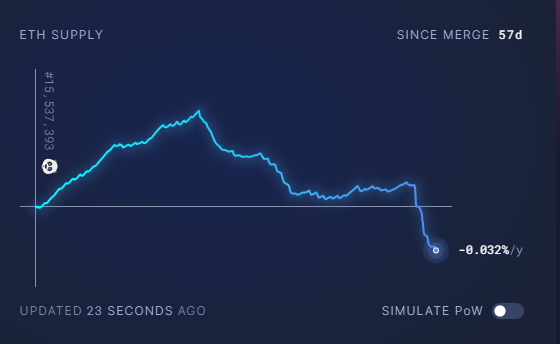

Ethereum grew to become probably the most deflationary in its historical past, because the annual provide dipped under zero for the primary time since the Merge.

In line with Ultrasound Cash, the annual inflation fee has fallen to -0.032/yr, which signifies that the community is now burning extra Ethereum than its minting.

The damaging inflation fee has decreased Ethereum’s web provide by 5,598 since Ethereum switched to proof-of-stake consensus on September 15.

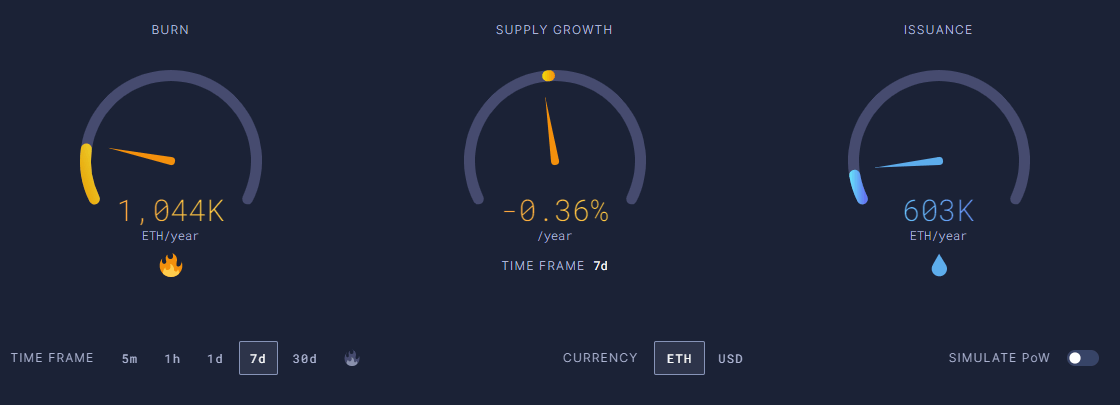

Inside a 7-day timeframe, Ethereum has burned 1,044k tokens towards 603,000 issued, a fee of 773,000 tokens per yr, which exhibits ETH’s provide goes down by 0.36% per yr.

The latest adjustments will be attributed to the Merge improve and the sudden rise in transactions because of market uncertainties.

After Ethereum’s improve from Proof-of-Work (PoW) to Proof of Stake(PoS), Ethereum grew to become a deflationary asset. The improve changed miners with validators changed in operating the blockchain, inflicting a major discount in newly minted ETH. Consequently, Ethereum’s annualized inflation fee dropped to just about zero after the Merge, however it took a while to achieve the present degree.

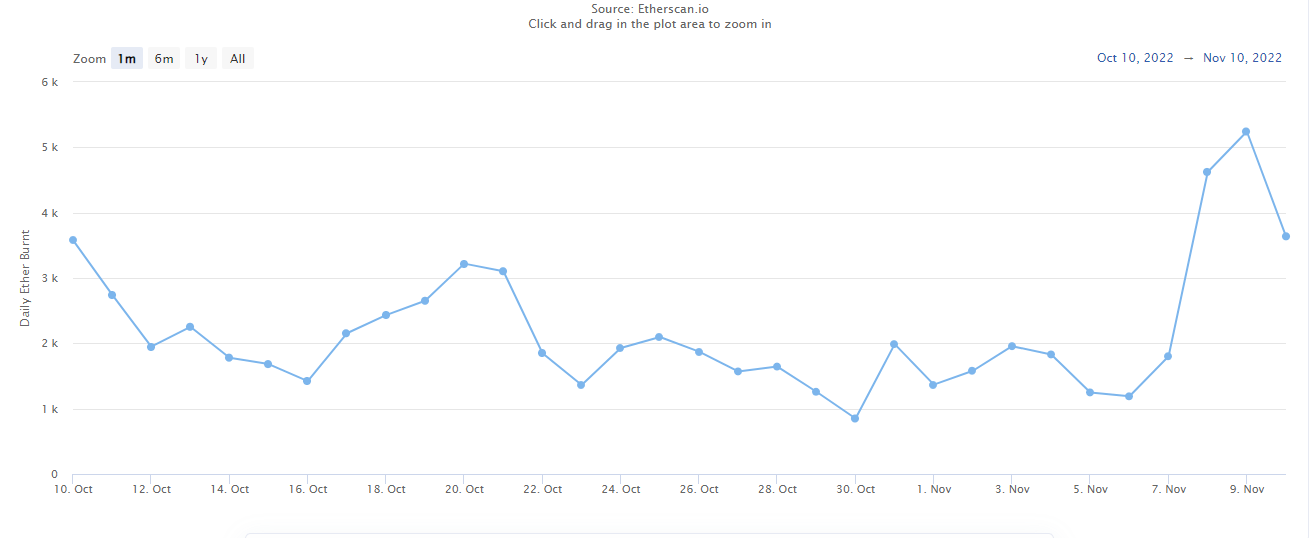

Furthermore, the latest surge in Ethereum community exercise through the FTX debacle elevated ETH burn.

Not too long ago, Etherscan reported the best every day tally since June, as 5,242 ETH burned on Wednesday. The quantity of ETH burned this week was over 15,305 as of Thursday.

Supply: Every day ETH Burn

In complete, 2.72 million ETH have been burned on the Ethereum community since August 2021, after the Ethereum Enchancment Proposal (EIP)-1559 went dwell. In essence, the EIP relates ETH burn to community utilization.

Ethereum to outperform Bitcoin?

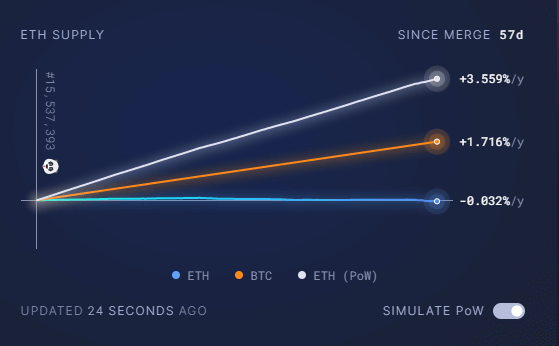

In distinction, on PoW the inflation fee of Ethereum was 3.559% per yr, with 4,931k Ethereum being issued yearly. However, Bitcoin has a progress fee of 1.716% per yr.

Ether’s deflationary prospects might enhance its shortage general, and when the panic brought on by the FTX fades, Ether’s tokenomics might outperform bitcoin.

At present, Ethereum is buying and selling at $1277.15, down 29.4% from its 7-day excessive of $1653.29.