In gentle of DeFi’s latest lending market financial assaults, danger monitoring and administration has turn out to be a key issue for fulfillment inside the ecosystem. Acceptable procedures should be taken into consideration with a view to guarantee the longer term development of the area. This text goals to discover the latest Mango Markets financial assault, the way it was orchestrated, and potential mitigation methods.

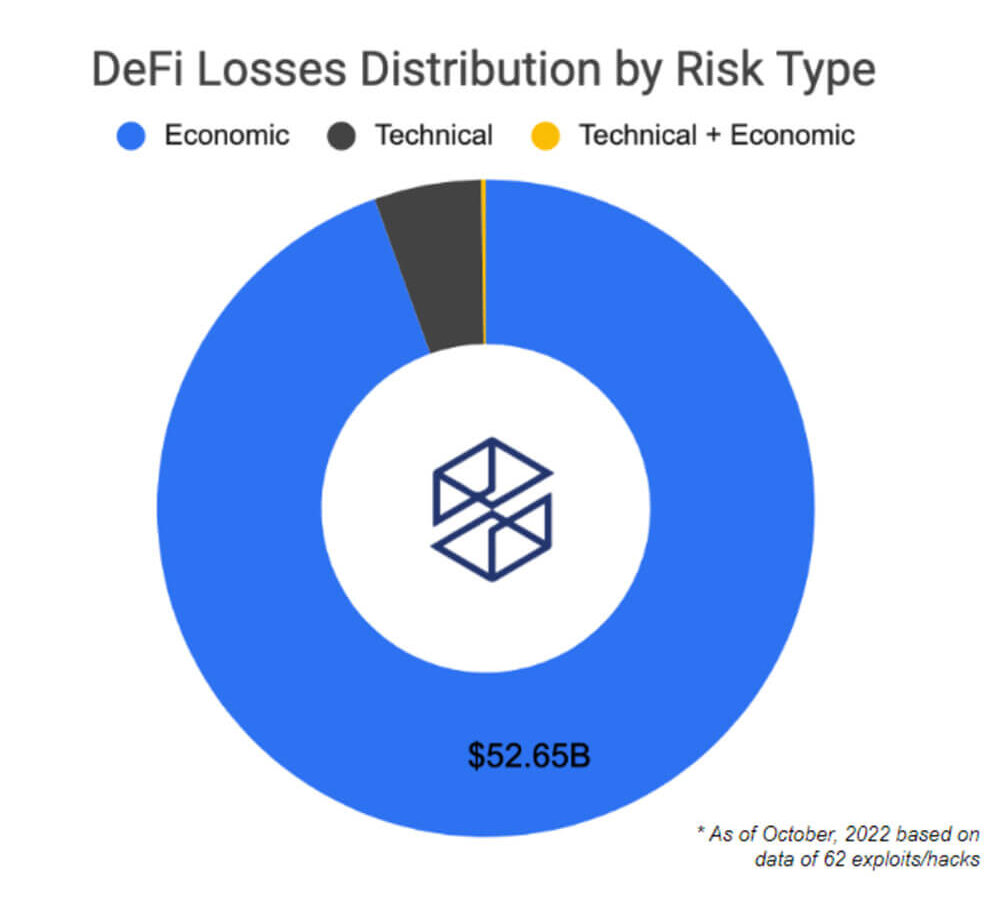

To be able to perceive how prone DeFi protocols are to every particular kind of danger, we delve into the 62 largest incidents which have taken place thus far. This contains hacks within the a whole bunch of tens of millions for bridges, financial collapses of algorithmic stablecoins, and outright theft of person funds.

Right here is the distribution of the principle danger elements behind the 62 largest DeFi assaults. Over $50B in losses are accounted for financial dangers. This estimate contains the collapse of the notorious Terra ecosystem. Regardless of technical elements being behind essentially the most variety of assaults in DeFi, a better greenback worth has truly been misplaced because of financial dangers.

Furthermore, the latest collection of financial assaults on a number of lending protocols like Mango and Moola has introduced gentle to the hazard that this poses over the ecosystem. As well as, many of those lending protocols had been attacked utilizing the identical vector. The assault consisted of a extremely complicated technique through which the attacker recognized the supported collateral asset with the bottom liquidity and market cap. Low liquidity belongings are essentially the most susceptible to flash loans or worth oracle manipulation assaults.

The indicator proven above is only for academic functions; no dwell information is proven because it’s only for reference. DEX Swimming pools Liquidity indicator is a part of a set of mock-ups constructed for a proposal on the Euler discussion board.

By monitoring liquidity obtainable for an asset in decentralized exchanges, we will gauge how susceptible it may be to being manipulated. A wholesome stage of accessible liquidity for supported collateral belongings is a vital security issue. Within the case of low liquidity tokens listed as collateral, issues of stability within the protocol may come up. Furthermore, this might facilitate a better path for worth manipulation, through which attackers benefit from the protocol.

The primary purpose of an attacker orchestrating this sort of assault shall be to extend the sum of money he can borrow. This might be finished by pumping the noticed low liquidity asset so as to have the ability to borrow giant portions of different supported, extra steady belongings.

