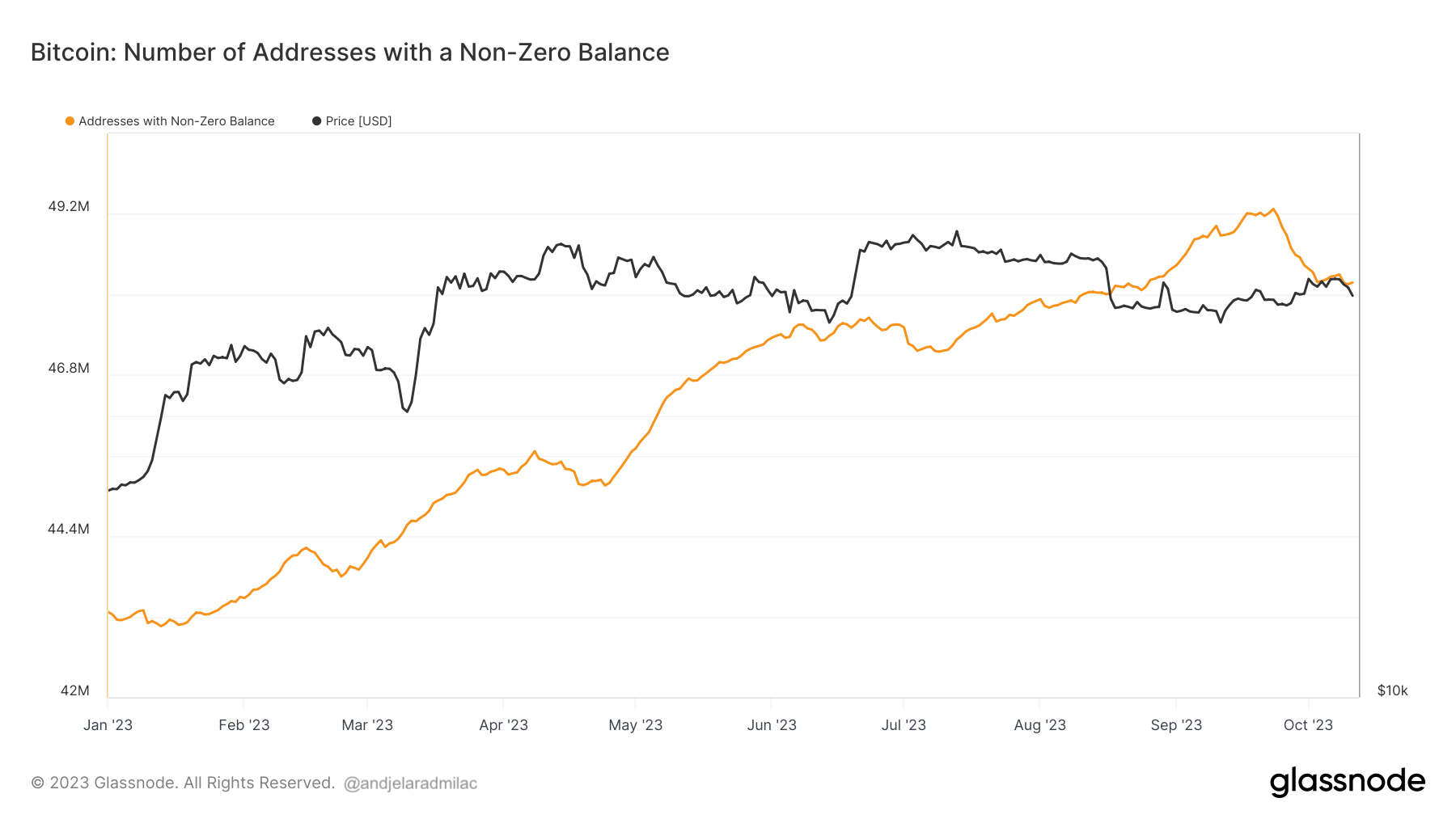

From January to September, there was an addition of 6.01 million new addresses with non-zero balances. Nevertheless, this momentum reversed by October, witnessing a lower of 1.1 million.

