The most important information within the cryptoverse for Jan. 13 noticed Celsius’ former CEO face a NYAG lawsuit as the corporate introduced plans to dump its mining rigs. In the meantime, Polygon proposed a tough fork, Crypto.com introduced layoffs, and Congress member Tom Emmer criticized the U.S. Securities and Alternate Fee. Plus, numerous stories and analysis on Bitcoin, the crypto market, and stablecoins.

CryptoSlate High Tales

Former Celsius CEO sued for allegedly defrauding clients

New York Lawyer Basic Letitia James filed a lawsuit towards Alex Mashinsky, the co-founder and former CEO of Celsius Community LLC.

James mentioned that Mashinsky violated the Martin Act and New York’s Govt and Basic Enterprise Legal guidelines by allegedly defrauding traders into depositing billions of {dollars} into digital property throughout the cryptocurrency lending firm.

Celsius Mining to promote 2687 BTC mining rigs for $1.34M

Celsius Mining entered right into a Jan. 7 gross sales settlement to promote 2,687 Bitcoin mining rigs for $1.34 million to Touzi Capital , in response to a Jan. 11 courtroom submitting.

The mining rigs are “MicroBT ASIC M30S” situated in Houston, Texas, with a hashrate ranginf between 84TH/s to 92TH/s.

Celsius Mining mentioned it held discussions with a number of brokers and market contributors and decided that Touzi Capital’s supply was the perfect.

The mining agency mentioned the proceeds from the rig’s gross sales could be used for normal and company bills.

Crypto.com to slash workforce by 20%

Crypto trade platform Crypto.com has moved to put off about 20% of its international workforce.

Crypto.com CEO Kris Marszalek mentioned in a Jan. 13 publish that the trade made the troublesome resolution to slash its workforce to climate the challenges of the present bear market.

Crypto.com reportedly grew its workforce to roughly 4,000 in 2022. Nonetheless, the impact of the latest FTX fallout and market contagions has pressured the corporate to conduct its second spherical of layoffs.

Polygon plans Jan. 17 arduous fork to cut back fuel charges

Ethereum (ETH) Layer-2 community Polygon (MATIC) proposed a tough fork on Jan. 17 to cut back fuel spikes and handle chain reorganizations by altering the BaseFeeChangeDenominator, in response to a Jan. 12 assertion.

Though Polygon boasts higher scalability and cheaper charges than Ethereum, it isn’t proof against fuel spikes throughout community congestion.

The arduous fork proposal is designed to cut back these fuel spikes by altering the BaseFeeChangeDenominator to 16 from 8, dropping base fuel charges to six.25% from 12.5%.

US lawmaker Tom Emmer says SEC is ‘defending’ nobody

U.S. lawmaker Tom Emmer mentioned SEC chairman Gary Gensler is “defending” nobody together with his “regulation by means of enforcement” technique.

As a substitute, Emmer believes that the coverage hurts “on a regular basis Individuals.”

Emmer added: “When can we count on proactive steering as an alternative of leaving the business to interpret the foundations of the street by means of your after-the-fact enforcement actions?”

The lawmaker was reacting to SEC fees towards crypto companies Genesis and Gemini over their Earn product. Based on the regulator, the product was an unregistered supply and sale of securities.

BTC hashrate hits ATH second time in 7 days, issue anticipated to develop 9%

Bitcoin (BTC) hashrate rose 20% to a brand new all-time excessive on Jan. 12 — the second time the hashrate elevated to a brand new ATH within the final seven days.

It has since retraced to 251.79 EH/s as of press time.

Crypto investor Asher Hopp identified that Bitcoin’s hashrate rose to an all-time excessive regardless of bankrupt miner Core Scientific turning off 9,000 ASICs in December. Based on Hopp, “hash is transferring from weak palms to robust palms.”

BTC’s elevated hashrate is anticipated to result in a 9% rise in mining issue, in response to bitrawr.

Complete crypto market cap exceeds $900B – marking 9 week excessive

The overall crypto market cap surpassed $900 billion on Jan. 12 to file a nine-week excessive.

Along side a number of tokens recording “monster features” just lately, some have taken this as a sign of the arrival of a brand new bull run.

9 weeks in the past, the fallout from the FTX collapse spooked the market, resulting in huge capital outflows. A backside was reached when the full market cap discovered assist at $783 billion on Nov. 21, 2022.

Stablecoin reserves in centralized exchanges proceed to fall after FTX collapse

Step by step, alongside the cryptocurrency business, stablecoins are rising in power and recognition. Their progress outcomes from the steadiness they provide towards cryptocurrency volatility.

For the time being, USDT stays the biggest stablecoin by market cap, as USDC, Binance USD, and DAI make up the highest 4.

The whole lot of the stablecoin sector has a market cap of $138 billion, in response to CoinMarketCap. The massive 4 stablecoins contribute greater than $130 billion to the determine, dominating the stablecoin market.

