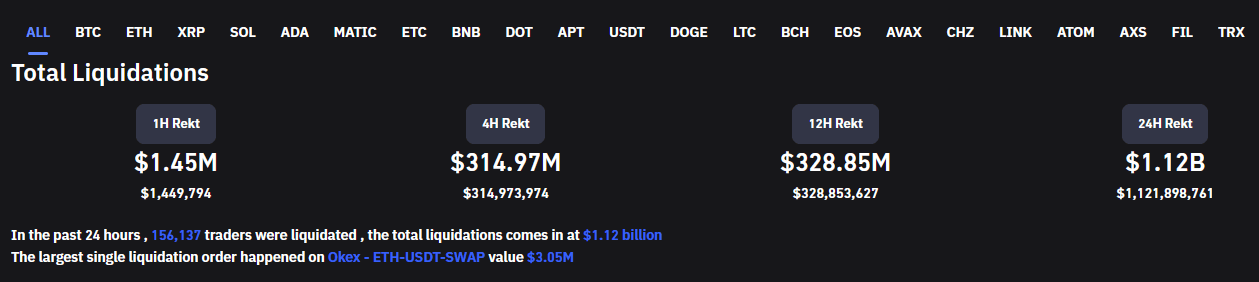

Information from Coinglass confirmed an additional $314.97 million crypto shorts have been liquidated because the Euro buying and selling session opened. This transfer brings the whole liquidations during the last 24 hours to $1.12 billion.

Shorts get rekt

During the last 24 hours, $66.4 billion of capital has flooded into the crypto market (+7%,) taking the whole crypto market cap to $994.06 billion.

Throughout this time, the Bitcoin worth jumped $1,300 (+7%) to $20,610, reclaiming the psychological $20,000 stage whereas additionally marking a six-week excessive.

The ensuing worth motion lifted the remainder of the crypto market increased, with many giant caps experiencing double-digit positive aspects. Dogecoin leads the highest 10, up 14.7%, adopted by Ethereum at 14.2%.

The welcome return of bullish worth motion spelled doom for shorters, with 86% liquidated because the market elevated. Remaining open brief positions will probably be sweating over a continuation of bullish kind.

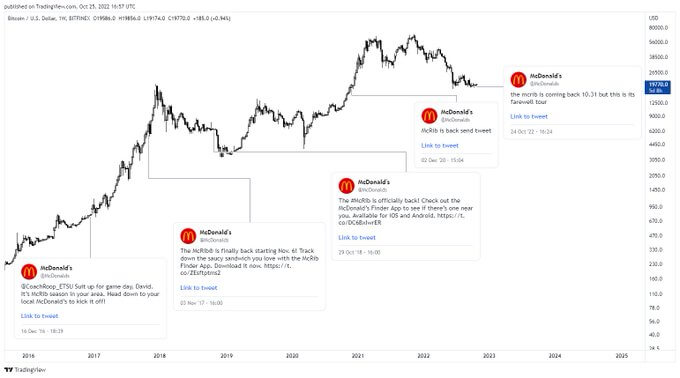

Bitcoin McRib correlation has born panic-stricken.

Crypto winter, particularly since June, has been a permanent time for crypto buyers. Bullish worth actions during the last day don’t equate to an imminent bull market return.

Nevertheless, in a tongue-in-cheek tweet, @zackvoell drew consideration to the correlation between McRib sandwiches and bullish worth actions for Bitcoin.

Sadly for shorters, on October 23, McDonald’s introduced the return of the McRib in its “2022 Farewell Tour.” The McRib has been “in circulation” on a restricted foundation since 1981. Nevertheless, McDonald’s teased the potential for the present launch being the final.

“Like several true farewell tour, we’re hoping this isn’t a ‘goodbye’ however a ‘so long.”

The chart under reveals a logarithmic worth chart of Bitcoin since 2016. Every McRib reissue is marked, and all of which, aside from late 2017’s reissue, coincided with sustained strikes increased for Bitcoin. All the identical, late 2017 did mark the earlier cycle high.

With October 23’s McRib reissue, hopes are excessive that the “statistically vital” correlation will maintain this time round.