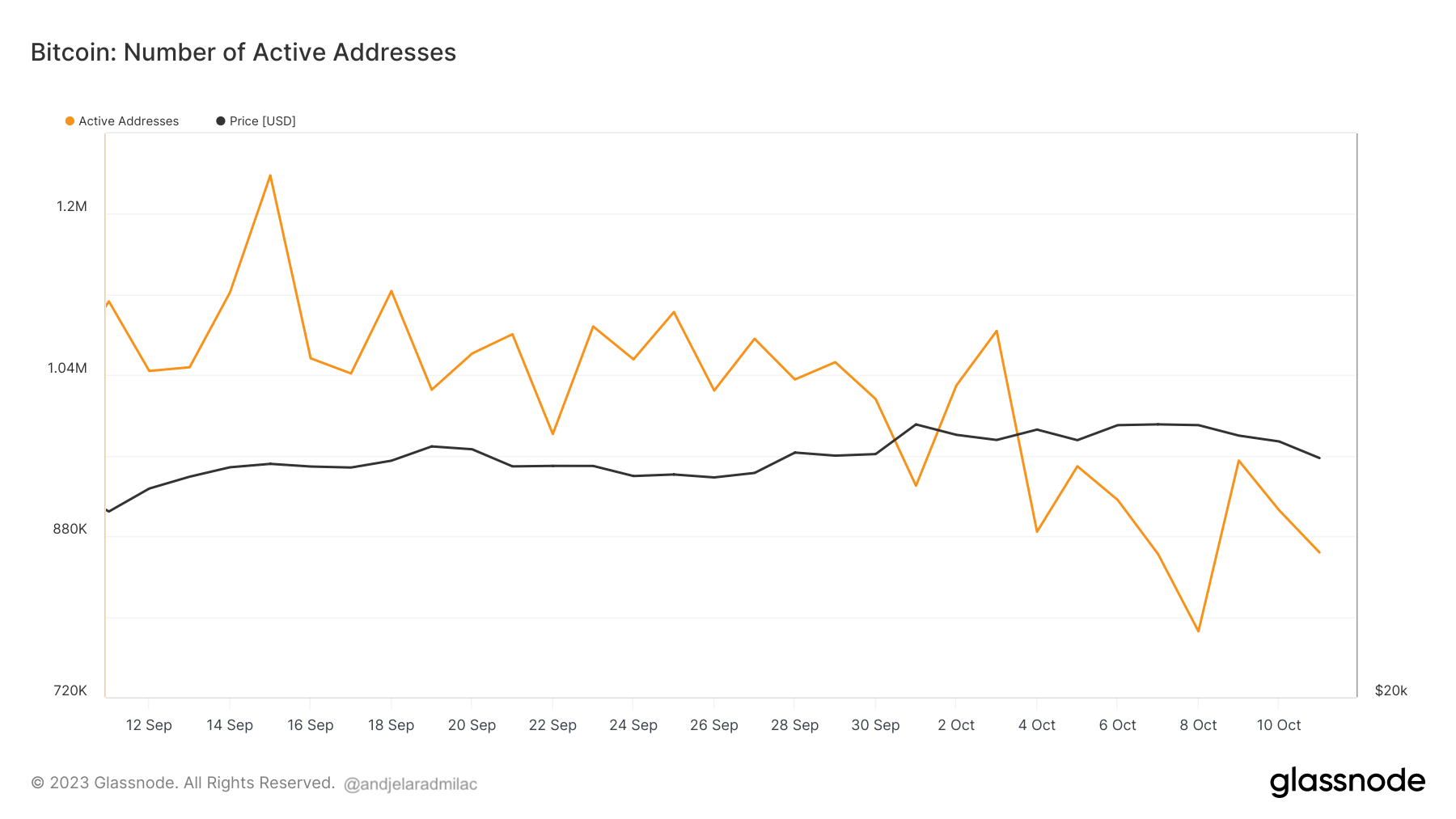

A pointy decline of 367,000 energetic addresses in October hints at potential fund consolidations or transfers out of Bitcoin.

