Ethereum has been following the overall pattern within the crypto market, giving again its revenue obtained over the previous week. The cryptocurrency was shifting in tandem with Bitcoin and enormous cryptocurrencies, however now ETH’s value is reacting to new financial information printed in the US.

On the time of writing, Ethereum trades at $1,300 with a 2% loss and sideways motion within the final week. Different cryptocurrencies within the high 10 by market capitalization report related value motion apart from XRP. This token is displaying power in opposition to the pattern and continues to knock on income over the identical interval.

Ethereum Inbound For One other Sideways Week

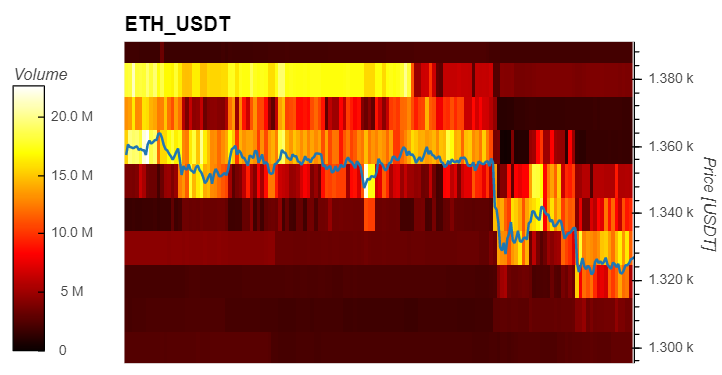

Knowledge from Materials Indicators (MI) exhibits that Ethereum is seeing some bids at its present ranges. This might sign a short-term rally into earlier resistance ranges neat $1,340 with potential for $1,400.

As seen within the chart under, the Ethereum value has reacted comparatively effectively to the current value motion with bid (purchase) liquidity coming in at at present’s low. This has supported the worth of ETH permitting it to bounce into the world of round $1,340.

Earlier at present, the second cryptocurrency by market cap was experiencing a spike in promoting from all traders, from retail to whales. Nonetheless, the promoting has been mitigated in current hours with giant gamers with bid orders of as a lot as $100,000 shopping for into Ethereum’s value motion.

These gamers purchased over $800 million in ETH on quick timeframes and may be capable of maintain ETH for some time. However, ETH’s value motion could be in jeopardy because the market heads into the weekend.

For Ethereum and Bitcoin, $1,200 and $18,500 are key ranges to forestall a recent leg down into the yearly lows. In keeping with a pseudonym dealer, so long as these ranges maintain, the cryptocurrency will maintain the road with extra days of sideways motion. The dealer mentioned:

The second $18.5K or $20.5K (for Bitcoin) offers in we’ll seemingly see it adopted by an enormous transfer. Chop chop and extra chop till then. CPI on Wednesday might change it up a bit however as we communicate we’re again to the center of the vary.

Ethereum And Bitcoin Poised For Incoming Volatility

On the latter, the upcoming Shopper Worth Index (CPI) print for September and at present’s information on the U.S. financial system present that macroeconomic forces are nonetheless in management. To this point, the financial information has been optimistic and has even surpassed knowledgeable expectations.

That is unfavourable for Bitcoin, Ethereum, and world markets as a result of it indicators that the U.S. Federal Reserve (Fed) can sustain and even flip up the strain to decelerate inflation metrics. In that sense, subsequent week’s CPI print might be one of many key occasions for ETH, BTC, and all the trade.

Speaking in regards to the potential for the Fed to take a much less aggressive stance, and pivot its financial coverage, Keith Alan from Materials Indicators wrote:

A FED pivot isn’t seemingly with out one thing of main significance taking place. The #FED desires to see consecutive months of declining CPI and growing unemployment.