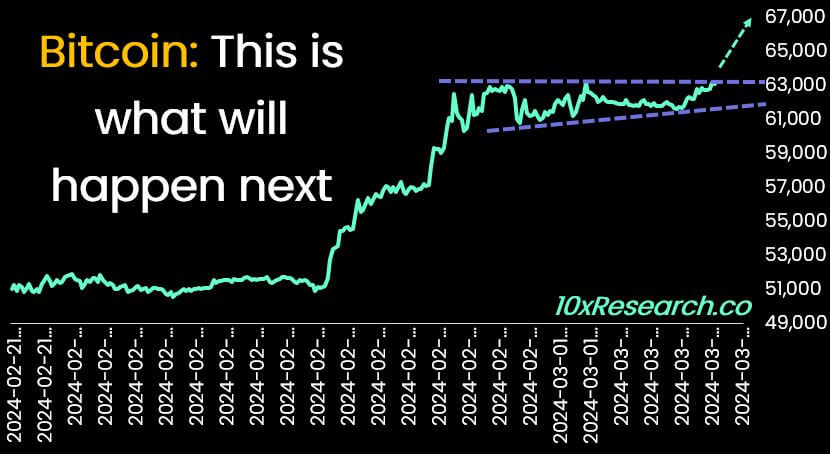

Bitcoin’s value is primed for a surge that might hit record-breaking highs this week, in keeping with a 10X Analysis report shared with CryptoSlate.

Why BTC will print new ATH

The report outlines key elements driving this bullish momentum. It means that Bitcoin will expertise a big upswing if the outflows from Grayscale’s Bitcoin ETF drop under $100 million whereas substantial inflows proceed to BlackRock.

These ETFs, launched in January, have notably influenced Bitcoin’s value, propelled by institutional demand. Markus Thielen, the founding father of 10X Analysis, mentioned this affect contributed to a notable 43% enhance, amounting to $18,615, in Bitcoin’s value throughout February.

Past the US-based ETFs, Bitcoin’s demand is surging globally. Buying and selling quantity in Korea has skyrocketed from below $1 billion to almost $8 billion. Moreover, the pending ETF purposes in Hong Kong are anticipated to draw Chinese language traders upon approval.

Thielen additional emphasised the shifting funding patterns, noting that a good portion of Bitcoin ETF inflows is redirected from Gold ETFs, with Bitcoin more and more seen as a superior macro asset. This notion is bolstered by Bitcoin’s favorable response to modifications in rate of interest expectations and geopolitical occasions.

Furthermore, heightened institutional demand has led to declining Bitcoin balances on Over-the-counter (OTC) desks and crypto exchanges. Thielen reported OTC balances have plummeted from round 10,000 BTC within the earlier yr’s second quarter to lower than 2,000. Equally, change balances have decreased by 63,000 Bitcoins over the previous month.

Thielen concluded that the inflow of latest retail and institutional traders might not be price-sensitive, significantly with the prevailing notion that Bitcoin’s halving is bullish. So, he predicts that Bitcoin will doubtless attain a brand new all-time excessive this week, supported by the absence of sellers and ongoing makes an attempt to spice up leveraged lengthy positions.