Not all bear markets are created equal and the identical will be stated when evaluating the 2018 crypto bear market, and the present 2022 bear market.

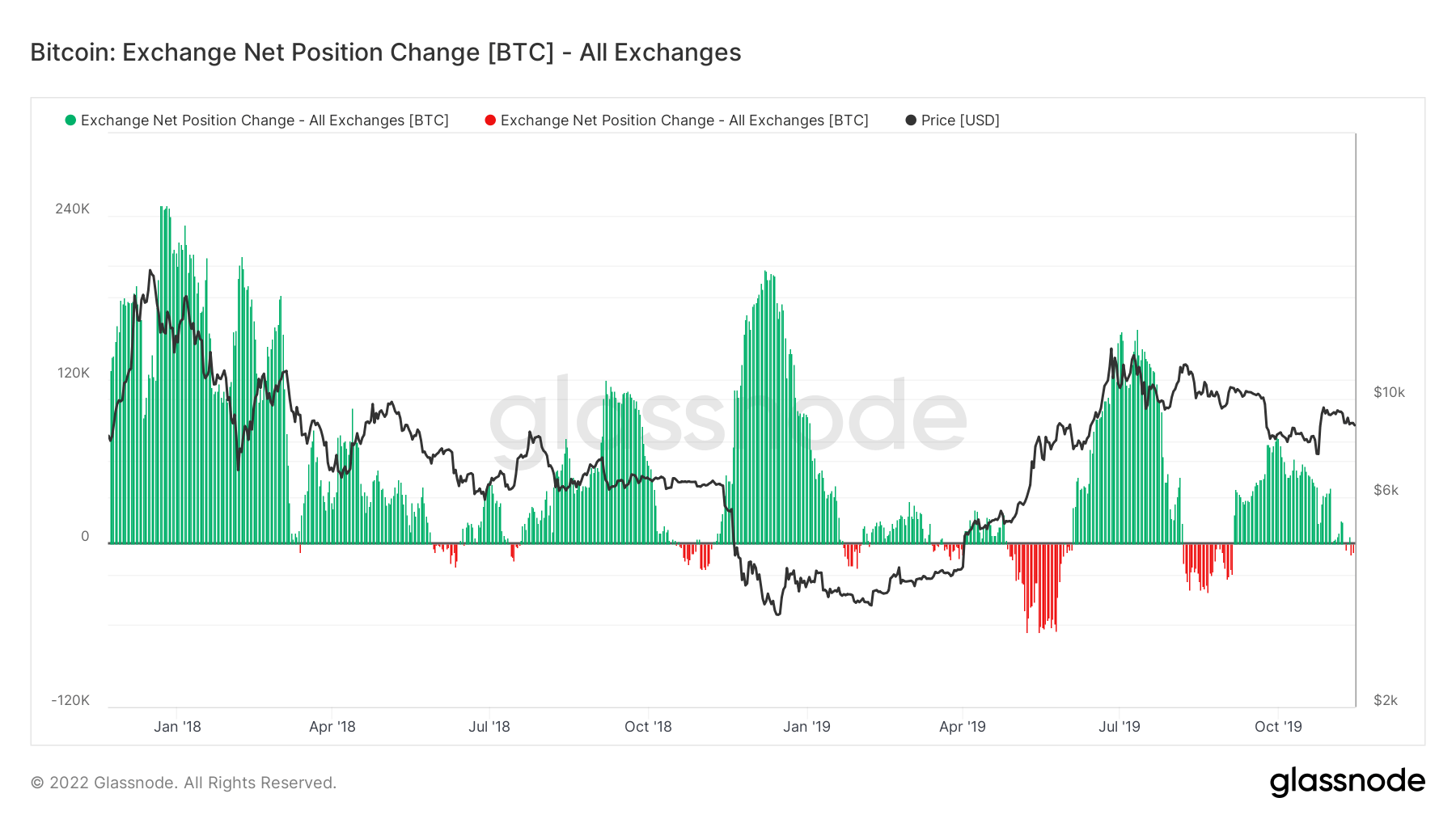

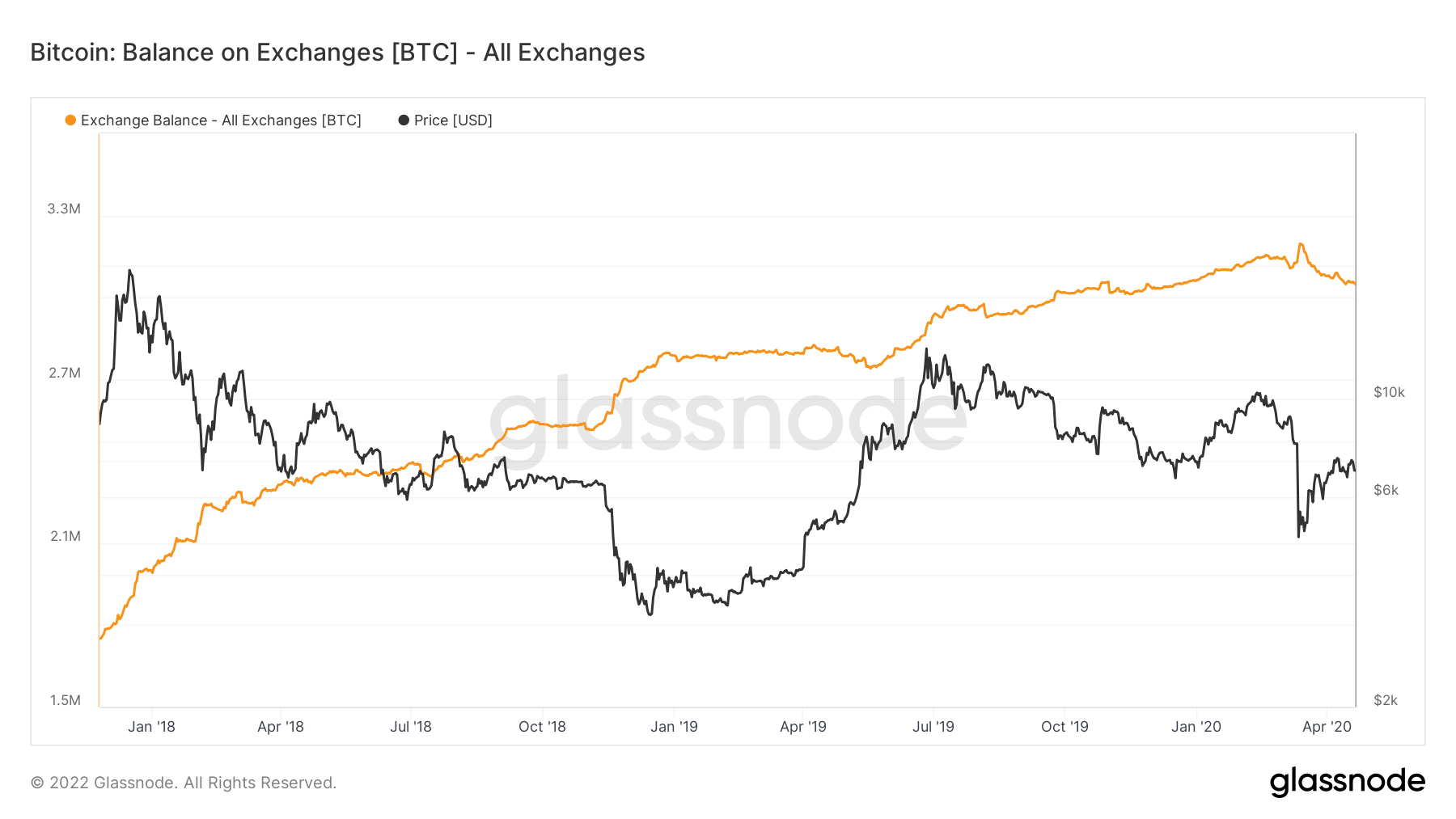

Alternate BTC stability 2018-2019

Following the height of the bull run in Dec. 2017, Bitcoin (BTC) value dropped beneath $10,000, and what adopted from Jan. 2018 to This fall 2019 was a big influx of BTC onto exchanges.

Beginning with round 1.7 million BTC on exchanges in Jan. 2018, by the tip of 2019 exchanges held an estimated 3 million BTC.

