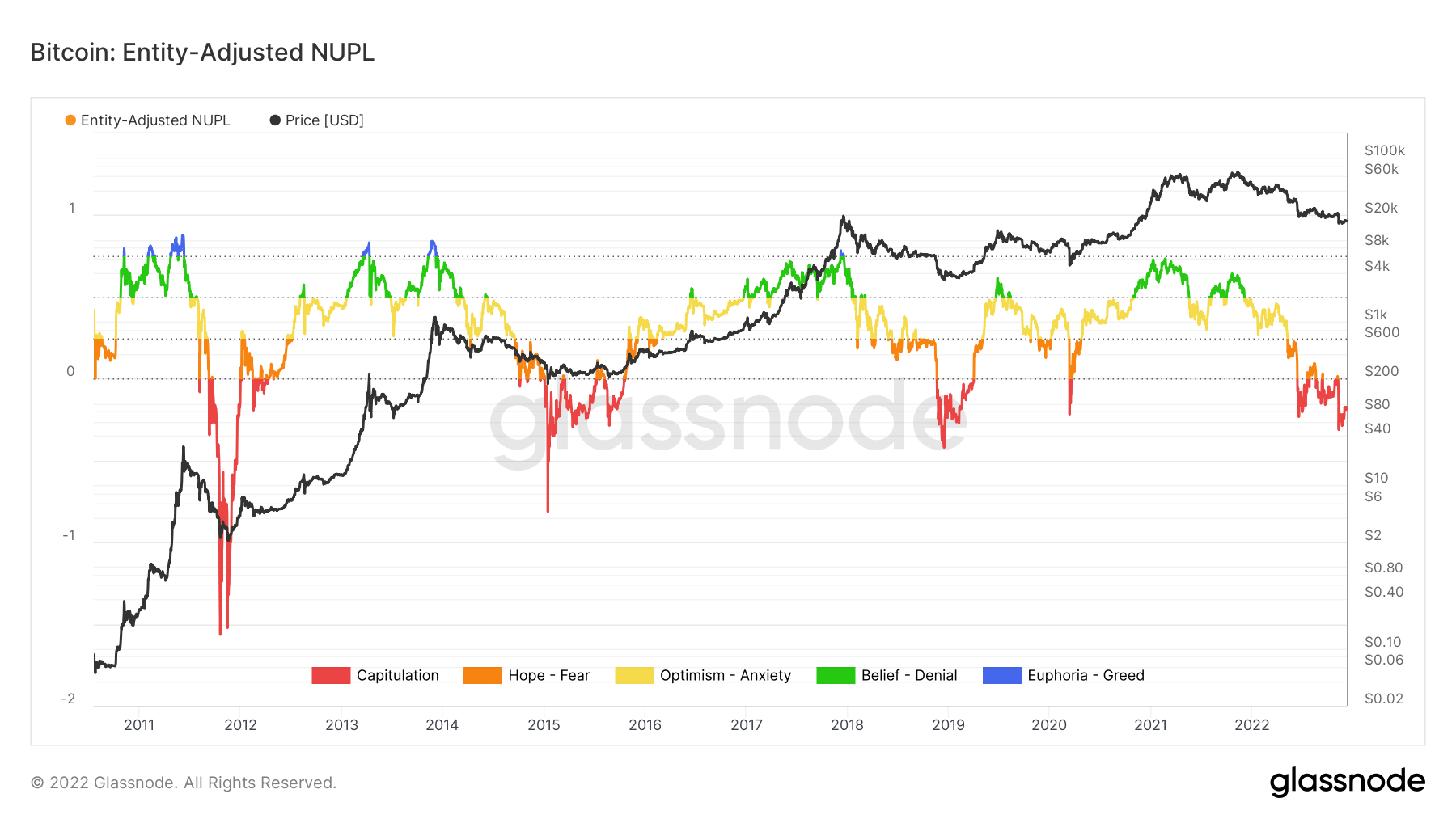

Since June, Bitcoin (BTC) – and the final market subsequently – has been in capitulation, aside from a handful of rallies seen in the summertime of this ongoing bear market in keeping with on-chain information offered by Glassnode, and analyzed by CryptoSlate.

Each bull and bear markets reveal on-chain sentiment information, starting from ‘Capitulation’ to ‘Euphoria – Greed. Within the peak of a bull market, the highest is traditionally indicated when Euphoria grips tightly. Alternatively, Capitulation normally indicators the underside.

Ongoing capitulation

The chart beneath reveals that BTC has firmly sunk into the Capitulation sentiment because the Internet Unrealized Revenue/Loss (NUPL) on-chain information shows a descent into pink territory seen earlier solely in 2012, 2015, and 2019.

