On April 20, the day of the Bitcoin halving, complete transaction charges paid to miners jumped to 1,257.71 BTC, the best since December 2017.

The excessive quantities starkly contrasted with charges from the day past, which amounted to solely 116.94 BTC. When considered alongside the decreased block rewards post-halving, this surge in transaction charges led to a unprecedented situation the place over 75% of miner income was derived from transaction charges, as beforehand analyzed by CryptoSlate.

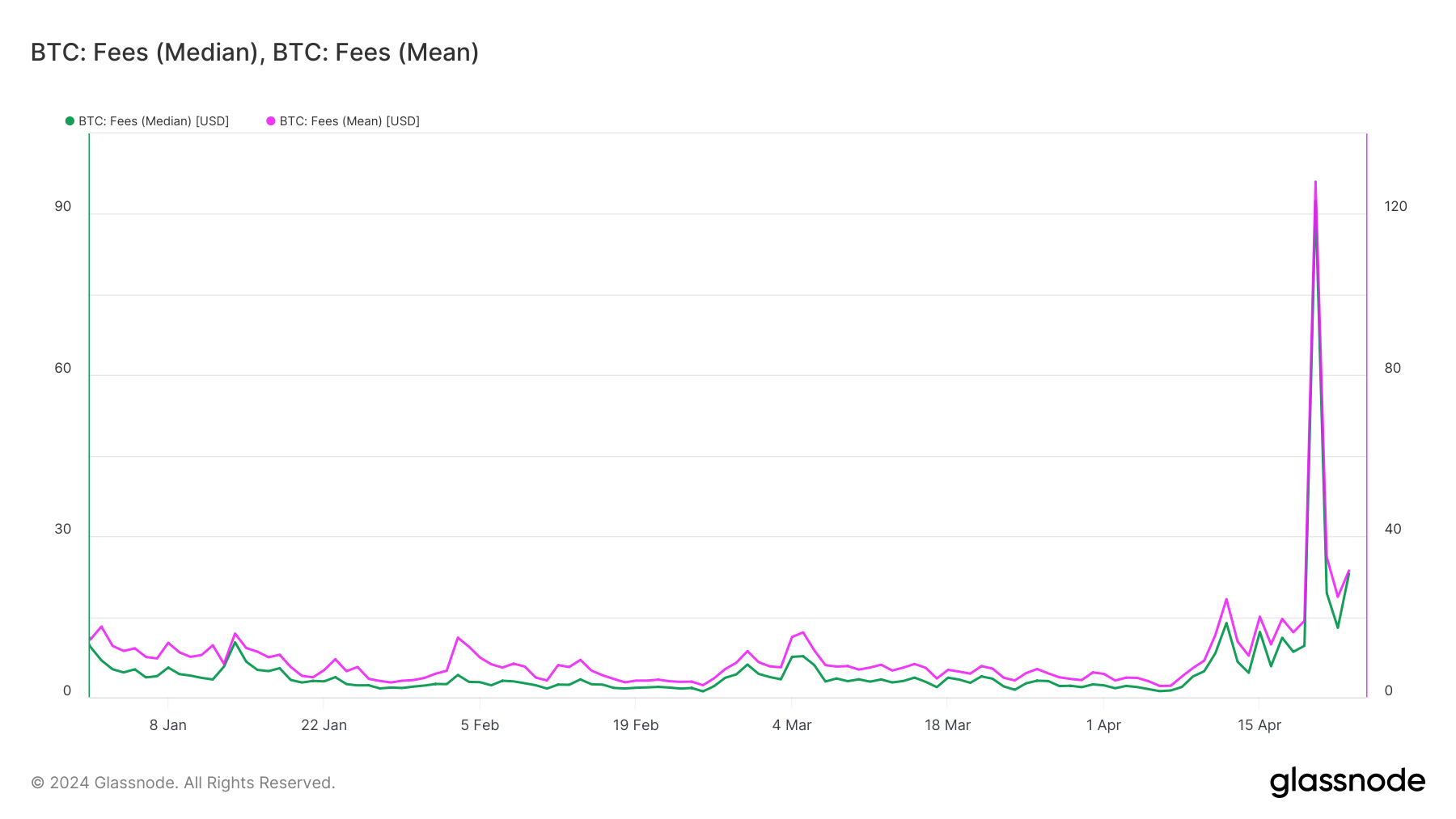

Such excessive charges have appreciable implications for the utility of the Bitcoin blockchain. All through the weekend surrounding the halving, the imply transaction charge was $130, whereas the median charge hovered round $93, rendering the price of settling common monetary transactions on the community prohibitively excessive for many customers.

Consequently, solely high-value transactions have been possible, the place the substantial charges constituted a minor portion of the general transaction worth. The difficulty was additional exacerbated by the introduction of Runes, which CryptoSlate evaluation discovered performed a major position in community congestion, notably on the day of the halving, considerably impacting community performance.

