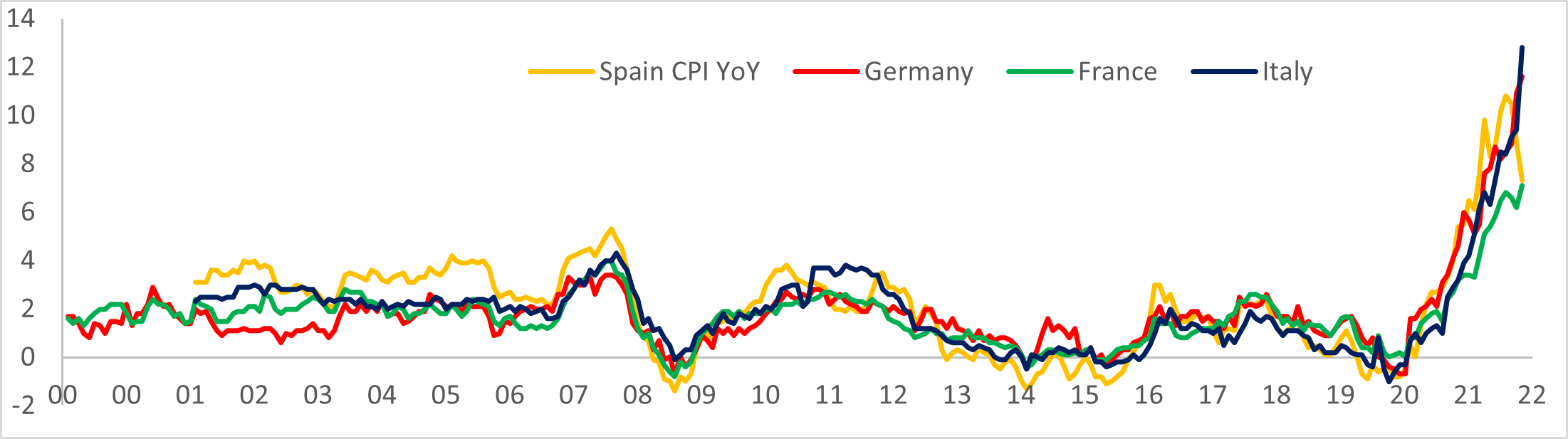

Surging inflation and weak progress have been plaguing the worldwide financial system for months, however the rising CPI and a devaluating nationwide forex first seen within the U.S. have now unfold to Europe as nicely.

The European Central Financial institution (ECB) hiked its base rate of interest by 75 bps for the second consecutive time, bringing its deposit charge to the best stage in over a decade. The ECB hopes the aggressive charge hike will be capable of curb inflation within the Eurozone, which reached its ATH in October at 10.7%.

Europe’s 4 largest economies — Germany, France, Italy, and Spain — all delivered painful upside surprises. Inflation in Germany reached 11.6% final month, the best it has been in over 70 years. Italy’s 12.8% inflation makes it a pacesetter within the Eurozone, with France and Spain tailing behind with 7.1% and seven.3%.

Whereas some nations within the Eurozone managed to put up sudden GDP progress prior to now month and keep away from a right away recession, the hazard is way from over.

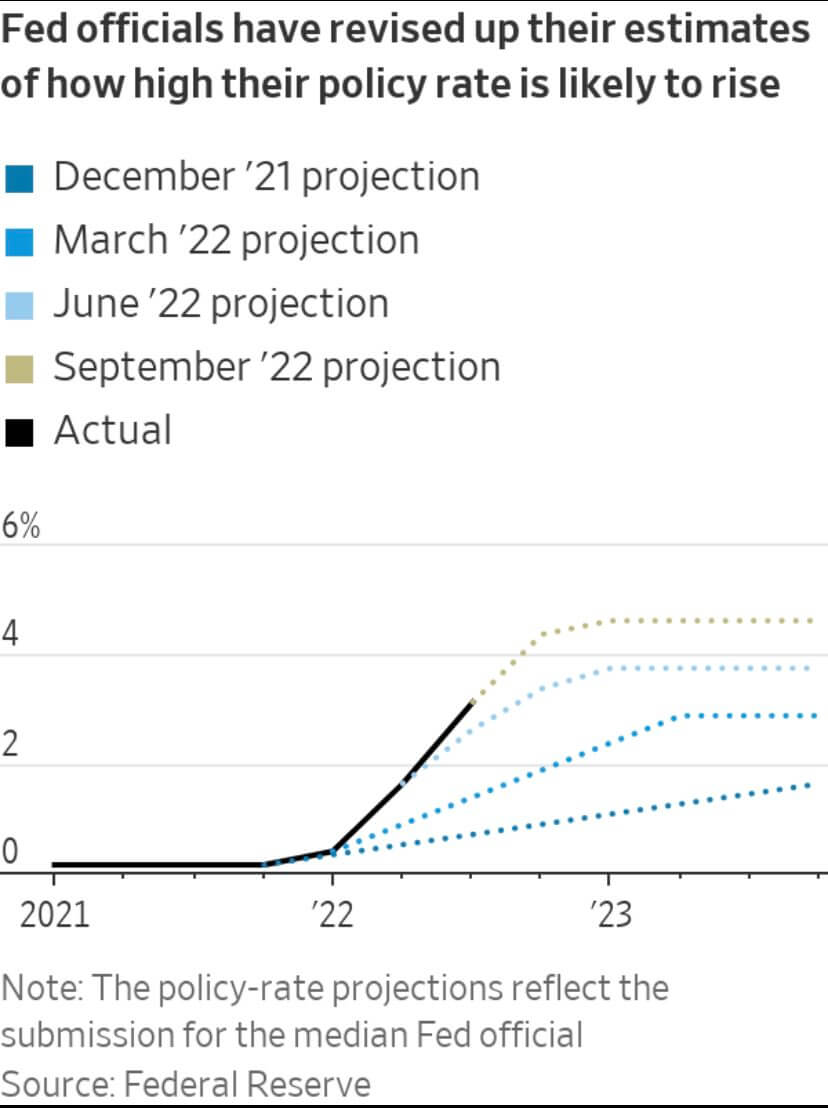

Rising rates of interest within the U.S. have been growing the energy of the U.S. greenback and weakening each the euro and the British pound. With the Fed anticipated to enhance the rate of interest by 75 bps in its Nov. 1-2 assembly, Europe’s two largest currencies might proceed declining even additional.

