With the Merge lastly accomplished, Ethereum is now working as a Proof-of-Stake (PoS) community.

Nonetheless, its transition from a Proof-of-Work (PoW) system has been extremely controversial. Supporters of PoW mining feared that staking would centralize the community and threaten its independence. These combating for a PoS community touted the scalability and precision that may come up from the brand new system.

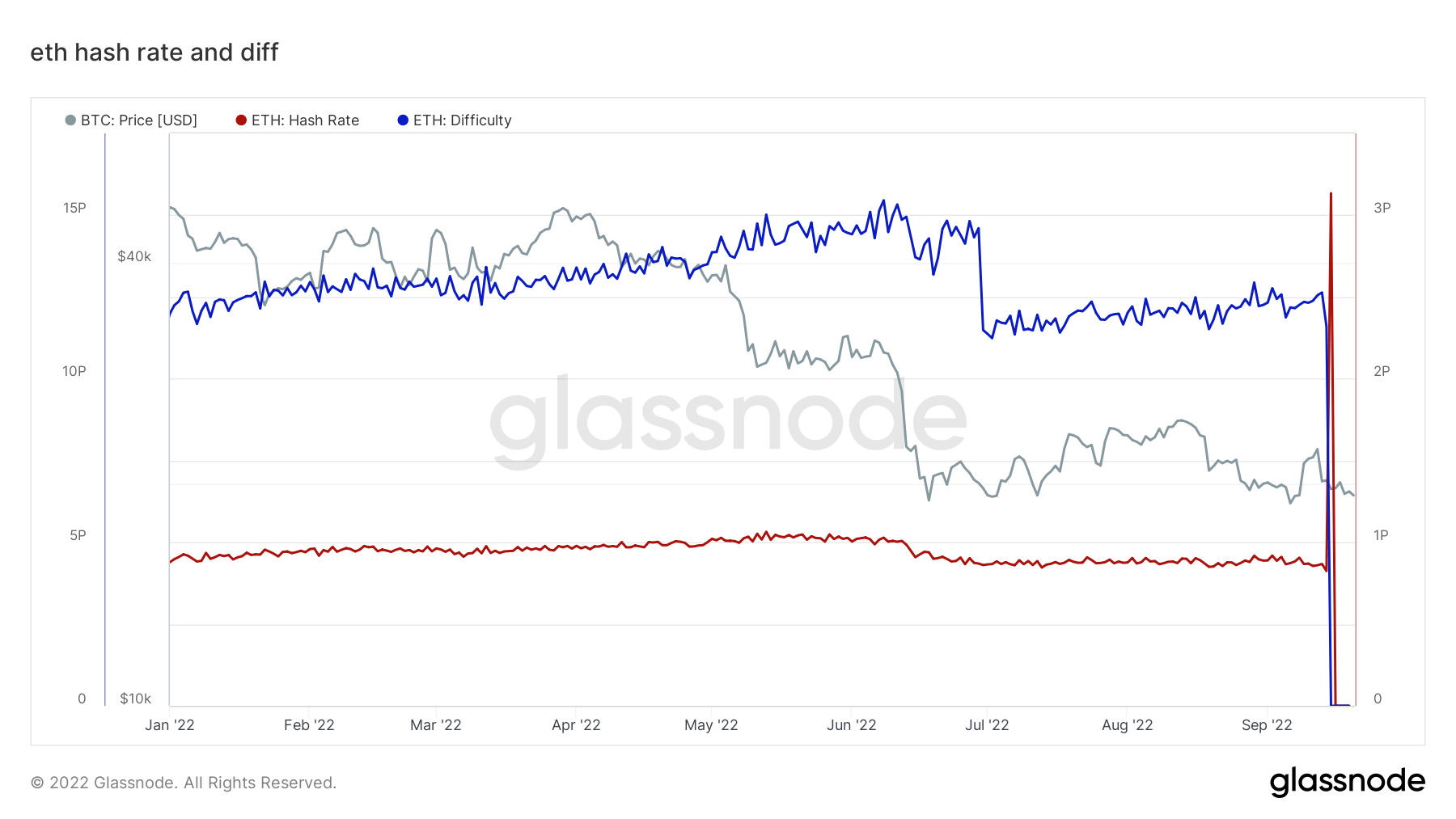

On-chain evaluation supplies us with a transparent view of all the professionals and cons of the Merge. Trying on the Ethereum blockchain exhibits when the transition from PoW to PoS occurred, with ETH mining problem and hash charge dropping to zero.