The congestion and excessive charges precipitated by each Runes and the elevated demand for block area throughout the halving had a pronounced impact on the Bitcoin community. Though the monetary advantages for miners have been clear, with a noticeable spike of their income, the community itself sustained important non-monetary injury.

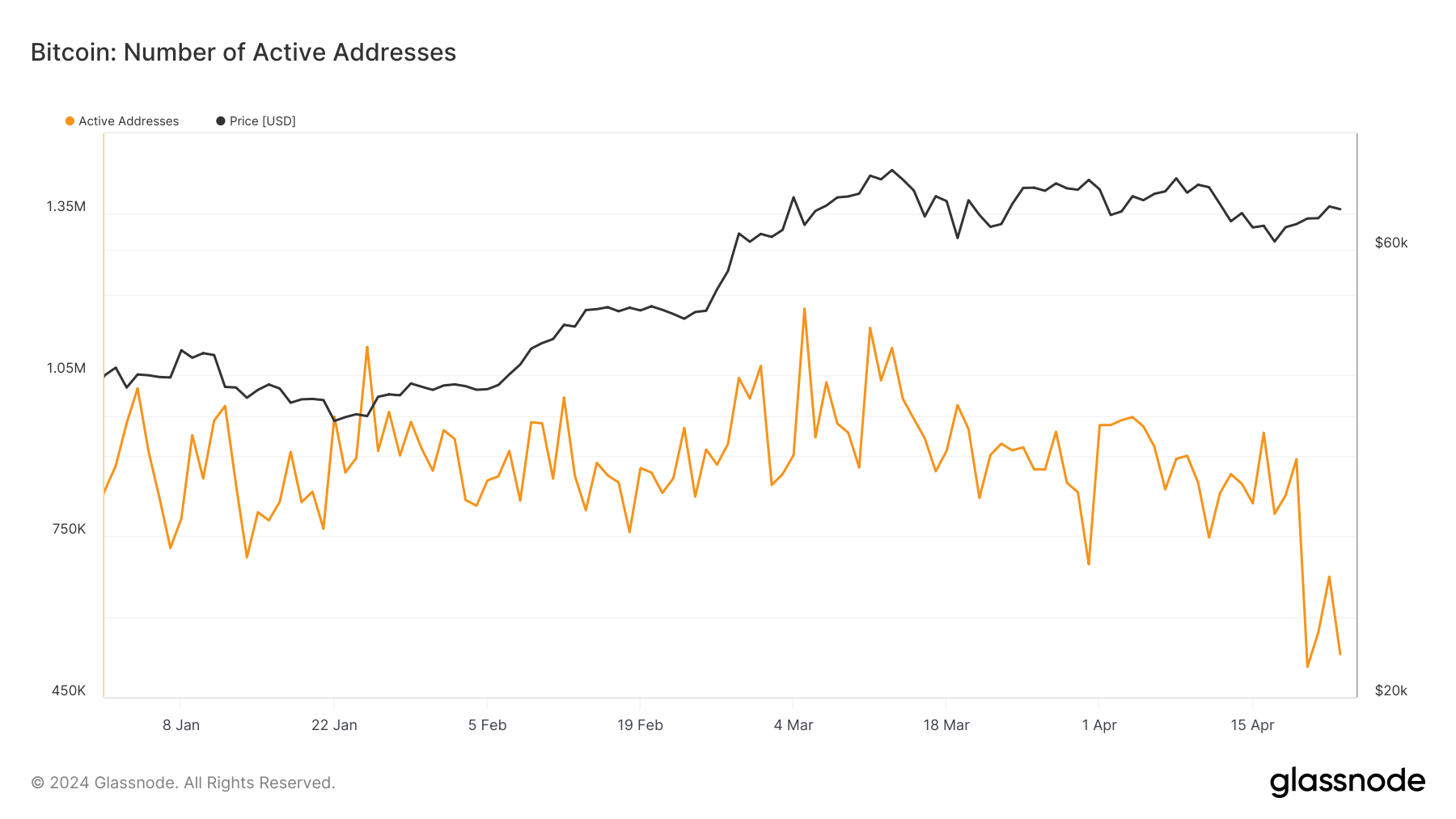

The practicality of utilizing Bitcoin for on a regular basis funds and transfers was severely compromised, alienating a considerable phase of its person base. This alienation was evident from the sharp decline in energetic addresses, a essential metric for gauging community engagement.

