Market jitters from the FTX collapse have triggered document portions of Bitcoin leaving international exchanges.

Bitcoin Journal Senior Analyst Dylan LeClair famous that 136,992 BTC had been withdrawn over the previous 30 days, including that the occasion was “historic.” The determine equates to 0.7% of the circulating provide.

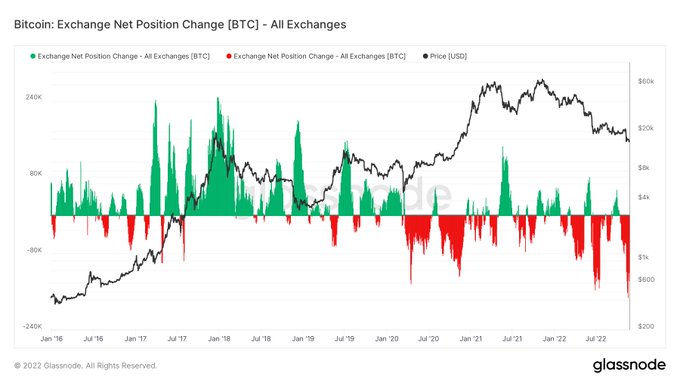

Accompanying the message, LeClair included an Change Web Place chart illustrating the dimensions of the exodus. The chart under exhibits web outflows from international exchanges at their highest since 2016.

The earlier outflow peak was round June, on the top of the Terra implosion, which noticed roughly 120,000 tokens leaving exchanges.

In reference to the outflow pattern, LeClair additional commented, “Drain. Them. All.”