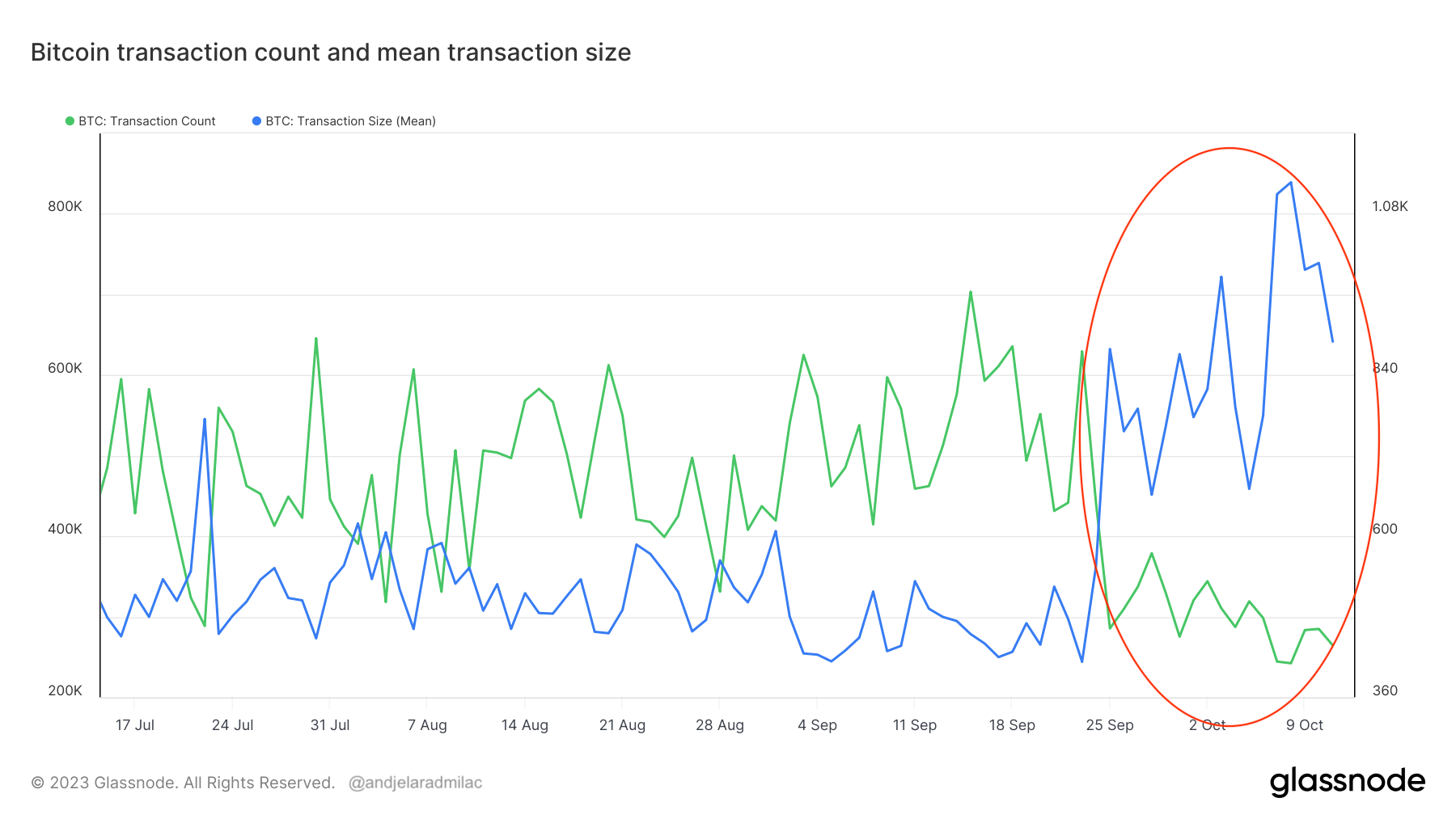

There was additionally a big improve in transaction counts, which grew by over 516,000 from January to September. However this tide turned in October, plummeting by 439,000.

Nevertheless, throughout this era, the imply transaction measurement expanded considerably. This enlargement suggests transactions have develop into extra intricate, doubtlessly attributable to a number of inputs, which signifies fund consolidations.