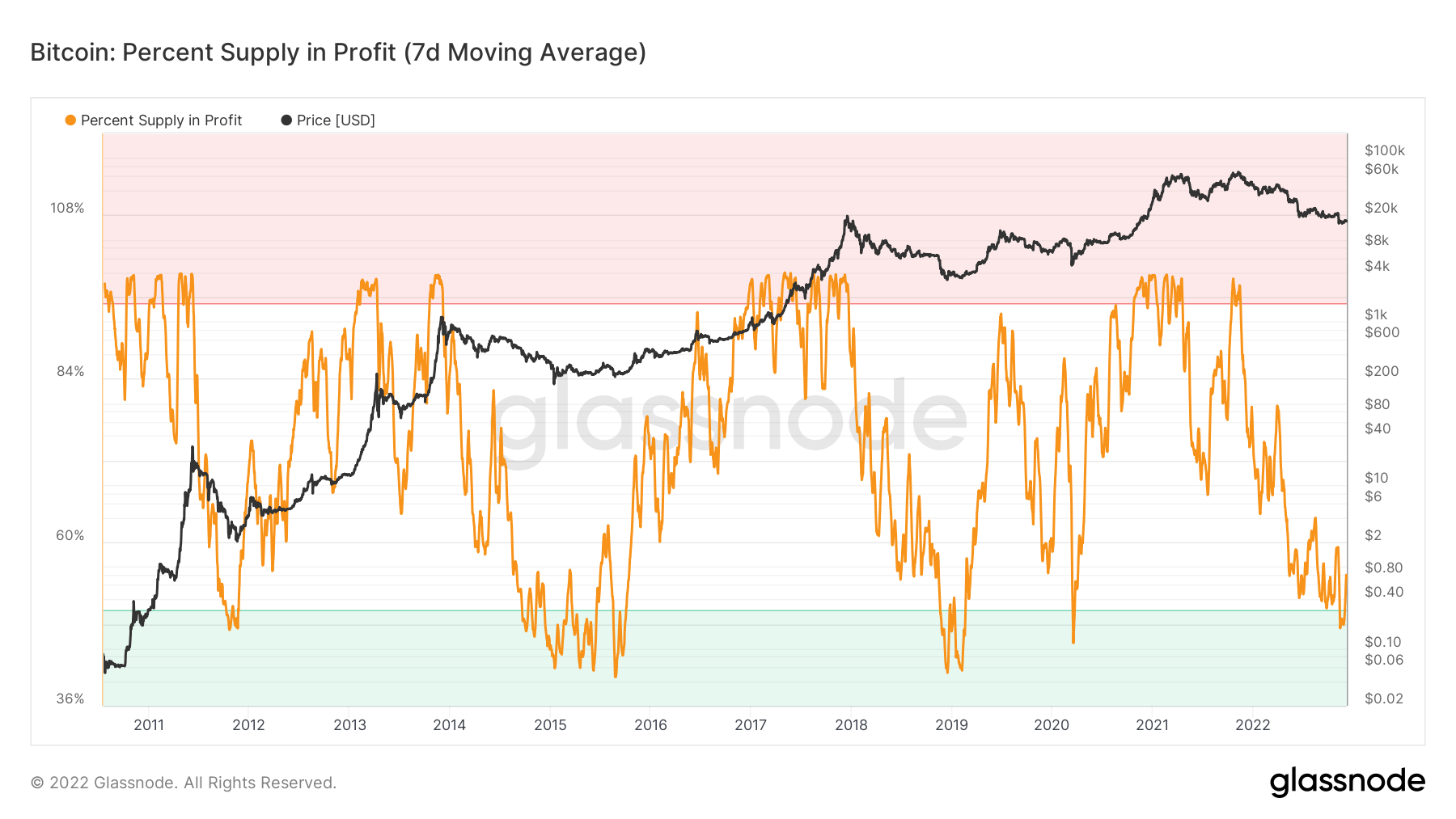

Bitcoin: Decreased circulating provide

The Bitcoin: % Provide in Revenue (7-day Shifting Common) metric reveals that presently, solely 54% of BTC’s circulating provide was final moved on-chain for revenue. By way of the FTX collapse, this metric depicts BTC circulating provide falling beneath 50% – a stage which has solely occurred throughout bear market lows.