The centralization points PoS opponents warned about are evident on-chain.

The full quantity of ETH transferred to the ETH2 deposit contract by way of staking suppliers presently stands at round 13.8 million ETH. Round 70% of that quantity, or round 10 million ETH, is concentrated with simply 4 staking service suppliers—Lido, Coinbase, Kraken, and Binance.

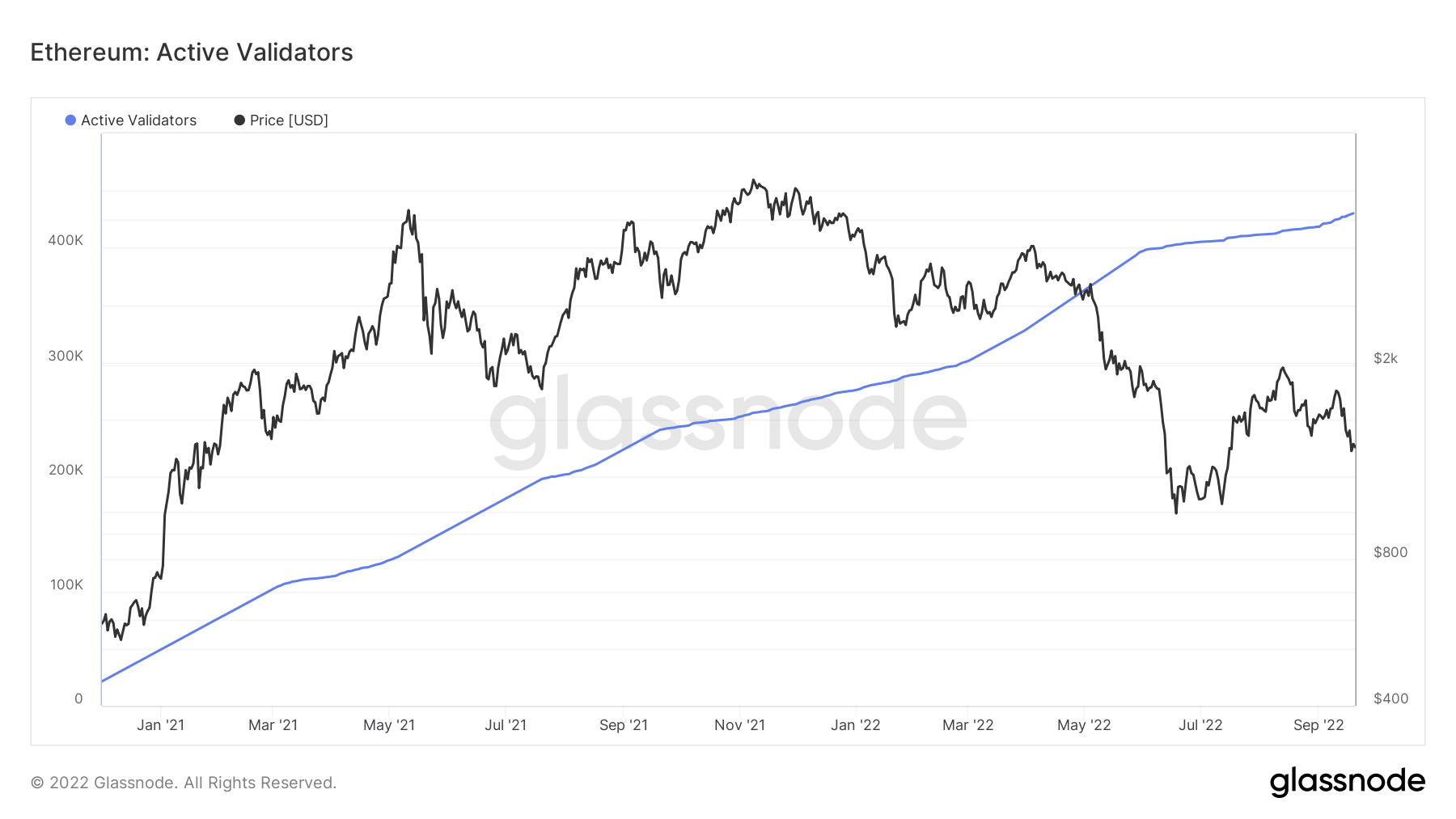

Nonetheless, the variety of lively validators on the community has reached its all-time excessive. The next variety of impartial validators drastically will increase the decentralization of the community and provides a extra optimistic different to the centralization seen amongst staking suppliers.