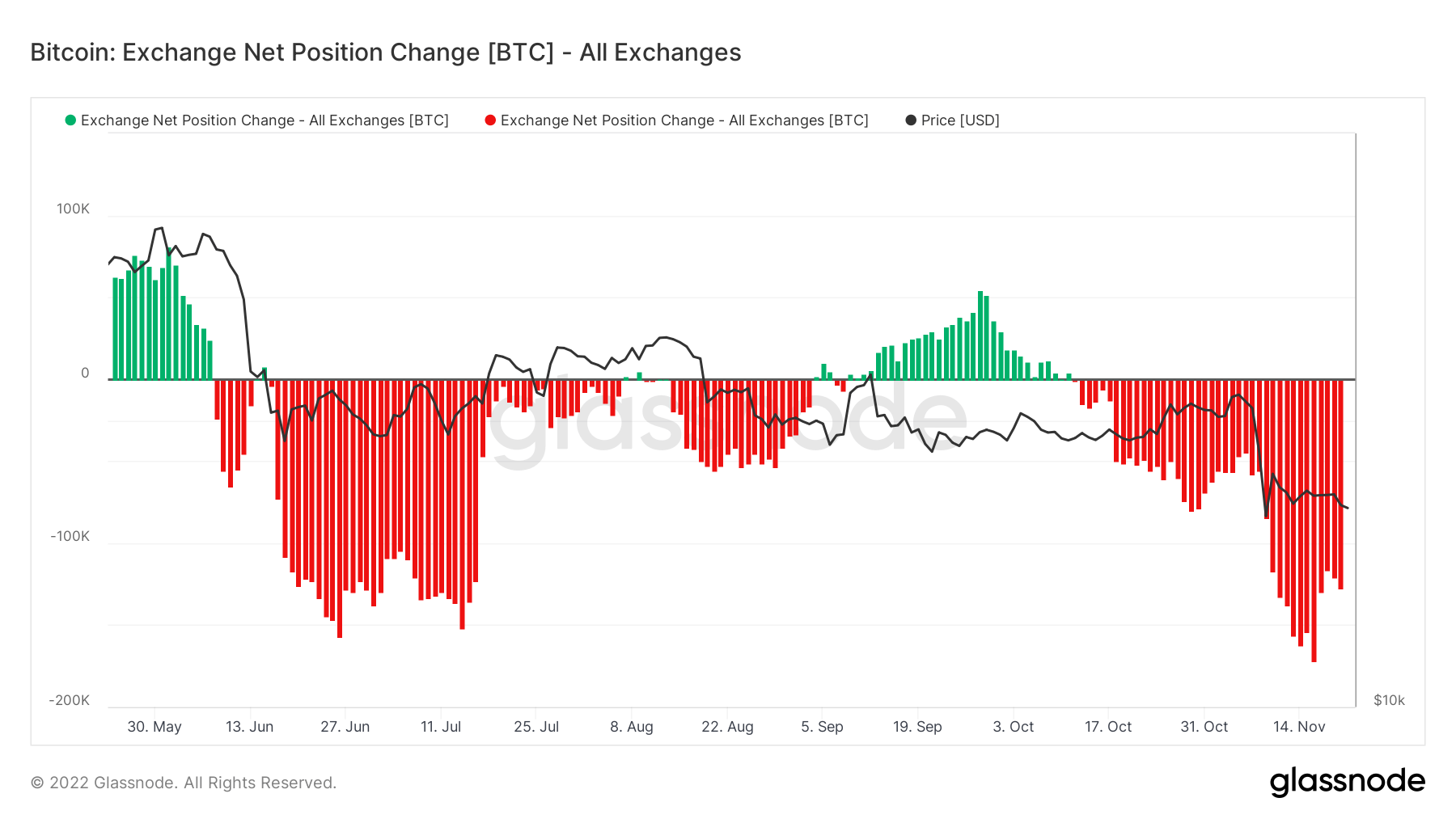

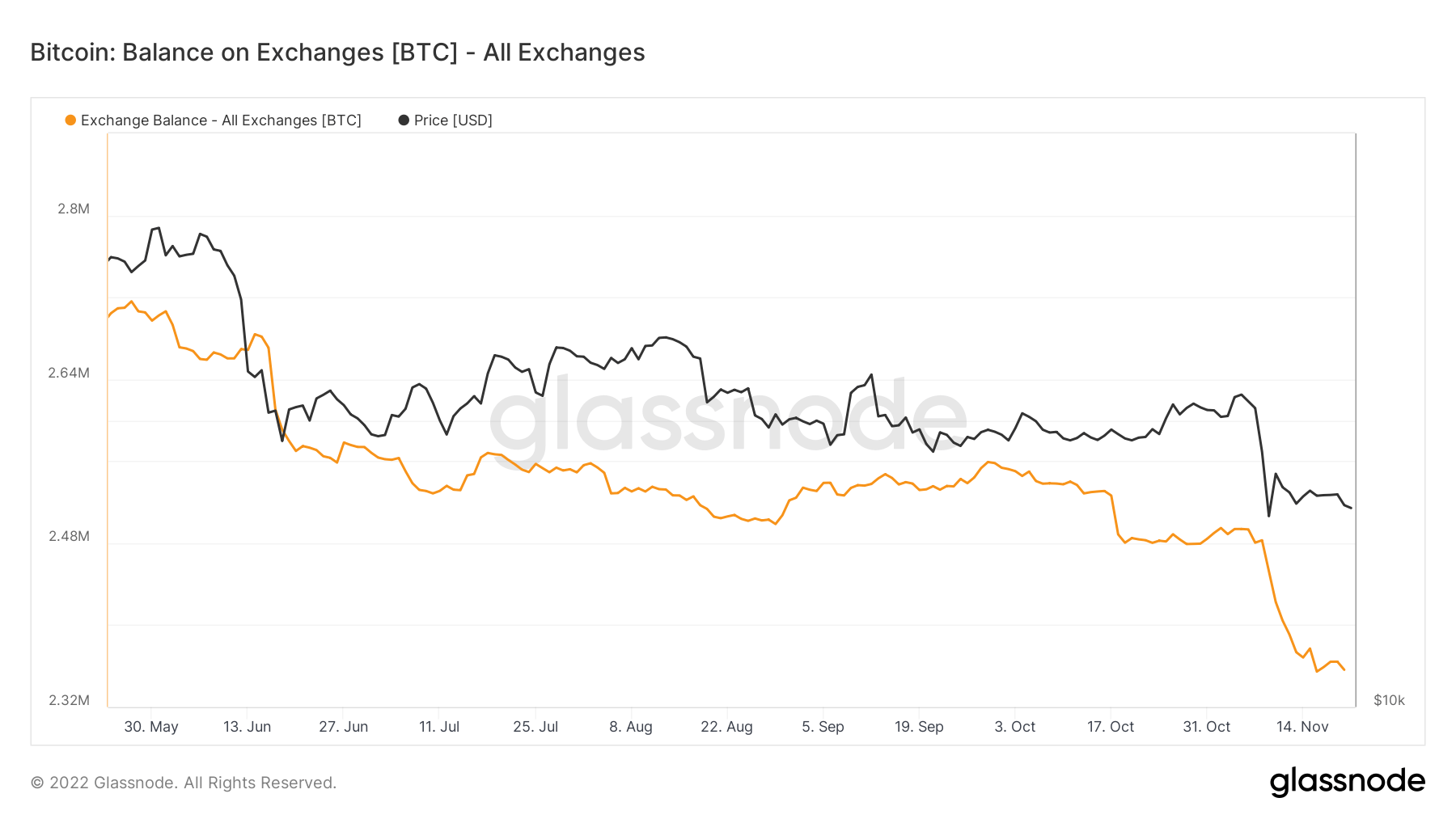

Alternate BTC stability 2022

Not like its 2018 predecessor, the bear market of 2022 has proven itself to be a totally totally different animal. By means of 2022, an unprecedented quantity of BTC has left exchanges numbering within the lots of of hundreds at a time on events.

Previous to the aftermath of the FTX collapse, a complete of round 300,000 BTC started to depart exchanges beginning at the start of June 2022. Following the collapse, this uptrend of BTC elimination from exchanges solely accelerated because the mantra ‘not your keys, not your cash’ took maintain.

