Ethereum is moving higher over today’s trading session and seems to be targeting previous levels about the $2,000 mark. The cryptocurrency soars as “The Merge” becomes imminent and backs the bullish sentiment across the market.

At the time of writing, ETH’s price trades at $1,900 with a 3% profit in the last 24 hours and a 17% profit over the past week. Ethereum is the best performing asset in the crypto top 10 by market cap recording bigger gains than Solana (14%), Polkadot (16%), and Bitcoin (7%).

The bullish momentum for Ethereum seems poised to extend. In a recent ETH core developers calls, “The Merge” mainnet release was tentatively scheduled for September 15 to 16 at epoch 144896.

This announcement comes at the heels of a successful implementation of “The Merge” on another main Ethereum testnet, Goerli. Called the final “dress rehearsal” for this major upcoming event that will combine Ethereum’s execution layer with its consensus layer.

In other words, Ethereum will finally complete its transition from a Proof-of-Work consensus to a Proof-of-Stake. This process will provide the blockchain will better performance, much lower transaction fees, scalability, and less energy consumption.

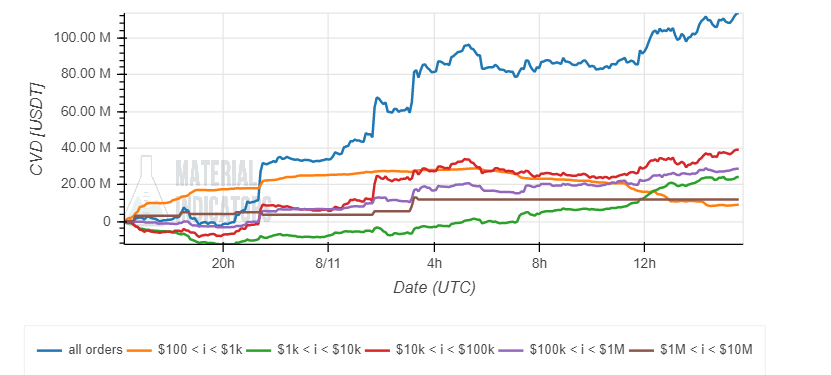

The potential for “The Merge” to attract new users and capital into the Ethereum ecosystem is one of the reasons why it’s perceived as bullish by the market. Data from Material Indicators (MI) indicates that almost every investor class has been buying into ETH’s price current price action.

This buying pressure is trending upwards and appears to be picking up momentum, over the past 12 hours as news about the tentative date for the mainnet release broke.

Further data from Material Indicators records important ask liquidity above ETH’s price current levels. There are over $40 million in selling orders stack from $1,920 to $2,000. These orders will operate as critical resistance.

What “The Merge” Could Spell For The Price Of Ethereum

If Ethereum is able to break above those levels, the orderbook record almost no resistance to the upside. Thus, ETH’s price could reclaim previously lost territory and extend its climb.

However, MI records low buying pressure for ETH’s price on higher timeframes from large investors. Over the past two months, retail investors appear to be jumping into Ethereum’s price action.

Additional data provided by Jarvis Labs coincides that retail investors having been accumulating ETH. Larger investors need to begin accumulating to provide ETH’s price with an extended trend.

Jarvis Labs believes that this sustainable bullish price action might only be triggered if Bitcoin picks up momentum and follows the bullish trend. The price of the number one cryptocurrency has also been supported mainly by retail, but the research “would like to see a Q4 2020 repeat”.

At that time, retail was buying BTC and ETH and in Q4, whales took over and prices were able to reach new highs.