Analysis Spotlight

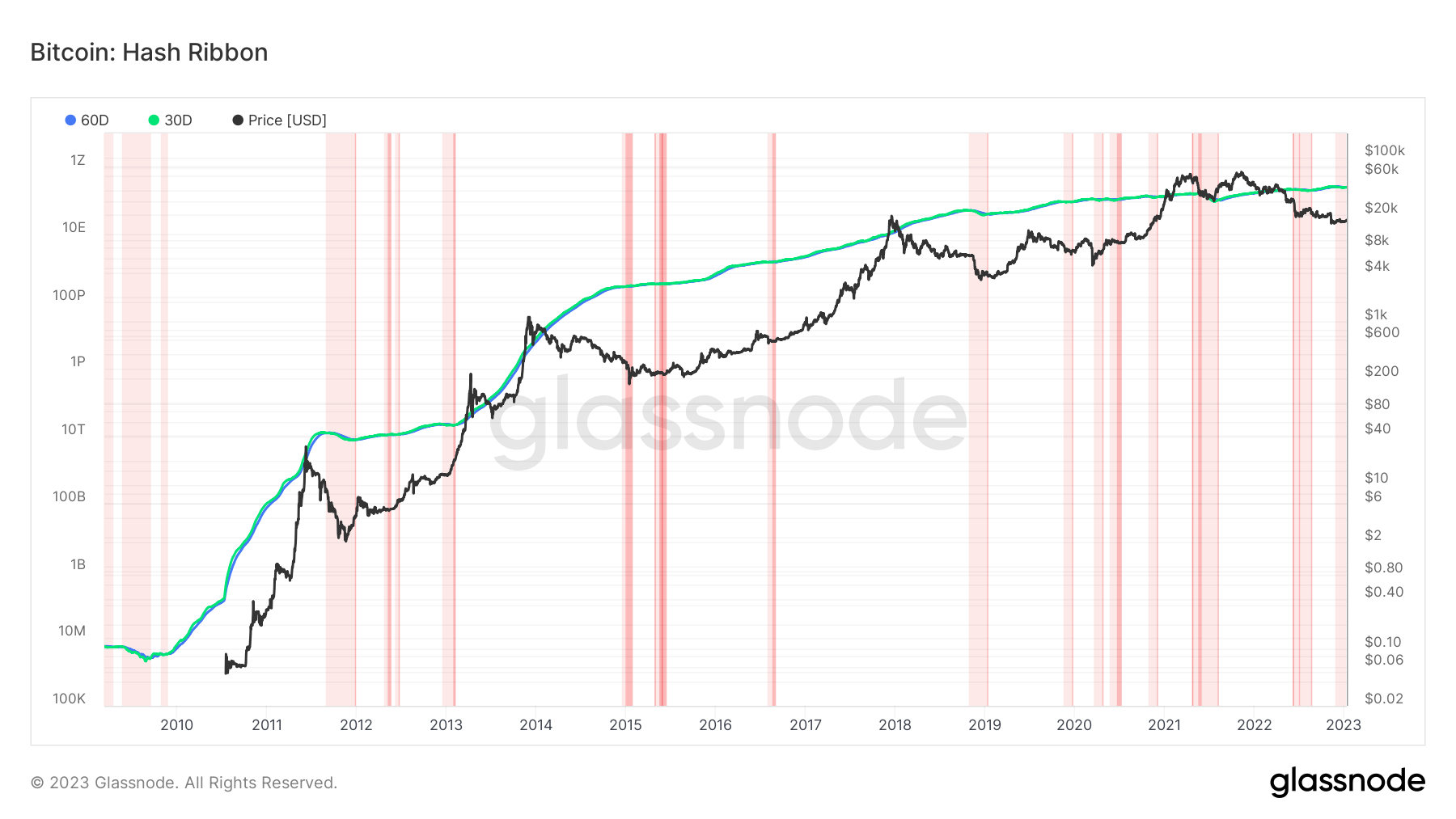

Analysis: BTC Hash Ribbon indicator indicators miner capitulation could possibly be virtually over

Bitcoin (BTC) holders had it powerful in 2022, however it was an excellent more durable 12 months for BTC mining — mining shares fell over 80%, and mining firm bankruptcies solidified the bear market — however the worst of miner capitulation could possibly be over, in response to CryptoSlate evaluation.

With BTC value down 75% from its all-time excessive (ATH), the hash fee too reached an all-time excessive as miners elevated efforts to make sure profitability within the vitality disaster.

The Hash Ribbon indicator chart above signifies that the worst of miner capitulation is over when the 30-day transferring common (MA) crosses the 60-day MA — switching from light-red to dark-red areas.

Crypto Market

Within the final 24 hours, Bitcoin (BTC) rose 4.6% to commerce at $19,716.86, whereas Ethereum (ETH) was UP 1.26% at $1,445.30.

Largest Gainers (24h)

- TNC Coin (TNC): 16148.13%

- Micromines (MICRO): 84.14%

- SingularityNET (AOIX): 62.12%

Largest Losers (24h)

- Neutrino USD (USDN ): -5.62%

- MX Token (MX): -4.73%

- Monero (XMR): -2.47%