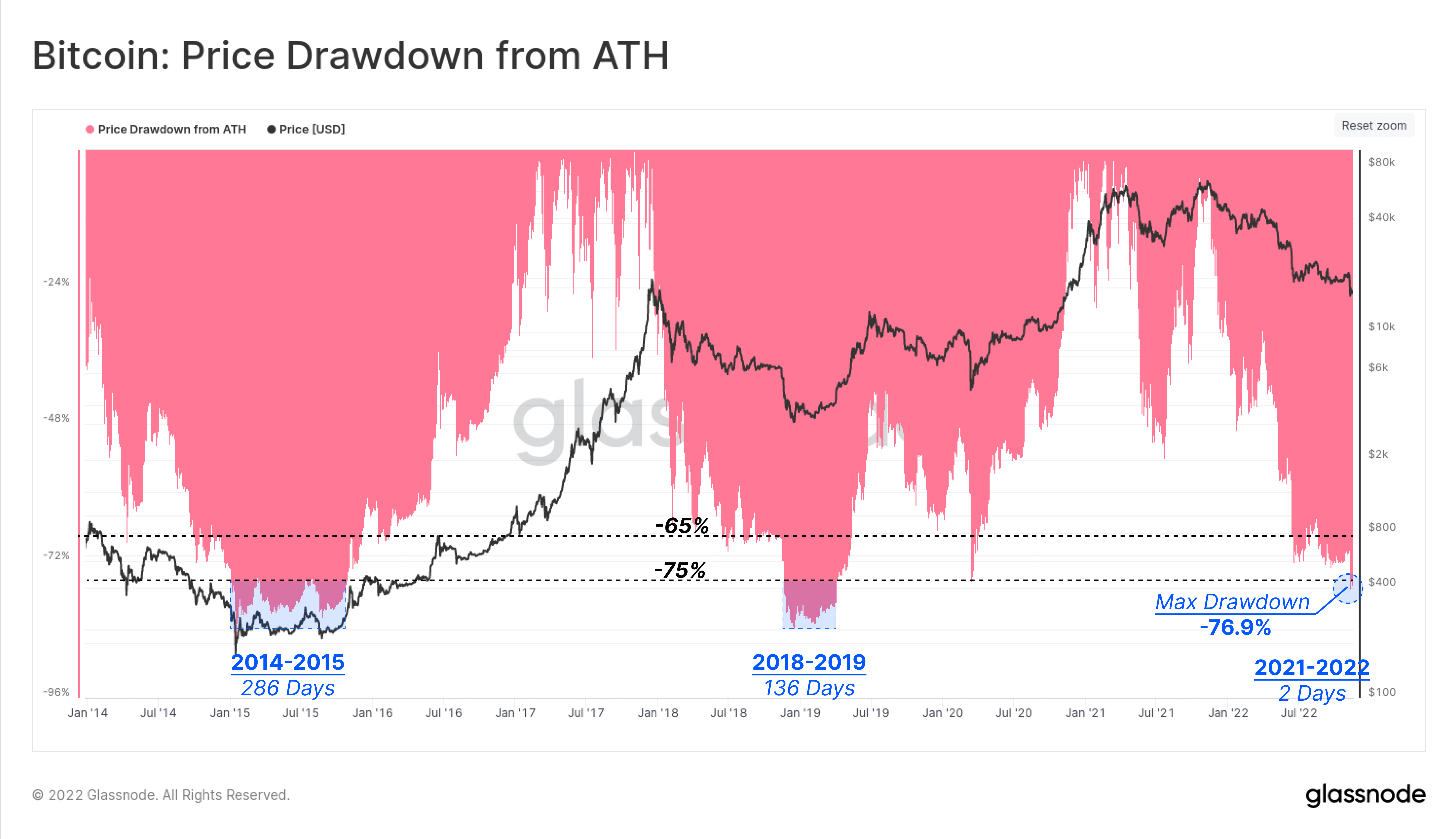

The height of the 2018 bear market lasted for round 136 days and noticed a fall in BTC value of over 80% from its all-time excessive (ATH). When in comparison with BTC value now – down by round 76% from it’s all-time excessive (ATH) over the past couple of days – chart patterns recommend the height of the 2022 bear market could also be right here.