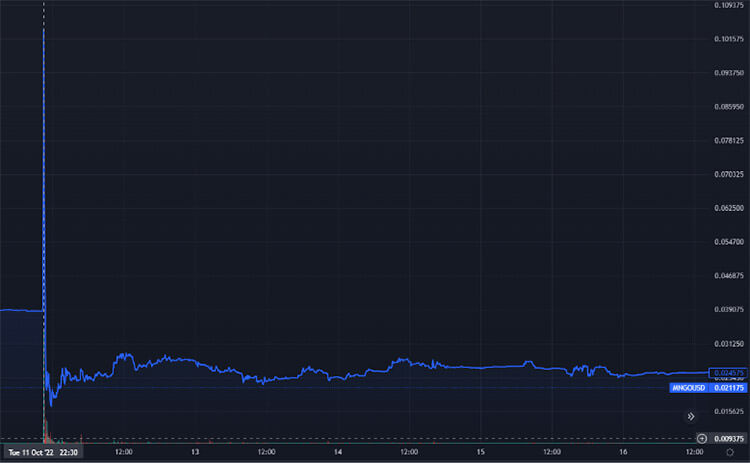

The graph above portrays the MNG token worth on the FTX trade. On this case, the attacker mixed the lending functionalities of the protocol with its perpetual contracts. The attacker manipulated the spot worth on Raydium, which triggered an oracle replace. This enabled him to borrow towards one other open place that he had beforehand positioned on the Mango Markets protocols. Ultimately, when the MNGO worth recovered, the protocol was left with a debt default.

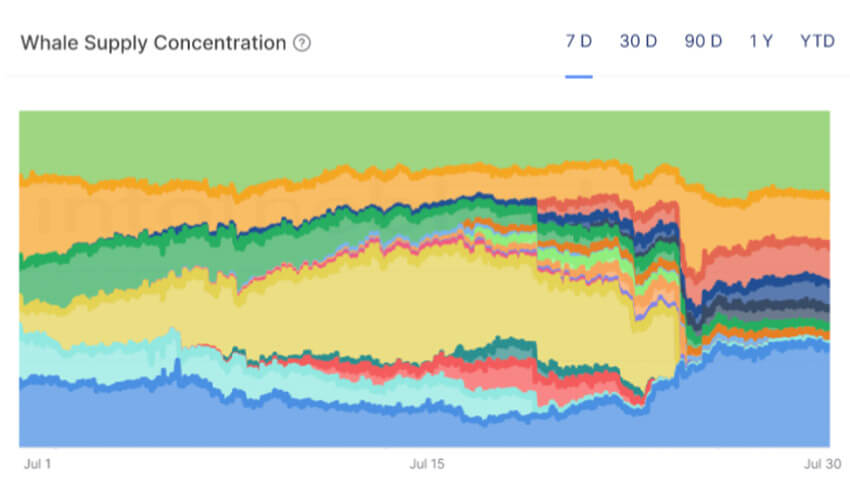

In relation to the indications proven above, through which they fight to determine weak hyperlinks within the protocol, there are additionally methods to try to determine potential threats from the attacker facet. Often, financial exploits are fastly executed; therefore indicators proven beneath serve academic functions in attempting to evaluate potential threats from the provision focus of whales.

The Whale Provide Focus indicator can be a part of the proposal on the Euler discussion board. This indicator is helpful to identify potential threats to the protocol depositors. For instance, if one of many largest protocol depositors is within the least liquid asset that the protocol helps as a collateral asset, it might be price to additional wanting into the particular deal with.

This indicator might be helpful to make use of along with the DEX Swimming pools Liquidity indicator proven above and is especially price monitoring if the focus whale tokens is likely one of the weakest tokens supported by the protocol. This might assist convey gentle to potential damaging occasions.

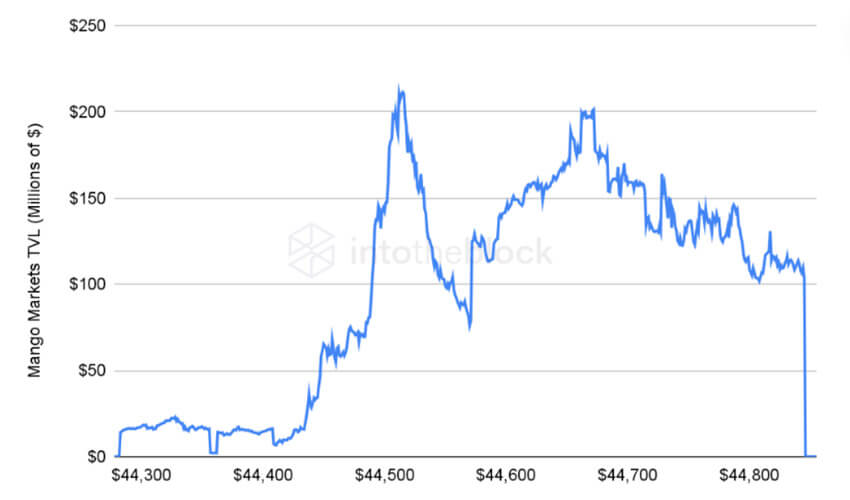

Mango Markets protocol TVL may be seen on the indicator above. A transparent drop may be seen after the attacker borrowed cash along with his place on the MNGO token as collateral. Finally the protocol was left with unhealthy debt as a result of worth manipulation occasions.

Acceptable instruments just like the above-shown purpose to maneuver the DeFi ecosystem one step nearer in the fitting route. These are simply a few of the preliminary indicators that first describe the latest occasions and second attempt to shield customers from incidents like this sooner or later. The item is that customers and protocols acquire a bonus from obtainable on-chain data.