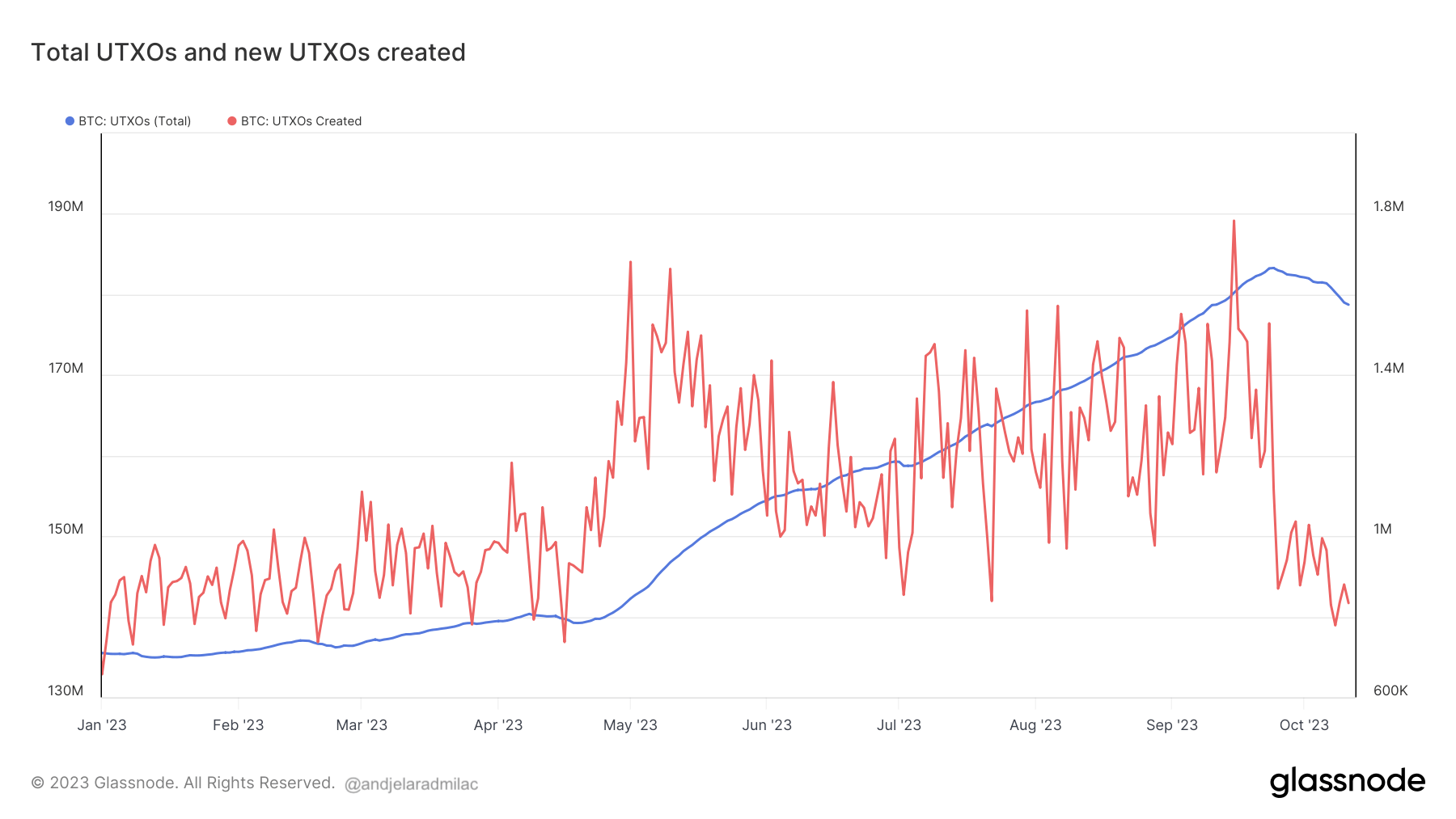

The UTXO knowledge furthers this narrative. Whereas there was a marked improve in whole UTXOs from January to September, a slight dip was noticed by October. This decline and the decreased variety of new UTXOs created in October alerts UTXO consolidation actions.