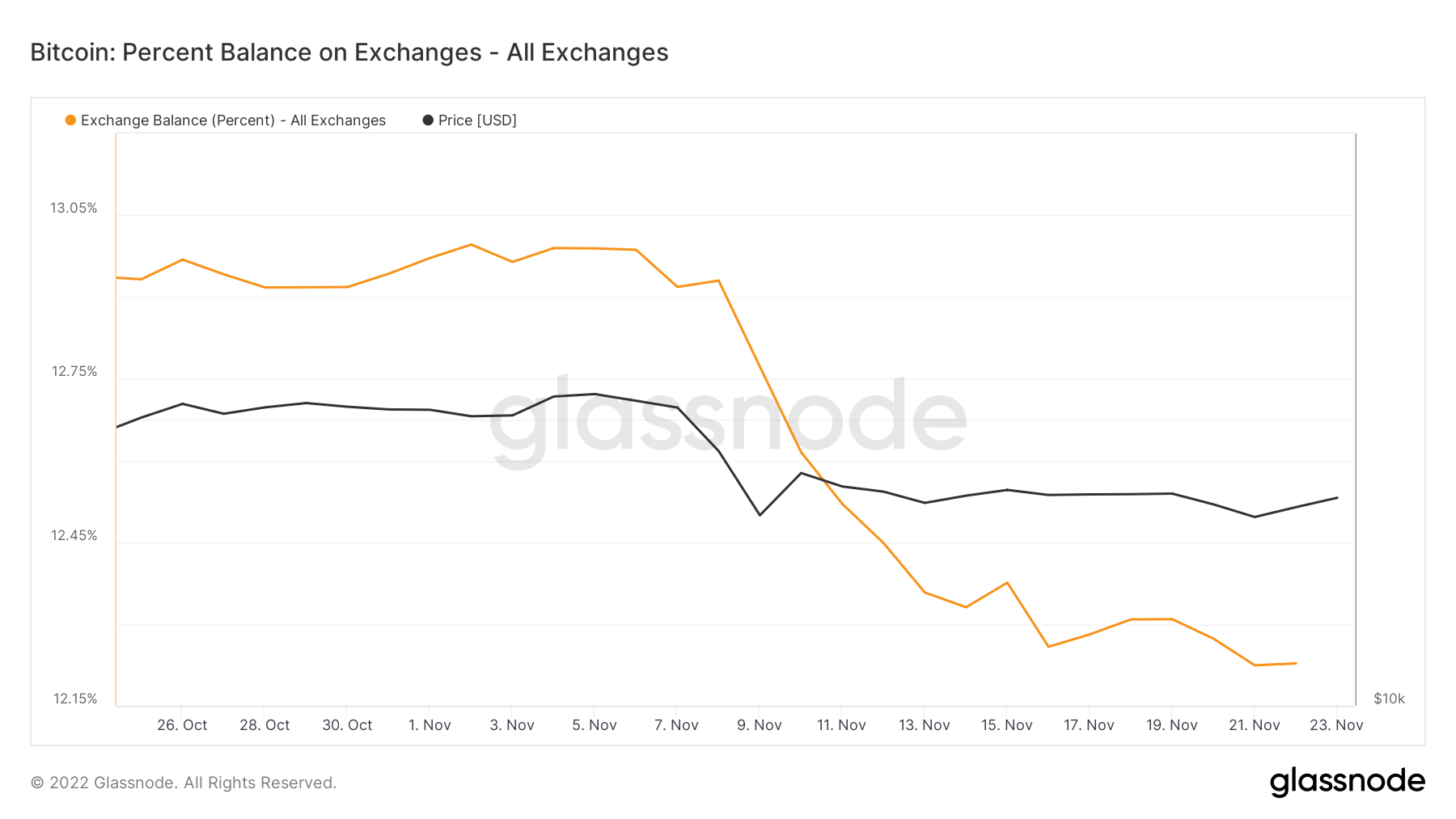

Knowledge per Glassnode exhibits holders heeding the warnings as the proportion of Bitcoin held on exchanges drops from 13% to 12.2% since rumors of hassle at FTX first broke.

Can Bitcoin construct on latest positive aspects?

As information of FTX mismanagement filtered into the general public area, the value of Bitcoin noticed sharp sell-offs in response to the allegations.

The height-to-trough motion noticed a 28% drawdown for the main cryptocurrency, with a neighborhood backside of $15,500 hit on Nov. 21.

Since bottoming, indicators of worth restoration have offered, with Tuesday closing 3.8% up on the day. On the identical time, right this moment noticed a continuation of shopping for strain as BTC grew 5% during the last 24 hours on the time of press.

Nonetheless, macro situations stay the identical, that means the probability of bulls constructing on present worth motion, to make a significant strike again above $20,000 and past, is slim.

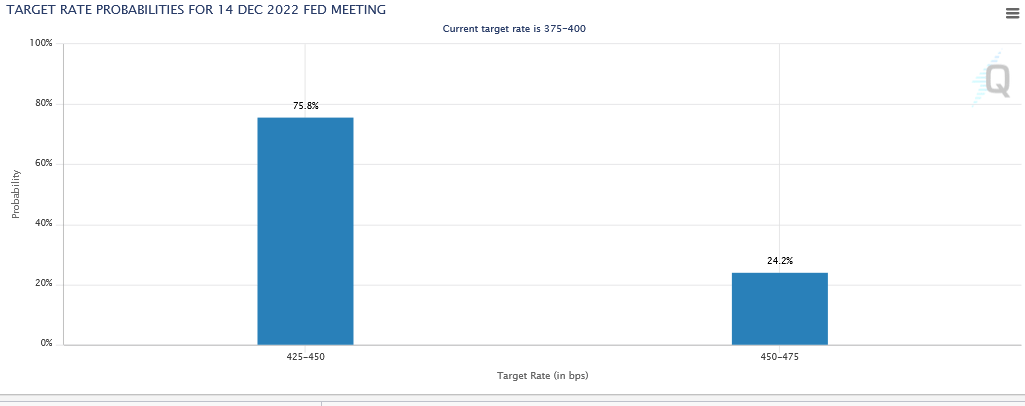

Traders are presently poised for a reversal within the Fed’s charge hike coverage, earlier than deploying capital. Fed Chair Jerome Powell enacted a fourth consecutive 75 foundation level hike on Nov.2, bringing the Federal Funds Charge to three.75 – 4%.

Markets are presently three to 4 in favor of a 50 foundation level hike subsequent, thus optimistic over the Fed easing its tempo of charge will increase.

The FOMC will announce the end result of their subsequent assembly on Dec. 14.

Contagion danger

Amid the FTX contagion, crypto brokerage Genesis warned that it wants$1 billion in capital to stave off chapter. The agency is taken into account a big Bitcoin OTC desk.

Thus far, having approached Binance and Apollo for help, the struggling brokerage has but to lift the cash it stated it wanted to remain solvent.

A full rundown of what went incorrect is unknown at the moment. Nonetheless, Leigh Drogen, the CIO of funding administration agency Starkiller Capital, claimed the supply of Genesis’s issues stemmed from a mortgage settlement with mum or dad firm Digital Capital Group (DCG).

What im mainly listening to from Genesis purchasers is that Barry did one thing just like Sam, he made a associated get together mortgage between genesis and DCG and he’s in an enormous gap now

— Leigh Drogen (@LDrogen) November 21, 2022

Nonetheless, DCG CEO Barry Silbert lately performed down the extent of the liquidity disaster, saying Genesis is due $575 million from DCG in Could 2023 and group income of $800 million is predicted this yr.