Confidence in centralized exchanges appears to have reached a brand new low following the FTX fallout. Buying and selling volumes throughout all exchanges have skilled a vertical drop over the weekend, as customers rush to withdraw their tokens from custodial wallets supplied by the platforms.

Information analyzed by CryptoSlate confirmed a drastic drop in Bitcoin’s actual buying and selling quantity. In response to Messari, the true buying and selling quantity throughout all centralized exchanges dropped to $2.82 billion on Nov. 12. At press time on Nov. 14, the volumes recovered to $3.14 billion.

This can be a sharp drop from the $13.71 billion quantity recorded on Nov. 8.

Graph displaying the true buying and selling quantity for Bitcoin throughout centralized exchanges (Supply: Messari)

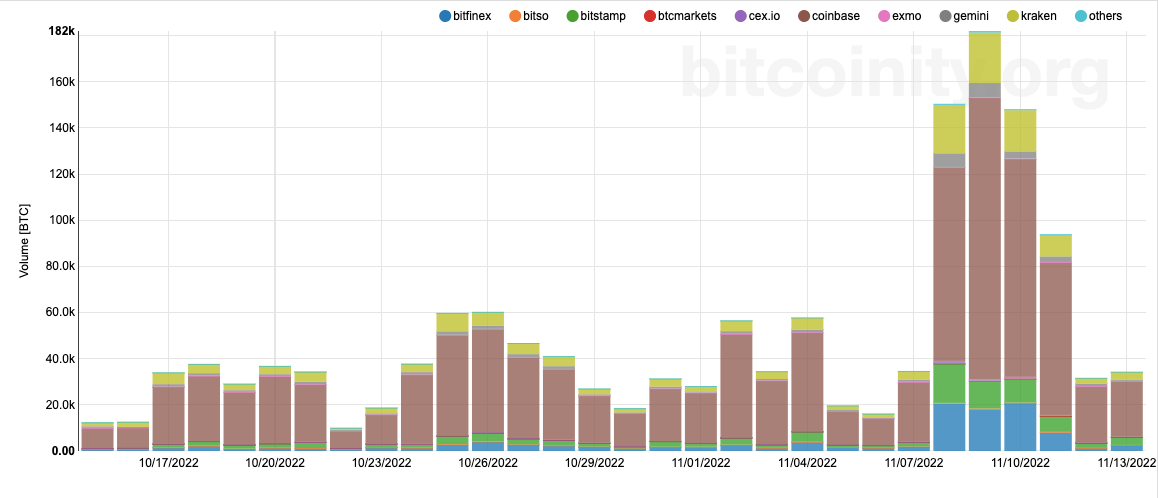

Taking a look at particular person exchanges additional confirms this pattern.

Bitcoin buying and selling volumes throughout 10 giant centralized exchanges, excluding Binance, OKEx, and BitMEX, decreased virtually fivefold within the span of some days, dropping from round 182,000 BTC per day on Nov. 9 to round 38,000 BTC on Nov. 13.

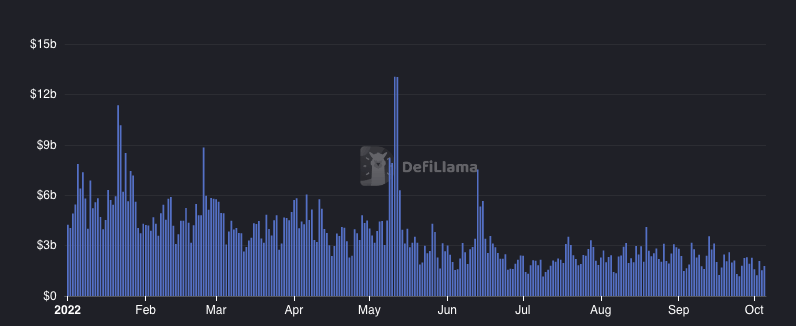

The entire volumes wiped from centralized exchanges appear to have transferred to decentralized ones. DEXs noticed a vertical spike in buying and selling quantity over the weekend, reaching virtually $12 billion. In response to DeFi Llama, buying and selling quantity throughout all decentralized exchanges reached $11.93 billion on Nov. 10, a pointy bounce from the $2.92 billion recorded on Nov. 7.

Out of all the massive DEXs, Curve led the way in which seeing its buying and selling quantity improve by 334% within the span of every week. Nonetheless, with $1.3 billion recorded on Nov. 12, Uniswap is the chief on the subject of sheer buying and selling quantity.

It’s nonetheless too early to inform what brought about the fast shift in quantity. The market disaster attributable to the FTX fallout put the safety of consumer funds into query and will have pushed retail merchants away from centralized exchanges. The extra clear and decentralized nature of automated smart-contract-based buying and selling platforms like Uniswap and Curve may come as an antidote to the retail market broken by the FTX fiasco.

Any spikes in buying and selling volumes on giant exchanges could possibly be led by institutional buyers, particularly on exchanges serving giant enterprise purchasers like Coinbase.