With a 75 bps hike in place, the Fed is predicted to proceed growing rates of interest till it reaches a goal of three.75% to 4%. Nevertheless, some economists argue that the Fed might take into account scaling again the tempo of charge will increase and announce a 50 bps hike in December.

Esther George, the President of the Federal Reserve Financial institution of Kansas Metropolis, believes that the speed hikes might proceed nicely into subsequent 12 months. She believes that Jerome Powell, the chairman of the Federal Reserve, might point out that the terminal charge could must be larger than the 4.6% projected for subsequent spring.

The excessive charges is likely to be essential to curb inflation that might enhance even additional as households faucet into their money financial savings. George famous that tapping into financial savings will enable households to spend in a method that retains demand sturdy regardless of hovering charges, a transfer that might proceed feeding the rising inflation.

In accordance with a report from Stifel, client spending within the U.S. rose 0.6% in

September, greater than the 0.4% achieve anticipated in keeping with Bloomberg, and following an analogous rise in August. 12 months-over-year, client spending elevated by 8.2%.

“That means to me we could need to preserve at this for some time,” George mentioned. “You may even see the terminal Fed funds charge larger and have to remain there longer.”

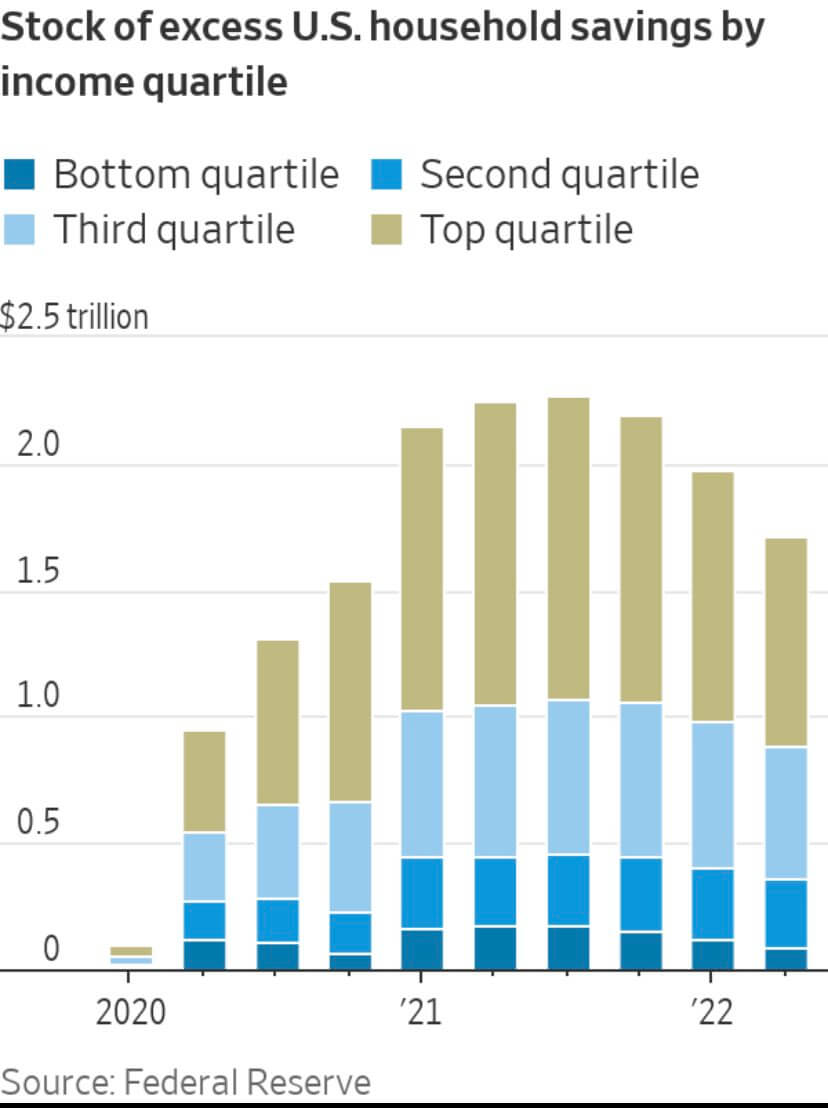

In accordance with the Federal Reserve, households within the U.S. had $1.7 trillion in financial savings on the finish of the second quarter of 2022. Whereas this can be a lower from the $2.3 trillion excessive recorded within the second quarter of 2021, it nonetheless represents an nearly seventeenfold enhance from the numbers recorded in the beginning of 2020.

The $1.7 trillion in family financial savings represents a major bump within the Fed’s makes an attempt to curb demand. Rising charges managed to deplete households’ financial savings by at the very least two trillion for the reason that starting of the 12 months, however the numbers are nonetheless larger than the Fed would really like.

Nearly all of that loss was taken by the highest and backside earnings quartile, that means that the richest and the poorest had been those who noticed their financial savings worn out by rising charges. the second and third earnings quartiles, representing the higher and decrease center class, saved their financial savings principally intact since 2021.

We will anticipate the struggle between solvency and rising charges to proceed nicely into 2023.