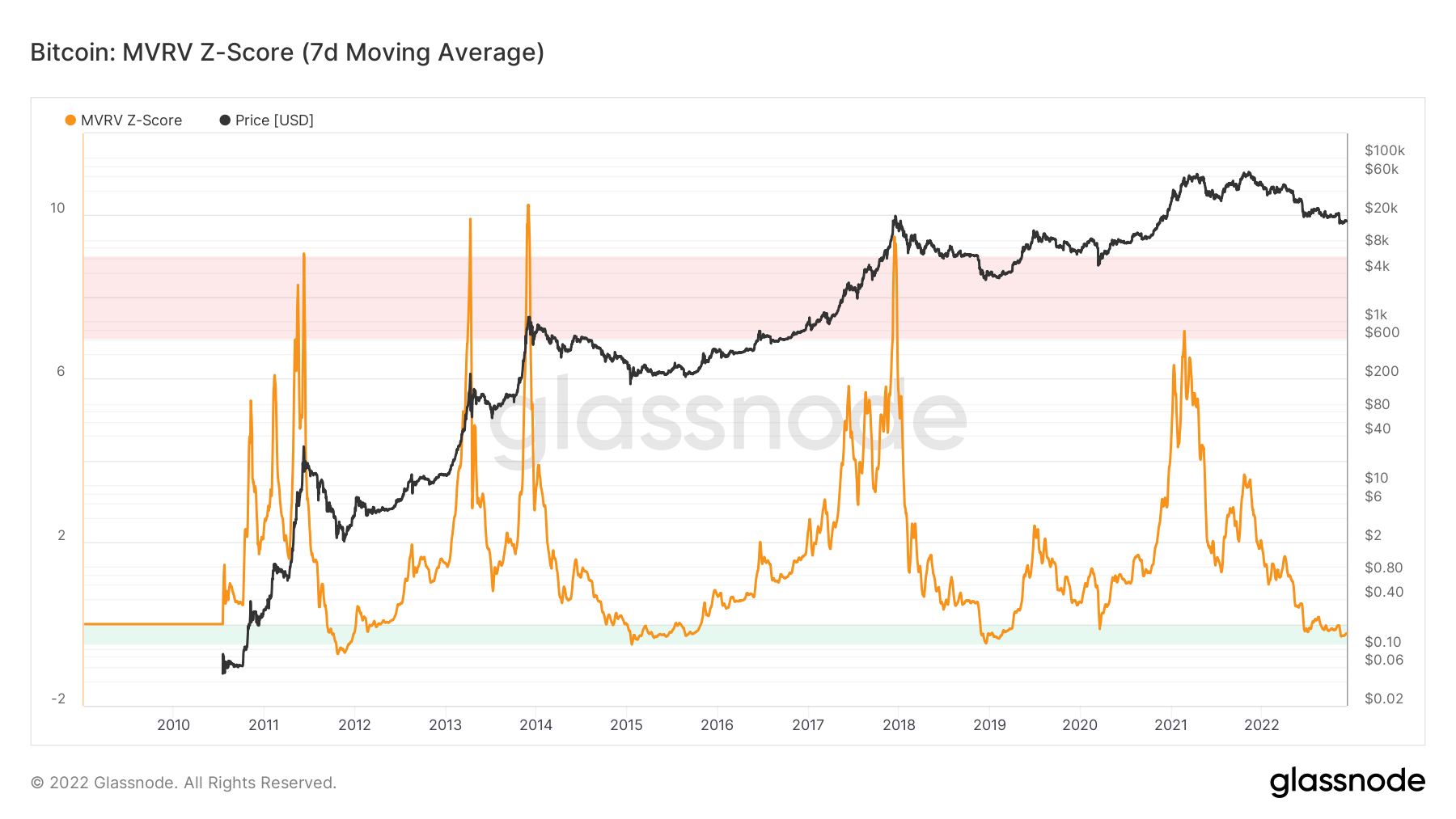

Bitcoin: Over or Undervalued?

Evaluation of the MVRV Z-Rating (7-day Shifting Common) metric reveals that we’re already over 170 days beneath the realized value.

Although Bitcoin did go above the realized value as the results of bear market rallies, traditionally earlier bear market days beneath the realized value counsel the potential for additional capitulation.

Earlier Bear Markets:

- 2019-20: 134 days beneath the realized value

- 2015-16: 384 days beneath the realized value

- 2011-12: 215 days beneath the realized value

To summarize all lined metrics on this evaluation, the indicators of the market backside analyzed are according to different bear market cycles. Nonetheless, in assessing and evaluating this bear market to earlier bear markets, we might simply be beneath the realized value for an additional six months to a 12 months.

With the addition of geopolitical points, macro uncertainty, and headwinds, calling a backside in an unprecedented time akin to this will solely stay hypothesis guided by historic information.