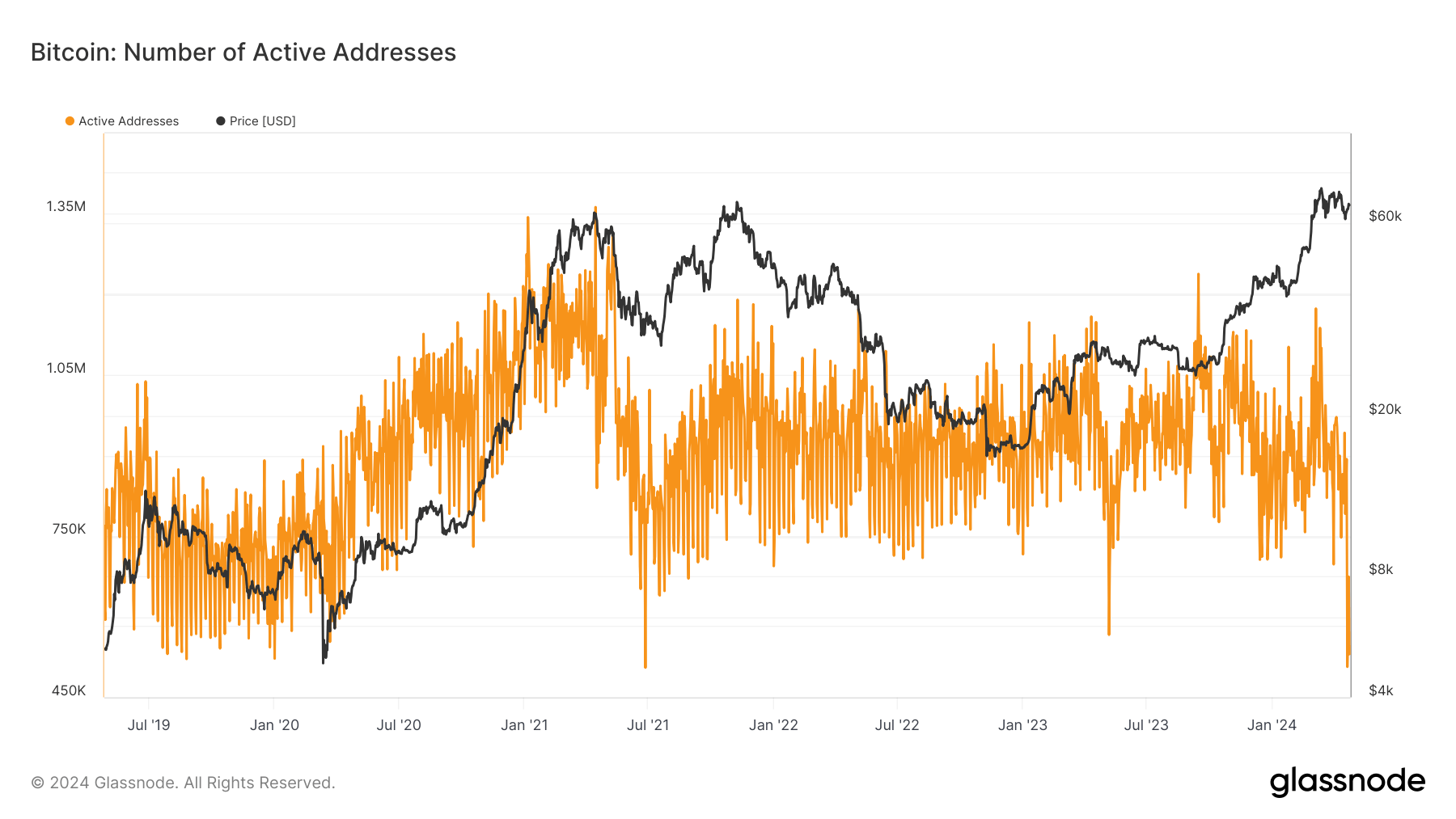

Energetic addresses characterize distinctive addresses that have been concerned within the community both as senders or receivers, and solely these energetic in profitable transactions are counted. For the reason that starting of the 12 months, the variety of energetic addresses on the Bitcoin community has fluctuated between 750,000 and 1.1 million.

Nonetheless, on the eve of the halving, there have been 893,528 energetic addresses, which plummeted to 506,862 on the day of the halving—marking the bottom in almost three years. Though there was a slight restoration to 674,613 energetic addresses on April 21, the numbers fell once more to 530,371 by April 22, suggesting that the community would possibly take time to return to its common yearly exercise.

From a market perspective, the drastic discount in energetic addresses signifies a possible lack of confidence amongst smaller buyers and on a regular basis customers, who might view the elevated prices and community congestion as boundaries to entry or continued participation.

Moreover, the introduction of latest protocols like Runes, whereas revolutionary, have to be managed rigorously to make sure they don’t overwhelm the prevailing infrastructure throughout essential durations reminiscent of a halving.

The put up Excessive Bitcoin charges push energetic addresses all the way down to 3-year low appeared first on CryptoSlate.