Lively validators are outlined as validators which have accomplished activation, aren’t lined in an exit queue, and have efficient balances higher than 32 ETH. There are presently over 430,000 lively validators, with the quantity rising considerably because the Merge was introduced in January 2021.

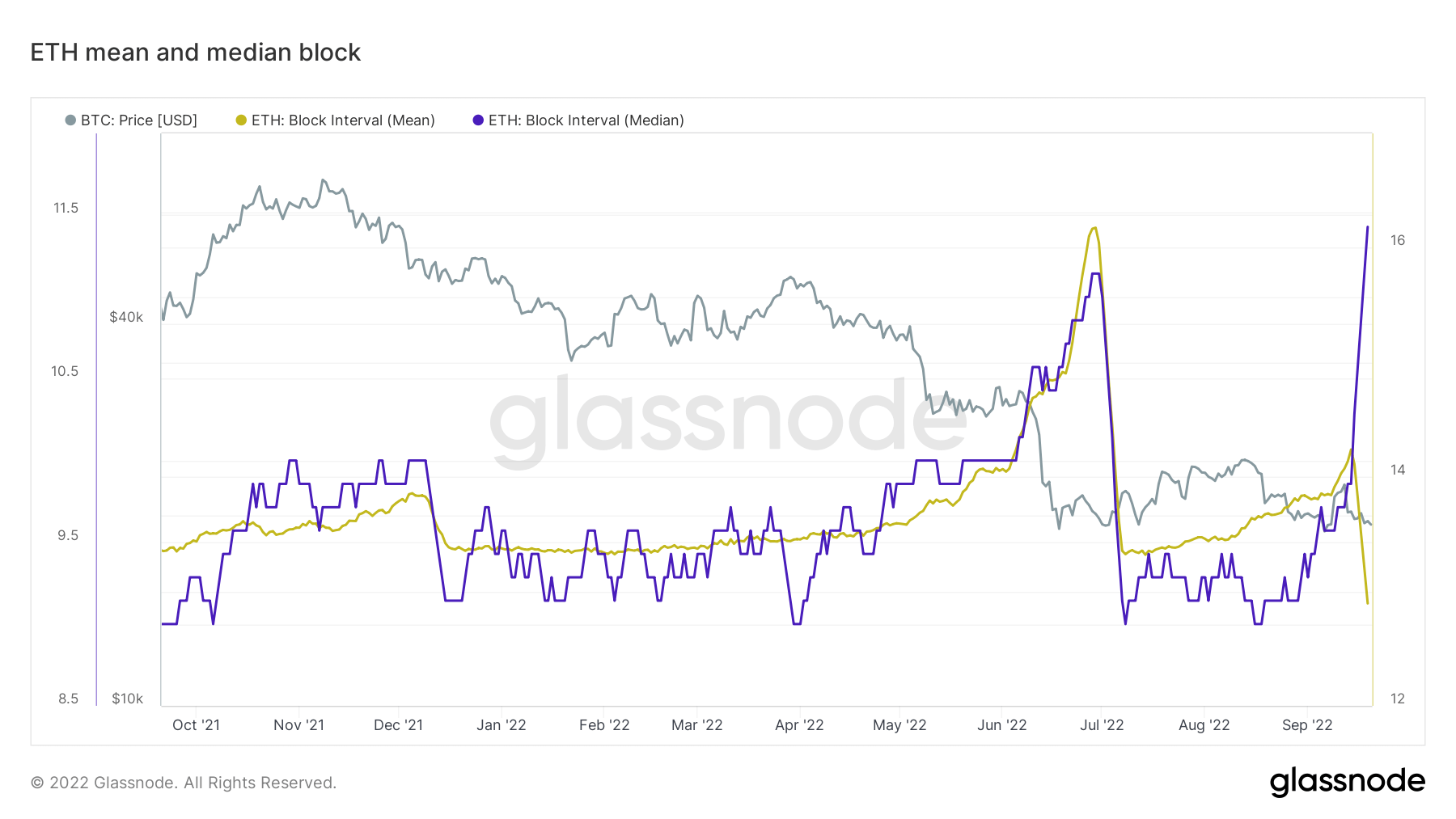

One other tangible profit PoS delivered to Ethereum is scalability.

The newly applied deterministic block instances introduced a 15% enhance in block area per day. The transition from PoW to PoS lowered block instances from 13.5 seconds to 12 seconds, making a precision staking consensus. Instantly following the Merge, the block interval median time and the imply programmed time dropped to 12 seconds.