The Introduction of Derivatives

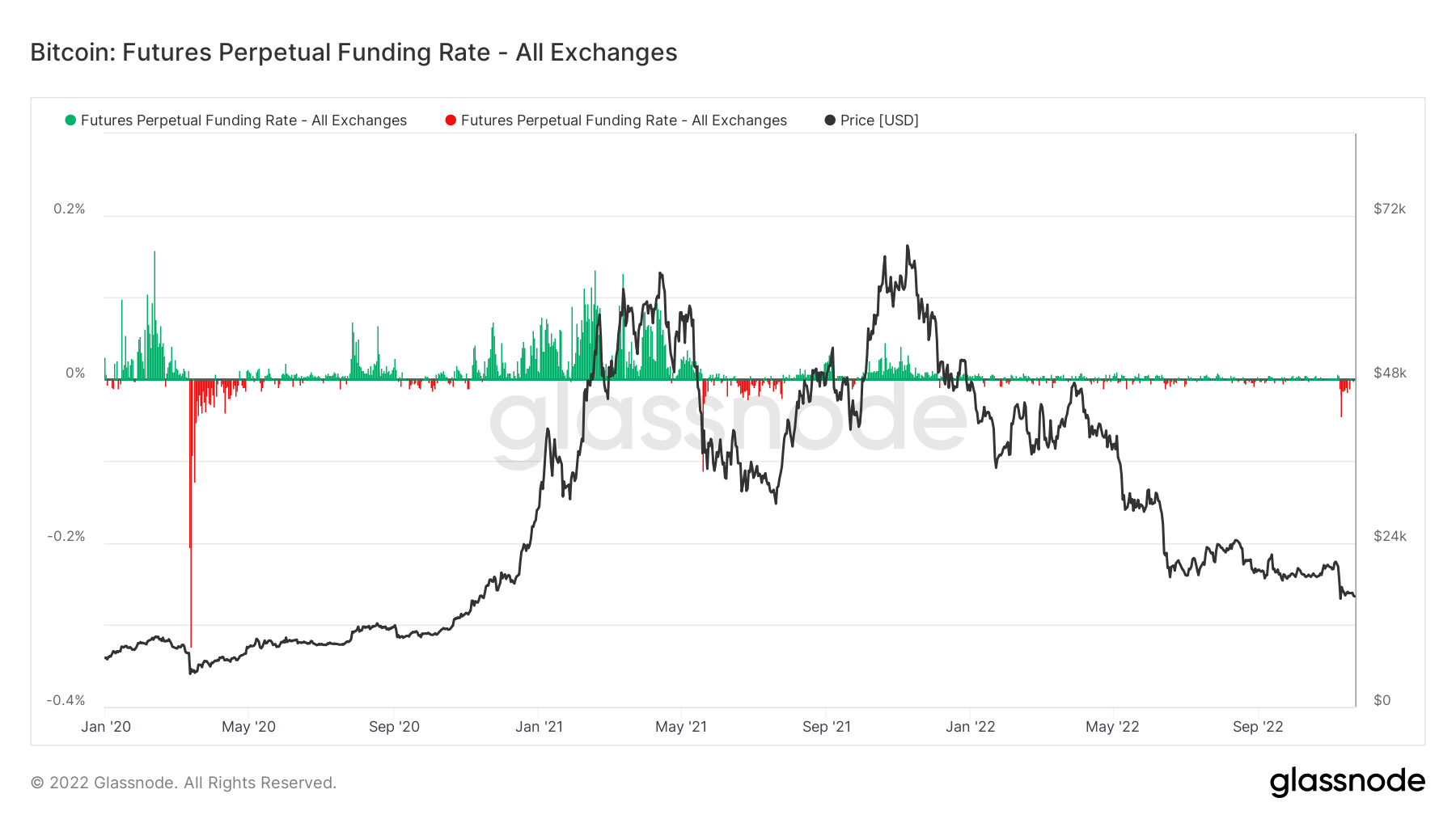

A stark distinction between the 2018 bear market and the 2022 is the introduction of derivatives to the cryptocurrency market.

With the introduction of futures and choices in 2021, derivatives have since been a elementary facet of the crypto market – making up an enormous quantity of the crypto ecosystem. Constructed upon $2.5 trillion of derivatives, the worldwide banking system evidences the sheer magnitude derivatives should play within the crypto ecosystem — and the influence they’ll and do make.

When analyzing earlier bear markets, Cryptoslate have discovered that the underside is in when shorts grow to be so aggressive that BTC value gained’t go down any additional. This has been seen in earlier bear market bottoms, the Covid-19 pandemic fallout, China’s crypto ban of summer season 2021, with the Luna crash, and now with the collapse of FTX.