The largest information within the cryptoverse for Sept 16 contains the crypto neighborhood arguing that ETH could possibly be thought of a safety post-merge, the Whitehouse releasing a framework for crypto regulation, U.S. banks pausing crypto lending plans amid difficult SEC pointers, Celsius looking for approval to promote $23M price of stablecoin property.

CryptoSlate High Tales

Debate rages over whether or not Ethereum must be thought of a safety post-Merge

SEC chairman Gary Gensler mentioned that cryptocurrencies that enable for staking could be categorized as securities primarily based on the Howey check.

With Ethereum’s profitable transition to a PoS community, some crypto neighborhood members expressed concern that ETH could possibly be thought of a safety and appeal to undue regulatory consideration.

Others argued that the technological distinction between PoW and PoS shouldn’t be a motive to categorise ETH otherwise.

White Home releases inaugural framework for crypto regulation

The long-anticipated framework launched at the moment proffered suggestions on points referring to cryptocurrency regulation, cracking down on crypto fraud, and decoupling the broader financial system from future contagion within the crypto market.

The White Home additionally hinted on the feasibility of creating a Digital Greenback to create a extra environment friendly cost system that can carry the monetary service trade as much as normal.

With the Merge performed, it’s all eyes on Cardano’s Vasil improve

Cardano’s Enter Output (I.O.) revealed an ecosystem readiness replace reiterating that the community is prepared for the Vasil onerous fork to happen on Sept 22.

The Vasil onerous fork will improve Cardano’s community efficiency by rising its throughput and script effectivity and lowering latency in block transmission.

Reuters experiences central U.S. banks are pausing crypto lending plans amid difficult SEC pointers.

In keeping with a current SEC guideline, crypto property held in custody by public corporations should be accounted for as liabilities.

To this finish, central U.S. banks like Bancorp and State Road are slowing performed on their crypto custody providers because of the want to carry extra cash to cowl their crypto liabilities.

Celsius seeks courtroom approval to promote $23M price of stablecoin property

Celsius Community holds about $23 million in eleven completely different types of stablecoins. The bankrupt crypto lender requested the courtroom to permit it to promote the stablecoins for U.S. {dollars}.

Celsius opted to promote the stablecoins to generate extra liquidity to fund its enterprise operations.

Analysis Spotlight

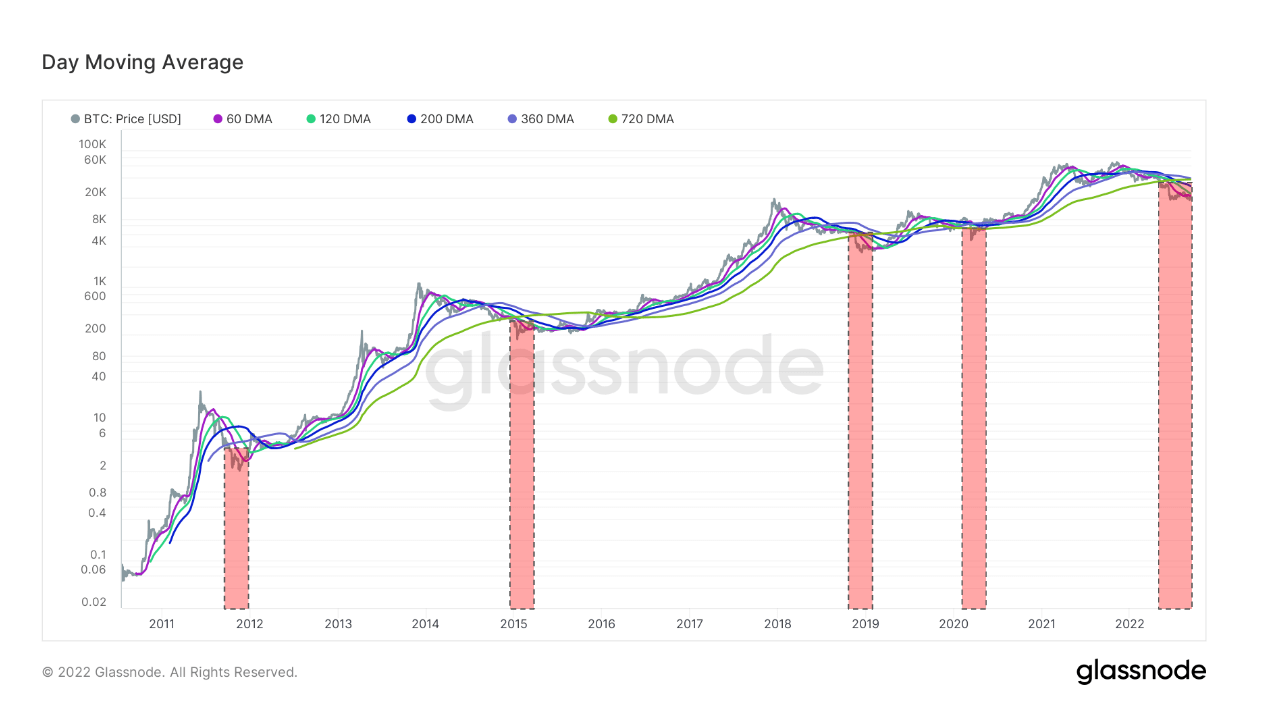

Bitcoin falls under all key shifting averages for the fifth time ever

In keeping with knowledge analyzed by CryptoSlate, Bitcoin has fallen under the 60-day, 120-day, 200-day, 360-day, and 720-day shifting averages for the fifth time.

By implication, the present BTC value is on the bear circle’s low. For a lot of analysts, this presents a “generational purchase” alternative.

Information from across the Cryptoverse

ECB units the stage to launch digital euro

The European Central Financial institution (ECB) selected Amazon, CaixaBank, Worldline, EPI, and Nexi to develop a prototype for its digital euro.

The prototype will assist the ECB develop person interfaces that swimsuit completely different segments of its goal customers.

GrayScale Funding strikes to promote ETHPOW tokens

Two funds owned by Grayscale Investments acquired 3,100,629 ETHPoW tokens as an airdrop. The agency introduced its intention to promote the tokens as quickly as buying and selling liquidity is developed for ETHW.

Binance misallocates $20m Helium’s HNT tokens.

Binance mistakenly despatched 4,8 million HNT tokens rather than Helium’s secondary token, MOBILE. The accounting error has value the crypto alternate about $20 million.

Osmosis co-founder questions the effectiveness of ETH staking post-merge

Osmosis Co-Founder Sunny Aggarwal mentioned that Ethereum’s staking design mannequin, which limits withdrawals, shouldn’t be sensible.

He added that the shortcoming of customers to withdraw staked ETH has contributed to the rising deviation of Lido’s stETH value from the underlying ETH.

Crypto Market

Bitcoin was flat at the moment, Sept 16, buying and selling down simply -0.01% within the final 24 hours. Bitcoin value sat round $19,700 all through the day, whereas Ethereum traded at $1,438.41, a lower of -2.7%.