The has been debate on Ethereum’s potential to grow to be deflationary after The Merge however the issuance enhance within the days following the transfer to proof-of-stake appeared to negate the deflationary concept; nonetheless, the burn fee all through October has led to ETH recording its first 30 deflationary days in historical past.

After The Merge was accomplished on Sept. 15, the full circulating provide was 120,520,222 ETH. By early October, it had risen to 120,534,212 ETH; this in and of itself marked a drastic lower within the issuance of Ethereum because of the removing of proof-of-work miners. Had the blockchain not moved to a PoS mannequin, the full provide would have neared 120,944,347 ETH.

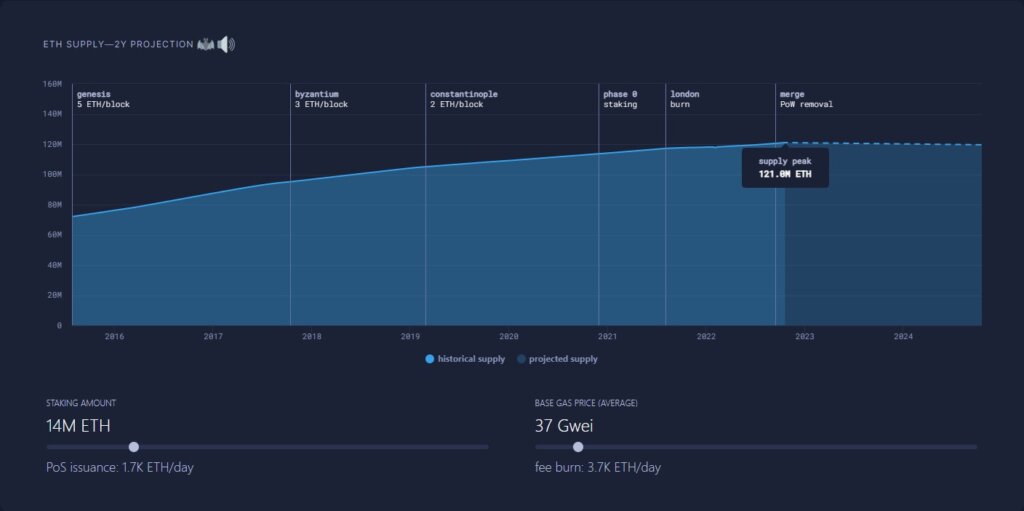

The graph under from Ultrasound.cash charts the provision of Ethereum post-merge.

Since Oct. 8, the full provide has been falling because the burn fee surpassed Ethereum issuance, inflicting a discount in circulating ETH. Consequently, over the previous 30 days, 49,562 ETH has been burnt at a median fee of 1.15 ETH per minute. The overall provide of Ethereum seems to have hit its peak and is now simply days away from doubtlessly dropping under the quantity circulating on the time of The Merge.

Roughly 3,318 ETH is at the moment burnt every day, with essentially the most vital contributors being Uniswap, OpenSea, and Tether. The burning mechanism inside Ethereum was launched throughout EIP-1559 when the ‘base payment’ was programmed to be burnt throughout every transaction. This base payment is topic to market circumstances and adjustments in line with community congestion. The common base should stay over 15 Gwei for ETH to be deflationary. On the time of writing, the typical payment is double the required degree at roughly 36 Gwei.

Whereas Ethereum is on monitor to cement its deflationary standing from present on-chain metrics, this doesn’t imply that there’ll essentially be a steep decline in circulating ETH. Ought to the current pattern proceed a projection on ultrasound.cash signifies that there can be 119,600,000 ETH by Oct. 20, 2024, a drop of simply 0.775% or 0.387% per 12 months.

If the bottom payment will increase, there may very well be an extra lower within the complete provide. Nevertheless, from evaluation of the information accessible, it’s extra probably that the full provide of Ethereum will stay mounted for the foreseeable future with a tolerance of round 1%. A protracted-term projection graph on ultrasound.cash signifies that the provision won’t drop under 100 million till 2072.