The Financial institution of Worldwide Settlements (BIS) predicted that there will likely be 15 retail and 9 wholesale Central Financial institution Digital Currencies (CBDCs) by 2030, in keeping with its survey of 86 central banks.

Central Banks more and more pro-CBDC

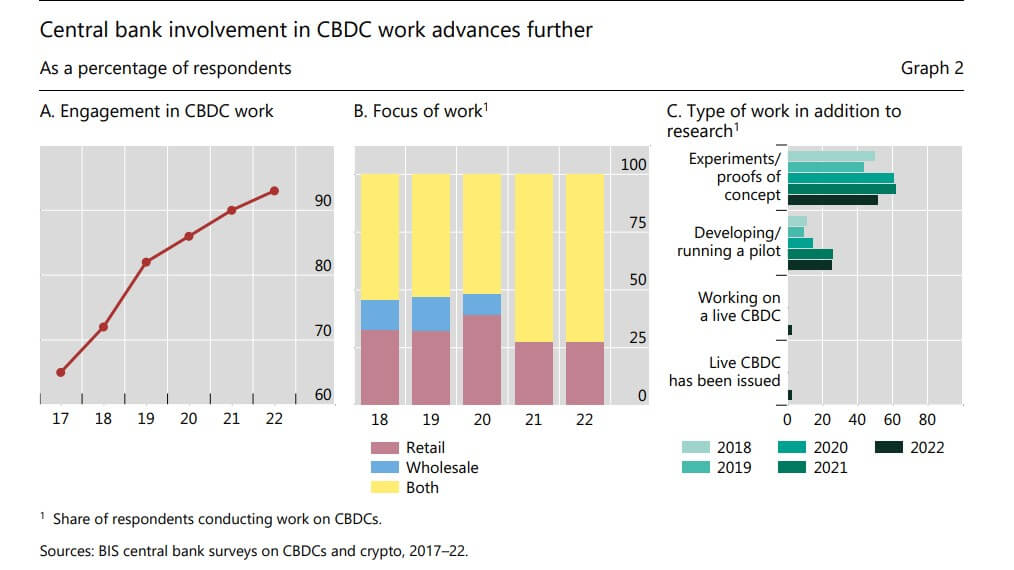

Based on the report, 93% of central banks are researching CBDCs, and greater than 50% have began making substantial efforts to develop one, together with making a pilot challenge.

Whereas solely 4 international locations—Nigeria, Jamaica, The Bahamas—have issued retail CBDCs, BIS famous that different apex banks might observe go well with, as 18% of the 86 banks surveyed mentioned they might give retail nationwide digital currencies quickly.

In the meantime, the highest banks of nations akin to England, Peru, India, Canada, and the European Central Financial institution are actively investigating the potential of issuing digital variations of their currencies.

Moreover, BIS famous that the growing recognition of cryptocurrencies seems to be a major issue driving Central Banks’ curiosity in CBDCs.

“Almost 60% of respondent central banks mentioned that the emergence of cryptoassets and stablecoins has accelerated their work on CBDCs.”

BIS extol CBDCs virtues

The report additionally highlighted the a number of benefits of stablecoins. It famous that retail CBDCs will enhance monetary inclusion and cost effectivity whereas wholesale CBDCs will improve cross-border funds.

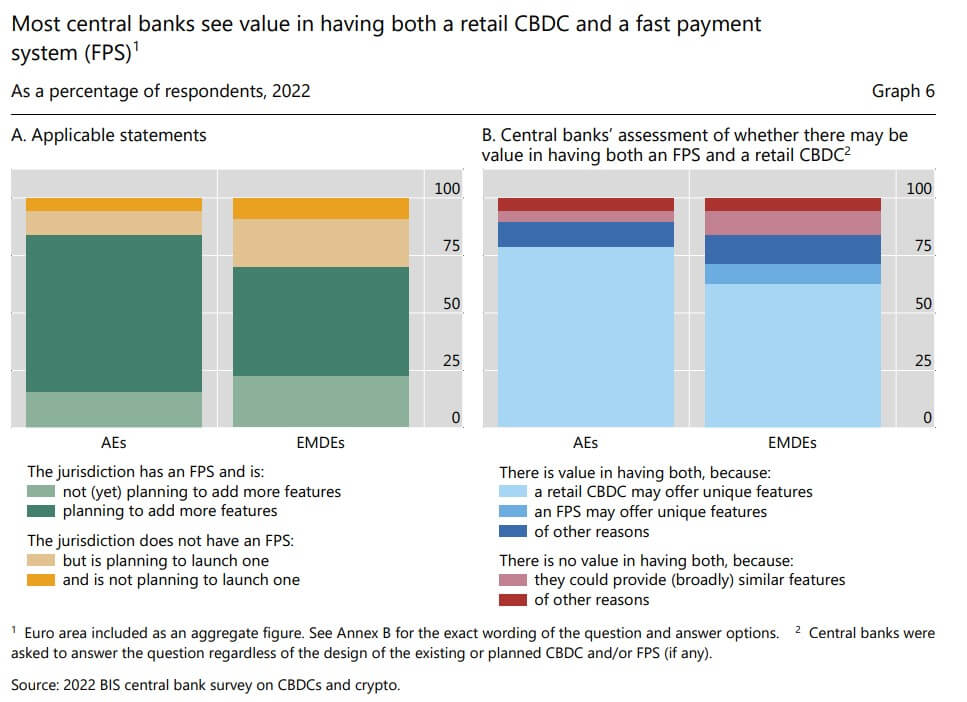

BIS said that CBDCs would complement the present quick cost methods (FPS) already in existence, including that greater than 80% of central banks assume there could be worth in having each an FPS and a CBDC.

“Relying on their design, FPS and retail CBDCs can obtain comparable targets, akin to enhancing monetary inclusion and selling quicker and extra environment friendly home and cross-border funds. As well as, they each allow broader innovation and enhanced competitors, which might improve the supply and accessibility of cheaper cost services and products.”

Nonetheless, BIS famous challenges to CBDCs growth, such because the uncertainty in regards to the authorized foundation to problem such digital currencies.

The put up Financial institution of Worldwide Settlements predicts 15 retail and 9 wholesale CBDCs by 2030 appeared first on CryptoSlate.