Fast Take

As a looming recession and potential stagflationary atmosphere draw nearer, CryptoSlate’s evaluation reveals the deepening wealth generational divide. Notably, the newborn boomers and the silent era maintain nearly all of the belongings.

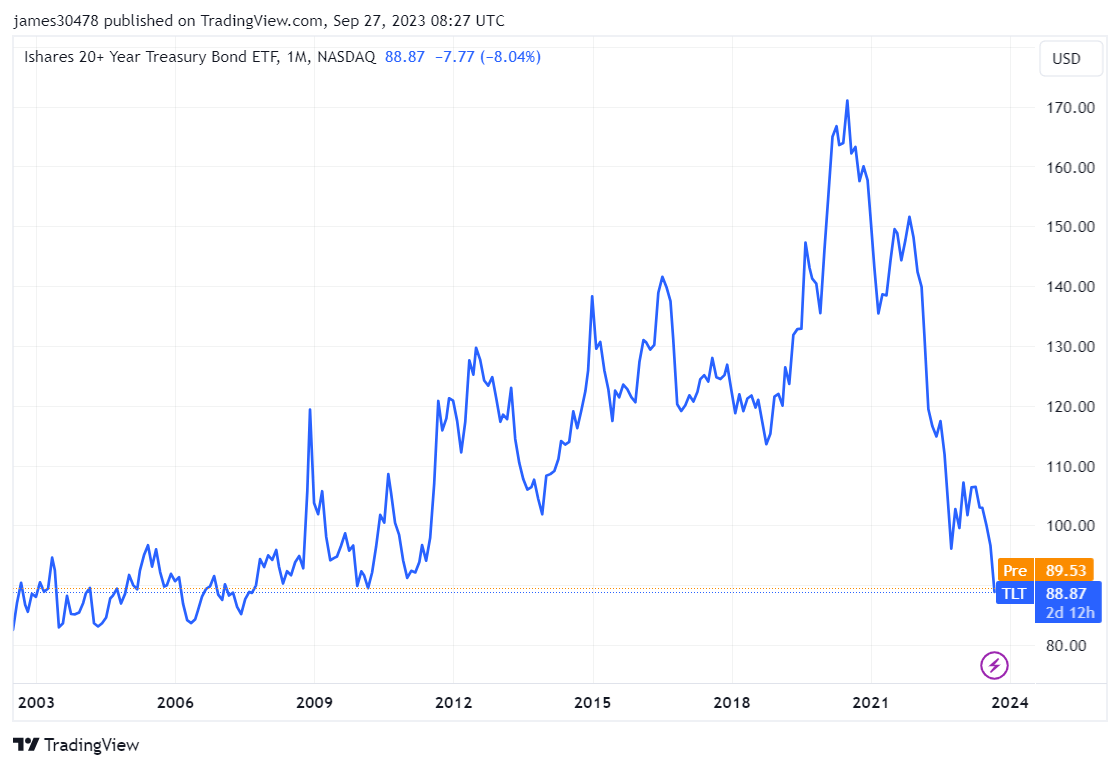

We at the moment are witnessing this divide beginning to shrink because the repercussions of high-interest charges begin to take the fold. This turns into starkly seen when analyzing the efficiency of the iShares 20+ Yr Treasury Bond ETF (TLT). That is an exchange-traded fund (ETF) that tracks the Barclays U.S. 20+ Yr Treasury Bond Index, a long-duration bond within the US (20+ years).

Remarkably, TLT has did not document a revenue for over a decade, reverting to ranges final seen in 2007. This development raises critical questions in regards to the state of the economic system and the possible impacts on the inventory and housing markets, significantly as rates of interest attain 15-year highs. The approaching recession, mixed with a potential stagflationary atmosphere, may additional exacerbate the wealth hole, probably resulting in far-reaching social and financial implications.

The submit Financial uncertainty sparks issues over the way forward for generational wealth appeared first on CryptoSlate.