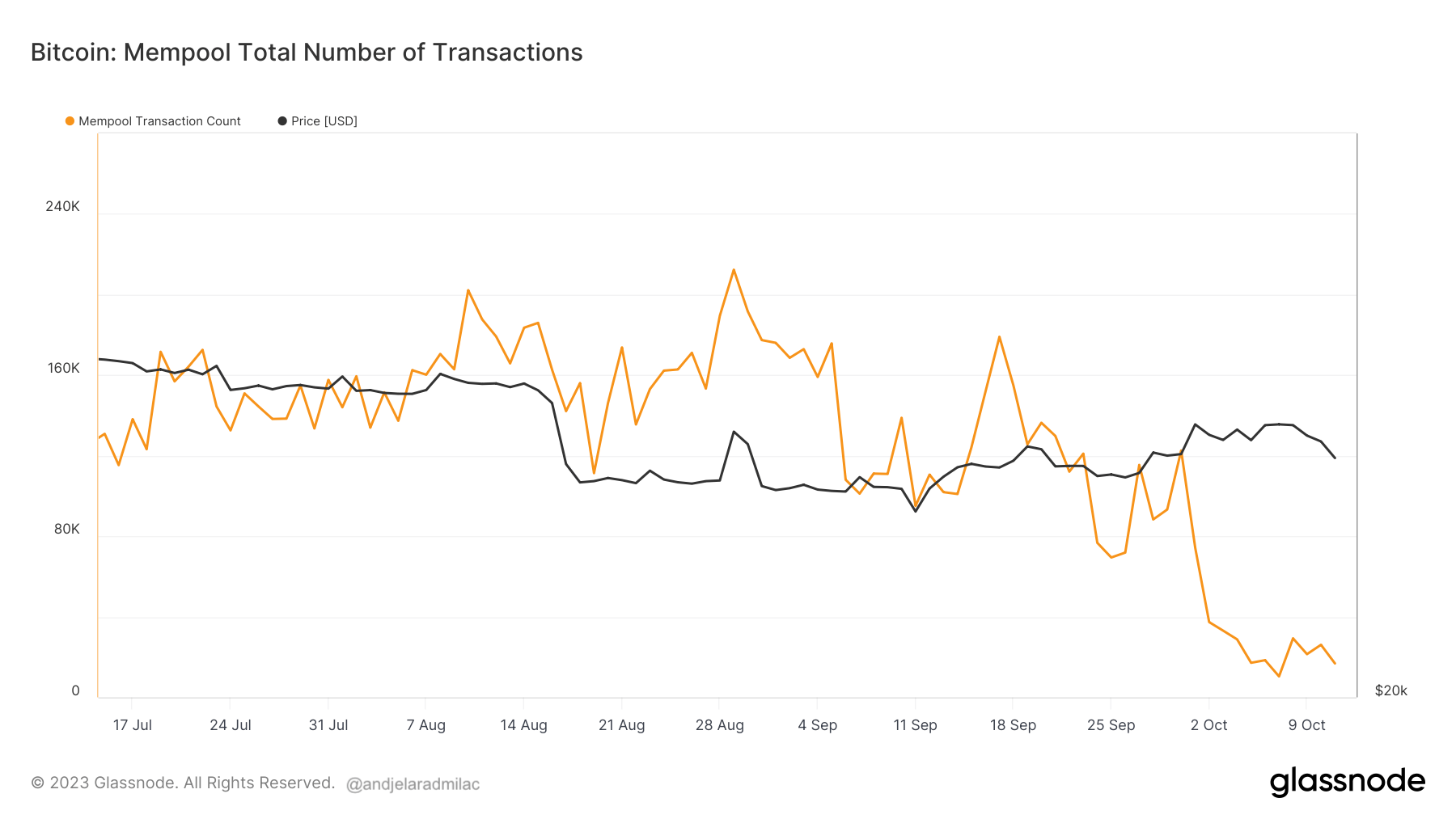

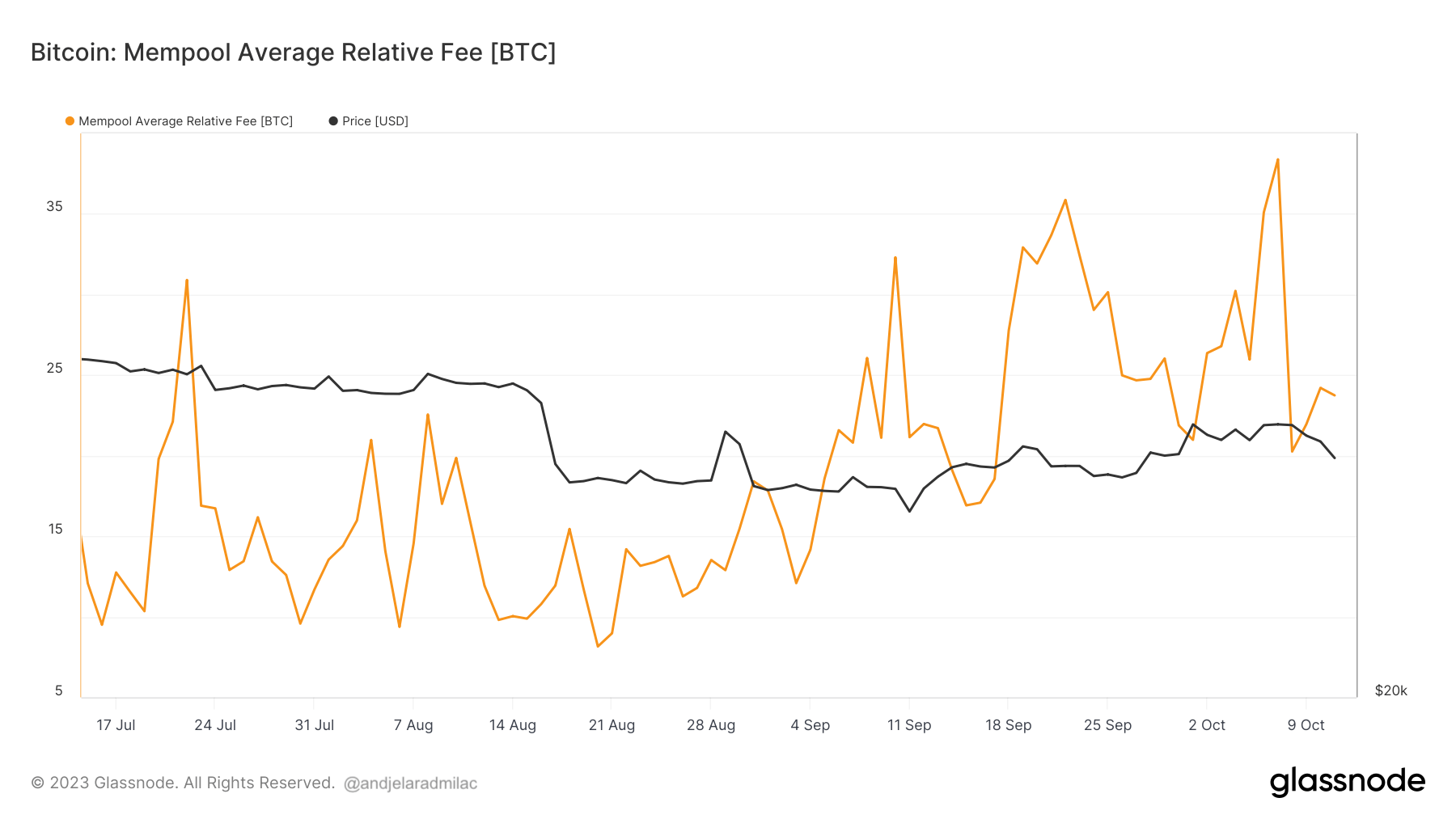

Delving deeper into community behaviors, September 2023 confirmed indicators of congestion. The mempool, Bitcoin’s transaction ready space, ballooned with 120,900 transactions, a pointy rise from 1,500 transactions recorded at first of the 12 months.

This bottleneck was accentuated by the elevated common relative charge of 32.4 BTC, denoting customers’ willingness to pay greater for transaction prioritization. Nevertheless, October ushered in aid. The transaction rely within the mempool and the related charges descended notably, suggesting a respite from the September congestion.

The congestion within the Bitcoin community throughout September 2023 doubtless deterred customers from enterprise UTXO consolidations. Nevertheless, when October ushered in a interval of decreased congestion and decrease charges, customers appear to have taken benefit of this to consolidate their UTXOs, resulting in extra economical transaction prices and quicker confirmations.

The put up Deciphering the position of UTXOs in Bitcoin consolidation patterns appeared first on CryptoSlate.