Fast Take

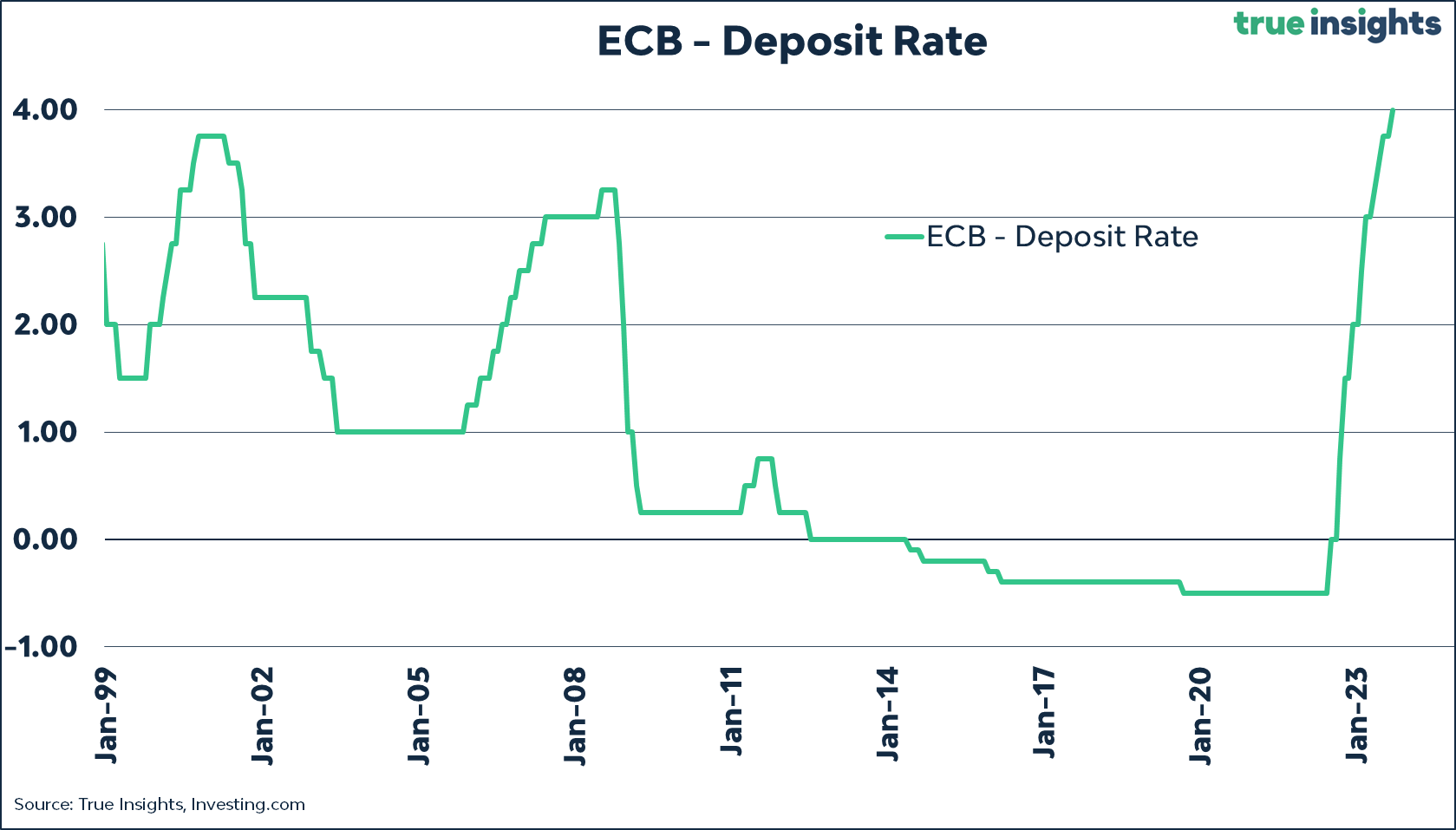

The European Central Financial institution (ECB) has initiated a price hike of 25 foundation factors, inflicting the ECB charges to now stand at 4%. This transfer, geared toward tightening financial coverage, has had a big impression on international alternate markets, notably influencing the EUR/USD pair.

The pair skilled a pointy decline, dropping to only under 1.07 post-announcement. This means the market’s sensitivity to the ECB’s financial coverage selections, reflecting the influential function of central banks on forex valuations.

The quick response of the EUR/USD pair underscores the shut connection between rates of interest and Foreign exchange actions. As greater rates of interest sometimes strengthen the native forex, the downturn might point out traders’ response to the potential financial implications of the speed hike. This motion, whereas seen as a measure to curb inflation, may replicate the ECB’s confidence within the area’s financial stability.

The submit ECB price hike catapults EUR/USD into sharp decline: a story of foreign exchange sensitivity appeared first on CryptoSlate.