Be a part of Our Telegram channel to remain updated on breaking information protection

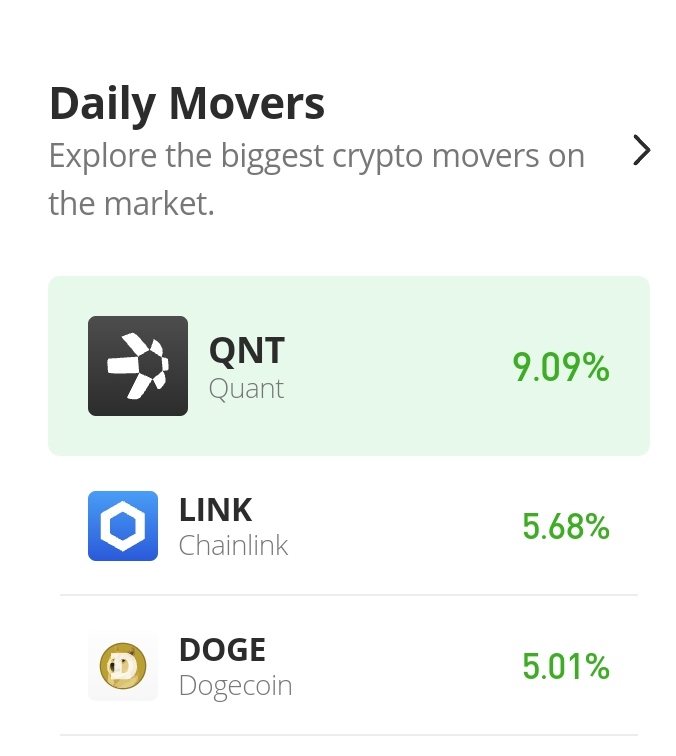

The DOGE/USD market takes its help at $0.569 on the twenty second of September to make for an upward worth stage with a really vital bullish candlestick sample. Nonetheless, in at this time’s market, on the peak of $0.0686, merchants start to promote and the value falls and it’s now balancing at $0.0649. If patrons can handle to maintain a maintain in the marketplace at this time, Dogecoin might proceed to rise in worth.

Dogecoin Market Value Statistic:

- DOGE/USD worth now: $0.06519

- DOGE /USD market cap: $8,613,730,715

- DOGE /USD circulating provide:132,670,764,300

- DOGE/USD complete provide: 132,670,764,300

- DOGE/USD coin market rating: #10

Key Ranges

- Resistance: $0.07000, $0.0750, $0.0800

- Help: $0.06000, $0.05500 $0.05000

Your capital is in danger

Dogecoin Market Value Evaluation: The Indicators’ Level of View

Within the Bollinger band indicator, the higher band and the decrease bands compress towards the value motion, and the newest worth motion (candlestick) will get nearer to the higher band of the Bollinger band. This will increase the chance of the continuation of the up-trend market. However within the MACD indicator, we see that DOGE/USD is breaking away from the ranging market and heading in direction of the upside. The RSI says the identical factor because the RSI line measures 55% whereas the sign line measures 45%.

Dogecoin: DOGE/USD 4-Hour Chart Outlook

After the robust bullish market that opens the day’s session, we start to see some little bearish development. However they don’t seem to be such a robust transfer. One other factor to notice from this viewpoint is that this bearish worth retracement is a results of a correction of worth from the overbought.

Be a part of Our Telegram channel to remain updated on breaking information protection